ID: PMRREP34086| 198 Pages | 13 Feb 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

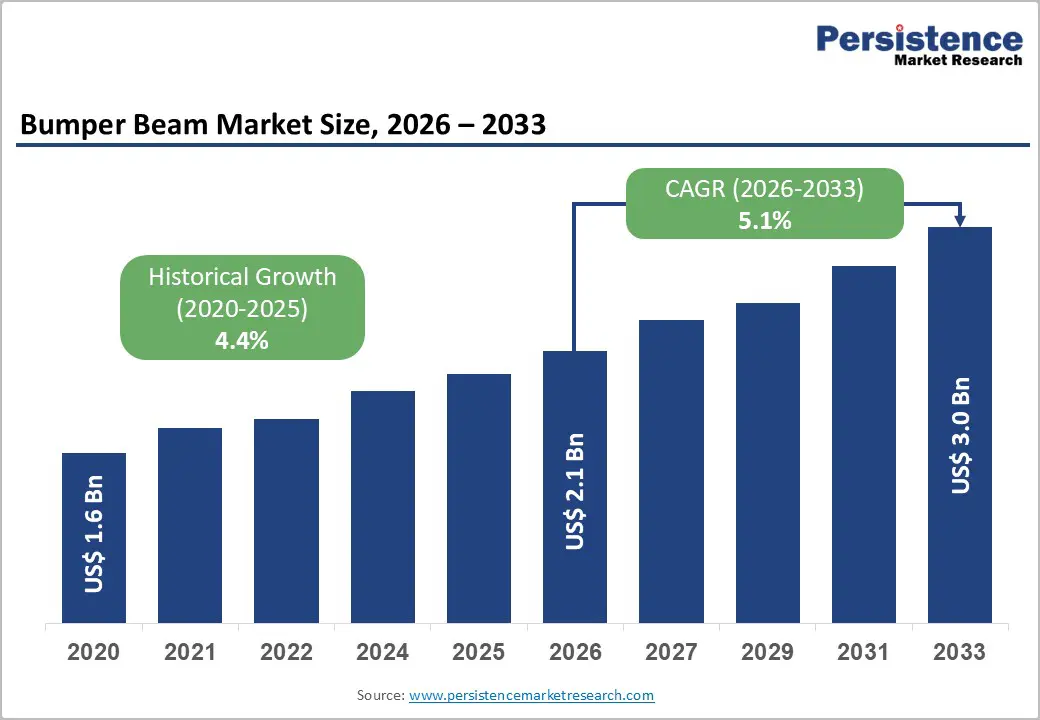

The global bumper beam market size is likely to be valued at US$2.1 billion in 2026 and is expected to reach US$3.0 billion by 2033, growing at a CAGR of 5.1% during the forecast period from 2026 to 2033, driven by increasing global vehicle production, stricter crash and passive safety regulations, and mounting pressure for lightweighting to meet fuel efficiency standards and support the transition to electric vehicles, boosting demand for aluminum and high-strength steel solutions.

The rising adoption of Advanced Driver Assistance Systems (ADAS) is transforming bumper beams from simple structural elements into advanced housings for critical sensors. As a result, the market is shifting from a price-driven, commoditized component toward a performance-focused, engineered system, favoring suppliers with expertise in high-strength steel, aluminum, and composite beam technologies.

| Key Insights | Details |

|---|---|

| Bumper Beam Market Size (2026E) | US$2.1 Bn |

| Market Value Forecast (2033F) | US$3.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.4% |

Automotive lightweighting is intensifying as fuel-efficiency mandates and electrification structurally elevate the value of mass reduction across vehicle architectures. Electric platforms amplify this pressure due to the weight burden of traction batteries, making structural components such as bumper beams central to range optimization and energy efficiency outcomes. Material substitution toward aluminum and advanced high-strength steel is reshaping crash-energy management strategies, enabling thinner-gauge structures with equivalent safety performance while improving vehicle-level efficiency metrics. This transition embeds lightweighting as a compliance-driven design imperative, reinforcing sustained demand for engineered structural components that balance mass reduction with regulatory crashworthiness thresholds.

