ID: PMRREP33801| 177 Pages | 10 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

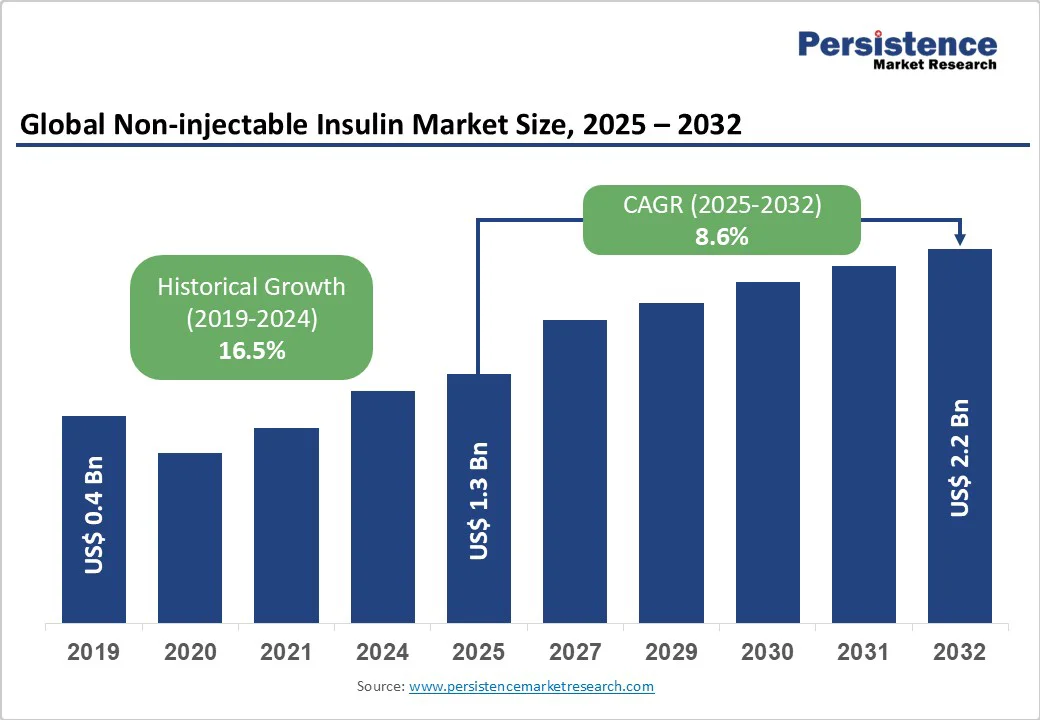

The global non-injectable insulin market size is likely to be valued at US$1.3 billion in 2025, estimated to reach US$2.2 billion by 2032, growing at a CAGR of 8.6% during the forecast period from 2025 to 2032.

The increasing prevalence of diabetes, rising demand for needle-free and patient-friendly insulin delivery options, and advancements in oral and nasal insulin formulations drive the need for non-injectable insulins.

| Key Insights | Details |

|---|---|

| Non-injectable Insulin Market Size (2025E) | US$1.3 Bn |

| Market Value Forecast (2032F) | US$ 2.2 Bn |

| Projected Growth (CAGR 2025 to 2032) | 8.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 16.5% |

The increasing prevalence of diabetes globally is a primary driver of the non-injectable insulin market. According to the International Diabetes Federation, over 537 million adults were living with diabetes in 2025, projected to rise to 783 million by 2045, with a higher burden in low- and middle-income countries.

This epidemic creates a substantial demand for effective and user-friendly insulin delivery methods. Non-injectable options, such as pills and sprays, offer painless administration and better adherence, with studies showing up to 70% of patients preferring needle-free alternatives to avoid injection-site reactions and psychological barriers.

For instance, oral insulin pills from companies such as Novo Nordisk have demonstrated improved glycaemic control in clinical trials, achieving blood sugar reduction in over 60% of participants within hours. Additionally, the rise in type 2 diabetes cases, coupled with growing awareness through campaigns by organizations such as the World Health Organization, has accelerated market growth.

