ID: PMRREP22960| 162 Pages | 8 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

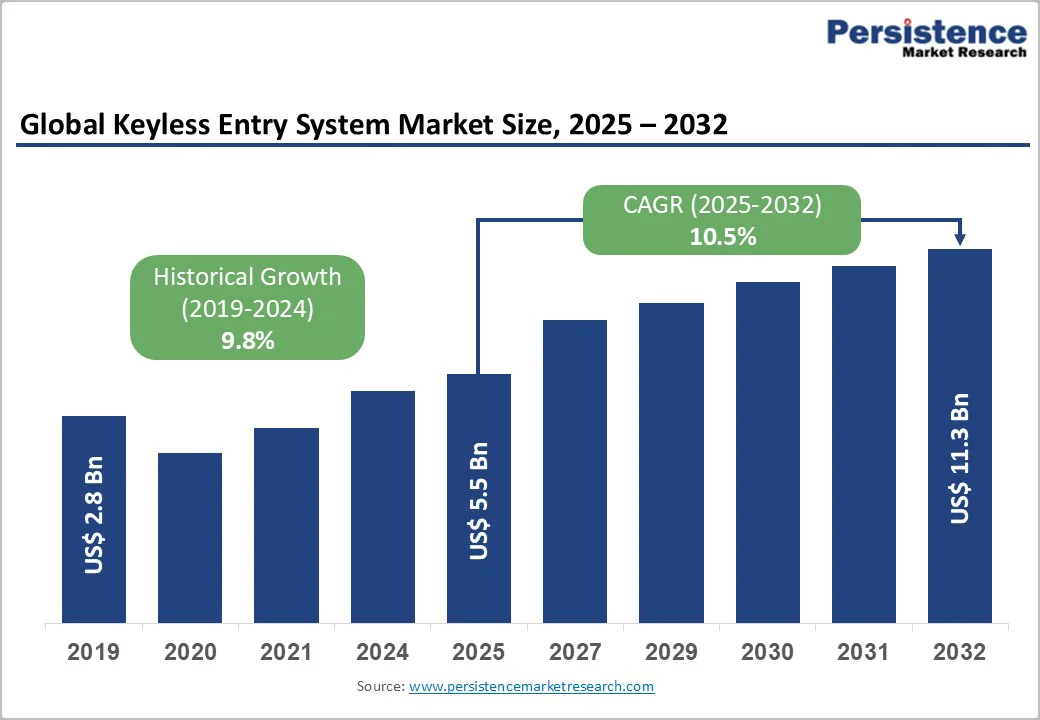

The global keyless entry system market size is likely to be valued at US$ 5.5 billion in 2025, and is projected to reach US$ 11.3 billion by 2032, growing at a CAGR of 10.8% during the forecast period 2025 - 2032.

This growth is driven by increasing consumer demand for convenient remote access management, enhanced security features with multi-factor authentication, and seamless integration with smart home ecosystems.

The market expansion spans both mature economies and rapidly emerging regions, reflecting the widespread adoption of advanced keyless technologies in residential, automotive, and commercial applications. Rising awareness around security, convenience, and technological innovation continue to propel market momentum globally.

| Key Insights | Details |

|---|---|

| Keyless Entry System Market Size (2025E) | US$ 5.5 Bn |

| Projected Market Value (2032F) | US$ 11.3 Bn |

| Global Market Growth Rate (CAGR 2025 to 2032) | 10.5% |

| Historical Market Growth Rate (CAGR 2019 to 2023) | 9.8% |

Consumer preference for keyless entry systems has surged primarily through convenience, remote access capabilities, and streamlined property management efficiency, driving substantial growth across residential and commercial sectors. The willingness to pay premium rates for smart apartments has been rising among consumers, signaling robust demand for contemporary, interconnected security infrastructure.

Mobile-first platforms have enabled single-tap smartphone unlocking, temporary visitor credentials, and real-time access visibility, delivering measurable differentiation relative to conventional mechanical systems.

Remote access functionality has particularly benefited property managers and maintenance teams by eliminating physical key distribution dependencies while establishing time-stamped audit trails satisfying regulatory compliance frameworks. Integration with voice assistants, such as Amazon Alexa, has facilitated voice command activation and smart home synchronization.

Breakthrough advancements in fingerprint recognition precision, facial identification technology, and integrated multi-factor authentication have established superior security frameworks justifying premium positioning and accelerating institutional adoption across high-security applications. Fingerprint biometric systems have achieved 99.99% accuracy thresholds with false rejection rates beneath 0.5%, effectively resolving historical biometric reliability concerns.

