ID: PMRREP15154| 177 Pages | 27 Oct 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

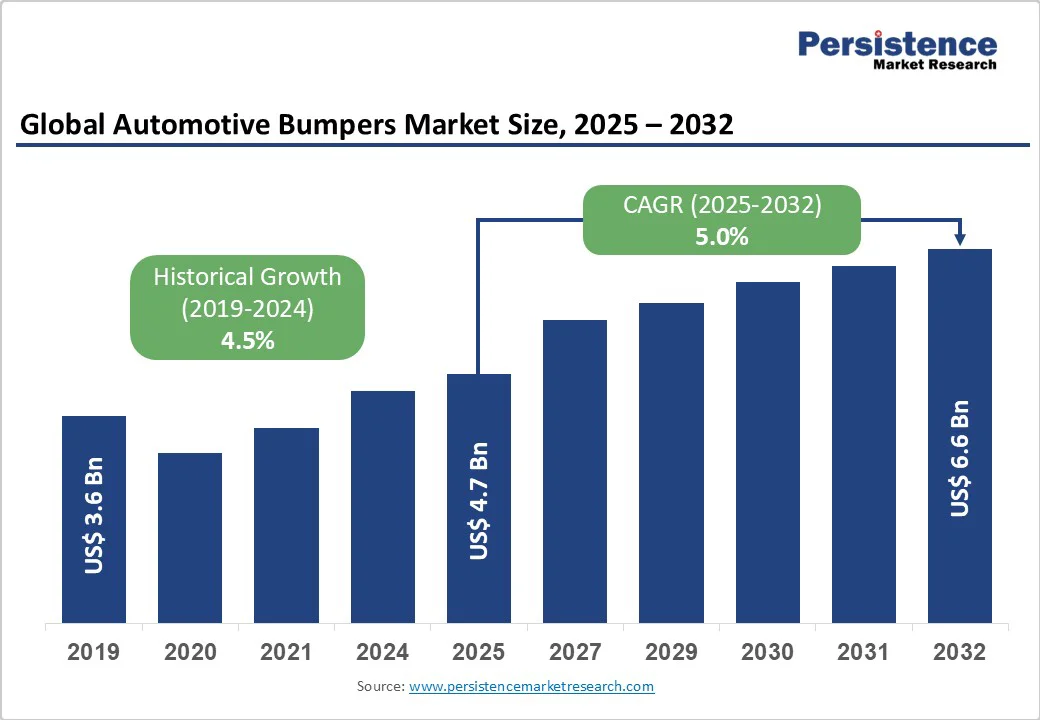

The global automotive bumpers market size is likely to be valued at US$4.7 Billion in 2025 and is estimated to reach US$6.6 Billion in 2032, growing at a CAGR of 5% during the forecast period 2025 - 2032, driven by increasing global emphasis on passenger and pedestrian protection.

This is pushing manufacturers to adopt energy-absorbing materials, lightweight composites, and novel design structures.

| Key Insights | Details |

|---|---|

| Automotive Bumpers Market Size (2025E) | US$4.7 Bn |

| Market Value Forecast (2032F) | US$6.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.0% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.5% |

Strict global safety standards are pushing automakers to develop novel bumper systems that can better absorb impact and protect both passengers and pedestrians. Organizations such as the National Highway Traffic Safety Administration (NHTSA) in the U.S. and Euro New Car Assessment Program (NCAP) in Europe have tightened regulations on low-speed crash performance and pedestrian safety.

It is leading to the adoption of multi-layered energy-absorbing materials such as EPP foam, thermoplastic composites, and aluminum reinforcements. For example, the EU’s updated pedestrian protection protocols require bumpers to reduce leg and knee injuries during impact, prompting OEMs such as Volkswagen and Volvo to introduce foam-filled bumper beams and flexible plastic facias that meet these targets without adding extra weight.

Vehicle bumpers have become an important part of exterior styling and brand identity rather than just functional components. Modern manufacturing technologies such as multi-shot injection molding and in-mold painting enable automakers to design sleek, aerodynamic bumpers that smoothly blend with vehicle contours.

Brands such as BMW and Hyundai now use bumpers with integrated lighting and grille elements to improve visual appeal. The booming aftermarket for customized bumpers, especially among pickup and SUV owners in North America, further supports this trend. This is because consumers today seek unique designs, off-road styles, and color-matched finishes that reflect their personality and vehicle usage.

