ID: PMRREP34015| 199 Pages | 2 Feb 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

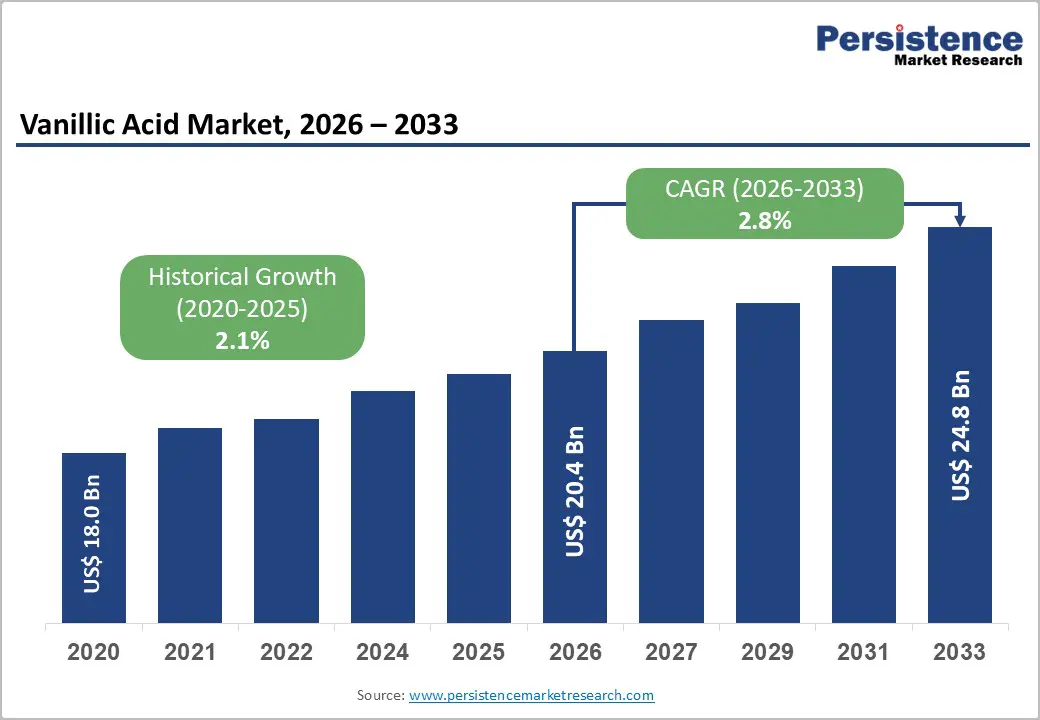

The global vanillic acid market size is likely to be valued at US$ 20.4 billion in 2026 and is expected to reach US$ 24.8 billion by 2033, growing at a CAGR of 2.8% during the forecast period from 2026 and 2033.

The market trajectory is fundamentally driven by the accelerating shift toward natural and clean-label ingredients in the food and pharmaceutical sectors.

| Key Insights | Details |

|---|---|

| Vanillic Acid Market Size (2026E) | US$ 20.4 Billion |

| Market Value Forecast (2033F) | US$ 24.8 Billion |

| Projected Growth CAGR (2026 - 2033) | 2.8% |

| Historical Market Growth (2020 - 2025) | 2.1% |

The global food and beverage industry is undergoing a clear transition as consumers increasingly reject synthetic additives and actively seek products labeled as “natural” or “clean.” This shift has significantly increased the importance of vanillic acid, which functions as a key intermediate in the production of natural vanillin and also acts as a bioactive preservative. Its antimicrobial properties help inhibit the growth of spoilage organisms, extending shelf life without the use of artificial chemicals.

Leading chemical companies such as Solvay have responded to this trend by expanding capacity across natural vanillin production chains, which directly boosts upstream demand for high-purity vanillic acid. The clean-label movement further strengthens this driver, as food manufacturers prefer ingredients derived from lignin or fermentation processes rather than petrochemical routes. As a result, sustained volume growth is expected across processed foods, bakery products, and flavored beverages, supporting long-term market expansion.

