ID: PMRREP13948| 186 Pages | 13 Oct 2025 | Format: PDF, Excel, PPT* | Consumer Goods

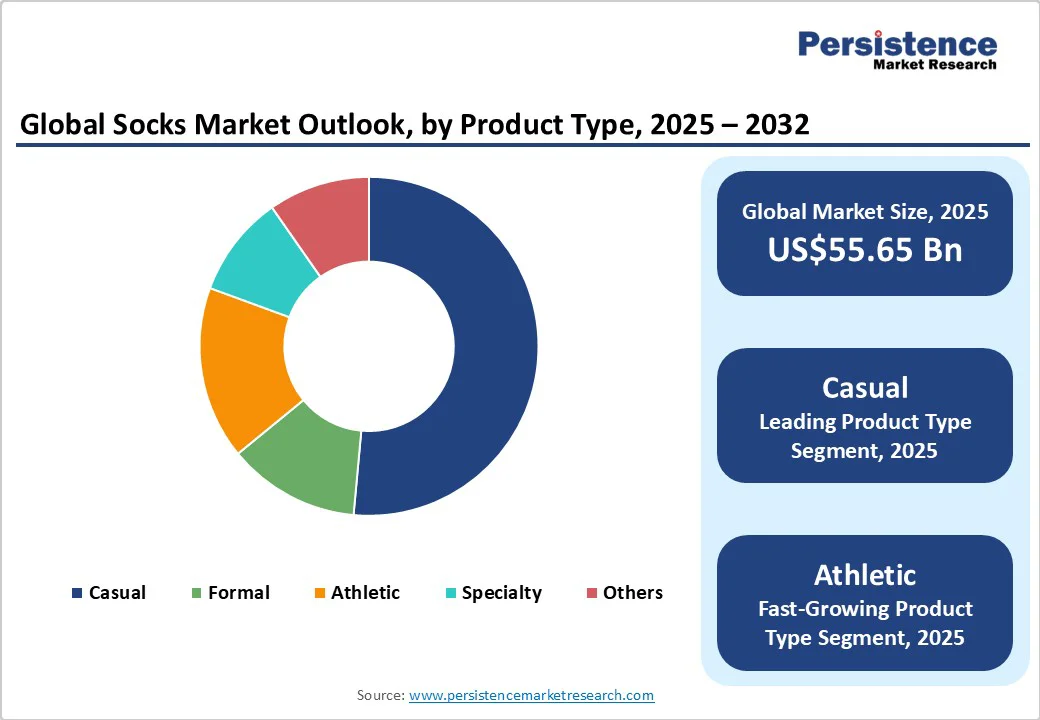

The global socks market size is likely to be valued at around US$55.65 billion in 2025. It is expected to reach around US$89.9 billion by 2032, growing at a CAGR of 7.1% during the forecast period from 2025 to 2032, driven by the rising demand for performance and specialty socks, including athletic, compression, and medical categories.

Growth is supported by rising disposable incomes in emerging economies and the widespread adoption of online retail, which has enhanced distribution reach and product variety. Sustainability initiatives, such as the use of recycled fibers and organic cotton, along with smart-textile innovations, are driving premiumization. Volatility in raw material prices and pricing pressures from low-cost producers temper profit margins, but do not hinder overall growth.

| Key Insights | Details |

|---|---|

|

Socks Market Size (2025E) |

US$55.65 Bn |

|

Market Value Forecast (2032F) |

US$89.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.5% |

The growing popularity of fitness, outdoor activities, and the athleisure trend has boosted demand for technical and athletic socks. These products, which feature moisture-wicking properties, compression zones, and targeted cushioning, enable manufacturers to charge premium prices and achieve higher margins. Partnerships with sports teams and brands have strengthened visibility, and performance-focused offerings are a primary driver of the market’s projected growth.

Online retail channels are the fastest-growing distribution segment, supporting rapid product launches and SKU proliferation. Direct-to-consumer models increase margins and facilitate subscription and personalization business models, including monthly sock kits. This channel reduces traditional retail costs and accelerates market reach while increasing competition based on price and product differentiation.

Consumer preference for eco-friendly products has led to an increase in the adoption of recycled fibers, bamboo, and organic cotton. Sustainable product lines enable manufacturers to secure retail placement and premium pricing. Vertical integration in recycled-material sourcing reduces exposure to raw-material volatility and strengthens brand credibility, positioning companies to benefit from the growing market for environmentally conscious products.

Fluctuations in cotton, wool, and synthetic fiber prices can compress manufacturers' margins. A 15–25% increase in cotton prices can reduce gross margins on commodity sock lines by 2–4 percentage points, forcing price adjustments or product-mix shifts. Hedging strategies and the use of blended fibers are critical to maintaining profitability.

Unbranded low-cost imports create price competition and can erode brand trust. Counterfeit products lead to increased returns and customer complaints, thereby raising the cost of customer acquisition and negatively impacting premium brands. Companies must invest in quality control and anti-counterfeit measures to protect their reputation.

