ID: PMRREP4396| 220 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

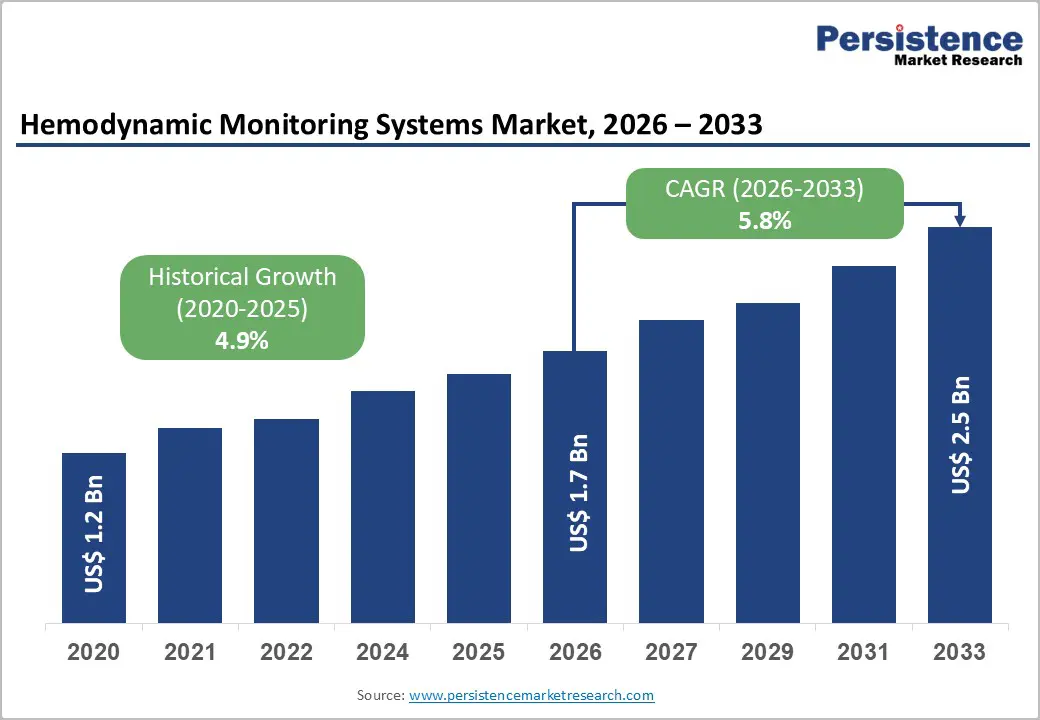

The global hemodynamic monitoring systems market is estimated to grow from US$ 1.7 Bn in 2026 to US$ 2.5 Bn by 2033. The market is projected to record a CAGR of 5.8% during the forecast period from 2026 to 2033.