Vanillic acid is gaining strong recognition within the pharmaceutical industry due to its growing therapeutic relevance. It is increasingly used as an intermediate in the synthesis of drugs targeting chronic conditions such as cardiovascular diseases and cancer. Scientific research published in pharmaceutical journals highlights its ability to reduce oxidative stress and manage hypertension, positioning it as a valuable precursor for high-quality active pharmaceutical ingredients (APIs).

With the global prevalence of chronic diseases continuing to rise, pharmaceutical manufacturers are placing greater emphasis on consistent, high-purity raw materials. This trend is driving strong demand for 99% purity grade vanillic acid, which meets strict regulatory and formulation requirements. Unlike commodity chemicals, pharmaceutical supply chains prioritize quality, traceability, and regulatory compliance over low pricing. This reliance enhances market resilience and supports higher value growth, particularly within regulated and premium pharmaceutical segments worldwide.

Despite strong demand for naturally sourced vanillic acid, production costs remain a major challenge. Extracting vanillic acid from bio-based sources such as lignin or ferulic acid is significantly more expensive than conventional petrochemical synthesis. This cost gap is largely driven by dependence on specific biomass feedstocks, which are subject to supply fluctuations. For example, lignin availability is closely tied to the paper and pulp industry, where changes in output can disrupt supply chains and increase raw material prices.

These cost pressures limit the adoption of bio-based vanillic acid in price-sensitive applications, especially where synthetic alternatives remain legally acceptable. As a result, smaller manufacturers often face margin compression and operational challenges. This restricts broader market penetration in developing regions and slows the transition toward fully natural production routes in mass-volume industrial applications.

The commercialization of vanillic acid for food, pharmaceutical, and cosmetic applications involves navigating complex and time-consuming regulatory frameworks. Products intended for consumption must comply with strict safety and quality standards set by authorities such as the FDA in the United States and EFSA in Europe. Achieving “natural” certification is particularly demanding, as it requires tightly controlled production processes, including fermentation-based methods that exclude synthetic solvents or chemical shortcuts.

These regulatory requirements significantly increase development timelines and compliance costs. For new market entrants, the approval process creates substantial barriers to entry, while established manufacturers may face delays when launching new formulations or scaling production. As a result, regulatory complexity acts as a friction point that slows overall market expansion, even as long-term demand fundamentals remain strong across multiple end-use industries.

Technological progress in microbial fermentation presents a major growth opportunity for the vanillic acid market. Biotechnology companies are actively developing genetically engineered microorganisms, such as Pseudomonas and E. coli strains, capable of converting renewable feedstocks like ferulic acid or eugenol into vanillic acid with higher efficiency. These advancements improve yields, reduce waste, and significantly lower environmental impact compared to traditional extraction methods.

Importantly, fermentation-based production helps address the cost challenges associated with natural sourcing, making bio-based vanillic acid increasingly competitive with synthetic alternatives. As sustainability regulations tighten across regions such as the European Union and North America, demand for environmentally friendly ingredients is expected to rise. Companies that invest early in scalable green chemistry platforms are well positioned to capture premium market share and secure long-term supply agreements with food, pharmaceutical, and cosmetic brands.

The cosmetics and personal care industry represents a high-growth opportunity for vanillic acid, driven by increasing demand for functional and science-backed beauty products. Vanillic acid is valued for its antioxidant, anti-inflammatory, and skin-brightening properties, making it suitable for advanced skincare formulations. As consumers gravitate toward “clinical beauty” and cosmeceutical products, manufacturers are incorporating vanillic acid into anti-aging serums, toners, and organic skincare lines.

Unlike conventional preservatives that may cause irritation, vanillic acid offers dual benefits by preserving formulations while improving skin health. This multifunctional profile aligns well with clean-beauty positioning and premium branding strategies. By expanding beyond food and pharmaceutical applications, suppliers can diversify revenue streams and access the high-margin personal care segment, where consumers are willing to pay more for natural, active, and performance-driven ingredients.

