ID: PMRREP17944| 300 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

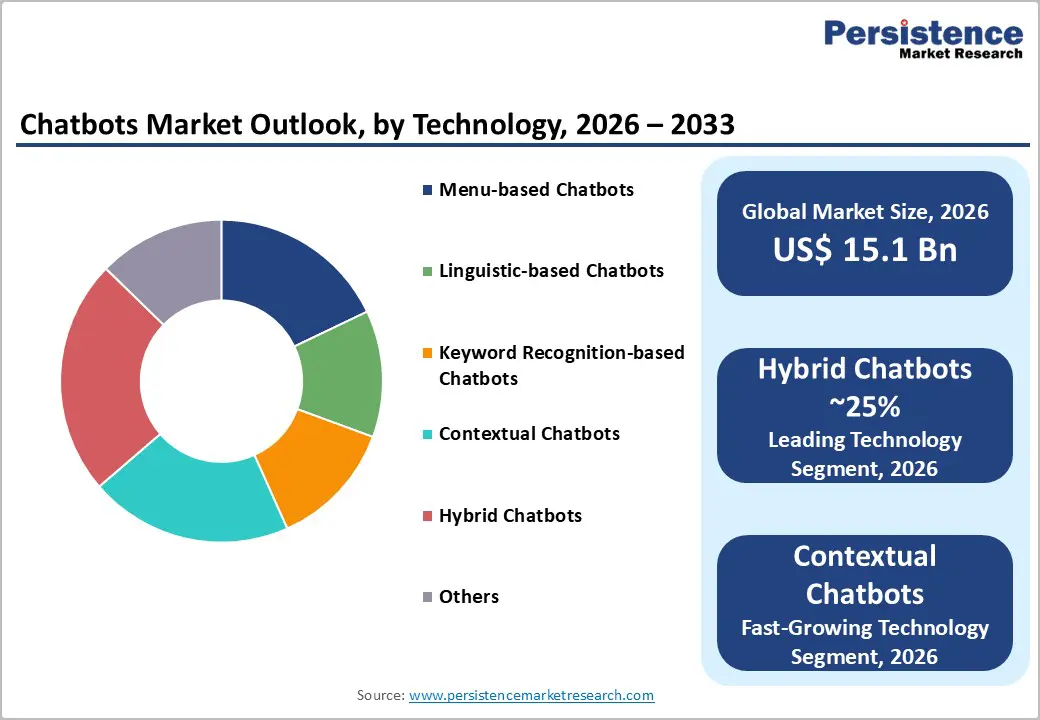

The global Chatbots Market size is expected to be valued at US$ 15.1 billion in 2026. It is projected to reach US$ 68.8 billion by 2033, growing at a CAGR of 24.2% between 2026 and 2033. This growth is driven by advancements in AI and natural language processing, enabling more natural and efficient customer interactions. Enterprises increasingly adopt chatbots to manage high volumes of inquiries, significantly reducing operational costs. Rising demand for 24/7 support in sectors like BFSI and retail, along with integration with messaging platforms and growing smartphone penetration, further accelerates market expansion.

| Global Market Attributes | Key Insights |

|---|---|

| Chatbots Market Size (2026E) | US$ 15.1 billion |

| Market Value Forecast (2033F) | US$ 68.8 billion |

| Projected Growth CAGR (2026-2033) | 24.2% |

| Historical Market Growth (2020-2025) | 23.1% |

Rising Global Demand for Automated, 24/7 Customer Service Solutions

Businesses worldwide are increasingly adopting chatbots to manage customer queries around the clock, drastically reducing response times and cutting operational support costs. Automated systems allow organizations to efficiently handle high volumes of interactions, ensuring consistent service quality even during peak periods. Industries such as banking, e-commerce, and retail are leading this shift, emphasizing seamless customer experiences and faster resolution of inquiries.

The move toward automation has been further accelerated by growing digital preferences post-pandemic. Enterprises are leveraging chatbots to enhance scalability and customer satisfaction, providing instant responses across multiple channels. By integrating chatbots into websites, mobile apps, and messaging platforms, companies can offer continuous support without heavily expanding human resources, making automated customer service a central part of modern business operations.

