ID: PMRREP7099| 194 Pages | 29 Aug 2025 | Format: PDF, Excel, PPT* | Food and Beverages

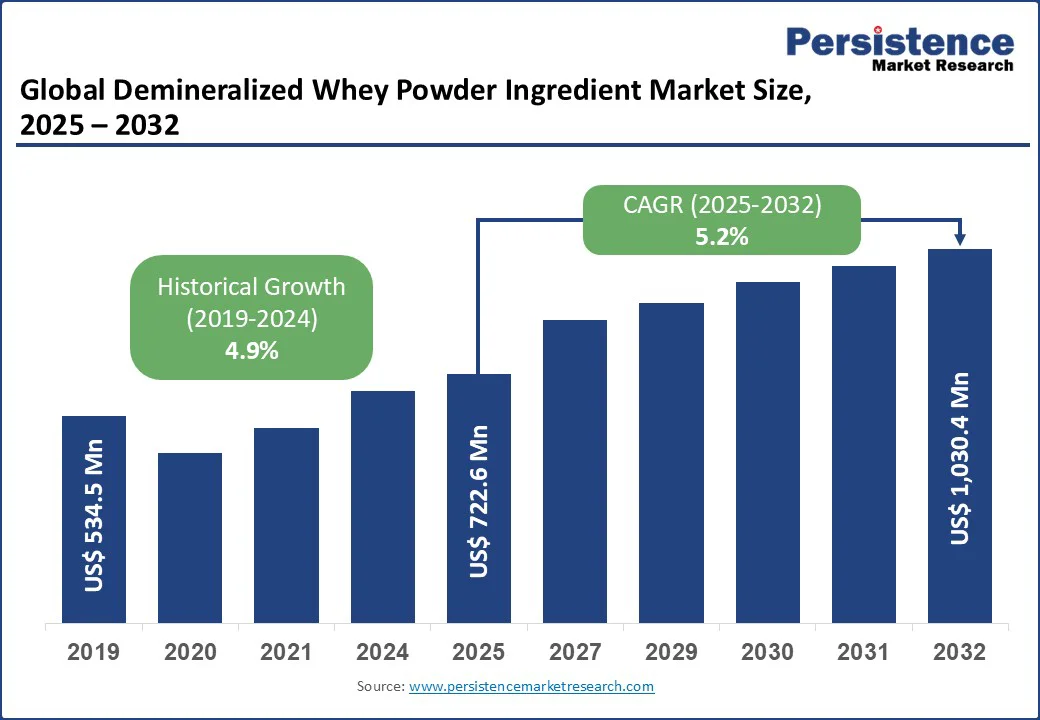

The global demineralized whey powder ingredient market size is likely to be valued at US$722.6 Mn in 2025 and is expected to reach US$1,030.4 Mn by 2032, growing at a CAGR of 5.2% from 2025 to 2032.

This growth is driven by the rising demand for demineralized whey powder in infant formula, owing to its close nutritional profile to breast milk, and increasing use in sports nutrition, functional foods, and dairy beverages.

The market is further supported by growing consumer preference for protein-enriched and easily digestible food ingredients, alongside expanding applications in bakery and confectionery products. Moreover, rapid urbanization, health-conscious lifestyles, and technological advancements in whey processing are boosting the growth.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Demineralized Whey Powder Ingredient Market Size (2025E) |

US$722.6 Mn |

|

Market Value Forecast (2032F) |

US$1,030.4 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.9% |

The rising demand for protein-rich and functional food ingredients is a major driver of the demineralized whey powder ingredient market. Demineralized whey powder delivers essential amino acids and high digestibility, making it suitable for infant formula, sports nutrition, functional beverages, and medical foods.

Consumers are increasingly adopting high-protein diets and seeking wellness-oriented products, leading to wider usage in bakery, confectionery, and dairy applications. For instance, the U.S. Department of Agriculture (USDA-ERS) reported that demand for whey protein concentrates in food and beverage products has grown strongly, especially in sports powders, fortified drinks, and nutrition bars, reflecting the shift toward protein-enriched nutrition.