From a market-structure perspective, lightweighting is converging with manufacturing process innovation, as roll forming and hot stamping enable complex closed-section geometries, tailored thickness profiles, and multi-material joining architectures that are not economically achievable through conventional stamping. These process capabilities increase capital intensity and technical barriers to entry, shifting value capture toward suppliers with metallurgical expertise, forming simulation, and integrated tooling competencies. As forming technologies scale faster than baseline vehicle output, differentiation is increasingly anchored in process mastery and material-forming integration, structurally advantaging participants positioned to deliver compliant, lightweight structural systems at automotive production cadence.

Tightening global safety and crashworthiness frameworks are structurally elevating performance requirements for vehicle energy management systems, positioning bumper beams as compliance-critical components within front and rear crash architectures. Regulatory mandates on occupant and pedestrian protection are compelling OEMs to redesign structural geometries and calibrate material stiffness to deliver controlled energy absorption across varied impact regimes. This regulatory ratcheting embeds crash performance into early-stage vehicle architecture decisions, increasing reliance on engineered beam systems that integrate material science, section design, and deformation management. As testing protocols evolve, compliance increasingly depends on predictable, repeatable crash behavior across diverse vehicle platforms.

From a market-structure perspective, regulatory escalation is accelerating material substitution toward ultra-high-strength steels and advanced alloys capable of delivering higher energy absorption within constrained mass budgets. The resulting design complexity raises validation, tooling, and forming requirements, increasing development cost intensity and extending qualification cycles across the supply chain. Compliance-driven redesign also shifts procurement toward suppliers with integrated simulation, metallurgical optimization, and forming process control capabilities. Collectively, safety regulation functions as a non-discretionary demand driver that tightens technical thresholds, elevates entry barriers, and structurally anchors advanced materials and engineered bumper systems within new vehicle platform programs.

As bumper systems evolve from passive structural members into multifunctional housings for ADAS sensors, material and design choices introduce a nontrivial technical constraint. The dielectric properties of composite skins, multilayer coatings, and surface treatments can attenuate, refract, or scatter radar and ultrasonic signals, degrading detection fidelity and increasing false positives or range uncertainty. Thickness tolerances, fiber orientations, and paint chemistries further complicate electromagnetic transparency, forcing tight co-optimization between crash-energy management, packaging geometry, and sensor line-of-sight performance.

This integration burden elevates development cost and time-to-validation because sensor performance must be re-certified across temperature, moisture, contamination, and impact-repair scenarios. OEMs and tier-1s must invest in specialized anechoic testing, materials characterization, and digital twin workflows that couple RF propagation models with structural FEA. The resulting calibration bottleneck constrains platform cadence, limits rapid material substitution, and narrows the viable supplier pool to those with cross-domain competencies in RF engineering, materials science, and crash systems integration, thereby raising switching costs and slowing design iteration cycles.

Bumper-beam manufacturing is constrained by the capital intensity and long asset life cycles of core forming technologies, notably roll forming and hot stamping. Modern high-strength-steel beam lines integrate decoiling, leveling, pre-cutting, roll forming, in-line welding, and precision cut-to-length, requiring multi-million-dollar capex per line with multi-year amortization horizons. Hot-stamping cells further embed fixed-cost rigidity through furnaces, high-tonnage presses, and quench tooling optimized for specific section geometries and metallurgical recipes. This asset specificity locks suppliers into technology pathways, limits rapid reconfiguration when OEM design envelopes change, and elevates switching costs across platform cycles.

The resulting capital lock-in dampens experimentation with alternative materials and processes, including aluminum extrusions and hybrid composite concepts, particularly among smaller and regional suppliers with constrained balance sheets. Market structure, therefore, skews toward consolidation dynamics, with a narrow cohort of well-capitalized tier-1s and specialized metal formers capturing disproportionate design wins, while lower-capability vendors remain confined to legacy steel sections on depreciated equipment. Strategically, this raises barriers to entry, elongates payback periods, and makes scale, learning-curve effects in forming process control, and vertically integrated simulation-to-production workflows decisive for sustainable margins and platform continuity.