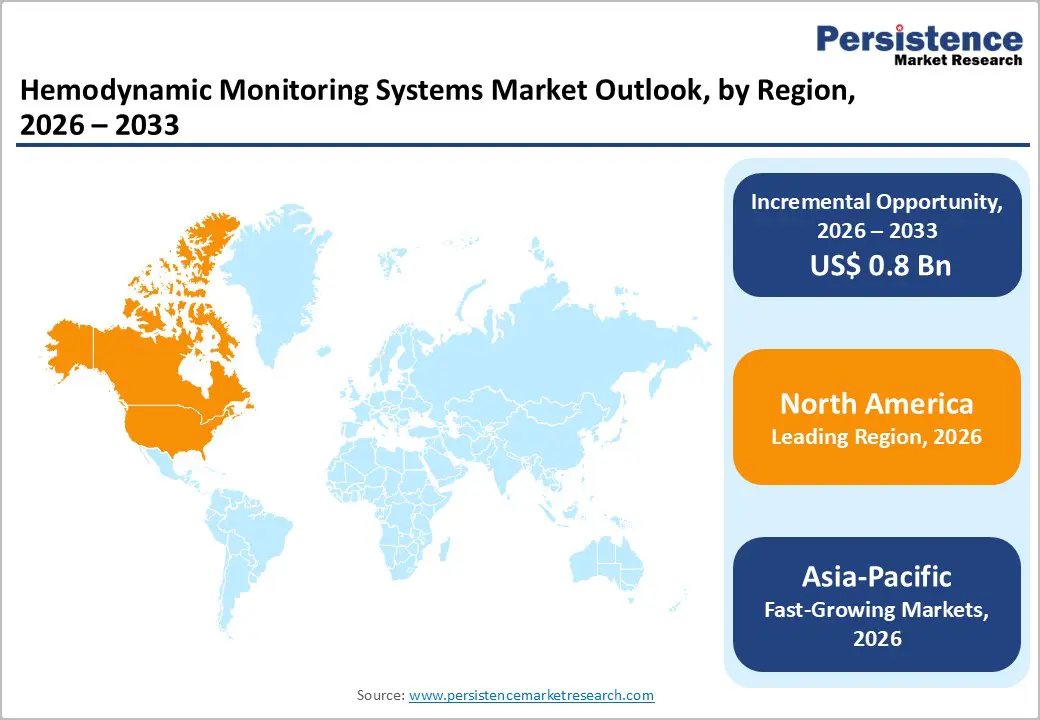

The global hemodynamic monitoring systems market is expanding steadily, driven by rising cardiovascular disease burden, emergency admissions, and demand for precise clinical interventions. North America dominates due to healthcare infrastructure and technology adoption, while Asia-Pacific is the fastest-growing region, supported by expanding facilities, increasing patient volumes, improved access, and awareness of early diagnosis and treatment.

| Key Insights | Details |

|---|---|

| Hemodynamic Monitoring Systems Market Size (2026E) | US$ 1.7 Bn |

| Market Value Forecast (2033F) | US$ 2.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.9% |

Continuous and real time hemodynamic monitoring enables clinicians to detect physiological deterioration earlier and respond faster than intermittent checks. For example, a study analyzing over 63 patient?years of continuous ECG data from 8,105 acute care admissions found that integrating continuous cardiorespiratory signals improved the predictive performance of deterioration models compared with traditional vital sign and lab data alone. In another clinical evaluation, the use of a wearable continuous monitoring system led to recognition and treatment of 97% of patient deterioration events, reducing rapid response activations by 53% and shortening ICU length of stay. These findings underscore the clinical value of real time monitoring in critical care.

Evidence shows that continuous monitoring can meaningfully improve outcomes for high risk cardiovascular patients. A systematic review of hemodynamic and telemonitoring in heart failure reported reductions in hospitalization rates of up to 45% with continuous hemodynamic monitoring compared with standard care. Continuous monitoring also enhances early warning systems for critical changes in vital signs, enabling proactive intervention and improved survival prospects. According to clinical evidence, enhanced real?time detection of sepsis with advanced ICU monitoring technologies has improved diagnostic accuracy by up to 75%. Collectively, these data demonstrate that continuous, real?time monitoring is a key driver for adoption of hemodynamic monitoring systems, improving patient outcomes and reducing acute care burdens.

Advanced hemodynamic monitoring systems require significant capital outlay, which can deter adoption, particularly in resource?constrained settings. For example, a comprehensive central monitoring setup for a 100?bed hospital can cost between $500,000 and $2 million, inclusive of hardware, installation, and staff training expenses. Smaller hospitals and clinics with limited budgets often delay or avoid such investments due to competing financial priorities. This high upfront investment not only affects acquisition but also the scale of deployment, restricting advanced monitoring capabilities in many facilities. These substantial costs serve as a key restraint on widespread adoption of hemodynamic monitoring technologies.

Real world cost data further illustrates the financial burden associated with advanced monitoring. In the context of tele?ICU implementations, a Veterans Health Administration (VHA) analysis found first?year costs for implementing and operating tele ICU monitoring technology ranged from approximately $70,000 to $123,000 per ICU bed, including technology, networking, and operational expenses. These figures highlight the recurring and capital costs that health systems must bear to deploy comprehensive monitoring infrastructure. In lower?income regions, the high initial and ongoing expenses for advanced hemodynamic and ICU monitoring often lead to reliance on basic systems, which limits precision and clinical insight.

