ID: PMRREP35052| 189 Pages | 2 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

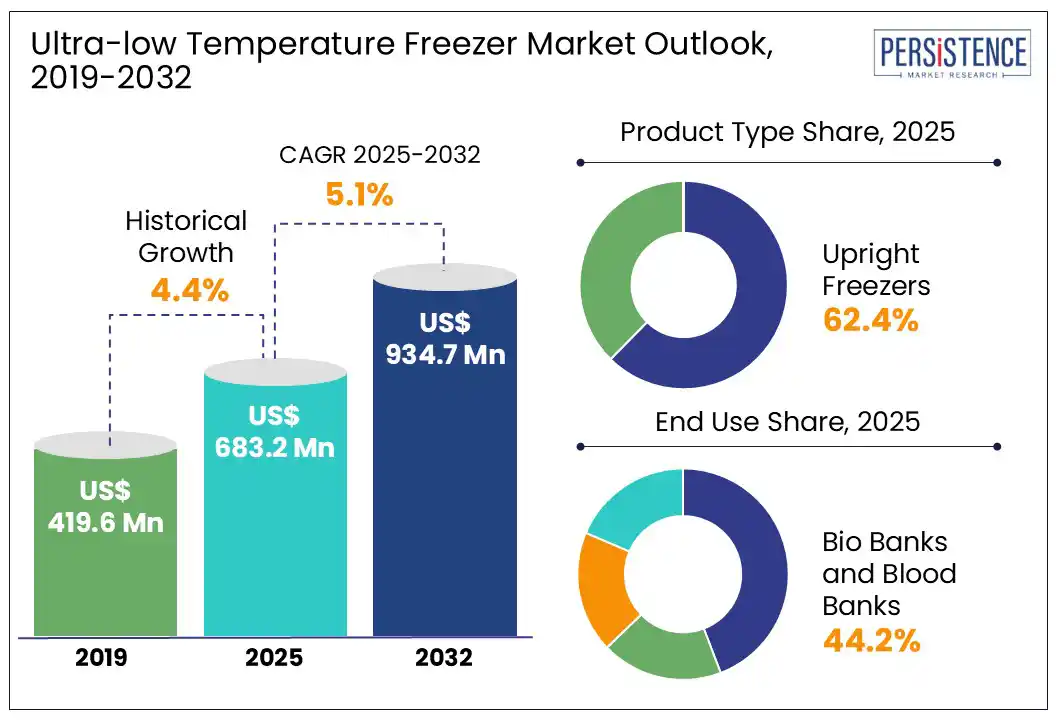

The ultra-low temperature freezer market size is likely to be valued at US$ 683.2 Mn in 2025 and is estimated to reach US$ 934.7 Mn in 2032, growing at a CAGR of 5.1% during the forecast period 2025-2032.

Ultra-Low Temperature (ULT) freezers have become significant assets across biotech, pharmaceutical, and research ecosystems. Operating at temperatures as low as -86°C, these freezers help preserve mRNA vaccine components, stem cells, genomic libraries, and cell therapy batches. However, beyond their cold chambers lies a dynamic intersection of regulatory pressure, sustainability goals, and technological innovation. As labs race to meet the rising demand for precision medicine and decentralized trials, ULT freezers are evolving from static storage units into intelligent systems.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Ultra-low Temperature Freezer Market Size (2025E) |

US$ 683.2 Mn |

|

Market Value Forecast (2032F) |

US$ 934.7 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.4% |

The boom in personalized medicine is significantly pushing the ultra-low temperature freezer market growth, finds a Persistence Market Research report. This is attributed to the surging emphasis on preserving temperature-sensitive biological materials such as DNA, RNA, cell lines, and patient-derived tissue samples. As more healthcare systems and pharmaceutical companies move toward individualized therapies, the volume and complexity of sample storage have increased. This is directly influencing the scale of biorepositories and the infrastructure they require, including ULT freezers.

Another key driver is the rise in decentralized biobanks and clinical trial centers, particularly for CAR-T and mRNA-based therapies. Novartis and Bristol Myers Squibb, for example, have established satellite facilities globally that include dedicated ULT storage for personalized treatment batches. Each patient sample often requires isolated, traceable cold storage to prevent cross-contamination and ensure integrity. It is further increasing the demand for compact, modular ULT units with secure, digital tracking features.

Significant maintenance demands and risks of sample degradation due to temperature fluctuations are creating operational and financial barriers around ULT freezer adoption. This is particularly evident across mid-sized laboratories and clinics with limited infrastructure support. ULT freezers often require continuous power supply, calibrated sensors, and routine defrosting and compressor servicing to maintain performance. Failures in these systems can lead to irreversible damage to high-value biological samples.