Facial recognition solutions incorporating liveness verification, anti-spoofing defenses, and mask-resistant algorithms have delivered enterprise-equivalent security comparable to credential-based systems while enhancing user experience. The integration of building management systems (BMS) has automated emergency containment, occupancy-driven access governance, and energy optimization, synchronizing protection protocols with facility infrastructure.

Existing building retrofits with keyless entry systems have demanded extensive technical integration, electrical upgrades, and compatibility evaluations, generating significant installation complexity and financial hurdles for cost-sensitive property owners. Legacy door hardware and outdated wiring have proven incompatible with contemporary smart locks, necessitating structural alterations, power enhancements, or full frame replacements.

Fragmented protocols spanning NFC, Bluetooth, Zigbee, and Z-Wave have required specialized expertise for selection and deployment, while certified technician involvement has inflated expenses by a wide margin. Rental portfolios have grappled with tenant transitions and lease limitations, undermining long-term viability absent rental premium realization amid competitive housing dynamics.

Connected keyless platforms have expanded cyber exposure surfaces, mandating robust encryption frameworks, vigilant oversight, and layered defenses that impose substantial operational burdens deterring swift deployment among risk-averse enterprises. Cloud-integrated devices have introduced breach pathways targeting credentials, logs, and user profiles through deficient authentication or legacy ciphers enabling remote intrusions despite physical safeguards.

Privacy apprehensions surrounding geolocation tracking, behavioral surveillance, and biometric repositories have triggered GDPR, CCPA, and nascent regulatory mandates, with vendor-locked cloud dependencies amplifying service disruption vulnerabilities.

Comprehensive modernization programs across corporate offices, hotels, and institutional facilities have generated substantial procurement opportunities for keyless entry systems as organizations upgrade legacy access controls and incorporate digital facility oversight.

For example, property developers have positioned smart locks as key differentiators securing high-value occupants, streamlining operations, and facilitating hybrid workspace occupancy tracking. Similarly, hospitality facilities have embraced mobile-based solutions enabling touchless arrivals, bypassing reception key exchanges, and minimizing staffing overheads.

Rapid smart home proliferation has further amplified value through lock integration with lighting controls, HVAC systems, surveillance feeds, and automation hubs, justifying elevated pricing for unified platforms.

Seamless connectivity across Apple Home, Google Home, and Amazon Alexa ecosystems has enabled voice-activated routines and app orchestration, establishing keyless technology as foundational infrastructure within connected residences. Subscription platforms bundling hardware with cloud intelligence, maintenance forecasting, and feature expansions have cultivated sustained revenue and opened a highly lucrative market opportunities.