Non?invasive and minimally invasive hemodynamic monitoring technologies present a major opportunity by reducing patient risk and broadening clinical applicability. A review published in Anesthesiology reported that non?invasive cardiac output monitoring had a correlation coefficient of 0.81 compared with pulmonary artery catheter measurements across diverse clinical settings, demonstrating acceptable agreement without the risks of invasive procedures. Continuous non?invasive systems also reduce complications such as infection and bleeding, which occur in up to 5–10% of invasive catheter placements according to clinical safety data. These features support broader adoption, especially in perioperative care and step?down units where patient safety and comfort are priorities.

Minimally invasive monitoring is increasingly recognized for its clinical value. A study in Critical Care found that less invasive pulse contour analysis devices tracked hemodynamic changes with high precision and improved clinician response times in septic shock patients, contributing to early goal?directed therapy. Importantly, guidelines from the European Society of Cardiology emphasize the use of non?invasive assessment tools for initial evaluation and ongoing management of heart failure, aligning practice with technology improvements. With global aging and rising chronic disease, systems that minimize procedural risk and streamline workflow can increase utilization across emergency departments, cardiology, and outpatient settings, expanding market reach.

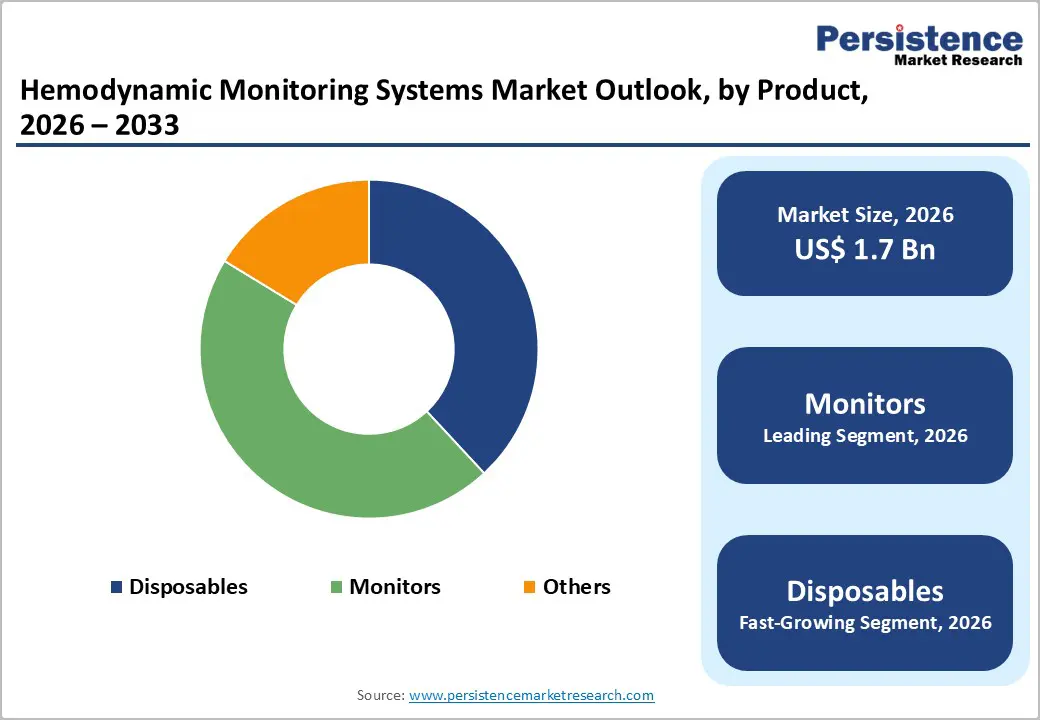

Monitors occupies 45.6% share of the global market in 2025, because they are indispensable for continuous, real?time assessment of critical cardiovascular parameters such as cardiac output, arterial pressure, and oxygen saturation, which guide urgent clinical decisions in ICUs, emergency rooms, and operating theatres. In the U.S., about 74 % of intensive care units use real?time hemodynamic monitors, reflecting their central role in managing unstable patients and complex cases. Continuous monitoring directly supports early detection of deterioration, which studies show can reduce ICU mortality and complication rates by enabling timely interventions. In high?acuity settings with millions of annual hospital admissions and substantial ICU utilization, multi?parameter hemodynamic monitors provide comprehensive data that disposable sensors alone cannot, making them the primary revenue and adoption driver in the hemodynamic monitoring systems market.