The surge in demand for convenient home-based treatments, especially post-COVID-19, and innovations in bioavailability-enhancing technologies continue to propel the market forward, particularly in regions with high diabetes incidence, such as North America and the Asia Pacific.

The high costs associated with the development and regulatory approval of non-injectable insulin formulations pose a significant restraint on market growth. Creating stable oral or nasal insulin requires advanced biotechnology, extensive clinical trials, and specialized delivery systems to overcome enzymatic degradation and ensure efficacy.

These processes involve substantial financial investment, often exceeding hundreds of millions of dollars, which can be a barrier for smaller companies and startups. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), impose stringent requirements, including long-term safety studies and bioavailability proofs, which extend timelines to 5-10 years.

For example, the approval of inhaled insulin such as Afrezza by MannKind Corporation faced delays and high costs due to multiple trial phases. Smaller firms struggle to compete with giants such as Sanofi, limiting innovation and market entry, especially in cost-sensitive emerging markets.

Advancements in oral and spray formulations present significant growth opportunities for the non-injectable insulin market. Oral pills reduce the need for injections, improving patient compliance, while sprays offer rapid absorption through nasal or buccal routes.

These innovations align with the demand for personalized diabetes management, as combination therapies integrate insulin with glucose stabilizers, thereby enhancing outcomes. For instance, companies such as Eli Lilly are investing in R&D for smart oral insulin capsules that release insulin based on blood sugar levels, potentially reducing the risk of hypoglycemia.

These developments shorten timelines and reduce costs through modular designs, and the integration of AI in dosing precision enhances efficiency. As diabetes awareness grows, these opportunities are expected to drive expansion in high-expenditure regions such as North America and Europe.

Pills dominate the market, expected to account for approximately 50% share in 2025. Their dominance is driven by ease of swallowing, discreet use, and advancements in enteric coatings that protect insulin from stomach acids. Pills such as those developed by Oramed Pharmaceuticals are effective for daily management, with trials showing over 50% improvement in patient adherence.

Sprays are the fastest-growing segment, driven by their quick onset and suitability for acute adjustments. Nasal and inhaled sprays offer absorption in under 30 minutes, appealing to patients with variable insulin needs, with growing adoption in innovative markets such as the Asia Pacific.

