ID: PMRREP3287| 192 Pages | 12 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

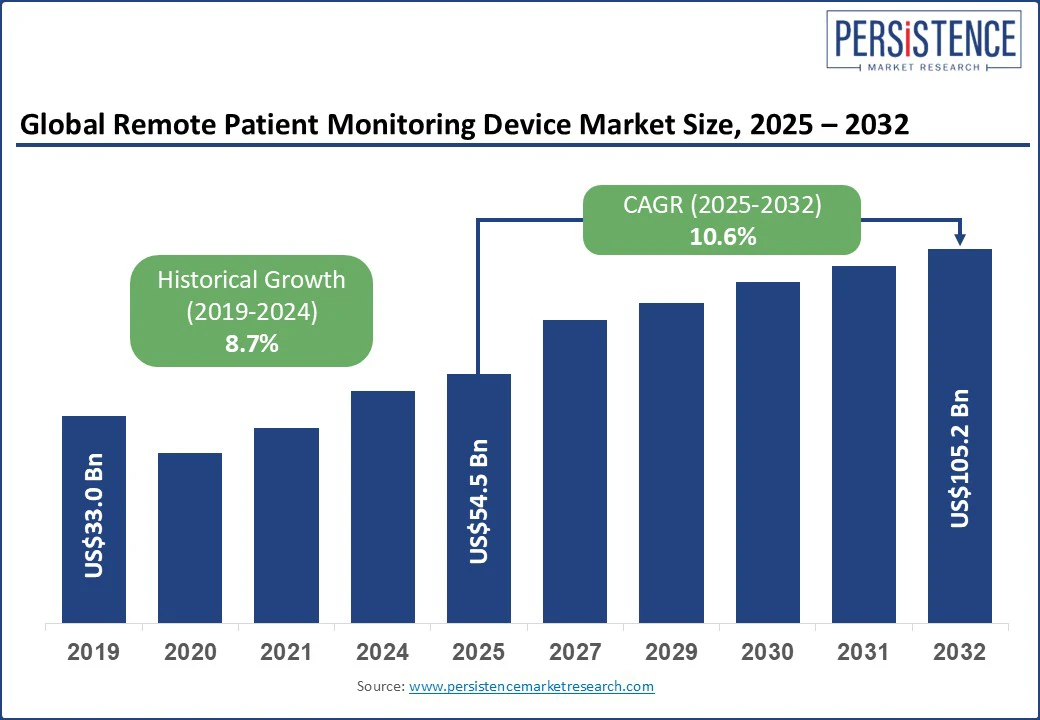

The global remote patient monitoring device market size is projected to rise from US$ 54.5 Bn in 2025 to US$ 105.2 Bn by 2032. It is anticipated to witness a CAGR of 10.6% during the forecast period from 2025 to 2032. The remote patient monitoring (RPM) device market growth is being driven by the rising prevalence of chronic diseases such as diabetes and hypertension. These are placing increasing pressure on healthcare systems, and novel RPM devices are gaining impetus as they provide an ideal solution by facilitating timely intervention and reducing hospital readmissions.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Remote Patient Monitoring Device Market Size (2025E) |

US$ 54.5 Bn |

|

Market Value Forecast (2032F) |

US$ 105.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

10.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.7% |

The shift toward value-based care models is spurring remote patient monitoring device market growth as healthcare systems prioritize outcomes over service volume. In value-based setups, providers are rewarded for preventing hospitalizations and managing chronic conditions efficiently. This makes RPM tools a strategic asset. The Centers for Medicare & Medicaid Services (CMS) in the U.S., for example, extended reimbursement for RPM services under Medicare in 2024. It covered chronic condition management through devices that collect patient vitals daily.

Hospitals and accountable care organizations are adopting RPM to lower readmission penalties. The Cleveland Clinic, for instance, reduced 30-day readmissions for heart failure by 18% in 2024 after integrating RPM into post-discharge care. These savings are incentivizing further investments into monitoring platforms that track patients in real-time and feed data into clinical dashboards for early intervention. Additionally, insurers such as UnitedHealthcare and Anthem are now offering RPM coverage in employer-sponsored plans.

