ID: PMRREP34150| 210 Pages | 13 Dec 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

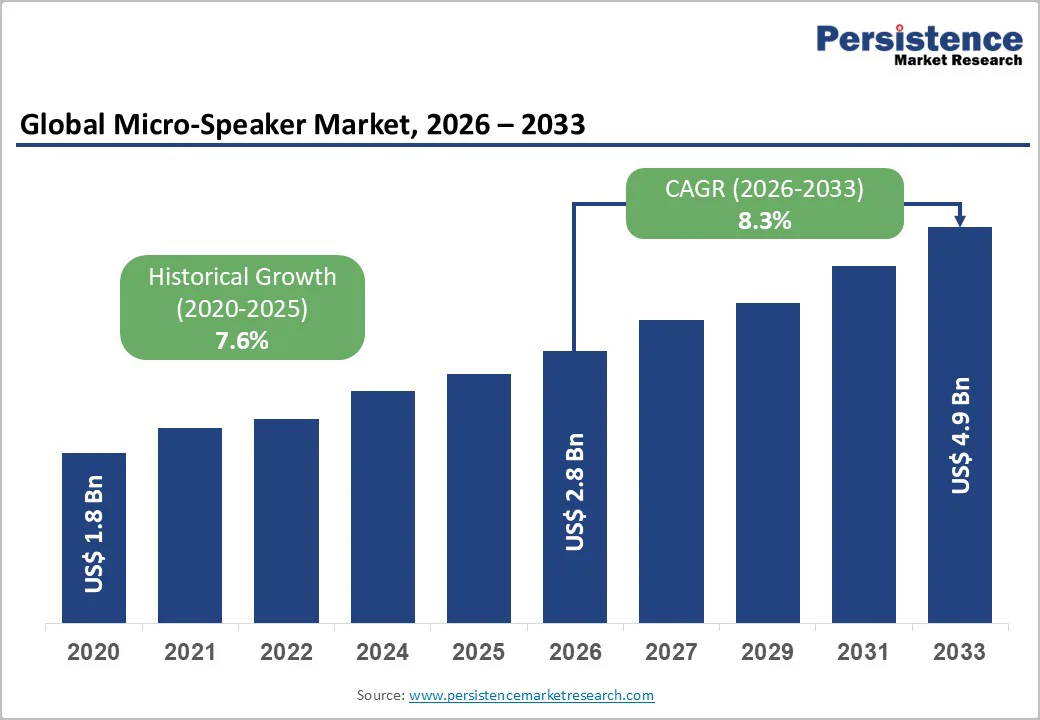

The global micro-speaker market size is likely to be valued at US$ 2.8 billion in 2026 and is estimated to reach US$ 4.9 billion by 2033, growing at a CAGR of 8.3% during the forecast period 2026−2033. The market expansion is supported by the rising integration of miniature acoustic components in smartphones, wearables, medical devices, and automotive electronics. Growth is further enabled by advancements in miniaturization, micro-electro-mechanical system (MEMS) fabrication, and acoustic engineering. Increasing demand for lightweight components and high-fidelity audio in compact consumer electronics strengthens adoption across both developed and emerging economies.

| Report Attribute | Details |

|---|---|

|

Micro-Speaker Market Size (2026E) |

US$ 2.8 Bn |

|

Market Value Forecast (2033F) |

US$ 4.9 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

8.3% |

|

Historical Market Growth (CAGR 2020 to 2025) |

7.6% |

The rapid expansion of smartphones and wearables elevates demand for compact, high-performance audio components, creating sustained momentum for micro-speaker adoption. Each device generation emphasizes slimmer designs, higher output efficiency, improved voice clarity, and immersive media experiences, which intensifies the requirement for advanced micro-speakers with superior acoustic precision. User engagement with voice assistants, mobile gaming, short-form video consumption, and video conferencing strengthens the need for reliable sound delivery in small enclosures. This shift toward feature-rich consumer devices directly accelerates volume procurement, as manufacturers integrate multiple micro-speakers within a single product to enhance stereo performance and noise-handled output. A 2024 industry report indicates that global smartphone users surpassed 5.6 billion, evidencing the scale at which audio components must be produced to meet technology cycles.

