ID: PMRREP35486| 189 Pages | 3 Sep 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

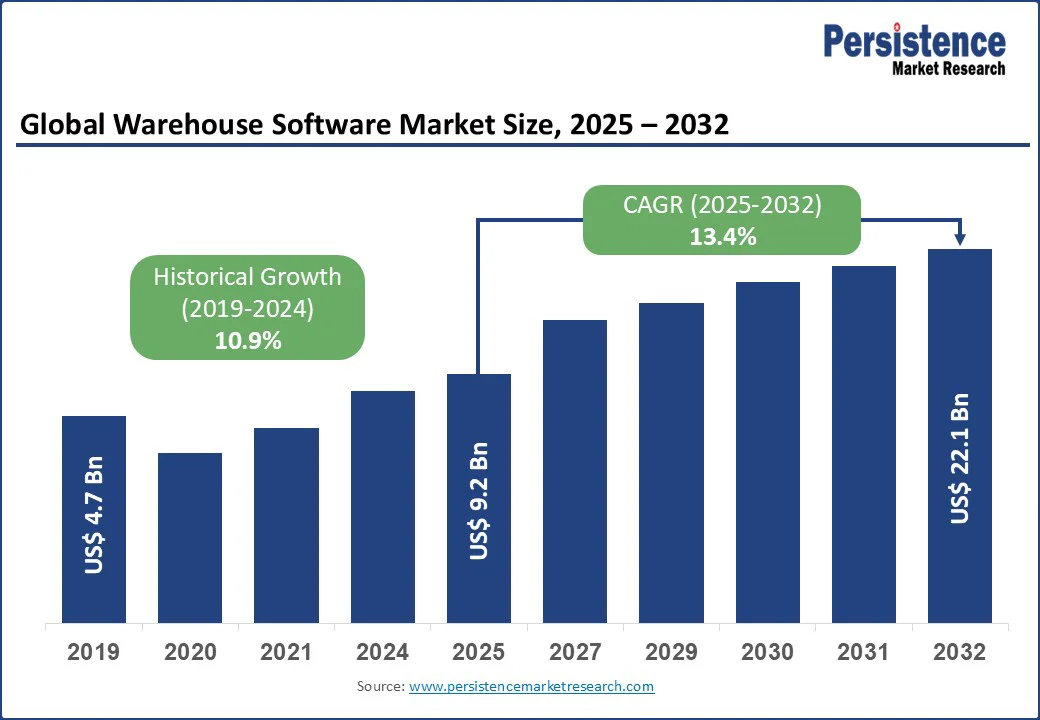

The global warehouse software market size is likely to be valued at US$ 9.2 Bn in 2025 and is estimated to reach US$ 22.1 Mn by 2032, at a CAGR of 13.4% during the forecast period 2025 - 2032.

The warehouse software market growth is driven by rapid e-commerce growth, necessitating systems to handle high volumes of orders, returns, and inventory movement. The adoption of cloud-based SaaS platforms and the increasing integration of AI-powered automation and robotics to enhance inventory accuracy and operational efficiency will also fuel market growth.

Businesses are increasingly relying on warehouse software to gain real-time visibility, enhance operational efficiency, and minimize manual errors. The adoption of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and robotics is accelerating this shift.

Integration with IoT devices, including RFID tags, smart sensors, and automated guided vehicles (AGVs), enables continuous data collection and monitoring, which significantly improves inventory accuracy, warehouse performance, and asset utilization.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Warehouse Software Market Size (2025E) |

US$ 9.2 Bn |

|

Market Value Forecast (2032F) |

US$ 22.1Bn |

|

Projected Growth (CAGR 2025 to 2032) |

13.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

10.9% |

The growing deployment of automation technologies and robotics, automated guided vehicles (AGVs), and IoT devices is reshaping warehouse operations and fueling the need for advanced software systems. These tools rely on Warehouse Management Software (WMS) platforms to synchronize activities such as order fulfillment, inventory visibility, and performance monitoring. According to a 2024 Supply Chain Management Review survey, 93% of warehouses are already using WMS, with average tech budgets increasing from US$ 1.15 Mn in 2023 to $1.8 Mn in 2024.

According to the study, 60% -70% of warehouses have adopted some level of automation, and up to 65% - 78% plan to expand investments by 2025. Labor shortages in logistics, especially for forklift operators and pick-pack roles, are pushing businesses to automate faster.

In 2025, automation-backed WMS and Warehouse Execution System (WES) platforms are expected to be integrated into approximately 60% of large distribution centers in North America, as inferred from the U.S. Census Bureau’s quarterly trade and inventory statistics.