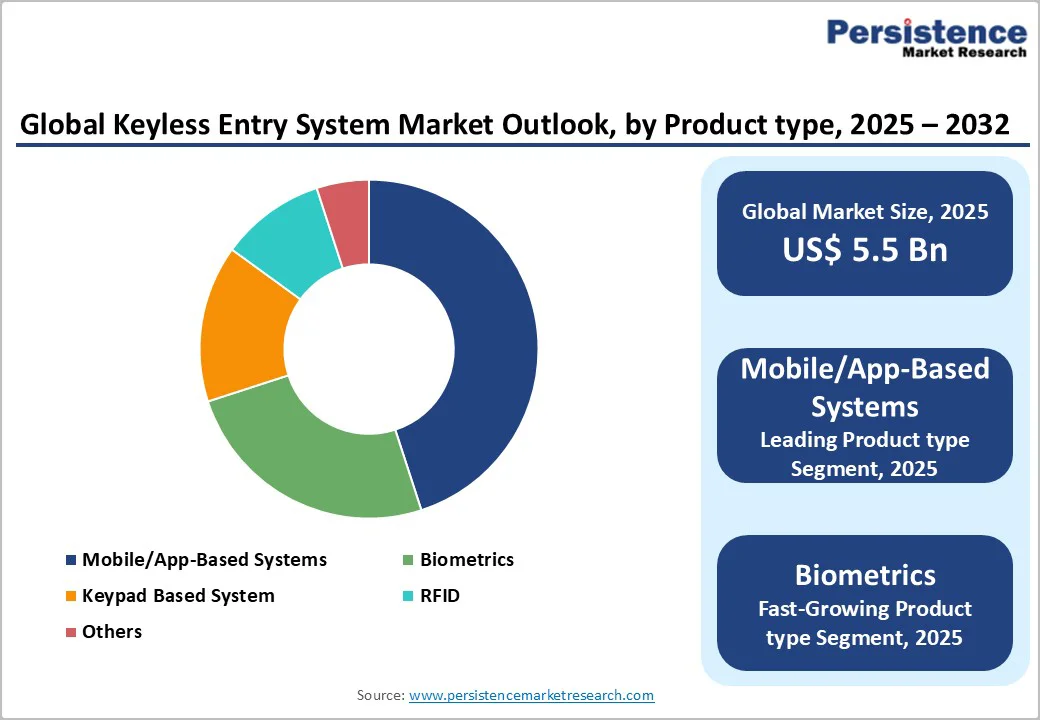

Mobile and app-based platforms have captured around 42.4% of the keyless entry system market revenue share in 2025, propelled by smartphone proliferation, effortless usability, and frictionless smart home connectivity.

Leveraging NFC, Bluetooth, or cloud authentication, these solutions have eradicated physical keys while enabling instant access control, visitor permissions, and comprehensive activity logs via intuitive interfaces. Wallet integrations with Apple and Google have facilitated keyless entry without dedicated apps, complemented by sub-second cloud response times maintaining functionality during connectivity lapses.

Biometric alternatives are expected to register an estimated 9% CAGR from 2025 to 2032, owing to their unmatched verification precision, contactless hygiene advantages, and fortified layered protections.

Fingerprint and facial modalities have attained institutional-grade dependability, accelerating deployment across medical facilities, public sector installations, and secure commercial environments. The touch-free property of biometrics has made the technology essential for high-traffic hygiene-critical applications, balancing enterprise security imperatives with streamlined user workflows.

Commercial properties command approximately 45.7% of the market revenues in 2025, backed by the widespread deployment of keyless entry systems across corporate headquarters, hospitality establishments, shopping centers, and public institutions. These entities are actively prioritizing sophisticated access governance, visitor oversight, and workflow optimization.

Office environments have implemented credential-free portals and dynamic seating configurations, while lodging operators have leveraged app-driven solutions streamlining arrivals and cutting personnel costs. Retail outlets and mixed-use developments have centralized networks supporting tenant flexibility and evening safeguards, with academic and civic sites favoring biometrics for complete traceability.

Residential applications are likely to emerge as the fastest-expanding segment between 2025 and 2032, fueled by tenants accepting rental surcharges for intelligent hardware, new constructions embedding connected ecosystems, and landlords embracing digital platforms for upkeep coordination and occupant permissions.

This momentum reflects surging homeowner enthusiasm for unified automation alongside property operators capitalizing on efficiency gains in multi-unit portfolios.