Wearables reinforce this growth through rising demand for earbuds, smartwatches, and fitness devices designed for continuous connectivity and on-the-go communication. Product strategies across leading original equipment manufacturers (OEMs) highlight miniaturized components with higher durability and lower power consumption, encouraging sustained investments in micro-speaker innovation. The widespread shift toward wireless audio ecosystems, combined with increasing upgrades in premium device segments, ensures consistent integration of micro-speakers across consumer electronics portfolios. This alignment of design priorities, user expectations, and technology upgrades positions micro-speaker manufacturing as a critical enabler of device differentiation.

High production costs arise from the continued push for ultra-miniaturization and premium acoustic performance. Advanced materials such as composite diaphragms, precision voice-coil assemblies, and MEMS structures demand specialized manufacturing lines with tight tolerances. These processes require capital-intensive equipment and highly skilled technical labor, driving a steep cost curve for manufacturers. This cost burden limits pricing flexibility and compresses margins, especially in high-volume consumer electronics segments.

Supply chain constraints further reinforce this challenge. Micro-components rely on a concentrated supplier base for magnets, diaphragms, semiconductor wafers, and nano-coatings, creating vulnerability to raw material fluctuations and component shortages. Any disruption such as logistics delays, geopolitical restrictions, or wafer allocation shifts impacts production timelines and reduces delivery reliability for device manufacturers. OEMs expect consistent quality and just-in-time supply, pushing producers to diversify sourcing networks and maintain higher inventory buffers, which escalates operational expenditure. These structural constraints create persistent bottlenecks and elevate the overall risk profile within the value chain.

The growth in healthcare and hearing-aid applications presents a strategic opportunity for micro-speaker manufacturers. The prevalence of hearing impairment is increasing globally, with the World Health Organization reporting that over 430 million people require rehabilitation for hearing loss. Aging populations and rising cases of noise-induced hearing damage are driving demand for hearing-aid devices, which rely on compact, high-precision micro-speakers to deliver clear sound in small form factors.

Technological advancements have transformed hearing aids into consumer-friendly audio instruments. Modern devices require micro-speakers that provide high fidelity audio, low distortion, and energy efficiency while remaining discreet. This shift toward miniaturization and performance creates a demand for specialized micro-speakers capable of meeting stringent medical and user requirements. Manufacturers focusing on healthcare and hearing-aid applications can capitalize on this trend by supplying components that combine reliability, compactness, and superior sound quality.

Dynamic micro-speakers are projected to capture over 45% market revenue share in 2026, owing to their versatility and cost-effectiveness across consumer electronics. Their proven acoustic performance, durability, and ease of integration into slim device architectures make them the preferred choice for smartphones, tablets, laptops, and portable audio devices. The increasing demand for compact, high-quality audio solutions in mobile devices reinforces their adoption. Manufacturers prioritize dynamic speakers for mass production, as they provide reliable sound output, compatibility with a wide range of devices, and efficient manufacturing scalability.

MEMS micro-speakers are expected to record the fastest growth from 2026 to 2033, on account of the rapid miniaturization of electronics and the rising adoption of wearables, medical devices, and industrial IoT applications. Their precision engineering enables consistent sound quality, low power consumption, and seamless integration into compact devices. OEMs increasingly forecast the use of MEMS speakers in premium and emerging applications where space, energy efficiency, and performance are critical. The expansion of next-generation electronics drives their selection as the preferred acoustic solution for innovative designs.

