ID: PMRREP30034| 188 Pages | 27 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

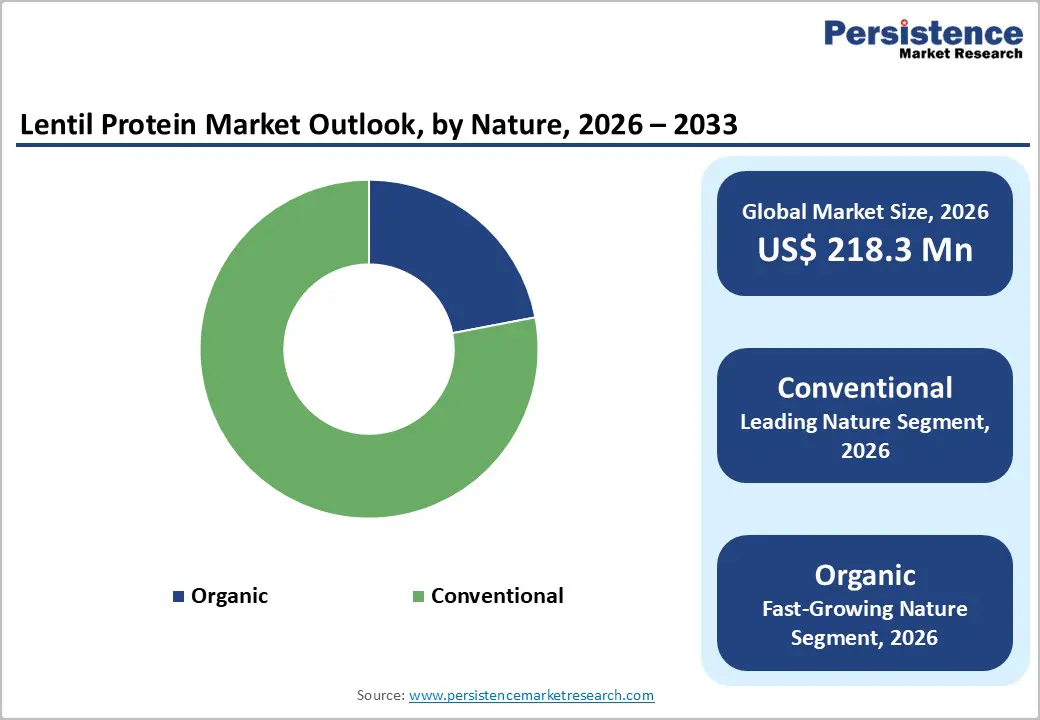

The global lentil protein market size is expected to be valued at US$ 218.3 million in 2026 and projected to reach US$ 309.2 million by 2033, growing at a CAGR of 5.1% between 2026 and 2033.

The global market is transitioning from a niche plant-based ingredient segment into a strategically important protein source across food, nutrition, and wellness industries. Shifts in dietary behavior, clean-label priorities, and regional innovation ecosystems are collectively reshaping competitive dynamics and growth pathways.

| Key Insights | Details |

|---|---|

| Lentil Protein Market Size (2026E) | US$ 218.3 Mn |

| Market Value Forecast (2033F) | US$ 309.2 Mn |

| Projected Growth (CAGR 2026 to 2033) | 5.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.4% |

Dietary choices are rapidly shifting as consumers reassess protein through ethical, health, and tolerance lenses. Vegan and flexitarian eating patterns are expanding beyond niche communities into mainstream households. Lentil protein aligns well with these lifestyles due to its plant origin, neutral taste, and functional versatility. Food formulators favor it for dairy alternatives, meat analogues, and nutritional beverages targeting sensitive consumers. Digestibility and low allergen perception further strengthen its acceptance.

Allergen awareness is now a decisive purchase filter, especially among families and aging populations. Lentils are naturally free from major allergens, supporting clean formulations without complex labeling warnings. This advantage accelerates adoption in schools, hospitals, and wellness-focused retail channels. As protein diversification continues, lentil-based ingredients gain strategic relevance across global food innovation pipelines focused on inclusivity, nutrition, safety, and long-term consumer trust-building efforts worldwide today and beyond markets.