Automotive bumpers, particularly modern plastic and composite designs, often require professional repair or full replacement even after minor collisions. This increases the total cost of ownership for consumers and can reduce demand for novel bumper systems. For example, Tesla’s modular front bumpers for its Model 3 and Model Y are lightweight and energy-absorbing but are expensive to replace if damaged, with repair costs sometimes exceeding several thousand dollars.

Luxury SUV owners in North America and Europe report high insurance premiums due to the costly nature of sensor-integrated bumpers. These financial considerations make both consumers and fleet operators cautious about fully adopting high-end, material-intensive bumper systems.

While modern plastic and composite bumpers excel at energy absorption, they lack the inherent structural rigidity of traditional steel bumpers. This can be a concern for heavy-duty vehicles such as trucks and large SUVs, where metal bumpers still perform better under high-impact scenarios.

For instance, pickup trucks in the U.S. often continue to use reinforced steel subframes beneath plastic fascias to ensure load-bearing strength. This limitation restricts the full replacement of metal bumpers in certain vehicle segments, especially those prioritizing towing, off-road durability, or extreme impact resistance.

The surging emphasis on vehicle efficiency and crash safety is creating new opportunities for bumpers made from next-generation materials. Manufacturers are now adopting carbon-fiber-reinforced plastics, thermoplastic composites, and hybrid materials that provide high impact absorption with reduced weight. For instance, Plastic Omnium’s 2024 Lightweight Smart Fascia uses long-glass-fiber-reinforced polypropylene to cut weight by 15% compared to traditional designs while maintaining durability.

Japan-based suppliers are also experimenting with biocomposite bumpers using natural fibers to meet sustainability targets without compromising strength. This transition toward novel materials not only helps automakers meet global emission and recycling regulations but also opens doors for material innovators and specialized suppliers.

With the rise of connected and autonomous vehicles, bumpers are evolving into intelligent modules that house radar, ultrasonic sensors, cameras, and even LiDAR systems. These embedded components support Advanced Driver-Assistance Systems (ADAS), including parking assist, collision avoidance, and adaptive cruise control. For example, Magna’s radar-transparent bumper fascia, launched in 2024, allows smooth sensor integration without signal interference, improving vehicle safety and performance.

Hyundai Mobis has also developed integrated lighting and sensor modules within bumpers for its IONIQ EV lineup. As ADAS becomes standard in new models, the demand for sensor-compatible bumper designs presents a key technological and commercial growth opportunity for suppliers.