A high-conviction opportunity is emerging around the co-design of bumper beams as sensor-ready structural platforms for LiDAR, radar, and ultrasonic modules. As ADAS penetration deepens across mass-market and premium vehicle platforms, OEMs are seeking modular, pre-validated mounting architectures that reduce integration friction, shorten validation cycles, and de-risk sensor alignment and durability across crash and repair scenarios. Smart beams with embedded brackets, standardized mounting interfaces, cable routing paths, and RF-transparent windows enable tighter packaging, improved sensor stability, and repeatable calibration performance across trims and facelifts.

This shift creates a defensible value pool for tier-1s that can bundle crash-energy management, electromagnetic compatibility, and sensor packaging into a single homologated component. Platform-level standardization supports faster SOP ramp-ups, lower BOM complexity, and reduced re-certification costs when sensor stacks evolve. Suppliers with digital co-engineering workflows that couple RF propagation, thermal management, and structural FEA can command premium program positioning, higher attach rates per vehicle platform, and longer design-win tenures. Over time, smart-beam architectures also enable software-defined upgrades and service-driven aftermarket revenues through standardized replacement and recalibration pathways.

A structurally important opportunity is the EV-driven shift toward lightweight bumper-beam architectures using aluminum and hybrid composite constructions in mid- to upper-segment vehicle programs. As electrified platforms carry higher curb weight due to traction batteries, OEMs are prioritizing mass reduction in peripheral structural systems to protect range, packaging efficiency, and total system cost. Lightweight beams that preserve crash-energy management performance while reducing front- and rear-end mass directly support vehicle-level efficiency targets and improve flexibility in battery sizing and thermal packaging. This elevates the strategic relevance of aluminum extrusions, tailored-gauge sections, and multi-material beam designs within EV bill-of-materials decisions.

From a program-execution perspective, the value pool favors suppliers that can deliver modular, variant-rich beam platforms with shared cross-section architectures adaptable across multiple EV nameplates. Platform modularity compresses development timelines, simplifies homologation across derivatives, and enables controlled differentiation between volume and premium EV trims through material grade and section tuning. This approach raises average system value per vehicle, supports higher design-win stickiness across refresh cycles, and insulates suppliers from commoditized steel-beam pricing pressure. Over the planning horizon, lightweight EV-centric beams constitute a premium growth lane within the bumper-beam market, with disproportionate margin capture for suppliers that combine forming know-how, multi-material joining, and crash-simulation co-engineering.

Steel is expected to dominate the automotive bumper systems market, accounting for approximately 48% share in 2026, underpinned by its entrenched role in mass-production platforms and qualification-ready crash architectures across high-volume vehicle programs. Adoption remains anchored by cost-efficiency, high tensile performance, and recyclability, with manufacturers prioritizing standardized tooling, scale economics, and stable supply chains in volume environments. Ongoing platform evolution, including press-hardened grades, tailored welded blanks, and digitally controlled hot-stamping lines, continues to reinforce replacement cycles and utilization intensity. Vendors such as ArcelorMittal, Benteler, and ThyssenKrupp are expanding portfolios with advanced steel grades and turnkey forming systems to lock in OEM workflows and long-term supply agreements. This combination of mature infrastructure, ecosystem lock-in, and predictable demand sustains steel’s leadership within structured deployment models.

Aluminum is likely to be the fastest-growing segment, driven by unmet lightweighting requirements and the performance limits of legacy steel designs in electrified platforms. Growth is being catalyzed by advances in high-strength extrusions, bumper-specific sheet, and large-format casting, which materially improve energy absorption per kilogram, packaging efficiency, and unit economics. Accelerating adoption is supported by improved recycling loops, simulation-led design, and automated joining, lowering operational friction for first-time adopters. Companies including Novelis, Constellium, and Alcoa are scaling dedicated bumper materials, closed-loop recycling services, and modular structures to capture early-cycle demand and embed switching costs.