Processing lentils into high-purity protein remains operationally demanding, creating structural constraints for rapid market expansion. Advanced extraction, filtration, and drying systems require high capital investment and technical expertise. Many producing regions still rely on small- or mid-scale facilities, which restricts output consistency and limits cost competitiveness. As demand rises, supply-side bottlenecks increasingly surface across food and nutrition manufacturing chains.

Capacity limitations also affect product standardization and delivery reliability for multinational buyers. Inconsistent protein content, batch variability, and longer lead times complicate formulation planning for global brands. Scaling facilities demands infrastructure, skilled labor, and stable raw material flows, which remain uneven across sourcing regions. Until industrial-scale processing expands significantly, lentil protein suppliers face challenges meeting volume requirements for mass-market applications across beverages, sports nutrition, and functional food categories worldwide.

Product innovation in plant proteins is shifting toward strategic blending to overcome nutritional limitations of single sources. Lentil protein has a high lysine content but lacks balance in sulfur-containing amino acids. Combining it with complementary proteins such as rice, chickpeas, or peas improves amino acid profiles while preserving clean-label positioning. This approach supports the formulation of nutritionally complete products without synthetic fortification.

For key players and emerging startups, hybrid blends unlock differentiation across sports nutrition, medical foods, and fortified staples. Blending also improves texture, solubility, and flavor masking, thereby expanding the application potential of beverages and meat alternatives. Flexible formulations allow brands to tailor protein ratios by region or use case. As consumers demand both performance and transparency, lentil-centric hybrid solutions offer a scalable pathway to premium positioning and long-term portfolio expansion.

Carotenoids hold approximately 47% market share as of 2025, yet lentil protein isolates lead within protein segmentation due to purity-driven demand. Isolates deliver a high protein concentration with reduced levels of starch and fiber, making them suitable for performance-focused nutrition. Their neutral sensory profile supports incorporation into beverages, powders, and clinical formulations where taste and solubility matter.

Manufacturers prioritize isolates for applications requiring precise nutritional delivery and consistent functionality. Higher digestibility and controlled composition simplify formulation across regulated food categories. Isolates also enable lower inclusion rates, optimizing cost per serving for brands targeting premium positioning. As protein fortification intensifies across functional foods, isolates remain the preferred format for scalability, label clarity, and technical performance in diverse end-use environments.

Organic Lentil Protein is projected to grow at a CAGR of 9.8% during the forecast period as consumers scrutinize farming practices behind protein ingredients. Demand is shaped by interest in chemical-free cultivation, soil health, and traceable agricultural systems. Organic lentils resonate strongly with clean-label expectations in infant nutrition, wellness foods, and premium supplements.

Food brands increasingly leverage organic certification to strengthen transparency and price positioning. Organic protein supports sustainability narratives tied to regenerative farming and reduced input intensity. Supply chains built around contracted growers improve traceability while reducing contamination risks. As regulatory oversight on ingredient sourcing tightens globally, organic lentil protein offers a credible pathway for manufacturers seeking differentiation through trust, environmental stewardship, and long-term brand resilience.

