ID: PMRREP2830| 297 Pages | 7 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

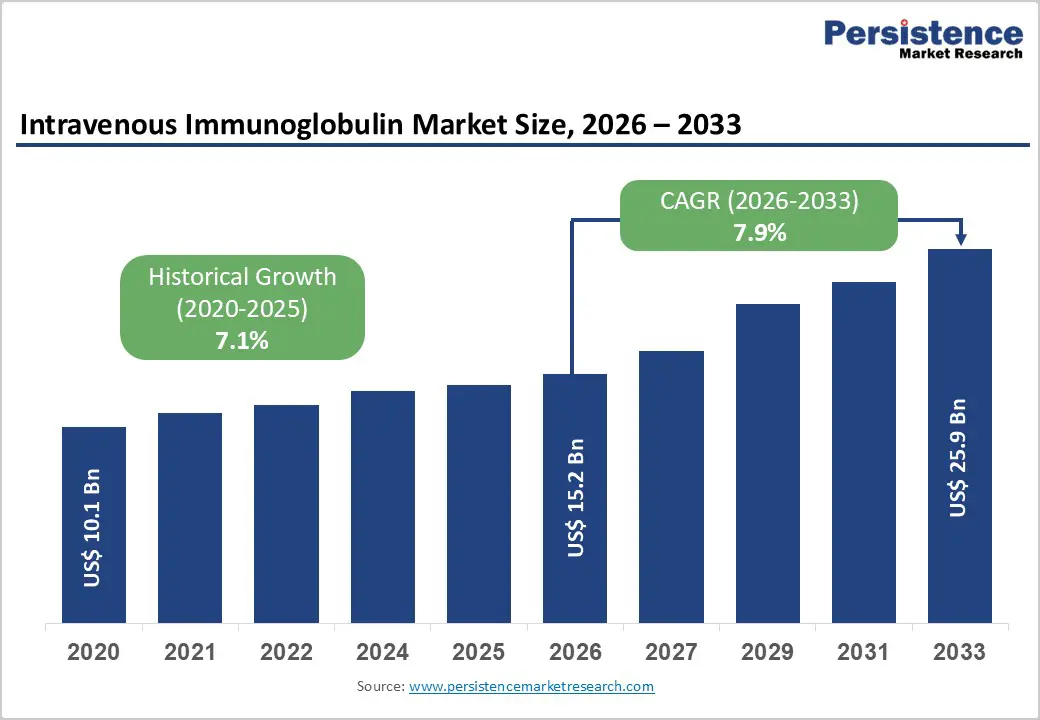

The global intravenous immunoglobulin market size is expected to be valued at US$ 15.2 billion in 2026 and projected to reach US$ 25.9 billion by 2033, growing at a CAGR of 7.9% between 2026 and 2033.