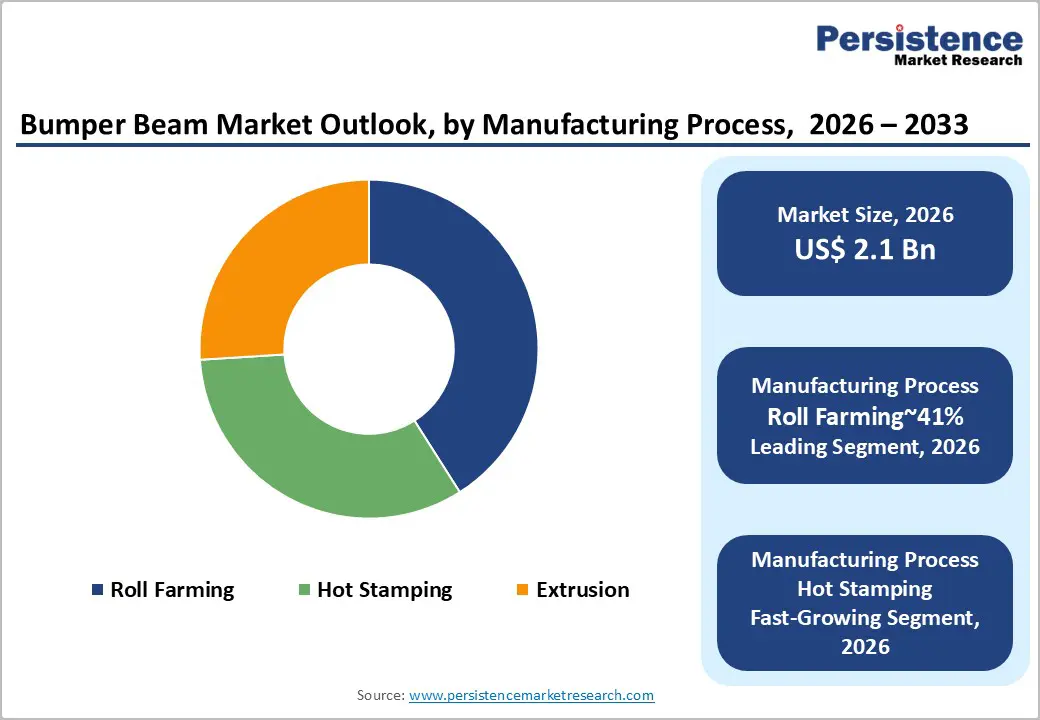

Roll forming is anticipated to dominate the automotive bumper beam manufacturing process market, accounting for approximately 41% share in 2026, underpinned by its entrenched role in high-throughput steel profiling and qualification-ready structural workflows across mass-production vehicle platforms. Adoption remains anchored by material utilization efficiency, dimensional consistency, and low scrap economics, with manufacturers prioritizing standardized tooling, continuous-line throughput, and predictable unit costs in volume programs. Ongoing platform evolution, including 3D roll forming, AI-enabled in-line inspection, and hydrogen-compatible forming lines, is reinforcing replacement cycles and utilization intensity. Vendors such as Shape Corp, Metalsa, and Kirchhoff Automotive are expanding portfolios with turnkey roll-forming systems and integrated welding, cutting, and piercing modules to lock in OEM workflows and long-term supply agreements. This combination of mature infrastructure, ecosystem lock-in, and predictable demand sustains the segment’s dominance within structured deployment models.

Hot stamping is expected to be the fastest-growing process within the automotive bumper beam manufacturing market, driven by rising crash-energy requirements and the geometric constraints of electrified front-end architectures. Growth is being catalyzed by ultra-high-strength press-hardened steels, tailored tempering, and laser-welded blanks, which materially improve strength-to-weight performance, packaging efficiency, and structural precision. Accelerating adoption is supported by simulation-led die design, automated furnace-to-press transfer, and integrated crash-module architectures, lowering operational friction for first-time adopters. Companies including Gestamp, BENTELER Automotive, and Sungwoo Hitech are scaling press-hardening platforms, integrated crash systems, and next-generation coated blanks to capture early-cycle demand and embed switching costs.