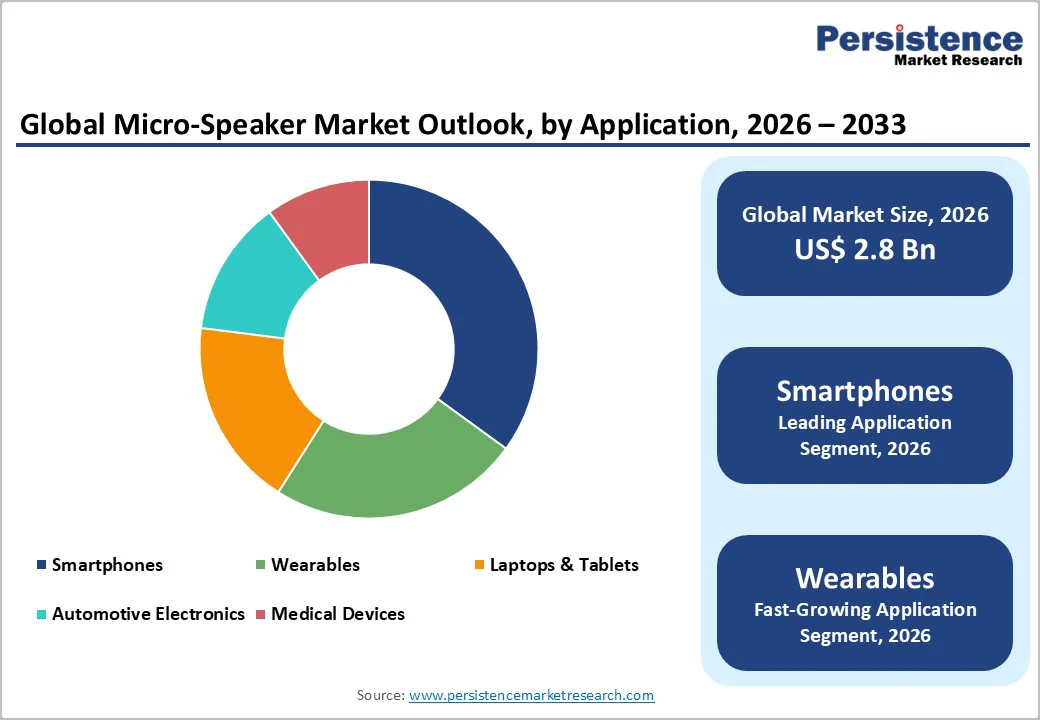

Smartphones are projected to secure approximately 35% of the micro-speaker market revenue share in 2026, driven by the widespread integration of multi-speaker stereo systems in consumer devices. The demand for immersive audio experiences in compact form factors compels OEMs to adopt micro-speakers that offer balanced sound, durability, and seamless compatibility with slim designs. Growing multimedia consumption, portability trends, and premium device expectations reinforce the dominance of smartphones as the primary segment for micro-speaker deployment, ensuring sustained market leadership.

Wearables are forecasted to emerge as the fastest-growing segment due to increasing adoption of TWS earbuds and smartwatches. These devices require ultra-compact, high-performance micro-speakers capable of delivering clear audio within minimal space. Technological advancements in MEMS and miniaturized speakers enable energy-efficient, high-fidelity sound suitable for small wearable form factors. The rising focus on health monitoring, fitness tracking, and on-the-go communication drives OEMs to integrate advanced micro-speaker solutions, positioning wearables as a high-potential growth segment in the market.

Consumer electronics are expected to dominate the end-user space, with a projected share exceeding 40% in 2026, supported by the high-volume production of smartphones, laptops, tablets, and personal audio devices. Micro-speakers play a vital role in delivering immersive audio experiences, supporting multimedia consumption, voice commands, and notification alerts. Continuous innovation, shorter device replacement cycles, and rising consumer expectations for high-quality sound drive sustained demand. OEMs focus on compact, energy-efficient, and durable speaker solutions, reinforcing consumer electronics as the primary segment for micro-speaker deployment.