Technological Advancements in AI and Natural Language Processing Driving Adoption

Rapid developments in generative AI and natural language processing (NLP) are enabling chatbots to conduct complex, context-aware conversations rather than relying on simple scripts. Platforms like ChatGPT demonstrate how AI can be integrated into enterprise systems to deliver personalized, real-time responses across multiple communication channels.

Multimodal capabilities, such as voice and vision, enhance the accuracy and relevance of chatbot interactions compared to traditional rule-based systems. Organizations across sectors, ranging from BFSI and healthcare to retail, are adopting advanced chatbots to improve engagement, support nuanced interactions, and provide human-like experiences that enhance overall customer satisfaction and operational efficiency.

Data Privacy and Security Challenges Limiting Chatbot Adoption

Strict data privacy regulations, such as Europe’s GDPR, impose significant compliance requirements on organizations deploying chatbots. Non-compliance can result in substantial penalties, making companies cautious about implementing conversational AI, especially in sensitive industries. Security incidents, including data breaches and unauthorized access in chatbot systems, further erode user trust and create hesitation in adoption.

To mitigate these risks, enterprises must invest heavily in secure infrastructure, encryption protocols, and regular audits, which can increase deployment costs and slow down implementation. Sensitive sectors like healthcare, finance, and government are particularly affected, as maintaining confidentiality and regulatory compliance becomes a critical barrier to scaling chatbot solutions across their operations.

Limitations in Handling Complex and Nuanced Customer Queries

Despite advances in AI, chatbots often struggle to understand accents, ambiguous language, and multi-turn conversations, leading to incomplete or incorrect responses. Early models frequently misinterpret user intent, requiring human intervention to resolve queries, which limits their ability to fully replace live agents.

This gap in understanding becomes particularly problematic in industries that demand nuanced interactions, such as legal advisory, medical guidance, or technical support. Organizations must balance automation with human oversight, slowing down the transition to fully autonomous customer service and highlighting the ongoing need for continuous improvement in AI comprehension and contextual reasoning.

Expansion Opportunities in Small and Medium Enterprises through Cloud-Based Chatbot Solutions

Small and medium enterprises (SMEs) are emerging as a rapidly growing segment for chatbot adoption due to affordable, cloud-based platforms that lower entry barriers. Cloud offerings from providers like AWS and Google enable SMEs to deploy advanced chatbots on a pay-as-you-go basis, eliminating the need for a significant upfront investment. This democratization of technology allows smaller firms to access tools previously limited to large enterprises.

As larger organizations continue leveraging chatbots for operational efficiency, SMEs can also benefit from streamlined customer service and scalable interactions. Government-led digital initiatives in regions like India and ASEAN further support adoption, providing additional opportunities for chatbot providers to expand their footprint while delivering cost-effective, automated solutions to this underserved market segment.

Growth Potential in Emerging Verticals Such as Healthcare

The healthcare sector presents significant opportunities for chatbot integration, particularly in triage, appointment scheduling, and patient engagement. The rise of telemedicine and remote care solutions has increased demand for automated systems that improve accessibility and reduce staff administrative burdens. Chatbots integrated with electronic health record (EHR) systems help reduce missed appointments and streamline patient communication.

Investments in AI ethics and regulatory approvals enable the development of personalized, patient-centric care solutions that address the needs of aging populations and chronic care management. As healthcare organizations increasingly prioritize efficiency and patient experience, chatbots provide scalable, reliable support, creating a fertile opportunity for providers in this emerging vertical.

Solutions lead the chatbot market with 64% share in 2025, dominating due to scalable platforms such as standalone and web-based systems that integrate AI-powered responses. Enterprises prefer these solutions as core infrastructure for customer service, leveraging advanced features like multilingual support and rapid deployment. Solutions reduce implementation time compared to fully custom builds, allowing organizations to streamline operations and manage high volumes of interactions efficiently.

The fastest-growing segment is services, which includes consulting, implementation, and managed support. As enterprises increasingly adopt chatbots, demand rises for professional guidance, system integration, training, and maintenance. Services complement solution platforms by ensuring seamless deployment, continuous optimization, and user adoption, making them an essential growth area for vendors looking to expand their market footprint.