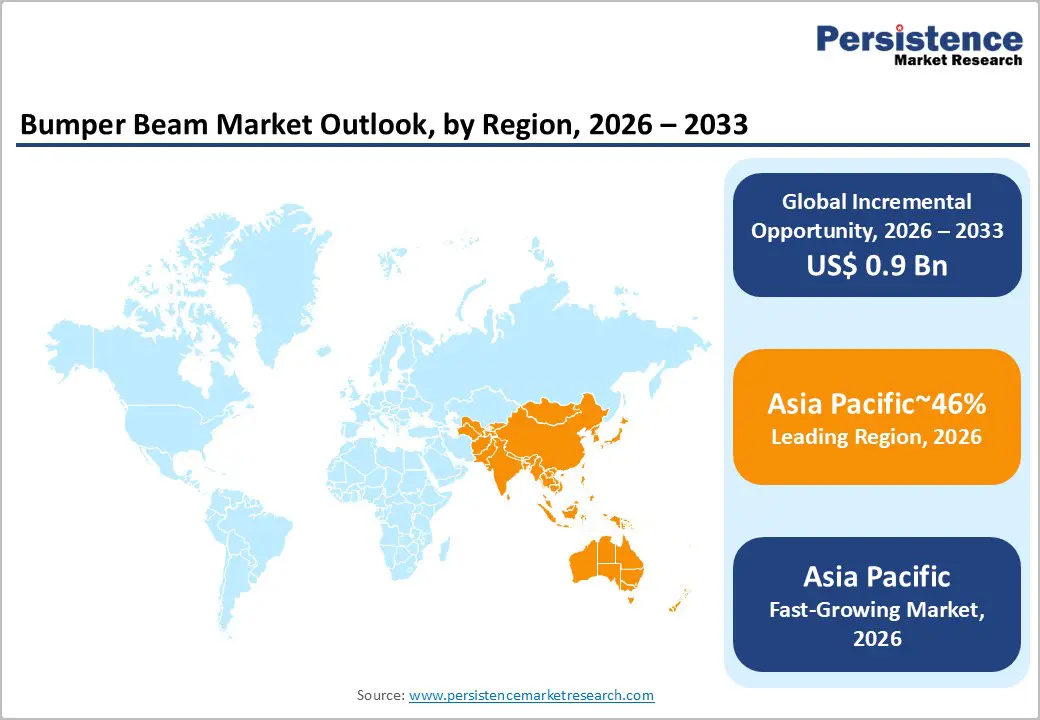

The Asia Pacific region is anticipated to lead with approximately 46% share of the global bumper beam market in 2026 and is expected to remain the fastest-growing regional block over. This leadership is anchored in the region’s scale of vehicle manufacturing, dense OEM–supplier ecosystems, and the localization of structural component production close to final assembly plants. China is expected to continue setting the volume baseline for bumper beams as domestic OEMs such as SAIC, BYD, Geely, and Chery expand both domestic and export-oriented production programs. India and Japan are expected to reinforce this trajectory through rising platform localization, growth in compact and mid-size vehicle platforms, and sustained investment by automakers such as Tata Motors, Mahindra, Toyota, and Honda.

APAC is expected to show the strongest growth momentum as electrification, platform consolidation, and safety content per vehicle increase across mass-market and premium segments. At the same time, rapid expansion of domestic OEM portfolios is expected to lift baseline safety specifications, moving entry-level vehicles toward energy-absorbing beam designs rather than basic structural reinforcements. The region’s competitive intensity favors high-volume, cost-efficient manufacturing combined with fast design-to-production cycles, allowing APAC suppliers to scale advanced bumper beam technologies quickly.

North America is anticipated to represent a stability-driven market within the global bumper beam landscape, anchored by the U.S. as the primary center of OEM engineering, platform development, and safety innovation. Demand is expected to remain structurally resilient due to the region’s sustained preference for SUVs and light trucks, which require larger, higher-strength bumper beam architectures and drive higher material intensity per vehicle. Companies such as Magna International, American Axle & Manufacturing, and Benteler are expected to continue shaping design standards through close collaboration with OEMs, particularly in high-volume pickup and SUV platforms.