The 99% purity grade segment dominates the vanillic acid market, accounting for a substantial share of total revenue. This dominance is driven by strict quality requirements in pharmaceutical and premium food applications, where even trace impurities can compromise product safety, efficacy, or flavor consistency. In pharmaceutical manufacturing, particularly in API synthesis, regulatory authorities enforce rigorous purity standards, making high-grade vanillic acid essential. Any deviation can lead to batch rejection or regulatory non-compliance.

As a result, buyers prioritize reliability, documentation, and consistency over cost savings. Leading producers such as Solvay and Parchem Fine & Specialty Chemicals focus heavily on advanced purification technologies to meet these expectations. Their ability to deliver consistent, high-purity output strengthens long-term customer relationships and reinforces the premium positioning of this segment within regulated and high-value end-use markets.

Crystalline powder is the most widely used form of vanillic acid, accounting for approximately 65% of the total market share. This preference is largely driven by its superior stability and logistical advantages. In solid form, vanillic acid offers a longer shelf life and is less susceptible to degradation compared to liquid solutions. Powdered material is easier to transport, store, and handle, particularly in bulk shipments, as it eliminates leakage risks and reduces packaging complexity.

Industrial users in food processing, pharmaceuticals, and chemical synthesis favor crystalline powder due to its precise dosing capabilities and compatibility with batch manufacturing processes. Additionally, powders integrate seamlessly into existing production systems without requiring specialized storage or temperature control. These operational benefits make crystalline powder the preferred choice across multiple industries, reinforcing its dominant position in the global vanillic acid market.

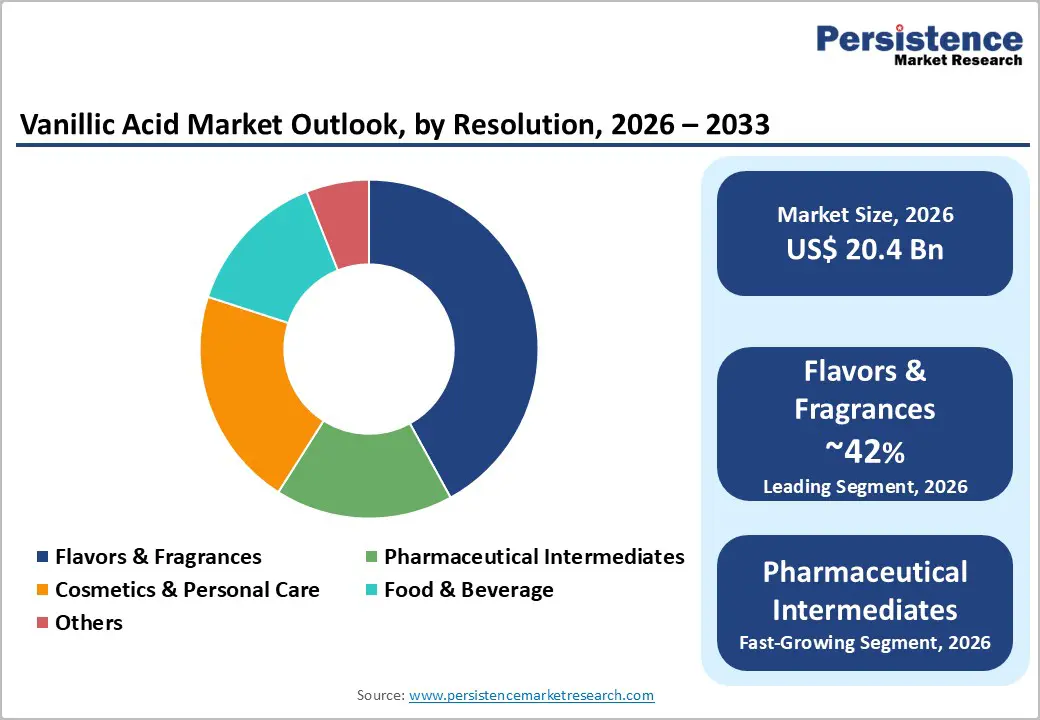

Flavors and fragrances represent the largest application segment of around 42% for vanillic acid, supported by consistent global demand for vanilla-based aromas and taste profiles. Vanillic acid plays a critical role in developing vanilla-like flavors and is also used as a fixative in fragrance formulations to stabilize volatile scent compounds. Its versatility makes it valuable in both food flavoring and fine perfumery applications.