This rising consumer preference, supported by government data, highlights how protein-focused dietary trends are accelerating the growth, positioning it as a critical component of the expanding functional food industry.

The demineralized whey powder ingredient market is significantly restrained by stringent food safety and quality regulations worldwide. Compliance with standards such as the U.S. FDA’s Current Good Manufacturing Practices (CGMP) and the European Commission’s infant formula directives requires manufacturers to implement advanced purification methods such as electrodialysis and ion-exchange to achieve the mandated mineral reduction levels.

These technologies increase operational costs, often making it challenging for small and mid-sized producers to compete. According to the USDA, U.S. food and beverage companies collectively spend over US$5 billion annually on food safety compliance, with dairy-based ingredients representing a considerable share.

Additionally, regulatory complexity across regions further intensifies production costs and trade barriers. The European Food Safety Authority (EFSA) imposes strict compositional and microbiological criteria on dairy ingredients, while China enforces rigorous import testing for dairy powders, leading to frequent shipment delays. These costly compliance requirements slow down market entry, limit cross-border trade, and restrain the growth.

The global shift toward organic and clean-label nutrition is opening significant opportunities for the demineralized whey powder ingredient market. Consumers are increasingly seeking products free from artificial additives, GMOs, and chemical residues, particularly in categories such as infant formula, sports nutrition, and functional foods.

According to the Organic Trade Association (OTA), U.S. organic food sales surpassed US$63 billion in 2023, with dairy products accounting for a major share, reflecting strong consumer confidence in organic-certified nutrition. This trend is accelerating demand for clean-label whey ingredients with verified sourcing and transparent processing.

In addition, rising awareness of sustainable and traceable food supply chains further boosts adoption. Clean-label whey powders appeal strongly to health-conscious consumers in Europe and North America, while rapid urbanization and premium product demand in the Asia Pacific are expanding growth prospects.

As leading manufacturers focus on organic-certified demineralized whey powders, this position puts it to benefit from increasing preference for safe, natural, and minimally processed nutritional ingredients.

In 2025, 40% demineralized whey powder dominates, holding about 45% share with a value of US$325 Mn. Its strong position is attributed to cost-effectiveness and versatility, particularly in bakery and confectionery applications.

With moderate protein content and good solubility, it improves dough elasticity, moisture retention, and overall texture, enhancing product quality. In fact, by 2024, nearly 60% of global bakery products had incorporated 40% demineralized whey to achieve better consistency and flavor.

Meanwhile, 90% demineralized whey powder has emerged as the fastest-growing category, valued at US$144 Mn in 2024 and projected to reach US$260 Mn by 2032. Its high purity and reduced mineral content make it particularly suitable for infant formula and pharmaceutical nutrition.

Growing consumer preference for premium baby foods and specialized medical nutrition products, expected to rise by about 10%, is fueling demand for this segment, positioning it as a key driver of market expansion over the forecast period.