Hybrid chatbots hold 25% share in 2025, combining rule-based logic with AI to provide reliable, adaptive interactions. They are widely adopted in complex sectors like BFSI, where maintaining context across multi-turn conversations is critical. Enterprises favor hybrid chatbots for accuracy, security, and flexibility, enabling them to handle nuanced customer requests while ensuring operational efficiency. Hybrid models outperform pure linguistic systems in managing sophisticated workflows and sensitive data.

The fastest-growing technology segment is contextual AI chatbots, which can interpret intent, situational nuances, and conversational context more effectively. These chatbots are increasingly applied in healthcare, legal services, and high-touch customer service industries, where accurate understanding and adaptive responses reduce reliance on human agents. As enterprises seek AI solutions capable of human-like interactions, contextual chatbots are driving innovation and adoption across emerging sectors.

Contact centers command 30% share in 2025, streamlining high-volume customer interactions and significantly reducing wait times. Adoption is especially strong in banking and finance, where chatbots integrate with CRMs to provide seamless escalation and consistent support. Enterprises achieve cost savings and operational efficiency while maintaining high-quality service across multiple communication channels. Contact centers remain the most common and strategic application of chatbot technology.

The fastest-growing application segment is mobile and messaging platforms, where chatbots enable direct customer engagement and real-time support. Social media apps, enterprise messaging platforms, and mobile apps allow businesses to provide personalized experiences, instant responses, and interactive features. Organizations are expanding these channels to improve accessibility, enhance customer satisfaction, and maintain continuous engagement with consumers in increasingly digital-first environments.

Large enterprises dominate at 60% share in 2025, deploying sophisticated chatbot solutions across global operations. Their scale allows integration of AI-NLP capabilities to efficiently manage vast customer bases. These organizations benefit from customizable platforms, advanced analytics, and robust infrastructure, enabling workflow automation, high-quality service delivery, and enterprise-wide consistency. Large enterprises also drive innovation through pilot deployments and complex integrations that smaller firms often cannot replicate.

The fastest-growing segment is SMEs, which increasingly adopt cloud-based, cost-efficient chatbot platforms. Scalable and flexible solutions allow small and medium enterprises to automate customer interactions, improve operational efficiency, and compete with larger firms without heavy upfront investment. As SMEs embrace digital transformation, chatbot adoption accelerates, providing significant growth opportunities for providers offering accessible, easy-to-deploy platforms and professional guidance tailored to smaller organizations.

BFSI leads with 18–21% share in 2025, deploying chatbots for transactions, fraud detection, and customer support amid digital banking transformation. Adoption is strong in the U.S. and other developed markets, enabling compliance, personalization, and enhanced customer engagement. Chatbots help institutions reduce manual workload, maintain operational efficiency, and provide consistent, real-time support across multiple channels, reflecting BFSI’s early embrace of automation and AI technologies.

The fastest-growing vertical is healthcare, where chatbots assist with appointment scheduling, triage, patient follow-up, and engagement. Integration with digital health systems enables providers to streamline administrative processes, improve patient experience, and deliver personalized care efficiently. Growing demand for telemedicine, aging populations, and digital-first patient interactions make healthcare a high-potential sector, offering expanding opportunities for chatbot providers to support critical services while reducing operational bottlenecks.