The initial investment required for warehouse software implementation poses a substantial barrier, especially for small and mid-sized enterprises. Costs often include software licensing, server upgrades, integration of IoT-enabled devices, and extensive workforce training.

According to the U.S. Small Business Administration (SBA) in 2024, 60% of small businesses cited high technology upgrade costs as a primary challenge. For example, a mid-sized retail warehouse may face over US$ 100,000 in upfront costs, making it difficult to justify the investment despite potential efficiency gains.

Downtime during implementation further complicates adoption by disrupting ongoing operations and inflating operational expenses. Migrating from manual or outdated systems typically requires temporarily scaling down or pausing processes, risking delays in order fulfillment. In logistics environments where just-in-time delivery is crucial, even brief interruptions can impact service-level agreements (SLAs) and customer satisfaction. These operational risks often deter companies from switching to new warehouse software.

The convergence of WMS, WES, and warehouse control systems (WCS) is reshaping the warehouse software landscape. By merging inventory management, task execution, and equipment control into a unified stack, warehouses are achieving real-time responsiveness, minimizing operational silos, and improving throughput. This integration allows dynamic adjustments based on order volume, labor availability, and equipment status, helping businesses reduce errors and avoid downtime.

According to the U.S. Census Bureau’s e-commerce statistics, online retail sales are projected to rise from US$ 1.1 Tn in 2023 to over US$ 1.3 Tn in 2024, pushing warehouses to adopt systems that can keep up with this demand.

Integrated WMS-WES-WCS platforms enable agile operations such as rerouting tasks when a sorter fails, ensuring consistent fulfillment. For example, a retailer can prioritize urgent orders using WES, direct robotic sortation via WCS, and update inventory in real-time across channels with WMS, ultimately supporting same-day delivery and maintaining customer satisfaction.

The integration of autonomous mobile robots (AMRs) in warehousing is driving a strong demand for sophisticated software solutions that can manage navigation, task allocation, and human-machine coordination. As e-commerce expands and labor shortages persist, businesses are relying more on AMRs to boost efficiency.

Government support is accelerating this trend such as the European Innovation Council’s 2024 work programme, which allocated US$ 1.4 Bn to robotics and AI in industries such as logistics and manufacturing, further pushing the demand for robust software that enables real-time tracking and predictive maintenance, as seen in Amazon’s fulfillment centers.

The growing adoption of Robotics-as-a-Service (RaaS) is reshaping the market, especially for SMEs. These cloud-based platforms reduce upfront costs while offering scalable AMR fleet management and seamless integration with warehouse software. Companies such as DHL are leveraging RaaS to deploy AMRs globally, using software to coordinate multi-site operations. This shift toward service-based, software-driven automation is making warehouse software indispensable for modern logistics infrastructure.

By solution, the market is divided into software and services. In the software segment, the standalone software is projected to hold the largest share in 2025 due to its cost-effectiveness, ease of deployment, and suitability for small to mid-sized enterprises (SMEs).

Many businesses, particularly in emerging markets and traditional industries, continue to prefer standalone warehouse software as it addresses specific warehousing needs without the complexity or cost associated with integrated systems. These solutions typically require lower upfront investment, minimal training, and quicker implementation, making them an attractive option for companies with limited IT infrastructure.

Integrated software will grow at a significant rate due to its ability to unify inventory management, order processing, and real-time data analytics into a single platform. This streamlines operations, reduces errors, and enhances decision-making. Businesses prefer integrated solutions for better scalability and lower long-term IT costs.