Regulatory compliance is drastically slowing down the adoption of RPM devices, mainly due to the complexities around data privacy, security, and interoperability. In the U.S., the Health Insurance Portability and Accountability Act (HIPAA) mandates strict patient data protection, and several RPM start-ups find it difficult and costly to meet these requirements. For instance, integrating secure cloud storage and user authentication adds a layer of technical and financial burden that small-scale players often cannot manage.

Interoperability standards are another drawback. While the 21st Century Cures Act in the U.S. and the EU’s European Health Data Space (EHDS) initiatives aim to improve data sharing, device manufacturers still face challenges managing their systems with electronic health records. Data localization laws in India, China, and Germany are further creating barriers. The norms require that health data be stored and processed within national borders, which complicates operations for firms relying on centralized cloud infrastructures.

Increasing demand for in-house patient monitoring is creating new avenues for RPM devices, primarily as healthcare systems move toward home-based care models. With rising hospital costs and a surging preference for aging in place, families and caregivers are investing in tools that enable chronic disease management at home. According to a 2025 survey by the American Association of Retired Persons (AARP), over 76% of adults over 50 prefer to receive care at home rather than in institutions. It is further pushing the adoption of RPM devices, including connected blood pressure cuffs.

The shift is also being fueled by caregiver burden. In Asia Pacific, where multigenerational households are common, Japan has witnessed high adoption of home-use RPM devices due to the increasing elderly population and limited hospital capacity. In India, start-ups are making affordable RPM kits available for in-home use, which are integrated with AI to flag early signs of deterioration.

