ID: PMRREP3537| 199 Pages | 12 Jun 2025 | Format: PDF, Excel, PPT* | Industrial Automation

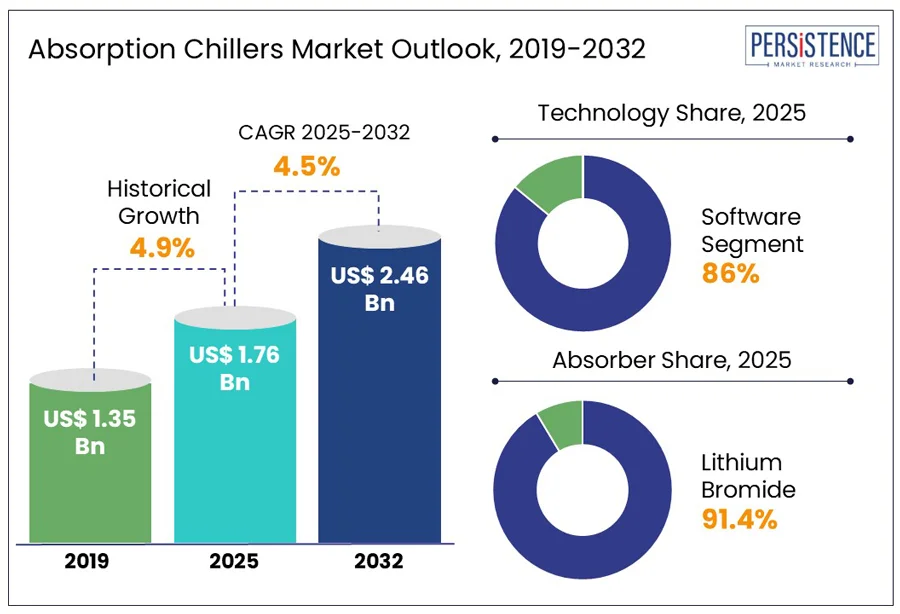

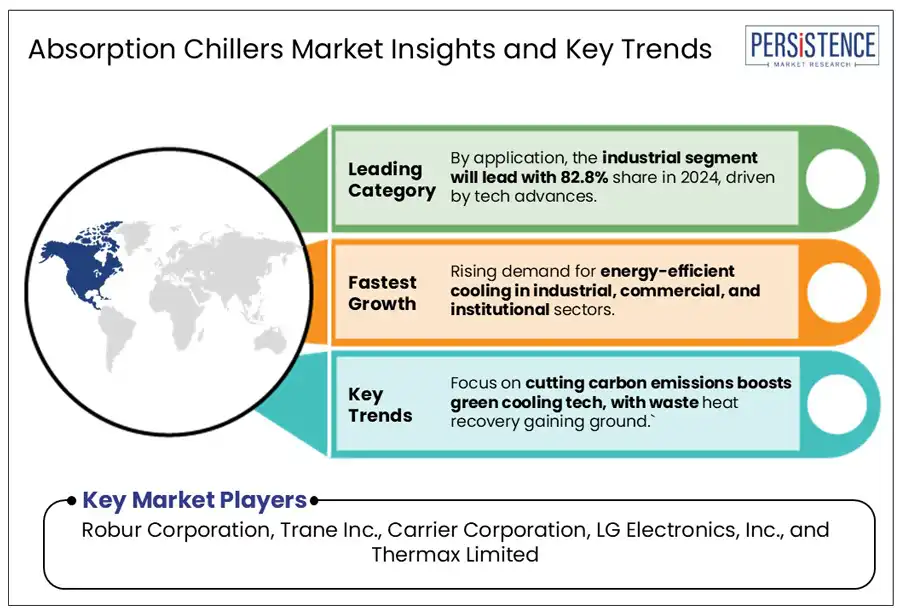

The global absorption chillers market size is anticipated to rise to US$ 2.46 Bn by 2032 at a CAGR of 4.5% from 2025 to 2032. The need for energy-efficient cooling solutions across a range of sectors encourages robust developments in the absorption refrigeration. The use of green cooling solutions focus on lowering carbon emissions, which is even highlighted by programs such as the EU Green Deal and the U.S. Inflation Reduction Act (2022).