The ongoing popularity of vanilla-flavored dairy products, beverages, baked goods, and confectionery ensures steady volume consumption. Leading flavor houses such as Firmenich and Givaudan regularly incorporate vanillic acid into complex formulations to enhance depth, warmth, and longevity. Continuous product innovation in premium and natural flavor profiles further strengthens this segment. As consumer preference for familiar yet refined flavors persists, flavors and fragrances will remain the primary demand driver for vanillic acid.

The food and beverage industry remains the largest end-use segment for vanillic acid, driven by high consumption volumes across bakery, confectionery, and dairy products. Vanilla and cream flavors are widely used staples in these categories, ensuring consistent demand. In addition to flavor enhancement, vanillic acid provides functional benefits by extending shelf life through its antimicrobial properties.

The growing clean-label movement has prompted food manufacturers to replace artificial flavoring agents with naturally derived or nature-identical ingredients, reinforcing adoption. Beverage manufacturers are also utilizing vanillic acid to improve flavor stability and preservation. Compared to niche industrial uses, food and beverage applications offer larger volumes and repeat demand. This combination of functional utility, regulatory acceptance, and consumer preference firmly anchors the sector as the leading end-use market for vanillic acid globally.

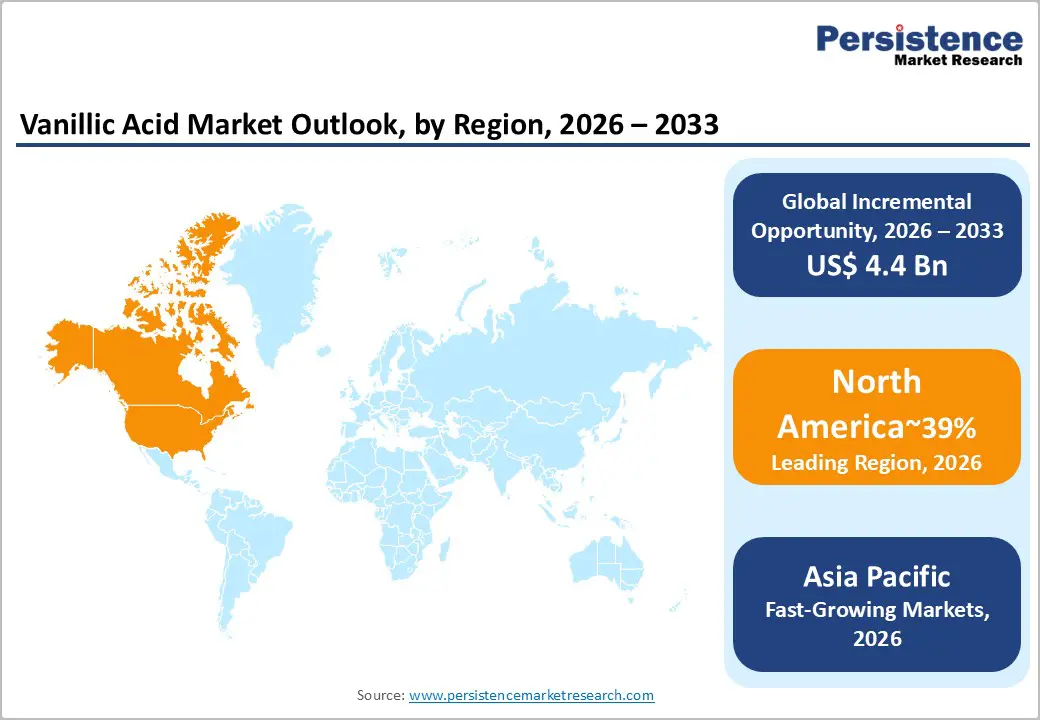

North America, led by the United States, holds a strong position in the global vanillic acid market due to advanced pharmaceutical manufacturing and high consumer awareness of clean-label products. Strict regulatory oversight by the FDA encourages the use of traceable, high-purity ingredients in both food and drug formulations. The region is home to major flavor and fragrance companies, further supporting steady demand.

North America is a key center for cosmetic innovation, where the clean-beauty trend is driving reformulation toward plant-derived preservatives such as vanillic acid. Well-developed supply chains and the presence of distributors like The Good Scents Company ensure reliable availability for industrial buyers. Together, regulatory rigor, innovation, and strong consumer demand position North America as a stable and high-value regional market.

Europe functions as both a major production hub and a regulatory leader in the vanillic acid market. Countries such as France and Germany play a central role, with France hosting major producers like Solvay. The region benefits from advanced chemical processing capabilities and a strong focus on sustainable manufacturing. European market dynamics are heavily shaped by REACH regulations and the European Green Deal, which promote environmentally responsible sourcing and production.

The demand for natural certification is particularly high, compelling manufacturers to invest in bio-based and fermentation-derived production routes. EFSA guidelines further influence product formulation and quality standards. This regulatory environment drives innovation in green chemistry, allowing European producers to develop advanced technologies that are later adopted in global markets, reinforcing Europe’s leadership in sustainable vanillic acid production.