The problem is compounded in regions with unreliable power grids or inadequate HVAC support. In parts of Southeast Asia and Latin America, labs have reported challenges in maintaining the ambient conditions necessary for stable freezer operation. It is resulting in high compressor burnout rates and shortened equipment life cycles. A 2023 online survey revealed that over 30% of participating institutions in Asia Pacific had to replace at least one ULT freezer in under five years due to performance instability linked to power fluctuations.

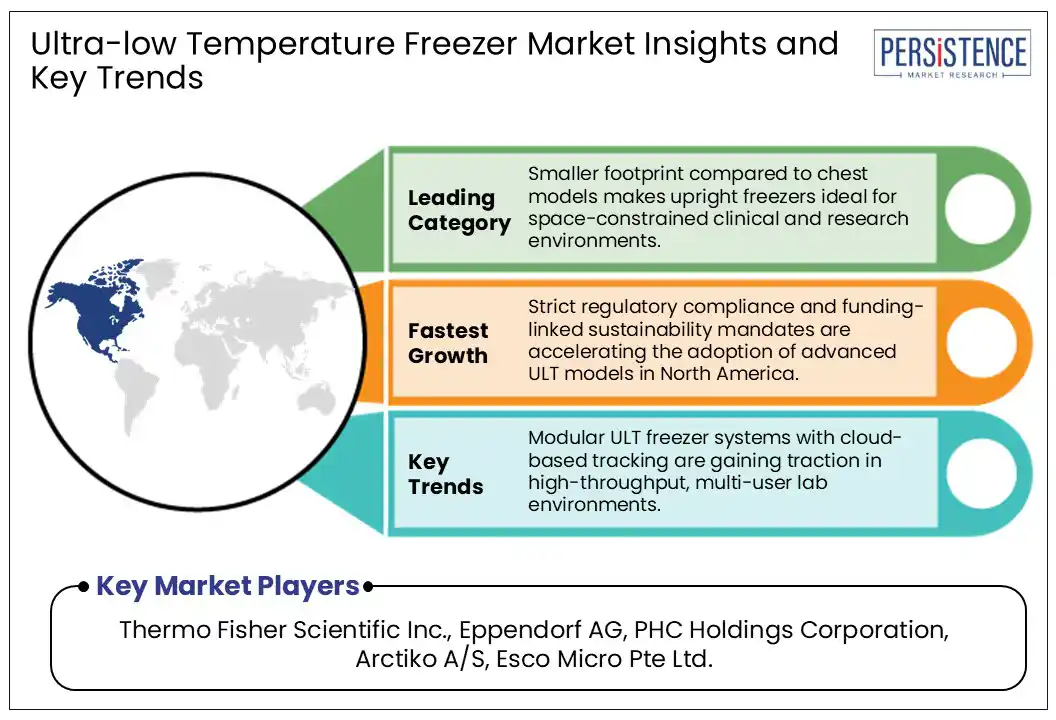

The integration of IoT-enabled features into ULT freezers is creating new operational efficiencies and safety assurances. It is further making these freezers appealing to research labs, hospitals, and pharmaceutical manufacturers that manage high-value, sensitive biological materials. These connected systems provide real-time monitoring, automated alerts, and predictive maintenance features that help reduce the risk of sample loss due to unnoticed malfunctions or power failures. Key players are launching novel platforms that enable labs to track temperature, door openings, and equipment health remotely through cloud-based dashboards.

The technological shift is primarily transformative for decentralized clinical trials and multi-site research networks. A notable case emerged during NIH’s All of Us research program, where IoT-connected freezers were deployed across various biorepository partners. These helped in ensuring consistency in sample preservation despite regional environmental differences. In addition, alerts triggered by threshold breaches such as sudden temperature rises or power interruptions enabled immediate corrective action, preventing catastrophic losses.

Based on product type, the market is bifurcated into upright and chest freezers. Among these, upright freezers are poised to account for approximately 62.4% of the ultra-low temperature freezer market share in 2025 owing to their space-efficient design and ease of sample organization. These are extensively used in high-density laboratory environments where footprint optimization is important. These enable vertical stacking of shelves and compartmentalized storage, making them ideal for facilities handling large volumes of diverse biological materials.

Chest freezers, on the other hand, are gaining momentum on the back of their superior thermal stability and energy efficiency. Their horizontal design significantly reduces cold air loss when the lid is opened, which maintains internal temperatures more consistently than upright models. This temperature resilience makes them valuable in genomics labs, biorepositories, and vaccine banks where irreplaceable biological samples are stored for extended periods. These also have a longer compressor lifespan due to reduced cycling stress, making them cost-effective over the long term for static storage requirements.