Healthcare is anticipated to be the fastest-growing end-user segment during the 2026-2033 forecast period, as a result of the increased adoption of hearing-assistance devices, diagnostic equipment, and wearable medical monitors. MEMS and balanced armature micro-speakers offer precision audio output, low power consumption, and reliability essential for medical applications. Aging populations, rising prevalence of hearing impairments, and expansion of health-tech solutions fuel growth. Regulatory approvals and technological advancements in miniaturized acoustic components accelerate integration, positioning healthcare as a high-potential segment with strong demand for specialized micro-speaker solutions.

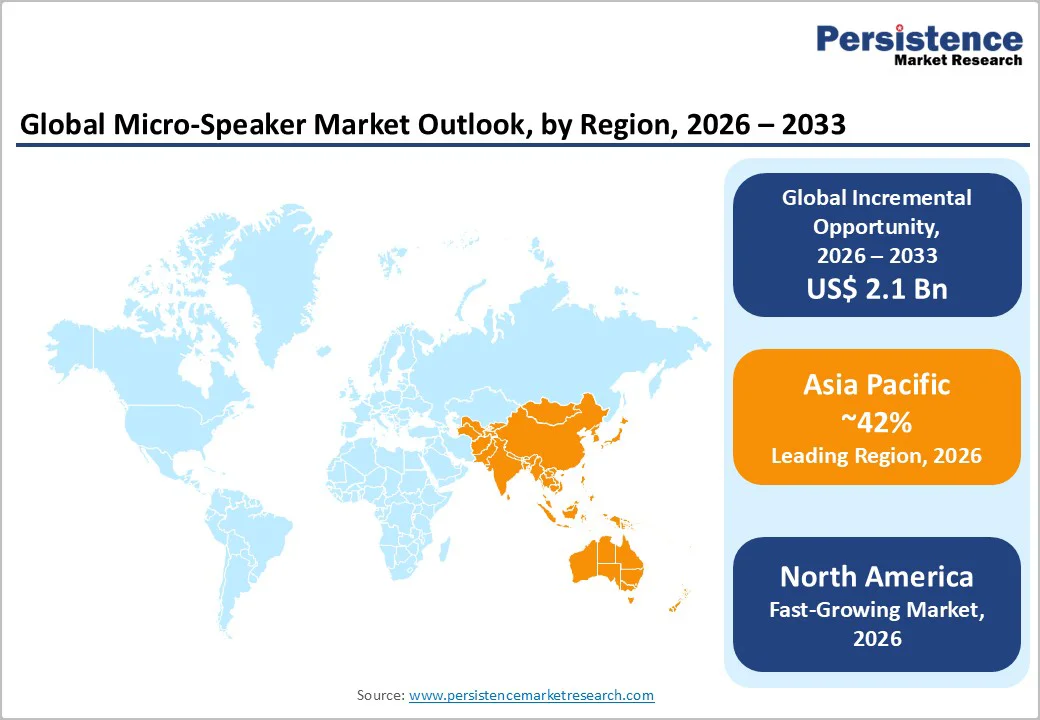

North America is emerging as the fastest-growing regional market for micro-speakers, driven by strategic investments in next-generation consumer and medical electronics. Growth is supported by advanced R&D ecosystems, early adoption of smart wearable technologies, and a focus on premium audio experiences. Companies in the region are integrating micro-speakers into innovative devices such as AR/VR headsets, fitness wearables with biofeedback audio, and AI-enabled hearing aids, creating demand for precision, low-latency acoustic components that remain difficult to scale elsewhere.

A key factor supporting expansion is the emphasis on local manufacturing and rapid prototyping for high-performance components, allowing swift deployment of MEMS and balanced armature micro-speakers. The adoption of healthcare technologies, particularly hearing-assistance devices and connected medical instruments, is rising due to an aging population and stringent regulatory standards. Combined with growing consumer expectations for immersive sound in home automation, gaming, and personal devices, the North America market landscape offers unique opportunities to develop specialized, miniaturized micro-speaker solutions tailored to technologically advanced applications.