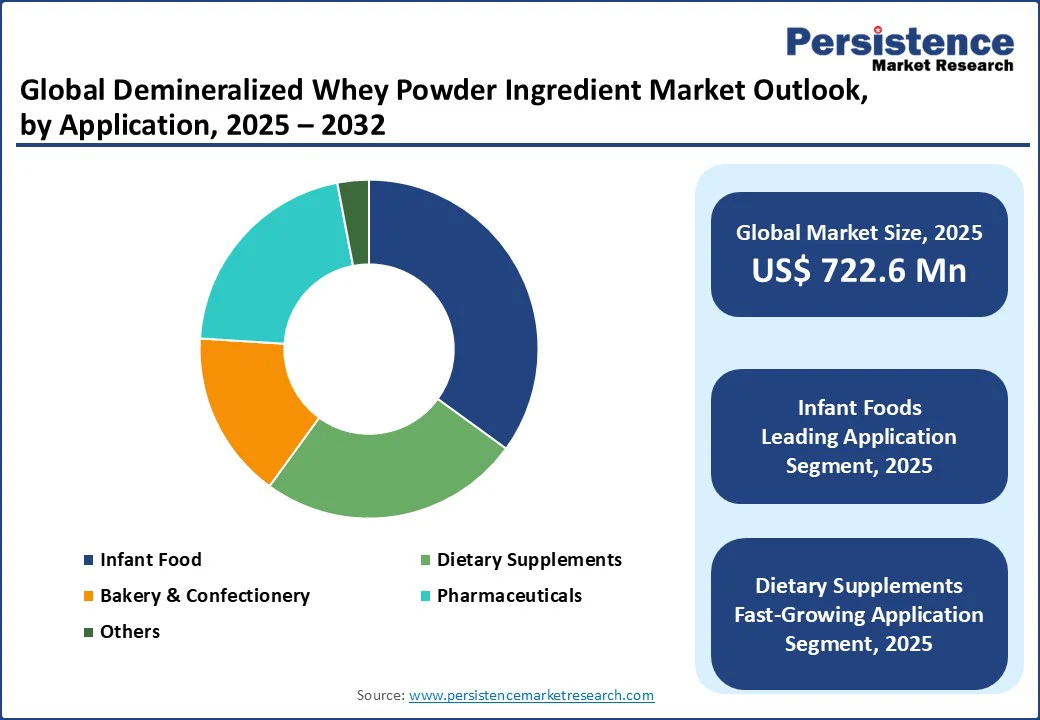

In 2025, infant food remains the leading application segment, accounting for nearly 35% market share and generating revenues of about US$253 Mn. Growth in this segment is primarily driven by the essential role of demineralized whey in developing infant formulas with balanced mineral profiles, closely aligned with the nutritional needs of infants.

In 2024, around 70% of global infant formula brands incorporated 70% and 90% demineralized whey, reflecting its value for digestibility and its nutritional resemblance to human breast milk.

At the same time, dietary supplements represent the fastest-growing application area, fueled by increasing fitness awareness and the rising popularity of protein-enriched products. This segment was valued at US$180 Mn in 2024 and is projected to reach US$350 Mn by 2032. Notably, whey-based protein powder sales grew by 15% in 2024, with demand particularly strong in North America and Asia Pacific, highlighting robust growth potential.