In terms of end use, the market is trifurcated into bio banks and blood banks, pharmaceutical and biotechnology companies, and academic and research laboratories. Out of these, bio banks and blood banks are anticipated to hold around 44.2% of share in 2025 as they handle high volumes of temperature-sensitive biological specimens that require long-term preservation. Blood banks, especially those managing cord blood and apheresis products for regenerative medicine, require ULT freezers to preserve cellular viability and functionality. As precision medicine and cell-based therapies expand, the dependence of biobanks and blood banks on high-performance ULT freezers is predicted to skyrocket.

Pharmaceutical and biotechnology companies are projected to witness a steady growth rate through 2032 due to their research and development processes that rely on the preservation of volatile biological components. A surging portion of the biotech market is tied to biologics and gene therapies, both of which demand ultra-cold storage across research, preclinical, and commercial stages. Manufacturers also rely on ULT freezers to safeguard production master and working cell banks. These serve as the genetic blueprint for large-scale biologic manufacturing.

In 2025, North America will likely account for nearly 40.2% of share due to the ongoing expansion of biobanking, genomics research, and biologics development. The U.S. National Institutes of Health (NIH) and Canadian Institutes of Health Research (CIHR) have significantly increased funding in genomics and personalized medicine. These are hence creating a high demand for reliable cold storage infrastructure. For instance, the National Institutes of Health’s (NIH) budget for biomedical research was about US$ 47.35 Bn in 2024 alone. A portion of this budget is responsible for ULT freezer demand across federally funded labs and clinical trials.

The U.S. ultra-low temperature freezer market is poised to remain at the forefront of growth owing to the inclusion of ULT freezer efficiency by the U.S. Department of Energy's Better Buildings initiative as part of its sustainability challenge. This is pushing vendors to innovate around energy consumption and lifecycle cost. Hence, there is a rising preference for freezers using hydrocarbon refrigerants such as R290 and R170. These help in complying with both environmental regulations and institutional carbon reduction goals.

In Europe, the market is being propelled by strict environmental regulations and climate policies, specifically the EU F-Gas Regulation. It has phased down high-GWP (global warming potential) refrigerants. This has further led to a widespread shift toward natural refrigerants, including R744 and R170, compelling manufacturers to rapidly redesign product lines to remain compliant. The market is also supported by large-scale government and EU-funded research projects, such as Horizon Europe.

The project allocated €95.5 Bn between 2021 and 2027 for research and development, and a portion of this directly benefits laboratories and biorepositories requiring ULT storage. In addition, pharmaceutical innovation in mRNA-based therapies and cell and gene therapy across the U.K. is expanding cold chain infrastructure requirements. Another emerging trend is the integration of ULT freezers into smart lab ecosystems, backed by institutions in the Netherlands and Sweden. These setups are leveraging IoT-connected freezers for predictive maintenance and energy optimization.

In Asia Pacific, demand for ULT freezers is rapidly rising due to the growth of genomic research hubs, vaccine manufacturing centers, and expansion of biopharmaceutical industries. According to a recent study, China alone accounted for over 20% of the global biobank capacity in 2023. This necessitated widespread deployment of high-capacity ULT freezers with novel monitoring systems. Domestic players, including Haier Biomedical, are currently capitalizing on this growth with AI-integrated and solar-powered ULT models catering to regional climate conditions.

India has seen a sharp uptick in ULT freezer installations, mainly after the expansion of mRNA vaccine research programs and government-backed biopharma parks. South Korea’s Celltrion and Samsung Biologics announced capacity expansions that include additional ULT freezer banks. These are aimed at supporting large-scale clinical trial material and biologics storage. Japan and Australia are focusing on energy efficiency and laboratory automation. Regulatory bodies in Australia have begun issuing sustainability guidelines for laboratory equipment procurement in universities and research hospitals, thereby pushing demand.

The ultra-low temperature freezer market is witnessing technological innovation, consolidation through acquisitions, and a focus on energy efficiency. Key companies are competing on storage capacity, temperature range, energy consumption, space optimization, and environmental footprint. They are differentiating themselves with free-piston engine technology that helps in reducing energy use and allows for performance in high ambient temperatures. Strategic collaborations between manufacturers and research institutions are also giving players a competitive edge. The surge in biobanking and cell and gene therapies is creating demand for modular freezer solutions that can be integrated into smart labs.

The market is projected to reach US$ 683.2 Mn in 2025.

Rapid expansion of gene therapy pipelines and growth in global clinical trials are the key market drivers.

The market is poised to witness a CAGR of 5.1% from 2025 to 2032.

Emerging biobank initiatives in developing countries and shift toward eco-friendly refrigerants are the key market opportunities.

Thermo Fisher Scientific Inc., Eppendorf AG, and PHC Holdings Corporation are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Temperature Range

By Capacity

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author