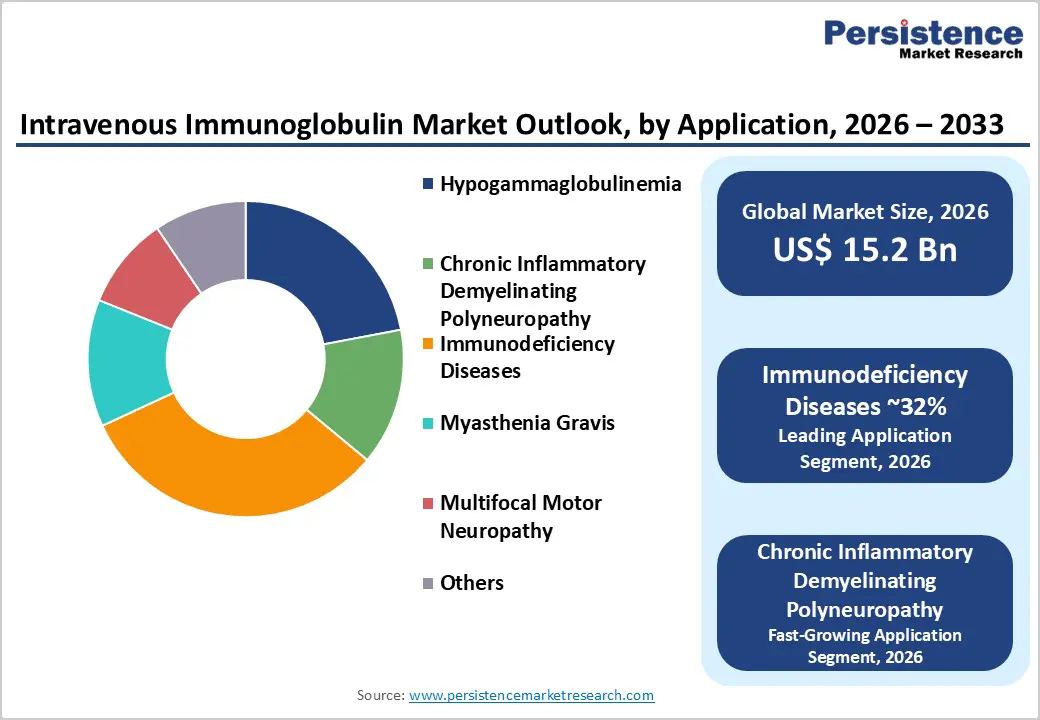

The global IVIG market is witnessing strong growth, driven by rising diagnoses of primary and secondary immunodeficiency disorders and expanding therapeutic applications, including Chronic Inflammatory Demyelinating Polyneuropathy (CIDP). IVIG is increasingly used in neuromuscular, autoimmune, and hematological conditions, reflecting its broad clinical relevance. Market expansion is supported by growing awareness among healthcare professionals, guideline-based adoption of therapy, and advancements in plasma fractionation technologies, which improve product safety and availability. Additionally, emerging markets are progressively integrating IVIG into standard care protocols for life-threatening immune dysfunctions, boosting demand. These factors collectively indicate a sustained upward trend, with the market poised to grow as access to IVIG therapy improves globally and therapeutic indications continue to expand.

| Key Insights | Details |

|---|---|

| Intravenous Immunoglobulin Market Size (2026E) | US$15.2 Bn |

| Market Value Forecast (2033F) | US$25.9 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.9% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.1% |

The intravenous immunoglobulin (IVIG) market is being propelled by several important factors that reflect both shifts in disease patterns and broader healthcare investments. A major driver is the rising prevalence of immunodeficiency and chronic inflammatory diseases worldwide, including conditions such as chronic inflammatory demyelinating polyneuropathy (CIDP), Guillain-Barré syndrome, myasthenia gravis, and primary immunodeficiency disorders. These conditions require long-term immunomodulatory therapy, making IVIG a critical treatment option and expanding the patient base demanding these biologic therapies. Furthermore, the rising global incidence of autoimmune diseases has increased the number of patients eligible for IVIG treatment, thereby boosting overall market volume. Enhanced diagnostic capabilities and greater disease awareness are contributing to earlier detection and more patients entering treatment pathways.

Lack of awareness amongst patients is restraining the growth of the overall market. This is owing to the ignorance of the effects of infections and the lack of inclination towards taking proper treatment. Furthermore, the rising cost of IVIG therapy is projected to be a significant barrier to market expansion. Immunoglobulin infusions are typically given once every 3 to 4 weeks, and the therapy is ongoing around 12-16 sessions yearly.

The estimated cost of IVIG is USD 73.89 per gram, with a total cost of USD 10,000 depending on the severity of the illness. Immunoglobulin replacement treatments are long-term therapies that typically last 6 months. According to the ABIM Foundation, the cost of IgG treatment exceeds US$30,000 per year.

A prominent opportunity lies in neuromuscular disorders, particularly Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) and Multifocal Motor Neuropathy (MMN), where IVIG is well established as a first-line or maintenance therapy. Large cohorts of CIDP patients receiving IVIG demonstrate median treatment durations exceeding 4 months, regular dosing intervals around 3 weeks, and high responder rates, highlighting the chronic, repeat-use nature of these indications. As aging populations and better neurological diagnostics increase identification of CIDP and related neuropathies, IVIG volumes per patient are expected to grow, positioning neurology as one of the fastest-expanding clinical segments. Companies that optimize dosing regimens, develop subcutaneous or home infusion–friendly formulations, and expand label indications can capture outsized value in this high-need population.

IgG is expected to remain the leading segment in the intravenous immunoglobulin market, accounting for the largest share of the intravenous immunoglobulin market due to its widespread clinical use and strong evidence base. IgG constitutes the bulk of IVIG formulations, as it provides broad-spectrum immunomodulatory and replacement effects essential in treating immunodeficiency disorders, autoimmune conditions, and neurological diseases. Clinical guidelines and longstanding therapeutic familiarity with IgG have cemented its role as the backbone of IVIG therapy. In contrast, IgM, IgA, IgE, and IgD are present in much smaller quantities in IVIG products or are not routinely formulated for intravenous administration, resulting in minimal market share for these isotypes. The extensive clinical data supporting IgG’s safety and efficacy, established dosing regimens, and regulatory acceptance reinforce its continued dominance in the IVIG antibody type category.

Among distribution channels, Hospital Pharmacy is expected to be the leading segment, likely to capture about 60% of the market share in 2026, given that most IVIG infusions are administered in inpatient or day care hospital settings. IVIG is frequently used to treat acutely ill patients with severe infections, immune thrombocytopenia, Guillain-Barré syndrome, and CIDP exacerbations, which require close monitoring for infusion reactions and dosing adjustments that are best supported within hospitals. Hospital pharmacies also manage complex procurement, cold-chain logistics, and allocation protocols during periods of product shortages, reinforcing their central coordinating role. While retailers and specialty infusion centers are gaining relevance in some high income countries, their share remains secondary to hospital based dispensing in most markets.

The increasing awareness of products used to treat immunodeficiency diseases, the growing inclination of clinicians towards these therapies, and rising healthcare expenditure are key factors driving market growth.