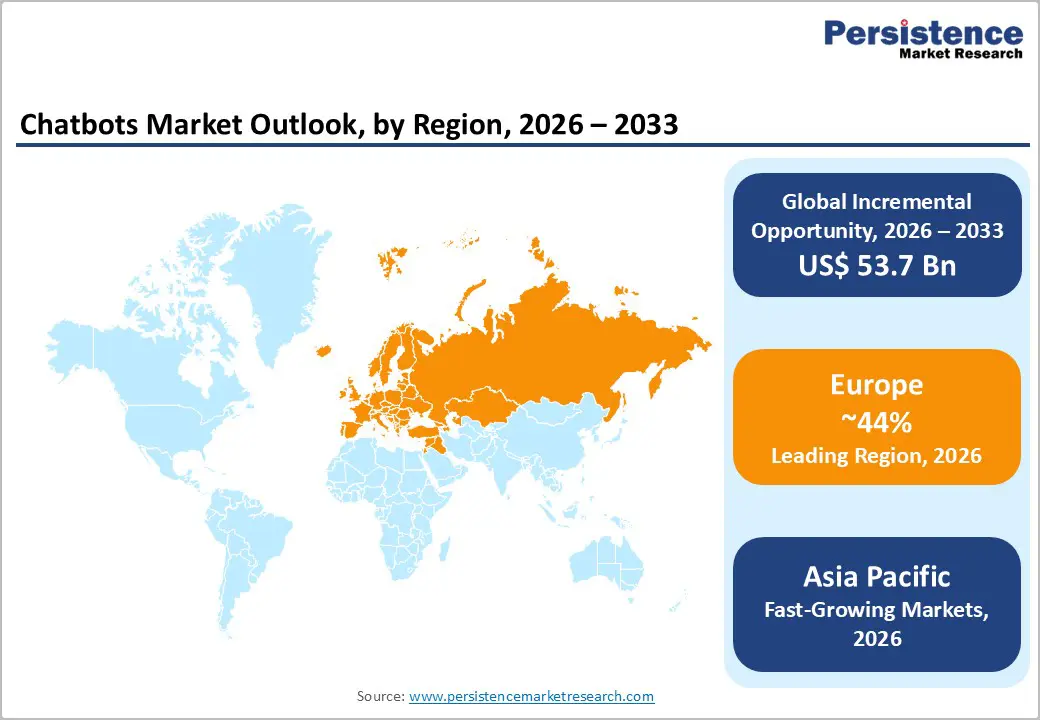

North America leads the global chatbot market with a 44% share in 2025, driven primarily by the U.S. Early adoption of large language models (LLMs), high labor costs, and mature digital infrastructure favor automation, making chatbots a strategic investment for enterprises. Support teams increasingly deploy chatbots to reduce operational costs and enhance customer service efficiency, while venture funding accelerates innovation in technology development.

Finance and retail sectors benefit from regulatory frameworks, including CFPB guidelines, which ensure ethical AI usage and promote trust in automated systems. North American enterprises continue integrating chatbots into contact centers, mobile apps, and messaging platforms, enabling 24/7 service availability. The combination of advanced infrastructure, investment backing, and early adoption maintains North America’s leadership position in the global chatbot market.

Europe is witnessing strong chatbot adoption with a projected CAGR of 25.1%, driven by harmonized regulations like GDPR that enforce privacy compliance. Countries such as Germany, the U.K., and France lead deployments, particularly in healthcare and BFSI, ensuring data protection while leveraging automation to improve operational efficiency. Enterprises are balancing innovation with compliance, encouraging ethical AI use across sectors.

Other markets, such as Spain, are expanding in e-commerce chatbots, integrating automated customer support while adhering to strict privacy rules. Enterprises in Europe focus on multilingual, privacy-compliant platforms to serve diverse populations. This combination of regulatory support, ethical AI emphasis, and sector-specific adoption positions Europe as a rapidly growing region in the global chatbot landscape.

Asia Pacific holds a significant 38% share in 2025, with China, India, and Japan driving market growth. Mobile-first economies, government AI initiatives, and expanding e-commerce ecosystems accelerate chatbot adoption. Enterprises leverage automation to enhance customer engagement, reduce operational costs, and scale across digital channels, particularly in high-volume markets. Manufacturing hubs in ASEAN also adopt chatbots to optimize business processes efficiently.

Digital initiatives, such as India’s national AI strategy and China’s e-commerce boom, further support regional expansion. Organizations in the Asia Pacific increasingly deploy chatbots in sectors like retail, BFSI, and government services, where cost-effective automation is critical. The combination of large consumer bases, tech-driven policies, and mobile penetration positions the region as a high-growth market for conversational AI solutions.

The global chatbot market remains moderately consolidated, with top players holding a significant share through continuous investment in generative AI research and development. Market leaders focus on expanding APIs, enhancing platform capabilities, and forming strategic partnerships to enable vertical-specific solutions across industries. Key differentiators include advanced multimodal functionalities, contextual understanding, and ethics-driven AI models, which help enterprises deliver more natural and reliable customer interactions.

Emerging trends are shaping hybrid business models that combine software-as-a-service (SaaS) platforms with professional consulting and managed services. Autonomous agents and intelligent workflow automation are gaining traction, enabling vendors to offer end-to-end solutions that improve scalability, efficiency, and customer engagement while maintaining competitive differentiation in a rapidly evolving market.

Key Market Developments

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Component

Technology

Application

Enterprise Size

Industry Vertical

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author