Smart socks with embedded sensors for gait, pressure monitoring, and fall detection, as well as medical socks for diabetic and compression use, represent high-value niches. These products command higher prices and can generate incremental revenue in the hundreds of millions globally by 2030. Partnerships with medical device companies or wearable tech firms offer a clear path to commercialization.

Asia Pacific markets, including China, India, and ASEAN countries, exhibit rapid urbanization and rising disposable incomes. Premium and specialty socks are gaining traction, and increasing penetration of organized retail and e-commerce channels could drive multi-billion-dollar incremental growth by 2030.

Takeback and recycling programs enable brands to monetize used products while reducing reliance on raw materials. Premium pricing on recycled fiber collections enhances gross margin stability. A mid-sized brand that converts 20% of its SKUs to recycled content can achieve higher profitability and gain retailer support.

Casual socks remain the largest product type, accounting for approximately 53.4% of market share in 2025. Their widespread use in everyday wear, including office, school, and home settings, makes them a core category for both mass retail and hypermarket channels. These socks are available in multi-packs, various lengths, and neutral colors, catering to a broad demographic. Leading examples include Hanes’ everyday cotton socks, Uniqlo’s Heattech casual socks, and Puma’s basic crew socks, which combine affordability with comfort and durability. High-volume sales and consistent demand make casual socks the backbone of the market.

Athletic socks are experiencing the fastest growth in the product type category, driven by increased fitness participation, athleisure trends, and the rise of professional and amateur sports leagues globally. These socks include performance features such as moisture-wicking fabrics, compression zones, and reinforced cushioning. Premium and branded products, such as Nike Dri-FIT athletic socks and Adidas Performance crew socks, support higher ASPs and niche positioning. Rising consumer focus on health and fitness, combined with endorsements and sponsorships in sports, has accelerated growth in this segment, resulting in above-average CAGRs compared to casual socks.

Cotton remains the dominant material in the market due to its comfort, breathability, and consumer familiarity, holding a market share of 59%. It is widely used across casual, formal, and mid-range product lines, making it the largest segment by both volume and value. Examples include Hanes Premium Cotton Socks, Jockey cotton crew socks, and Uniqlo Supima cotton socks, which are preferred for daily wear and office use. The softness, moisture-absorbing properties, and hypoallergenic nature of cotton continue to drive its demand across all age groups.

Recycled fiber socks are the fastest-growing material segment, reflecting rising consumer preference for sustainability and eco-conscious products. These socks are made from recycled polyester, reclaimed cotton blends, or bamboo fibers, offering functional benefits such as moisture management, odor resistance, and durability. Examples include Bombas recycled cotton socks and Adidas Parley Ocean Plastic socks, which are positioned as premium, environmentally responsible options. Growth is fueled by regulatory pressures, retailer sustainability commitments, and increased awareness among eco-conscious consumers.

Men’s socks account for the largest share in terms of revenue, driven by high purchase frequency and consistent use across age groups. Formal wear, office attire, and corporate uniforms contribute to a steady demand, along with casual daily use. Brands such as Hugo Boss men’s dress socks, Hanes men’s crew socks, and Nike men’s performance socks dominate the segment. Men’s socks benefit from broad distribution through department stores, specialty retail, and online channels, establishing a consistent revenue base for manufacturers.

Women’s socks represent the fastest-growing end-user segment, propelled by fashion trends, rising discretionary incomes, and lifestyle-oriented consumption. Premium, designer, and fashion-forward options, such as Stance fashion socks, Uniqlo Heattech styles, and performance-focused Nike Dri-FIT athletic socks, are growing in popularity among women. Growth is further accelerated by the athleisure trend and the rise of sports participation among women, resulting in higher ASPs and increasing market share in the overall socks industry.