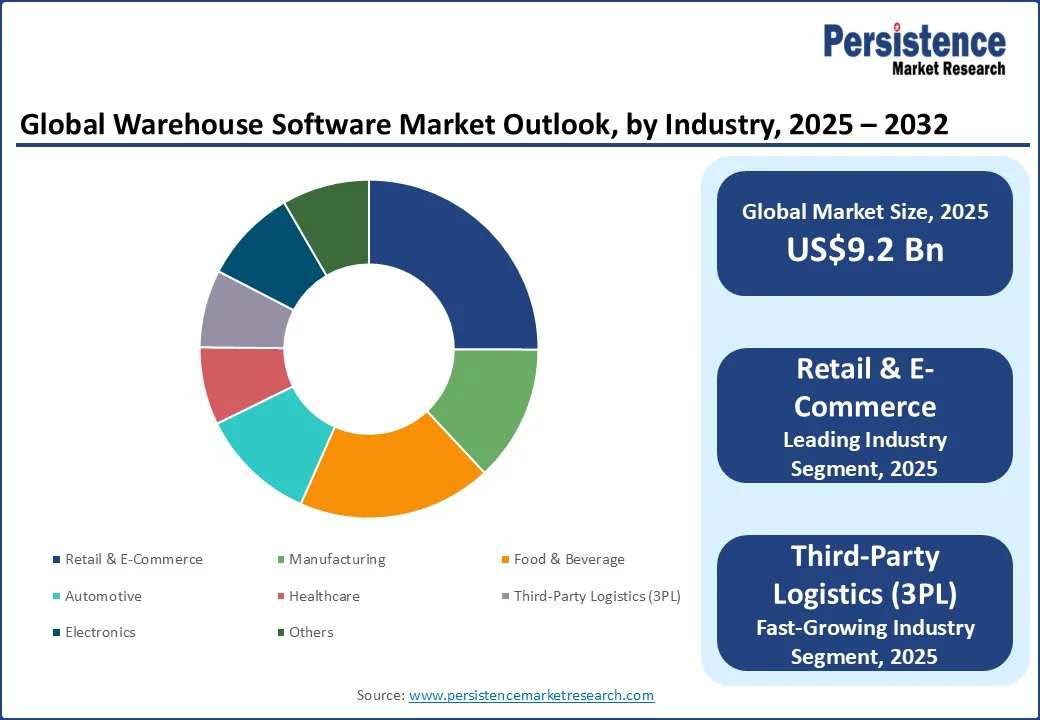

By industry, the market is segregated into retail & e-commerce, manufacturing, food & beverage, automotive, healthcare, third-party logistics (3PL), electronics, and others. The retail & e-commerce segment is expected to account for over 26% share in 2025.

This dominance is driven by the massive digital transformation of retail operations, growth in direct-to-consumer models, and the rise of omnichannel retail strategies. As online shopping becomes increasingly mainstream across geographies, retailers are heavily investing in advanced warehouse software to ensure real-time inventory visibility, faster fulfillment, and lower error rates.

The third-party logistics (3PL) sector is expected to grow substantially due to increasing demand for outsourced logistics services, rapid e-commerce expansion, and the need for real-time inventory and order visibility. 3PLs are heavily investing in advanced warehouse systems to enhance operational efficiency, scalability, and customer satisfaction.

The inventory tracking segment is expected to hold a significant market share of approximately 23% in 2025, driven by the growing need for real-time visibility, which optimizes stock levels, reduces overstocking and stockouts, and enhances overall supply chain efficiency.

The rise of e-commerce and omnichannel retailing drives the demand for real-time inventory visibility. Integration with technologies such as AI, IoT, and barcode scanning enhances accuracy and automation, making inventory tracking essential for various industries.