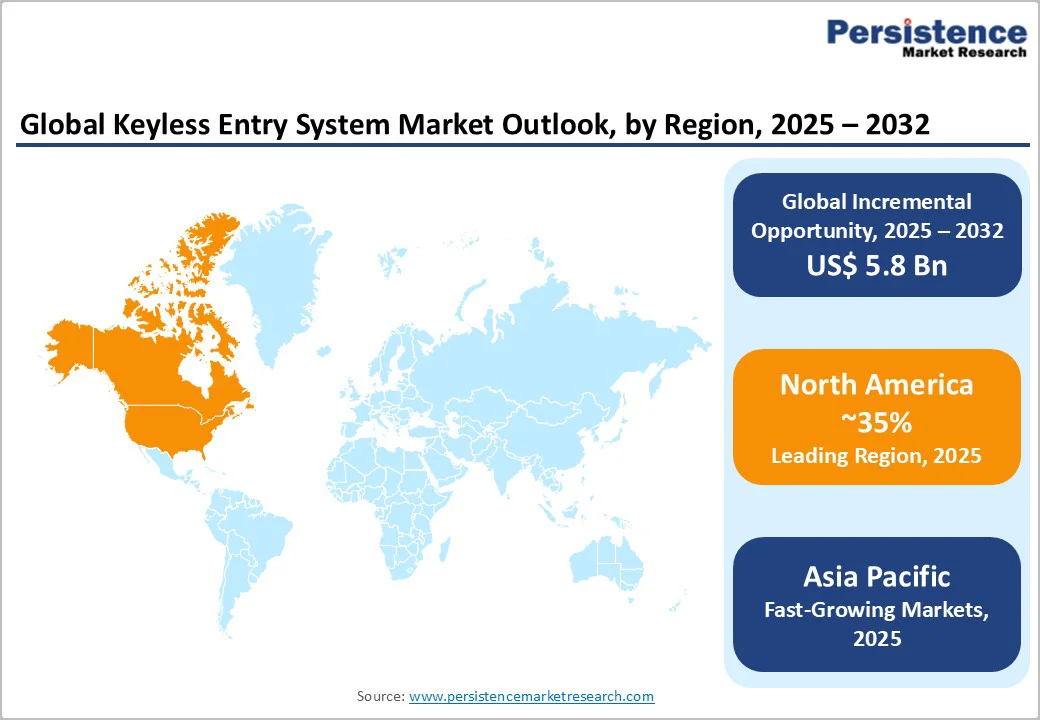

At about 45.4%, North America leads the keyless entry system market share in 2025, sustaining a robust growth momentum through 2032, as the region's technologically sophisticated ecosystem solidifies premium positioning.

The United States dominate the regional market aided by vibrant commercial real estate dynamics, thriving hospitality sector, and discerning consumers prioritizing advanced protection alongside effortless usability. Native platform synergies with Apple HomeKit, Amazon Alexa, and Google Assistant have accelerated seamless deployment, complemented by elevated disposable incomes and digitally native populations.

Property developers in the region have standardized intelligent hardware as core amenities elevating occupant satisfaction and facility performance, while mandates for enhanced structural safeguards and emergency protocols have reinforced institutional uptake.

Canada also contributes to regional expansion through accelerating electric vehicle (EV) adoption, spurring automotive solutions alongside residential and enterprise spillover effects. This confluence of economic strength, regulatory alignment, and innovation leadership has established North America as the benchmark for keyless technology maturation.

Europe occupies a significant position in the market in 2025, expected to maintain around 8.2% CAGR through 2032, powered by rigorous data safeguards, consumer affluence favoring upscale protection solutions, and stringent legislative frameworks.

Germany has spearheads the Europe market on the back of intelligent edifice programs, property portfolio renewals, and discerning demand for sophisticated safeguards. The market in the United Kingdom is experiencing an accelerated uptake of keyless entry systems through lodging sector transformations, vacation rental proliferation, and tenant-centric facility enhancements.

France and Spain have registered consistent advances fueled by enterprise investments, civic structure fortifications, and metropolitan developments embedding contemporary portals. GDPR mandates and nascent statutes governing biometric repositories have compelled privacy-centric designs, while Nordic markets have pioneered residential overhauls and institutional protections amplifying continental momentum.

Asia Pacific is anticipated to emerge as the fastest-growing market for keyless entry systems, projected to achieve a 13.5% CAGR between 2025 and 2032. Urban proliferation, escalating affluence, and contemporary developments embedding intelligent hardware as foundational elements have propelled this trajectory.

China commands regional supremacy via intelligent metropolis programs, pervasive residential IoT deployment, and economical local fabrication. Japan has sustained innovation primacy through pioneering lock advancements, premature connected dwelling adoption, and automotive solution mastery catalyzing continental diffusion.

India has accelerated as a breakout contender powered by metropolitan sprawl, surging homeownership, and state-sponsored facility renewals. Thailand, Vietnam, Indonesia, and the Philippines have capitalized on prosperity gains alongside intelligent structure initiatives. Concentrated production capabilities, competitive fabrication expenses, and resilient component networks have established the region as a hub of prolific market opportunities.

The global keyless entry system market structure exhibits moderate-to-high fragmentation with leading players commanding approximately 35% combined market share. At the same time, regional specialists and emerging innovators are carving a niche in growing segments through localized expertise and specialized applications.

ASSA ABLOY emerges as the market leader with estimated annual revenue of US$ 1.5 billion from smart lock operations across Yale, Mul-T-Lock, and ABLOY brands. DormaKaba Holding maintains competitive positioning with an estimated US$ 800 million to US$ 1.1 billion annual revenue from smart lock and digital access control operations serving commercial and institutional segments.

The global keyless entry system market is projected to reach US$ 5.5 billion in 2025.

Growing adoption of smart and connected technologies for enhanced security, convenience, and access management across residential, commercial, and automotive applications is driving the market.

The market is poised to witness a CAGR of 10.8% from 2025 to 2032.

Modernization programs across corporate offices, hotels, and institutional facilities and rapid smart home proliferation are key market opportunities.

ASSA ABLOY AB, Safran Group, Gemalto NV, and NEC Corporation are some of the key players in the market.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author