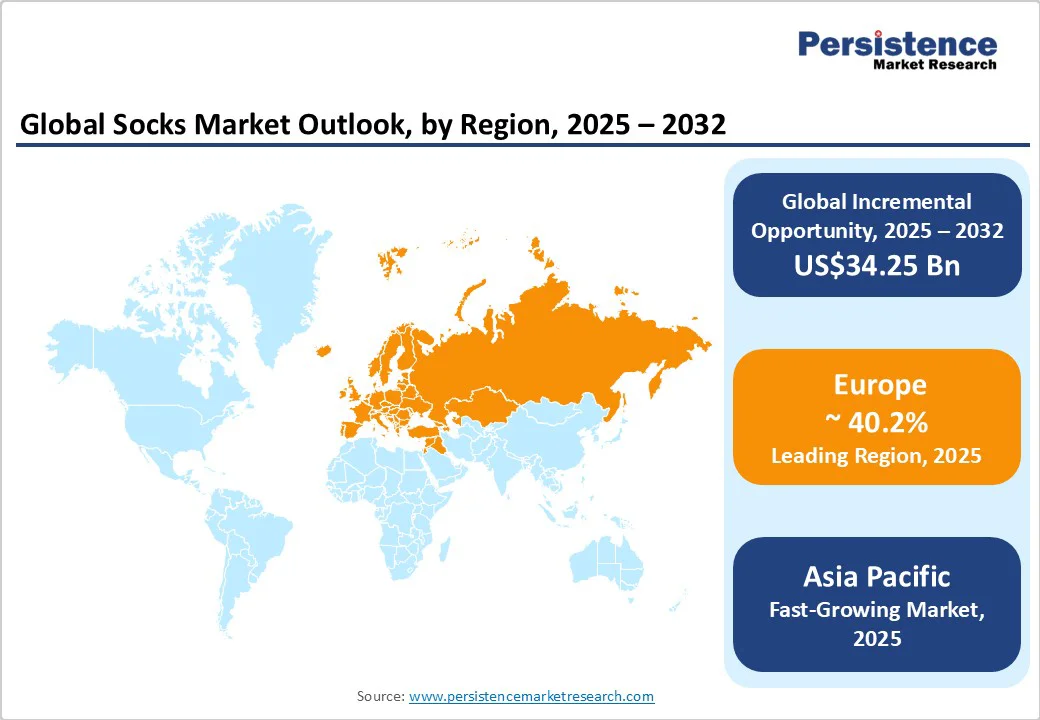

Europe accounts for the largest market share, at 40.2%, led by Germany, the U.K., France, and Spain. Key growth drivers include sustainability-conscious consumers, strict EU textile labeling and recycled-content regulations, and the dominance of organized retail channels such as Carrefour, Tesco, and Zalando. Fashion-forward designs and premium socks are gaining popularity among urban populations, particularly in Germany and the U.K., where athleisure and designer socks are increasingly popular.

The competitive landscape in Europe combines global sportswear brands, such as Adidas and Puma, with niche European manufacturers, including Falke and Burlington, which focus on premium and functional products. Recent developments include Puma’s 2024 launch of a recycled-material sock collection in the U.K. and Germany, and Falke’s expansion into digital customization services for premium socks. Investments are concentrated on brand consolidation, sustainable manufacturing, and boutique retail expansion, particularly in high-income European markets.

Asia Pacific is the fastest-growing regional market, with China, India, and Japan as primary contributors. Rising disposable incomes, rapid urbanization, and increased adoption of e-commerce and organized retail networks are key drivers. Online marketplaces, such as Alibaba, Flipkart, and Rakuten, are enabling small and medium-sized manufacturers to reach a broader consumer base. Fashion trends, coupled with a growing fitness-conscious population, are increasing the demand for athletic and premium socks in urban centers.

Local manufacturing hubs, particularly in China and India, offer cost advantages and large-scale production capacity, attracting global brands seeking regional entry or near-shoring opportunities. Regulatory compliance, including import duties and textile quality standards, influences production strategies and market access.

Recent developments include Li-Ning’s expansion into premium athletic socks in China in 2024 and India-based Lux Industries launching a sustainable bamboo sock line targeting urban youth. Investment trends focus on manufacturing scale-up, digital payment integration for e-commerce, retail chain expansion, and collaborations with sports and lifestyle brands to enhance market presence.

The North American market, particularly in athletic, performance, and premium segments, is fueled by the athleisure trend, rising fitness participation, and increased consumer focus on lifestyle-oriented apparel. The proliferation of e-commerce platforms and subscription services, such as Bombas’ sock subscription program and Stance’s Direct-to-Consumer channels, has enhanced consumer access and increased brand loyalty.

Regulatory oversight, including FTC guidelines on labeling and fiber claims, as well as trade policies affecting imported textiles, influences production costs and retail pricing. The competitive landscape is varied, with global sports giants such as Nike, Adidas, and Under Armor vying for market share alongside regional specialists and private-label brands from major retailers such as Target and Walmart, which lead in the volume-driven segment.

Recent developments include Nike’s launch of smart performance socks integrated with sensors for runners in 2024, and Bombas’ expansion into eco-friendly recycled cotton lines targeting environmentally conscious consumers. Investment trends focus on digital-first DTC platforms, smart textile innovation, and sustainability programs, reflecting growing consumer preferences for high-tech and eco-responsible products.

The global socks market is moderately fragmented, with leading global brands dominating premium and athletic segments, while private-label and regional manufacturers serve mid- and low-price tiers. Brand differentiation, cost competitiveness, and product innovation are key to maintaining market share. Market leaders focus on innovation, sustainability, premiumization, DTC growth, and strategic M&A. Differentiators include material certifications, smart-textile integration, and sports partnerships. Emerging models include circularity programs and medical sock adjacencies.

The socks market size is projected to be US$55.65 Billion in 2025.

The socks market is expected to reach US$89.9 Billion by 2032.

Key trends include athleisure adoption, growth of e-commerce and DTC channels, sustainability initiatives with recycled fibers, and premiumization of performance and fashion-oriented socks.

Casual socks remain the largest segment, dominating sales due to everyday use and mass retail availability.

The socks market is expected to grow at a CAGR of 7.1% from 2025 to 2032.

Major players include Nike, Inc., Adidas AG, Puma SE, HanesBrands Inc., and VF Corporation.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Material

By End-user

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author