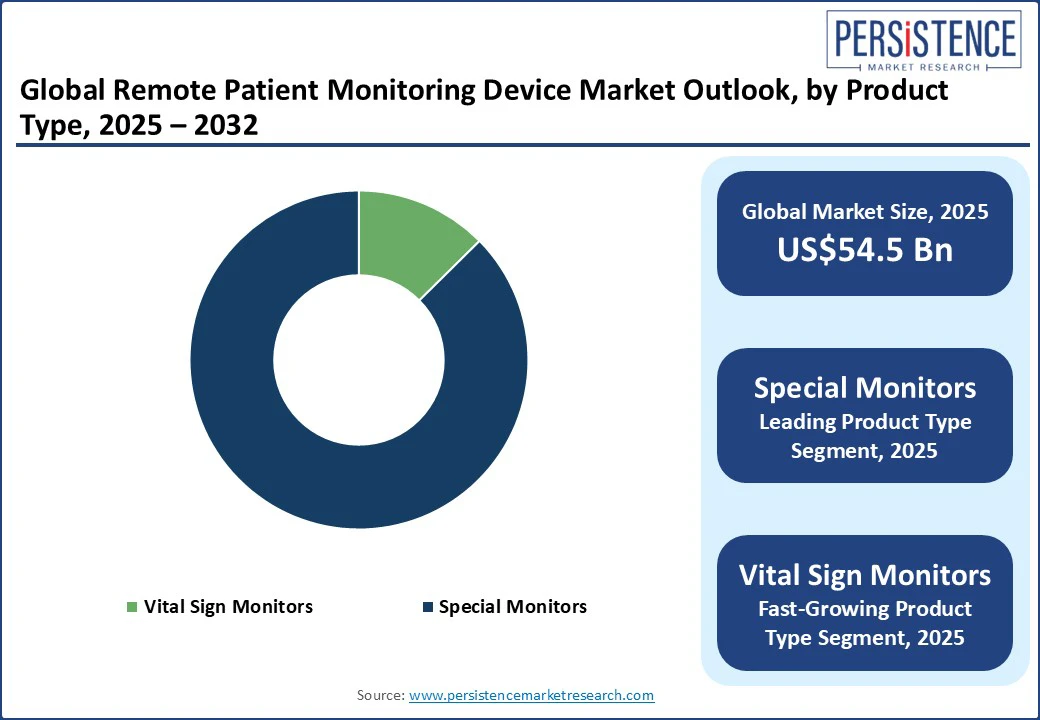

Based on product type, the market is bifurcated into vital sign monitors and special monitors. Among these, special monitors are predicted to hold about 87.4% of the share in 2025 as they provide disease-specific, real-time data that supports proactive treatment. These devices are designed to track parameters directly relevant to specific illnesses, such as Continuous Glucose Monitors (CGMs) for diabetes or implantable cardiac monitors for arrhythmia. Another reason for their popularity is the integration of novel connectivity and analytics features, which support smooth data sharing with care teams and electronic health records.

Vital sign monitors are seeing a high demand due to their versatility in tracking key health parameters, which are essential across a wide range of acute and chronic conditions. These are widely used in both hospital and home settings, making them indispensable during transitions of care. The COVID-19 pandemic boosted their adoption, specifically pulse oximeters and temperature sensors. However, the trend has continued post-pandemic owing to their role in early intervention and triage.

By application, the market is segregated into oncology, diabetes, cardiovascular diseases, sleep disorders, viruses, infections, bronchitis, hypertension, and others. Out of these, diabetes is expected to hold nearly 14.7% of the remote patient monitoring device market share in 2025, owing to the chronic nature of the disease and the immediate impact that continuous tracking can have on outcomes. Diabetes requires frequent monitoring of blood glucose levels, dietary intake, physical activity, and medication adherence. Devices such as CGMs have changed diabetes care by reducing the requirement for finger-prick tests and allowing for automated data sharing with caregivers and physicians.

Hypertension has emerged as a key application, backed by its silent progression and massive global burden. Often asymptomatic until complications arise, high blood pressure requires routine monitoring to prevent stroke, heart failure, and kidney disease. This makes it ideal for RPM, where continuous or frequent data capture can reveal patterns missed during occasional clinic visits. A key reason for its importance in RPM is the proven link between home-based monitoring and improved blood pressure control.