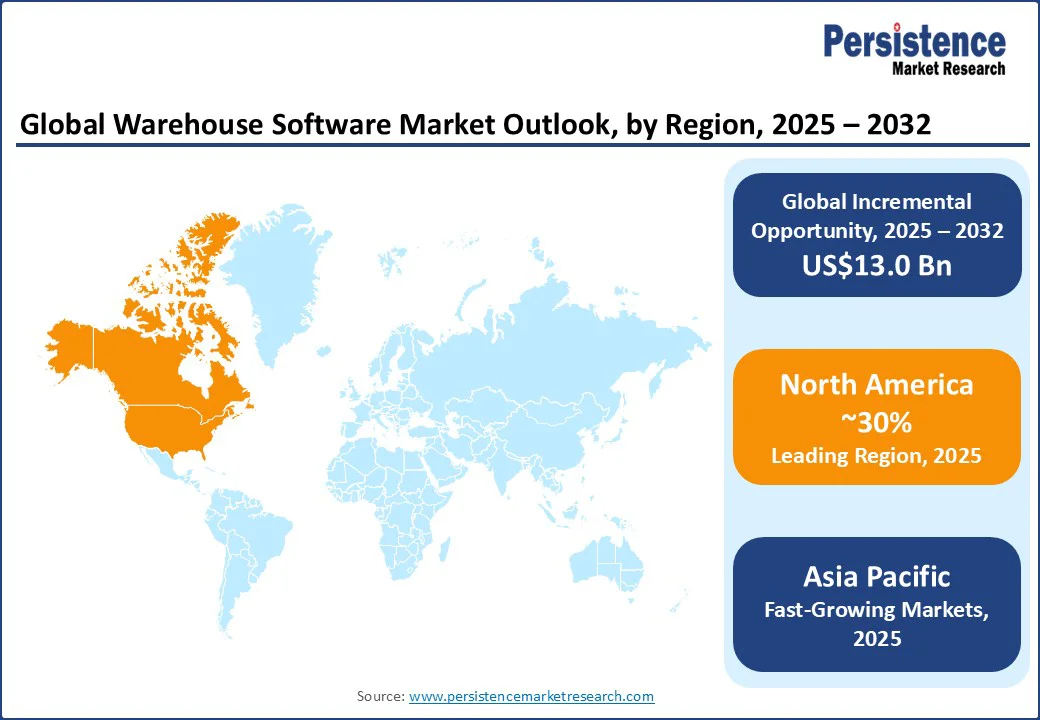

North America is expected to account for a share of about 30% in 2025. Online retail sales have surged since 2020, with U.S. e-commerce retail sales rising by 6.1% in Q1 2025, according to the U.S. Census Bureau. This growth has led to higher volumes of small, frequent orders, prompting widespread adoption of warehouse software.

In North America, 3PL and 4PL providers increasingly rely on scalable, API-enabled systems to manage multi-client operations, billing, and SLA compliance. In Canada, logistics outsourcing among mid-sized businesses is accelerating the demand for cloud-based warehouse management solutions.

The growing need for cold storage and temperature-controlled warehousing for fresh food, pharmaceuticals, and biologics is also fueling the demand for specialized software. These solutions are essential for tracking temperature, managing expiry dates, and ensuring regulatory compliance, particularly under Health Canada’s stringent norms.

Cloud-based software adoption is growing rapidly, especially among SMEs in the U.S., due to benefits such as cost savings, easy scalability, and low maintenance. Government programs such as the SBA’s Digital Tools for Small Businesses are further supporting this transition with funding and technical assistance.

Online shopping growth, driven by rising internet penetration and smartphone usage, has significantly increased the demand for efficient warehouse operations across Asia Pacific. In China, online retail sales reached 15.5 Tn yuan (approximately US$ 2.16 Tn) in 2024, prompting major players such as Alibaba and JD.com to deploy advanced warehouse software for real-time tracking and high-speed order fulfillment. These systems are crucial for managing massive daily transactions and optimizing last-mile delivery operations.

India is also witnessing a surge due to the expansion of organized retail and streamlined interstate logistics enabled by GST. In 2024, warehouse leasing rose by over 20% in key logistics corridors such as NCR, Mumbai, and Bengaluru, according to the Ministry of Commerce.

Cloud-based solutions are increasingly favored by start-ups and SMEs, supported by government initiatives such a Digital India, the National Logistics Policy, and ULIP. Japan had 435,299 industrial robots operating in factories, second only to China, highlighting the region’s push toward warehouse automation despite a 9% decline in new installations in 2023.

Germany’s strong manufacturing sector and commitment to Industry 4.0 are driving the integration of warehouse software with ERP systems, enabling real-time tracking and predictive analytics. In the U.K., the rise in e-commerce and 3PL services, especially after Brexit, has created a need for software that can manage added customs complexities and optimize cross-border logistics. France is focusing on sustainability, using warehouse software to minimize waste, reduce energy consumption, and lower emissions, supported by the government’s France Relance initiative.

Spain is becoming a regional logistics hub due to its strategic location and increasing e-commerce penetration, leading to the adoption of AI-powered software that manages multilingual, cross-border supply chains. Turkey’s Logistics Master Plan is pushing the digitization of warehouse operations, with software solutions supporting bonded warehousing, customs processing, and multimodal logistics. Turkish SMEs in the textile and electronics sectors are turning to cloud-based platforms to ensure efficient, responsive inventory management.

The global warehouse software market is fragmented, comprising a mix of global players and niche solution providers that cater to diverse warehousing needs. They are focusing on offering cloud-native, AI-powered platforms for real-time visibility and automation. Vendors are forging strategic alliances with robotics and IoT firms while enhancing integration with warehouse software, ERP, and TMS systems to strengthen market presence.

The global market is projected to be valued at US$ 9.2 Bn in 2025.

The rising need for real-time inventory visibility, operational efficiency, and automation is the key market driver.

The market is poised to witness a CAGR of 13.4% from 2025 to 2032.

Integration of AI, IoT, and robotics is enabling smarter, more efficient warehouse operations presents a significant opportunity.

SAP SE, Oracle Corporation, Manhattan Associates, Blue Yonder Group, Inc., Infor, and Microsoft are among the leading key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Solution

By Deployment Mode

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author