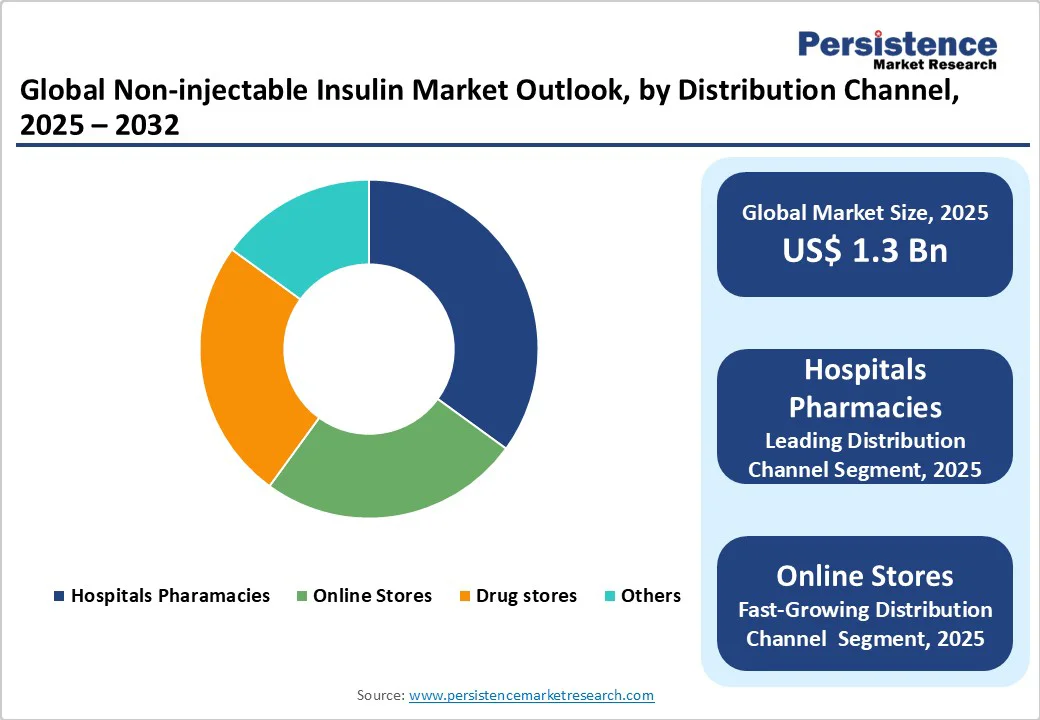

Hospital Pharmacies lead the market, accounting for approximately a 45% share in 2025. Their dominance stems from specialized dispensing for diabetes clinics, ensuring accurate prescriptions and patient education, making them essential for complex non-injectable regimens.

Online stores represent the fastest-growing segment in the non-injectable insulin market, driven by the expansion of e-commerce platforms and the convenience of home delivery. Competitive pricing, easy accessibility, and broad product availability enhance consumer adoption. This trend is particularly prominent in digitally advanced regions, such as the Asia Pacific, where increasing internet penetration fuels rapid market expansion.

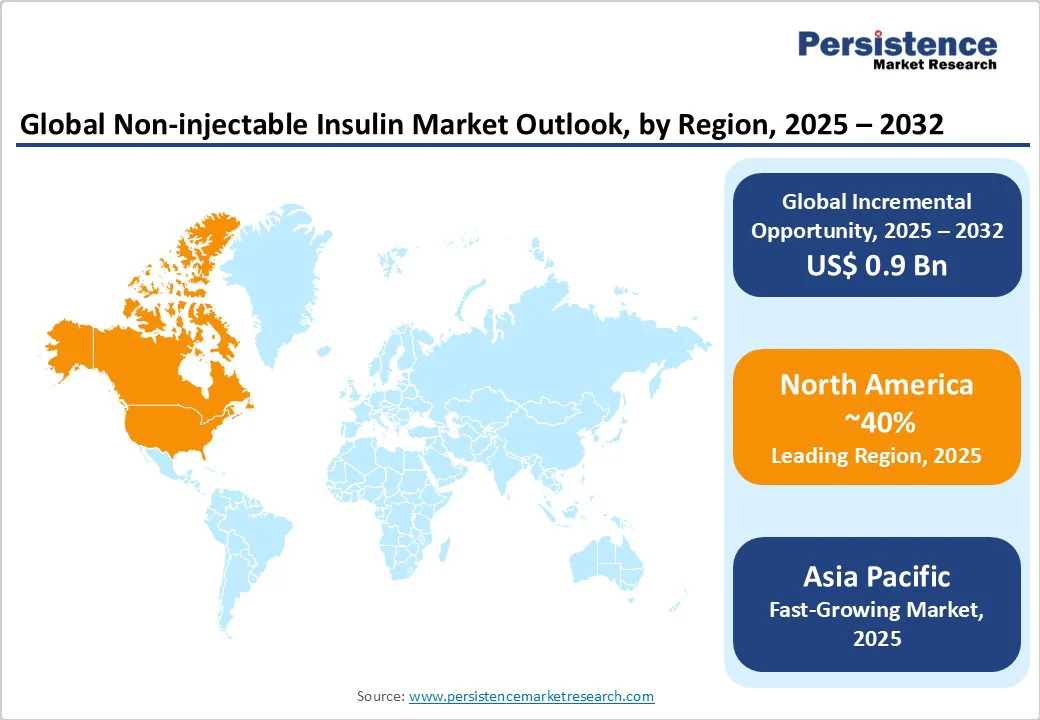

North America is projected to account for nearly 40% of the global Non-injectable Insulin Market in 2025, driven by a strong healthcare infrastructure, advanced R&D capabilities, and a high prevalence of diabetes affecting over 11% of the population.