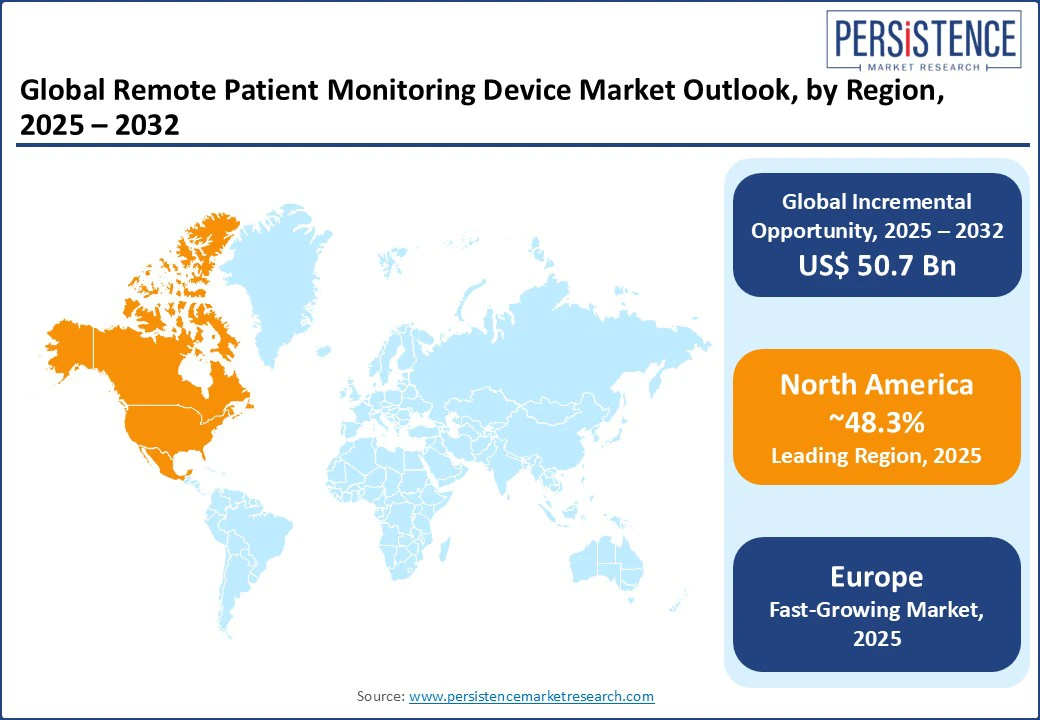

North America is predicted to account for approximately 48.3% of the share in 2025 due to the increasing prevalence of chronic diseases and a well-established digital healthcare infrastructure. The U.S. remote patient monitoring device market is anticipated to see steady growth as it benefits from a favorable regulatory environment, with Medicare and private payers reimbursing for RPM services. It has accelerated the adoption of RPM devices across hospitals, primary care practices, and home healthcare settings.

The use of RPM systems is prominent in managing diabetes, hypertension, cardiac conditions, and post-acute care. Expanding telehealth ecosystems and the increasing role of AI and predictive analytics in patient care are also spurring demand in the U.S. Strategic partnerships are helping eliminate connectivity barriers in rural and underserved communities. For example, Tenovi collaborated with Validic and Circadian Health in 2025 to deliver cellular-connected RPM kits that work independently of Wi-Fi or smartphones.

In Europe, Germany is poised to remain at the forefront of growth due to its structured digital health programs and supportive insurance reimbursement policies. Specialized monitors continue to push most of the revenue, but vital-sign monitoring devices are gaining momentum as hospitals and clinics move toward preventive care and at-home patient management. Several other countries are integrating RPM into their national healthcare systems. In the U.K., the National Health Service (NHS) is extending the use of virtual wards.

The systems allow patients with conditions such as heart failure and Chronic Obstructive Pulmonary Disease (COPD) to be monitored remotely. This helps in freeing up hospital beds and reducing healthcare costs. Private sector development is also augmenting the regional market. U.K.-based home care start-up Cera Care, for example, secured US$ 150 Mn in funding to expand its AI healthcare platform. The platform utilizes predictive analytics to track patient deterioration and automate home visit schedules, which lowers emergency hospital admissions.

Asia Pacific is experiencing considerable growth backed by the growing middle class seeking better healthcare access and expanding elderly populations. China and India are leading the market due to public healthcare initiatives and increasing digital health infrastructure. Demand for vital sign monitors and wearable RPM devices is skyrocketing, with specialized monitors still holding a key portion of the market. China’s growth is attributed to initiatives such as Healthy China 2030, surging public-private healthcare partnerships, and a mature electronics manufacturing landscape.

Large-scale local brands are extending their RPM portfolios, while international brands are strengthening their footprint in urban hospitals and home-care setups. India is emerging as one of the fastest-growing markets in Asia Pacific, propelled by national programs such as the Ayushman Bharat Digital Mission (ABDM). Governments in Japan, South Korea, and Australia are offering tax incentives as well as research and development grants to digital health companies. However, Asia Pacific still faces key hurdles, including inconsistent regulatory standards, data security concerns, and a lack of interoperability between platforms.

The global remote patient monitoring device market is characterized by fragmentation and ongoing developments. The market houses various large-scale medtech companies and small start-ups, creating a dynamic environment where no single player holds dominant control. Key players benefit from established infrastructure, global reach, and a broad portfolio of FDA-cleared or CE-marked devices that cover a wide spectrum. However, the market remains open to disruption, with new entrants introducing specialized devices or AI-enabled software platforms that appeal to niche patient segments.

The remote patient monitoring device market is projected to reach US$ 54.5 Bn in 2025.

Increasing burden of chronic conditions and expanding telehealth reimbursement policies are the key market drivers.

The remote patient monitoring device market is poised to witness a CAGR of 10.6% from 2025 to 2032.

Integration of predictive analytics and a shift toward preventive care are the key market opportunities.

Koninklijke Philips N.V., A&D Company, Limited, and Medtronic plc are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author