Minimally invasive hemodynamic monitoring dominates because it balances clinical accuracy with reduced procedural risk and resource use, making it preferable over fully invasive methods. For example, studies published in Critical Care Medicine show that minimally invasive pulse contour analysis systems provide cardiac output measurements with good agreement to pulmonary artery catheters (correlation coefficients often >0.80) while avoiding complications such as catheter?related bloodstream infection, which occur in up to 5–10 per 1,000 catheter days according to CDC surveillance data. Minimally invasive devices also align with clinical guidelines that recommend alternatives to invasive monitoring when possible to reduce patient harm. This combination of reliable data, lower infection risk, and easier implementation in varied care settings drives their dominant adoption in modern hemodynamic practice.

North America dominates the hemodynamic monitoring systems market with 39.6% share in 2025, due to its advanced healthcare infrastructure, high healthcare spending, and extensive critical care capacity. In the United States, more than 70 % of intensive care units utilize continuous hemodynamic monitors to manage complex cardiovascular and critical conditions, reflecting widespread clinical integration. The region also has a high prevalence of chronic diseases requiring intensive monitoring, with the CDC reporting that cardiovascular disease causes over 655,000 deaths annually in the U.S., underscoring demand for precise monitoring tools. Robust hospital networks, strong reimbursement frameworks, widespread digital health adoption (over 80 percent of U.S. hospitals use electronic health records), and skilled healthcare professionals further support early adoption and expansive use of advanced hemodynamic monitoring systems, cementing North America’s leadership in the market.

Europe is an important region in the hemodynamic monitoring systems market because it combines a high burden of cardiovascular disease with substantial critical care infrastructure that drives demand for advanced monitoring. In the WHO European Region, cardiovascular diseases account for around 42.5 % of all deaths, making CVD the leading cause of mortality and a major driver of clinical monitoring needs. Additionally, the European Union had approximately 4.7 hospital beds per 1,000 population in 2022, with wide variation across countries, indicating strong overall hospital infrastructure that supports critical care delivery. High rates of cardiovascular hospitalisations, such as over 2,000 CVD discharges per 100,000 population on average underscore the intensive clinical use of hemodynamic monitoring tools. These clinical and system?level factors make Europe a key market for hemodynamic monitoring systems.

Asia?Pacific is the fastest?growing region in the hemodynamic monitoring systems market because its healthcare infrastructure and chronic disease burden are rising rapidly, expanding demand for critical care technologies. Cardiovascular diseases remain the leading cause of death in the region, accounting for about 40 % of all mortality in the Western Pacific and substantial proportions in Southeast Asia, highlighting clinical need for advanced monitoring. Governments and healthcare systems are simultaneously expanding intensive care capacity; ICU penetration and beds are increasing across China, India and Southeast Asia to manage ageing populations and chronic conditions, driving adoption of hemodynamic systems. This combination of rising disease burden and expanding critical care infrastructure underpins Asia?Pacific’s rapid market growth.

The hemodynamic monitoring systems market is highly competitive, driven by global and regional players offering stationary, portable, and wearable systems. Companies emphasize device accuracy, safety, interoperability, and regulatory compliance. Innovations in minimally invasive and non?invasive monitors, AI integration, and remote connectivity, along with strategic collaborations and regional expansion, enhance differentiation and intensify competition across the global market.

The global hemodynamic monitoring systems market is projected to be valued at US$ 1.7 Bn in 2026.

Rising cardiovascular disease, ICU demand, technological advancements, continuous monitoring, and expanding healthcare infrastructure drive growth.

The global hemodynamic monitoring systems market is poised to witness a CAGR of 5.8% between 2026 and 2033

Opportunities include non-invasive devices, remote monitoring, AI integration, wearable systems, emerging markets, and home healthcare adoption.

Medtronic, Masimo Corporation, BD, Retia Medical Systems, Inc., ICU Medical, Inc., Caretaker Medical.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Type of System

By Modality

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author