The country serves as a global innovation hub, with leading companies such as Eli Lilly and MannKind Corporation spearheading advancements in oral insulin and non-invasive drug delivery systems. Continuous support from the U.S. Food and Drug Administration (FDA) for novel therapies and devices has accelerated market growth, encouraging faster commercialization of innovative solutions.

Rising healthcare expenditure, combined with comprehensive insurance coverage for diabetes treatments, has further enhanced patient accessibility and adoption. The market is witnessing an increasing interest in oral and inhalable insulin forms, which offer more convenience compared to traditional injections. This shift reflects a broader trend toward patient-centric care and improved quality of life for diabetic patients.

Europe is expected to hold a 25% market share in 2025, supported by its strong healthcare systems and research collaborations. This dominance is supported by advanced healthcare infrastructure, a widespread prevalence of diabetes with over 60 million cases, and consistent regulatory support from the European Medicines Agency (EMA) for innovative drug approvals. Leading countries such as Germany, France, and the U.K. drive market growth through extensive investments in biotechnology, clinical research, and diabetes awareness programs.

The region’s focus on next-generation formulations, including GLP-1 receptor agonists and SGLT2 inhibitors, enhances patient convenience and compliance. Additionally, well-established reimbursement policies and collaborations between research institutions and pharmaceutical firms accelerate product innovation.

Europe’s emphasis on sustainable healthcare practices, personalized medicine, and preventive care further strengthens its market position. Collectively, these factors ensure Europe remains a key global hub for diabetes management solutions, maintaining steady growth momentum and contributing significantly to advancements in diabetes care and treatment accessibility.

The Asia Pacific is the fastest-growing market for non-injectable insulin, driven by expanding healthcare access and increasing awareness in major economies, such as China and India. China, home to over 140 million diabetes cases, leads regional demand through strong government support and increasing investments from local pharmaceutical companies in developing affordable oral insulin and innovative delivery systems. The focus on cost-effective yet advanced treatments aligns with its growing middle-class population and enhanced healthcare infrastructure.

India’s market expansion is fueled by an alarming rise in urban diabetes prevalence and proactive government health initiatives such as the National Program for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS). These efforts, combined with the availability of low-cost sprays and biosimilars, are improving accessibility to modern diabetes care.

The global non-injectable insulin market is characterized by intense competition, driven by the presence of established pharmaceutical companies and emerging biotech innovators. In developed regions such as North America and Europe, major players leverage strong R&D capabilities, advanced healthcare infrastructure, and high patient awareness to develop cutting-edge formulations that improve bioavailability and patient compliance. These regions also witness robust collaborations between pharmaceutical firms and research institutions to accelerate the commercialization of oral and transdermal insulin therapies.

Asia Pacific is emerging as a key growth hub, with local and regional manufacturers focusing on cost-effective alternatives to expand access to diabetes care among large patient populations. Governments in countries such as China and India are supporting initiatives that encourage innovation and local production of advanced insulin formulations. Strategic alliances, licensing deals, and technology-sharing agreements are becoming common as companies seek to strengthen their pipelines and market reach.

The global Non-injectable Insulin Market is projected to reach US$ 1.3 Bn in 2025, driven by increasing diabetes prevalence and demand for convenient insulin delivery methods.

The market is driven by the rising global diabetes epidemic, with over 537 million cases, and the need for needle-free options that improve patient compliance and reduce injection-related issues.

The market is poised to witness a CAGR of 8.6% from 2025 to 2032, reflecting advancements in formulations and expanding access in emerging markets.

Advancements in oral and spray formulations offer key opportunities, enabling personalized diabetes management and reducing development costs through innovative technologies.

Novo Nordisk, Sanofi, Eli Lilly, MannKind Corporation, and Biocon are key players, leading through R&D in non-invasive insulin solutions.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author