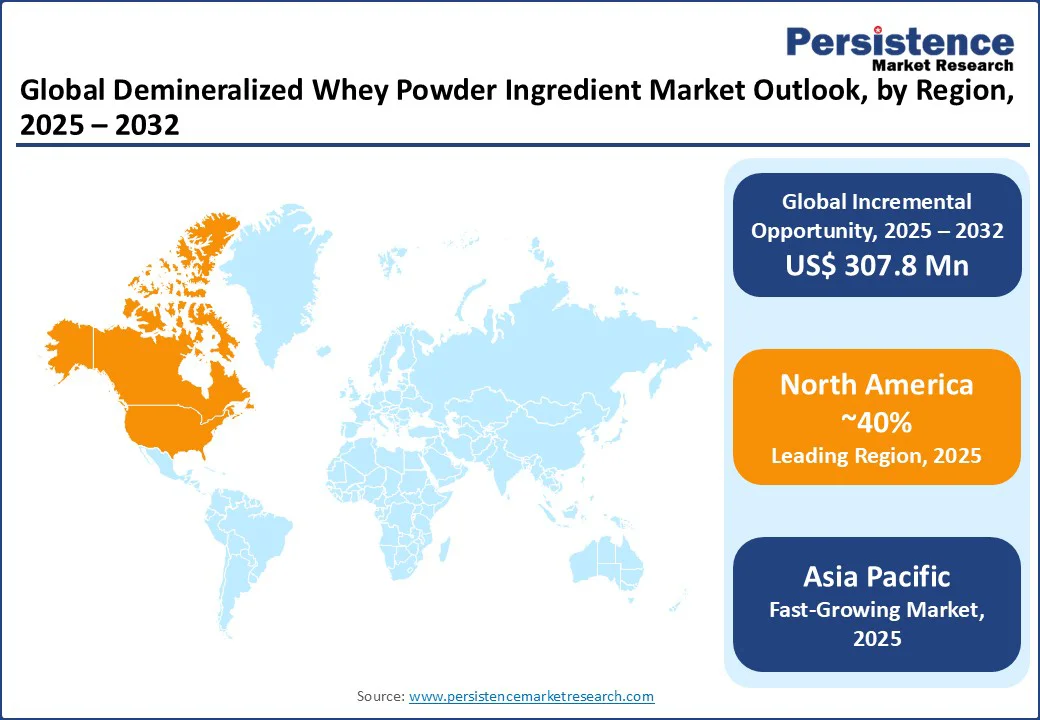

North America remains the leading regional market, accounting for nearly 40% of the global share in 2025, supported by high consumption in the United States and Canada. The U.S. generated about US$260 Mn in revenue, driven by the strong presence of infant nutrition and sports nutrition sectors. In 2024, nearly 50% of protein supplements in the country contained demineralized whey, underscoring its role in the growing protein-based product category.

Meanwhile, Canada’s market growth is shaped by rising health-conscious consumer preferences and wider dairy innovation. Notably, about 20% of Canadian dairy products incorporated demineralized whey in 2024 to improve texture and nutritional content, a trend further encouraged by government-supported nutritional programs promoting healthier food choices.

Europe holds a significant share supported by strong demand from the infant formula and functional food industries. Countries such as Germany, France, and the Netherlands are leading contributors, given their well-established dairy processing sectors and advanced nutrition markets. In 2025, Europe is estimated to contribute nearly 30% of global revenue, with steady adoption in both infant food and sports nutrition.

In 2024, over 65% of infant formula brands across Europe utilized 70% and 90% demineralized whey, highlighting its importance in delivering balanced mineral profiles and improved digestibility. Rising consumer preference for clean-label and organic nutrition further strengthens regional growth, while strict EFSA regulations ensure high product quality and safety standards.

Asia-Pacific is the fastest-growing region driven by rising demand in China, India, and Southeast Asia. Increasing birth rates, a growing middle-class population, and higher spending on premium infant formula are key factors fueling regional growth. In 2025, the Asia Pacific is projected to contribute nearly 25% of global revenue, with strong potential for further expansion.

In 2024, demand for 90% demineralized whey surged as over 60% of leading infant nutrition brands in China incorporated it into formulas for enhanced digestibility and closer nutritional similarity to breast milk. Additionally, the region’s expanding sports nutrition and dietary supplements sector, particularly in India and Australia, further supports rapid adoption, making the Asia Pacific the most dynamic market over the forecast period.

The global demineralized whey powder ingredient market shows a moderately consolidated structure, with leading producers accounting for over 65% of global revenue in 2025. Competition is shaped by advancements in demineralization technologies, product innovation, and compliance with stringent food safety regulations.

Companies are increasingly emphasizing clean-label, organic-certified, and high-purity whey powders to meet rising demand from infant formula, sports nutrition, and functional food applications. Expansion in Asia Pacific and Europe highlights strong growth opportunities, supported by increasing consumption and evolving nutritional standards

The demineralized whey powder ingredient market is projected to reach US$722.6 Mn in 2025, driven by demand for protein-rich ingredients.

Key drivers include rising demand for protein-rich diets, infant nutrition needs, and advancements in food processing technologies

The demineralized whey powder ingredient market will grow from US$722.6 Mn in 2025 to US$1,030.4 Mn by 2032.

Opportunities include organic and clean-label product demand, expansion in emerging markets, and growth in dietary supplements.

Leading players include Valio Ltd., Eurosérum, Dairygold Food Ingredients, Dairy Crest Group Plc., Lactalis Ingredients, and Royal FrieslandCampina NV.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Product Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author