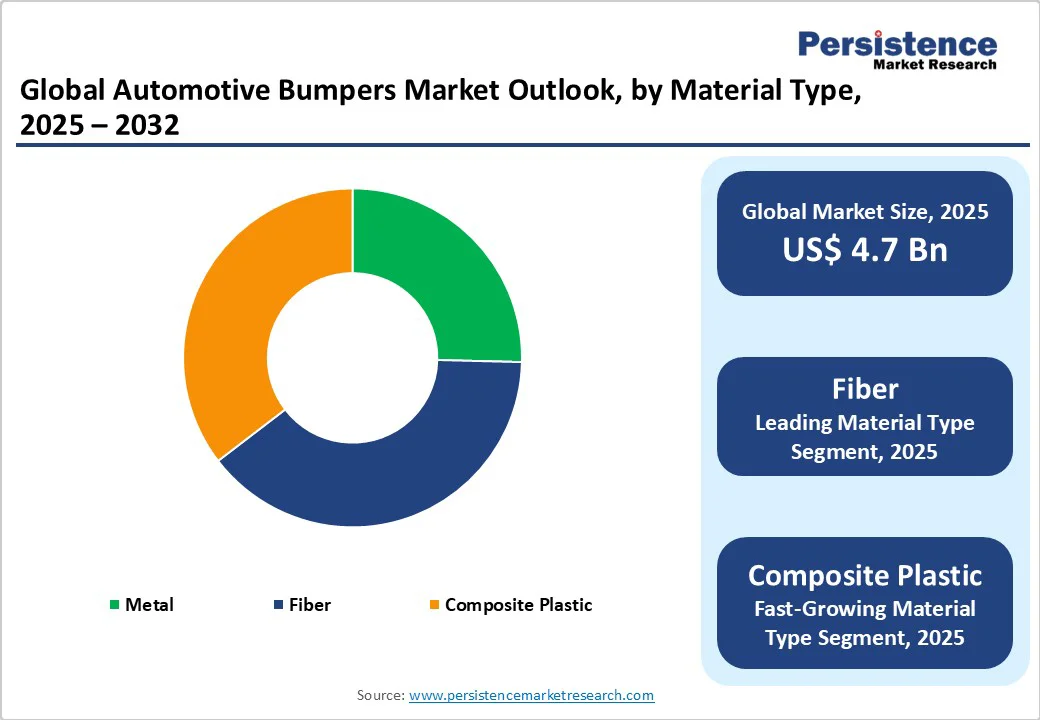

Fiber-reinforced automotive bumpers are estimated to hold a share of around 39.2% in 2025 as they combine lightweight construction with high impact resistance. Materials such as long-glass-fiber polypropylene or carbon-fiber composites allow bumpers to absorb collision energy effectively while reducing vehicle weight, which improves fuel efficiency and EV range. Fiber bumpers also deliver better dimensional stability and resistance to cracking under stress, making them ideal for both high-performance and passenger vehicles.

Composite plastic bumpers continue to see consistent demand due to their versatility, cost-effectiveness, and ease of integration with modern vehicle designs. They can be easily molded into complex shapes for aerodynamic styling while accommodating sensors, cameras, and other ADAS components. In addition, composite plastics allow for partial use of recycled materials, helping automakers meet sustainability and regulatory requirements.

Passenger vehicles are predicted to capture a share of nearly 58.2% in 2025, owing to safety regulations, styling trends, and consumer expectations pushing frequent innovation in this segment. Modern cars require bumpers that absorb low-speed collisions and also integrate sensors, cameras, and radar for ADAS features. Passenger vehicles also push design flexibility, with bumpers contributing to brand identity and aerodynamics, making them a key focus area for OEMs and aftermarket suppliers.

Commercial vehicles such as trucks, buses, and delivery vans continue to fuel steady bumper demand due to their exposure to heavy loads, frequent urban collisions, and operational wear. These vehicles require durable bumpers capable of withstanding minor impacts while protecting structural components and cargo. Ford and Freightliner have developed reinforced thermoplastic or hybrid metal-plastic bumpers for commercial pickups and vans, providing both impact resistance and easier maintenance.

Rear end bumpers are poised to account for about 62.7% of the share in 2025, as they absorb impacts in low-speed collisions, which are among the most common types of accidents, especially in urban environments. Modern rear bumpers often incorporate energy-absorbing cores and crumple zones to protect the vehicle body and reduce repair costs. These are also used to house sensors for parking assist, cameras, and lighting systems, making them essential for both safety and convenience in passenger vehicles.

Front bumpers are seeing steady growth due to the rising integration of ADAS and pedestrian safety requirements. They must accommodate radar, LiDAR, and camera modules for collision avoidance, adaptive cruise control, and autonomous driving features. Also, front bumpers are essential for vehicle aesthetics and aerodynamics, especially in EVs and luxury cars, further augmenting demand as manufacturers aim to blend style with functional safety.