Asia Pacific is the fastest-growing region in the global vanillic acid market, driven by rapid industrialization and expanding consumer markets in China and India. China remains the dominant producer, supported by a large number of chemical manufacturers such as Quzhou Mingfeng Chemical that supply cost-competitive industrial-grade material worldwide. The region benefits from lower production costs, established export infrastructure, and strong manufacturing expertise.

At the same time, rising disposable incomes in India and ASEAN countries are fueling domestic demand for processed foods, cosmetics, and personal care products. This internal consumption growth is gradually transforming Asia Pacific from a purely export-focused region into a significant demand center. Local manufacturers are increasingly upgrading purification technologies to meet international quality standards, enhancing the region’s competitiveness in higher-value segments.

The vanillic acid market exhibits a moderately consolidated structure in the high-purity segment, while remaining fragmented at the industrial grade level. Leading global players such as Solvay, Borregaard, and Lanxess dominate pharmaceutical and food-grade supply through proprietary technologies and vertically integrated operations. These companies leverage strong quality control, regulatory compliance, and long-term customer contracts to maintain pricing power. In contrast, the lower-purity segment is characterized by numerous regional manufacturers, particularly in China, competing primarily on cost.

Differentiation among top players increasingly focuses on sustainability credentials, traceability, and compliance with global pharmacopeia standards. Emerging business models emphasize collaborative “green chemistry partnerships,” where suppliers co-develop bio-based solutions tailored to major FMCG brands. This strategic alignment creates long-term competitive advantages and strengthens market positioning.

The market is projected to reach a value of US$ 24.8 Billion by the year 2033, growing at a CAGR of 2.8% from 2026.

The primary drivers include the rising consumer preference for natural food preservatives and the increasing use of vanillic acid as an intermediate in pharmaceutical drug synthesis.

The Flavors & Fragrances segment leads the market, as vanillic acid is extensively used to impart vanilla profiles and stabilize scent formulations.

North America currently dominates the market, supported by strong regulatory frameworks and high consumption in the food and pharmaceutical sectors.

A significant opportunity lies in developing bio-based production methods, such as microbial fermentation, to produce cost-effective and sustainable "natural" vanillic acid.

Key players include Solvay, Firmenich SA, Givaudan SA, Quzhou Mingfeng Chemical, and Lanxess.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Purity Grade

By Form

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author