Europe represents a significant and steadily growing market for micro-speakers, propelled by a strong demand for consumer electronics, automotive, and healthcare applications. Regional market stakeholders lay considerable emphasis on high-quality, precision-engineered components, creating opportunities for MEMS and balanced armature speakers in premium devices such as TWS earbuds, smartwatches, and advanced hearing-assistance technologies. European manufacturers and OEMs prioritize acoustic performance, energy efficiency, and miniaturization, supporting innovation in compact speaker solutions tailored for high-end applications.

Regulatory standards and environmental policies in Europe also shape product development, encouraging sustainable materials and energy-efficient manufacturing processes. The automotive sector, with its focus on infotainment systems and in-car communication, further fuels adoption of micro-speakers. Europe’s mature healthcare technology infrastructure and growing wearable adoption support specialized micro-speaker integration in medical devices and diagnostic equipment. The combination of high-quality manufacturing standards, technological sophistication, and regulatory focus positions Europe as a strategically important region for micro-speaker innovation and growth.

Asia-Pacific is projected to hold an estimated 42% of the micro-speaker market share in 2026, establishing it as the dominant market. This leadership is driven by the concentration of large-scale electronics manufacturing hubs, including China, South Korea, Japan, and Taiwan, which collectively produce the majority of global smartphones, laptops, tablets, and wearables. The region benefits from integrated supply chains, access to key raw materials, and advanced semiconductor fabrication capabilities, enabling manufacturers to produce high-performance micro-speakers at scale. Local OEMs are increasingly embedding multi-speaker audio systems, MEMS, and compact acoustic components into premium and mid-tier devices, reinforcing regional dominance.

High domestic consumption of consumer electronics, coupled with rapid urbanization and rising disposable incomes, fuels demand for devices that require compact, high-fidelity audio solutions. Innovation clusters in Asia Pacific support continuous development of MEMS and miniaturized speaker technologies tailored for TWS earbuds, smartwatches, and emerging IoT applications. Strategic partnerships between micro-speaker suppliers and device manufacturers enhance product customization and reduce time-to-market. The combination of robust production infrastructure, proximity to component suppliers, and strong regional device demand positions Asia Pacific as the clear leader, shaping global micro-speaker trends and setting performance benchmarks for other regions.

The global micro-speaker market structure is moderately fragmented, with leading companies maintaining significant positions due to advanced manufacturing capabilities, deep technological expertise, and long-term supply partnerships with global consumer electronics OEMs. These relationships enable consistent volume supply, high-quality output, and integration of micro-speakers into a wide range of devices, including smartphones, wearables, laptops, and tablets. Market competition is fueled by the need to deliver compact, high-performance speakers that meet evolving consumer expectations for immersive audio and device miniaturization.

Innovation is a key differentiator, particularly in MEMS-based architectures and precision-engineered balanced armature speakers. Companies compete on acoustic performance, energy efficiency, and durability, targeting both high-volume consumer electronics and specialized medical or industrial applications. Cost optimization, quality consistency, and product customization allow manufacturers to secure market share and establish a competitive edge in this evolving sector.

By Application

By Region

The global micro-speaker market is projected to reach US$ 2.8 billion in 2026.

Surging demand for compact, high-fidelity audio in smartphones, wearables, consumer electronics, healthcare devices, and IoT applications is mainly driving the market.

The market is poised to witness a CAGR of 8.3% from 2026 to 2033.

Key market opportunities include growth in wearables, healthcare devices, smart home electronics, MEMS technology adoption, and miniaturized high-performance audio solutions.

Some of the key market players include Goertek Inc., AAC Technologies Holdings Inc., Knowles Corporation, Sonion, TDK Corporation, BSE Co. Ltd., and Foster Electric Co. Ltd.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author