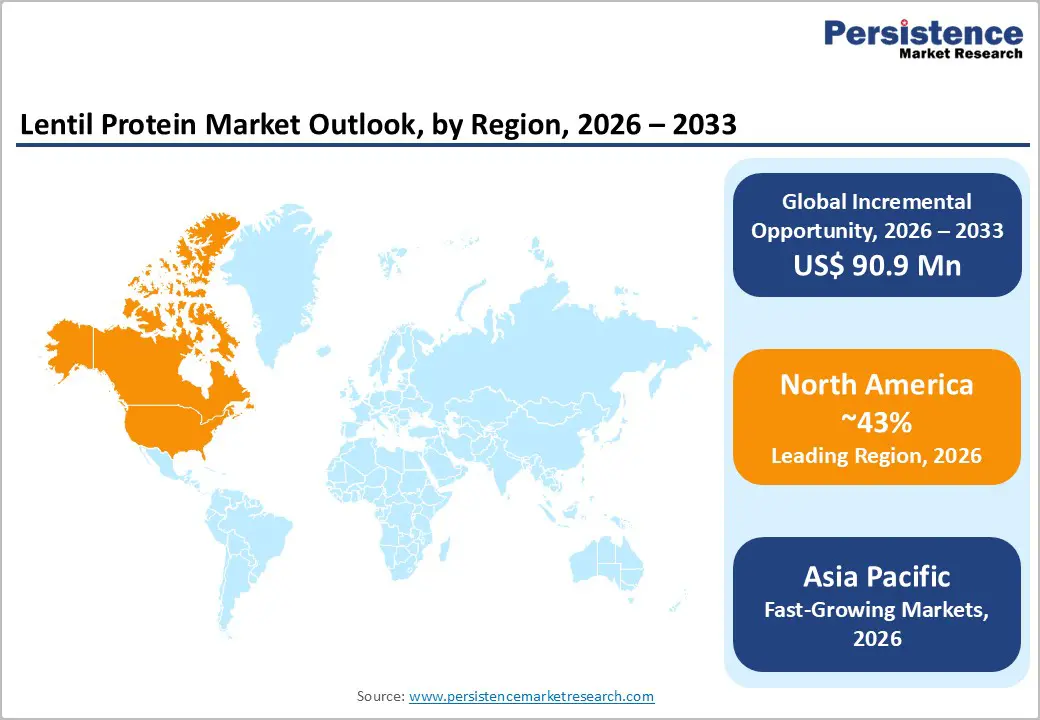

North America holds approximately. 43% market share in the global Lentil Protein Market, driven by advanced product innovation and strong plant-based adoption. In the United States, lentil protein is gaining traction in sports nutrition, ready-to-mix beverages, and functional snacks emphasizing digestibility. Clean-label reformulation continues across mainstream brands, supporting steady ingredient demand.

Canada plays a strategic role through lentil cultivation and expertise in ingredient processing. Domestic manufacturers integrate lentil protein into fortified foods aligned with sustainability goals. Cross-border supply chains enhance availability while supporting export-oriented growth. Investment in food-tech startups and alternative protein research accelerates the diversification of applications. As consumer focus shifts toward transparency and performance, North America remains a testing ground for premium lentil protein innovations.

Asia Pacific Lentil Protein Market is expected to grow at a CAGR of 10.6% as dietary patterns evolve across urban centers. In India, lentil protein aligns naturally with pulse-based diets and the rising interest in protein fortification. Local brands integrate it into nutrition powders and traditional food formats.

China shows growing adoption in plant-based beverages and meal replacements driven by fitness culture. Japan focuses on precision nutrition, favoring lentil protein for elderly-friendly and medical foods. South Korea emphasizes high-protein snacks and beauty-from-within products using plant proteins. Regional innovation prioritizes functionality, taste refinement, and cultural compatibility. Expanding middle-class consumption and domestic processing investments continue to strengthen the Asia Pacific’s growth trajectory.

The global Lentil Protein Market remains moderately fragmented, with a mix of ingredient specialists and diversified plant-protein suppliers. Leading companies focus on clean-label formulations, investing in flavor masking and improved solubility. Certifications related to organic, non-GMO, and sustainability are increasingly used to support premium positioning.

Product innovation centers on application-specific proteins for beverages, sports nutrition, and clinical foods. Sustainability initiatives include water-efficient processing and responsible sourcing of ingredients. Strategic B2C partnerships with food brands accelerate market visibility. Compliance with evolving government regulations on labeling and protein claims shapes competitive strategies. As demand scales, differentiation increasingly depends on processing efficiency, formulation support, and transparent supply chains.

The global lentil protein market is projected to be valued at US$ 218.3 Mn in 2026.

Growth in vegan, flexitarian, and allergen-friendly lifestyles boosting demand for alternative proteins is a key driver for the global Lentil Protein market.

The global Lentil Protein market is poised to witness a CAGR of 5.1% between 2026 and 2033.

Integration of lentil protein into hybrid blends with complementary plant proteins to enhance amino acid profiles is key opportunity.

Major players in the global Lentil Protein market include ADM, Glanbia plc, Ingredion Incorporated, Bunge Limited, Kerry Group, Tyson Foods, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Nature

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author