Manufacturing and sourcing strategies in North America are expected to prioritize supply chain resilience and platform flexibility as electrification scales across vehicle portfolios. Nearshoring of component production into Mexico is likely to expand, enabling OEMs to balance cost efficiency with shorter lead times for EV and hybrid platforms. Overall, North America is expected to remain a core value market characterized by a premium vehicle mix, high per-unit content, and continuous engineering iteration rather than purely volume-driven expansion.

Europe is anticipated to remain a structurally mature market for bumper beams, underpinned by the concentration of premium OEMs in Germany, France, and the U.K. The region’s leadership is shaped by deep engineering intensity, platform standardization across multi-brand portfolios, and early adoption of advanced safety architectures. European automakers such as Volkswagen Group, BMW, Mercedes-Benz, and Stellantis are expected to continue specifying pedestrian-friendly bumper systems and energy-absorbing beam designs as part of their core vehicle safety propositions. This design philosophy places sustained emphasis on high-precision forming, multi-material integration, and tighter tolerances, reinforcing Europe’s position as a benchmark market for bumper beam performance rather than purely a volume-driven region.

The regional supply base is expected to advance circular manufacturing models and lightweighting strategies as core competitive levers. Tier-1 suppliers, including Gestamp, Benteler, and Magna, are expected to expand the use of recycled aluminum, green alloys, and hybrid metal–composite beams to align with OEM decarbonization roadmaps while maintaining crashworthiness in electric vehicle platforms. As electrification deepens across European fleets, bumper beam architectures are expected to evolve toward lighter, modular designs that support battery protection, pedestrian safety, and vehicle range optimization simultaneously.

The global bumper beam market is moderately consolidated, with leading Tier 1 suppliers such as Magna International, Plastic Omnium, and Benteler exerting strong influence through deep OEM relationships, advanced R&D capabilities, and globally scaled manufacturing footprints. These players matter because their platform integration expertise and materials engineering depth allow them to set performance benchmarks and qualification standards across major vehicle programs. Their scale also enables rapid industrialization of lightweighting solutions and compliance with evolving crash and safety requirements, reinforcing leadership across high-volume platforms.

Beneath the top tier, competition remains active as regional suppliers in China and India serve cost-sensitive programs with standard-specification beams. Competitive positioning reflects a split between technology-led leaders focused on advanced materials, modular design, and platform integration, and cost-driven regional manufacturers competing on price and local supply responsiveness. Industry behavior points toward continued lightweighting innovation, platform standardization, and selective consolidation, signaling rising competitive pressure as OEMs demand higher performance at lower system cost.

The global bumper beam market is projected to be valued at US$2.1 billion in 2026 and is expected to reach US$3.0 billion by 2033, driven by rising vehicle production, tightening safety regulations, and lightweighting pressures from electrification.

Electric vehicles use heavy battery packs, making weight reduction in structural components such as bumper beams essential for maximizing range. This drives demand for aluminum and advanced high-strength steels that maintain crash performance while reducing mass, positioning lightweighting as a regulatory and design necessity.

The bumper beam market is forecast to grow at a CAGR of 5.1% from 2026 to 2033, reflecting steady demand from global vehicle production and increasing safety content per vehicle.

Asia Pacific is both the leading and fastest-growing regional market, accounting for approximately 46% share, supported by the world's largest vehicle production footprint, dense OEM–supplier networks, and rising safety and electrification content across mass-market and premium segments.

The bumper beam market is moderately consolidated, led by global Tier 1 suppliers such as Magna, Benteler, and Gestamp, supported by strong OEM ties and advanced materials expertise. In Asia Pacific, players such as Minth Group and Sungwoo Hitech compete through cost-efficient, high-volume manufacturing and rapid design-to-delivery capabilities.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Position

By Manufacturing Process

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author