Data centers, hospitals, and large commercial buildings, which collectively represent 40% of global cooling demand, are increasingly implementing absorption chillers for consistent and efficient operation. Large-scale central air conditioning applications benefit greatly from the efficiency of lithium bromide-based absorption refrigeration systems, which are predicted to account for 91.4% of the market in 2025.

Developing countries, including India and Brazil, have witnessed a surge in investments in advanced cooling technologies due to expanding industrial infrastructure. Based on the studies, the waste heat recovery systems, using absorption chillers, are gaining popularity with a projected 12.5% annual growth in global market penetration through 2028. Since 2020, renewable energy integration, such as solar-powered chillers, has significantly reduced operational costs largely due to their environmental and economic benefits.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Absorption Chillers Market Size (2025E) |

US$ 1.76 Bn |

|

Market Value Forecast (2032F) |

US$ 2.46 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.9% |

Absorption refrigeration technology, which uses waste heat from food processing for cooling is used by the food and beverage industries to help with decarbonization. Absorption chillers using a water-lithium bromide refrigerant cycle are safer and efficient than conventional systems.

By integrating with combined heat and power systems and reaching temperatures as low as 23°F, they improve energy efficiency and lower operating costs, therefore achieving industrial decarbonization targets. Green solutions are becoming a popular trend in the food industry, because of their advantages for the environment and financial incentives.

Regulations are tightened by the governments, which is speeding up the adoption of green technologies in food processing. Growing consumer desire for ecological practices is predicted to fuel a rapid expansion of the absorption refrigeration trend.

The absorption chillers market is facing mounting challenges due to rapid advancements in electric chiller technologies. Modern electric chillers have become more energy-efficient and cost-effective, posing strong competition to absorption systems. Innovations such as variable-speed drives and smart controls have enhanced performance by enabling electric chillers to efficiently adapt to varying load conditions, thereby lowering energy consumption and operating costs. These improvements make electric chillers increasingly attractive across industries, negatively impacting the market share of absorption cooling solutions.

A notable example is the recent launch of Mitsubishi Electric’s MECH-iF Air Cooled Chiller, offering capacities from 345kW to 921kW, utilizing R1234ze (G04) or R513A (G05) refrigerants and featuring proprietary screw variable speed compressors for optimized efficiency.

The demand for absorption chillers offers a strong chance for technical advancement with cutting-edge hybrid cooling systems. Manufacturers may create complex and adaptable cooling technologies by combining absorption chiller technology with additional cooling techniques, including heat pumps, solar thermal systems, and thermal storage solutions.

The hybrid systems offer flexibility and energy economy while meeting a variety of cooling needs in a wide range of commercial and industrial applications. There are many chances for study and development in this field, including the creation of scalable, and modular cooling systems that can be adjusted to various operating environments, energy sources, and temperature needs. By putting producers at the forefront of sustainable cooling technology innovation and improving the value proposition of absorption chillers, the approach creates new market niches and attracts eco-conscious customers.

Lithium bromide-based absorption refrigeration systems are widely preferred for large-scale central air conditioning due to their high efficiency and reliability. Lithium bromide (LiBr) exhibits a strong chemical affinity for water, the refrigerant, allows to maintain vacuum conditions essential for continuous cooling. In these systems, water undergoes flash boiling under vacuum at sub-freezing temperatures to cool the evaporator or chilled water coils. Lithium bromide absorbs the accumulated water vapour thus preserving system stability. This unique mechanism ensures consistent performance and low operational costs.