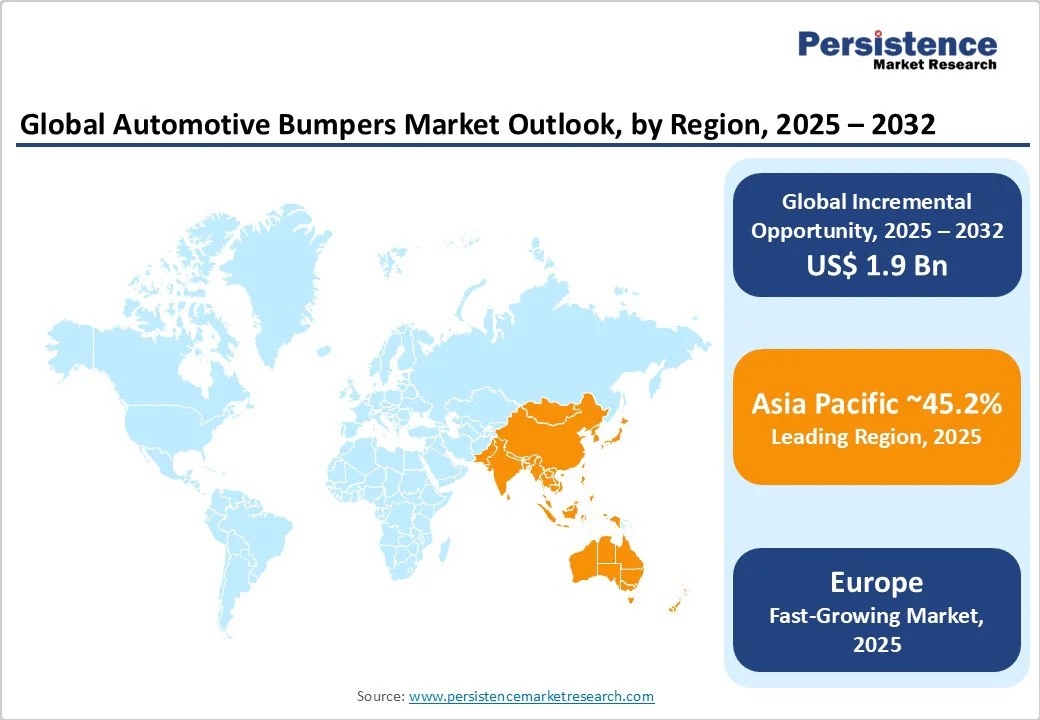

In 2025, Asia Pacific is estimated to account for approximately 45.2% of the share, supported by the massive vehicle production base in China, India, Japan, and South Korea. China remains the manufacturing hub, with global suppliers such as Plastic Omnium, Motherson, and Flex-N-Gate expanding their local facilities to cater to key OEMs, including BYD, Geely, and SAIC. India is also emerging as a powerful production base, backed by government initiatives such as ‘Make in India’ that encourage domestic manufacturing of automotive components.

In 2024, Motherson opened new facilities in Chennai and Pune to supply bumpers to Hyundai and Suzuki, reflecting the surging localization trend. Lightweighting is a major focus across Asia Pacific, especially for electric and hybrid vehicles. Automakers are replacing metal bumpers with thermoplastic and composite alternatives to improve energy efficiency and meet emission goals. Japan and Korea-based manufacturers are leading in developing smart bumpers that integrate radar sensors and cameras for ADAS.

In Europe, the market is undergoing a significant transformation propelled by sustainability and safety regulations. The European Union’s End-of-Life Vehicle (ELV) Directive and upcoming recycled-plastic mandates are pushing automakers and suppliers to use more eco-friendly materials. Leading companies, including Plastic Omnium (now OPmobility), Faurecia, and Magna, are developing bumpers made from recycled polypropylene and bio-based polymers.

For instance, OPmobility recently unveiled a bumper concept using 50% recycled plastic as part of its low-carbon exterior systems initiative. This focus on circular production has led to collaborations with recyclers and polymer producers across France, Germany, and the Netherlands. Domestic automakers are further integrating sensors, cameras, and radar units into bumpers for ADAS and collision-avoidance systems. These features require radar-transparent materials and seamless designs to avoid signal interference.

In North America, the market is heavily influenced by the region’s preference for large vehicles such as SUVs and pickup trucks. These vehicles require superior bumpers with reinforced steel or aluminum structures to handle heavy-duty use and towing functions. Metal bumpers still hold a noticeable share, especially in trucks produced by Ford, General Motors, and Ram. However, there is a gradual shift toward novel thermoplastics and composite bumpers to reduce weight and improve fuel efficiency.

Suppliers such as Magna are leading this shift, developing hybrid bumpers that combine metal reinforcement with plastic fascias for better crash performance and light weight. The rising adoption of electric and autonomous vehicles in the U.S. and Canada is further boosting demand for smart bumpers. For example, Magna recently introduced radar-transparent bumper fascias designed specifically for EV platforms. Tesla’s latest models also use modular bumpers that simplify repairs and improve sensor alignment.

The global automotive bumpers market is moderately concentrated, with a few global Tier-1 suppliers dominating original equipment contracts. Companies such as Plastic Omnium (now OPmobility), Magna International, Flex-N-Gate, Motherson Group, and Hyundai Mobis are the leading players supplying to renowned automakers worldwide. They have superior engineering capabilities, global production footprints, and the ability to meet strict OEM requirements.

Regional suppliers such as Toyoda Gosei in Japan, Kirchhoff Automotive in Germany, and Tong Yang in Taiwan serve localized markets and often cater to aftermarket demand.

The automotive bumpers market is projected to reach US$4.7 Billion in 2025.

Rising safety regulations and the integration of ADAS sensors are the key market drivers.

The automotive bumpers market is poised to witness a CAGR of 5.0% from 2025 to 2032.

Increasing EV adoption and sustainable material mandates are the key market opportunities.

Futaba Industrial Co., Ltd., Magna International, Inc., and Plastic Omnium SA are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Vehicle Type

By Positioning

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author