Changing lifestyles and the rising geriatric population at risk of chronic diseases are among the factors contributing to the growth of this industry. In addition, increasing incidences of PID are expected to present this market with future growth opportunities. In the U.S., autoimmune illnesses are the third most prevalent cause of chronic illnesses. Since many autoimmune disorders are uncommon, the National Institutes of Health predicts that diseases affect between 5% and 8% of the U.S. population. Autoimmune illnesses are becoming more common for unclear causes. The number is expected to grow over the forecast period.

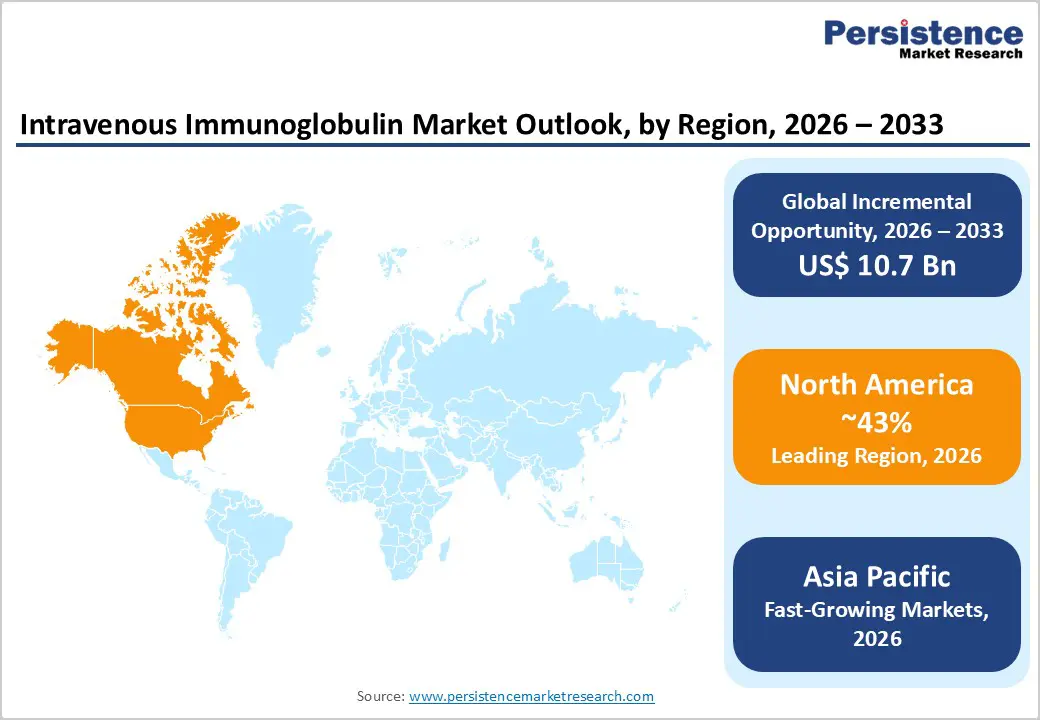

Furthermore, the growing administration of IVIG therapies for the treatment of illness, the existence of established healthcare and research infrastructure, and the rapidly increasing number of product approvals from the U.S. FDA are factors anticipated to contribute to regional market growth. Thus, North America is expected to possess 43% market share for intravenous immunoglobulin in 2026.

Asia Pacific is anticipated to exhibit a robust growth rate over the forecast period, driven by increasing awareness and potential opportunities for the adoption of immunoglobulin-based therapies for the treatment of primary immune deficiencies, coupled with a growing geriatric population. Other factors contributing to this business's growth include emerging economies, growing healthcare spending, and the rapidly expanding immunoglobulin market.

In addition, rising incidence of immune disorders, increasing awareness of intravenous and subcutaneous immunoglobulin therapies, and improving healthcare facilities are anticipated to drive further growth in the near future. Thus, Asia Pacific is expected to account for 35% of the intravenous immunoglobulin market in 2026.

The Intravenous Immunoglobulin market is moderately consolidated, with a handful of large plasma-derived product manufacturers accounting for a substantial share of global supply, alongside regional fractionators. Leading companies focus on securing plasma access through extensive donor center networks, investing in high-yield fractionation technologies, and differentiating their portfolios with ready-to-use liquid formulations, higher-concentration products, and flexible infusion options. Strategic moves include capacity expansions, long-term supply agreements with hospitals and national blood services, and clinical development targeting high-value neuromuscular and immunology indications. Emerging business models increasingly emphasize supply chain resilience, geographic diversification of plasma sourcing, and digital tools for donor engagement and pharmacovigilance.

The global market is projected to be valued at US$ 15.2 Bn in 2026.

Rising prevalence and improved diagnosis of primary immunodeficiency and neuromuscular disorders such as CIDP, combined with guideline‑driven use of IVIG as first‑line therapy, significantly boosts chronic treatment demand worldwide.

The global market is expected to witness a CAGR of 7.9% between 2026 and 2033.

Expansion of plasma collection and local fractionation capacity in Asia Pacific offers a major opportunity to reduce import reliance, improve access, and capture rapidly growing demand for immunodeficiency and neuromuscular indications.

Key players include Biotest AG, Baxter International Inc., Octapharma AG, LFB Biotechnologies, Grifols SA, CSL Behring, China Biologics Products Inc. and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Antibody Type

By Application

By Distribution Channel

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author