The growing demand for eco-friendly, energy-efficient cooling solutions without harmful emissions further boosts the adoption of LiBr-based chillers, making them an ideal choice for commercial and industrial applications prioritizing sustainability and efficiency.

Double-stage absorption chillers are anticipated to dominate the technology segment with a market share of 86% in 2025, reflecting their superior efficiency and cost-effectiveness. Double-stage systems, offering upto 35% higher efficiency than single-stage units are increasingly preferred for high-efficiency cooling solutions in industries focusing on operational cost reduction and sustainability.

The global energy-efficient cooling market experienced 11% growth in 2023, primarily due to the adoption of double-stage systems in sectors such as pharmaceuticals, petrochemicals, and data centers. For example, in February 2023, Trane Technologies introduced a double-stage absorption chiller reducing energy consumption by 20% and integrating waste heat recovery technologies, highlighting their importance in energy sustainability and operational excellence.

Asia Pacific is predicted to attain a market share of 29.6% in 2024, driven by rapid industrialization and cost-effective manufacturing, with China and India leading the way due to expanding industrial infrastructure. China invested over US$ 12 Bn in energy-efficient cooling systems in 2023, aiming to achieve peak emissions by 2030 under its "Dual Carbon" goals. India's Production-Linked Incentive (PLI) scheme for green technologies, launched in 2022, has experienced a 15% annual growth in green technology adoption.

The increasing need for air conditioning in commercial and industrial settings has boosted sales as absorption cooling systems providing a dependable and environmentally responsible cooling option. Mahan Energen Limited has anticipated 1600 MW ultra-supercritical power plant expansion, as well as Haldia Petrochemicals' USD 10 billion oil-to-chemicals project is set to lead to an increasing usage of absorption refrigeration units that are important for regulating process cooling and ensuring proper temperatures.

The adoption of energy-efficient and renewable cooling solutions, especially in the United States, and federal incentives such as the U.S. Inflation Reduction Act are expected to propel industry growth in North America and account for a 34.1% share in the global market in 2025.

Projects such as the Natrium Advanced Reactor Demonstration in Wyoming and AWS's USD 11 billion data center complex in Indiana are set to create a significant need for absorption cooling systems that can handle cooling demands efficiently. Google's USD 2 billion data center project and PPG's USD 300 million investment in innovative manufacturing procedures are further projected to increase the demand for efficient cooling systems.

The European Absorption Chillers Market is projected to account for fast-growth in 2025 positioning as a global leader in urban innovation. This growth is primarily driven by the robust policy frameworks and strategic funding initiatives from the European Union.

The UK Absorption Chillers Market is expected to witness significant growth in the coming years, driven by a strong shift toward digitally integrated governance and citizen-centric urban services.

Market players in the global absorption chillers market are enhancing their presence and competitiveness by incorporating unique technologies, such as variable-speed compressors and intelligent controls. They are integrating renewable energy sources to improve energy efficiency and environmental sustainability.

Manufacturers are introducing new products and investing significantly in research and development to improve chiller technologies. These innovations will give companies a competitive edge in the market. They are diversifying their product portfolios and offering industrial chillers with varying capacities and configurations.

Businesses are targeting specific industries to cater to specialized cooling requirements. Consumers prefer companies that offer comprehensive solutions, including installation, maintenance, and support services. Market reach and distribution networks are crucial. Maintaining customer loyalty and trust is vital as customer relationships shape the competitive landscape.

The market is set to reach US$ 1.76 Bn in 2025.

The industry is estimated to rise at a CAGR of 4.5% by 2032.

The growing demand for energy-efficient cooling solutions and increasing focus on sustainability and decarbonization are the major growth drivers.

Expansion in renewable and waste heat utilization, and Rising adoption in district cooling and urban infrastructure are the key market opportunities.

Robur Corporation, Trane Inc., Carrier Corporation, LG Electronics, Inc., and Thermax Limited are a few leading players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

US$ Billion for Value |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Power Source

By Application

By Absorber Type

By Technology

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author