ID: PMRREP35284| 185 Pages | 7 May 2025 | Format: PDF, Excel, PPT* | Food and Beverages

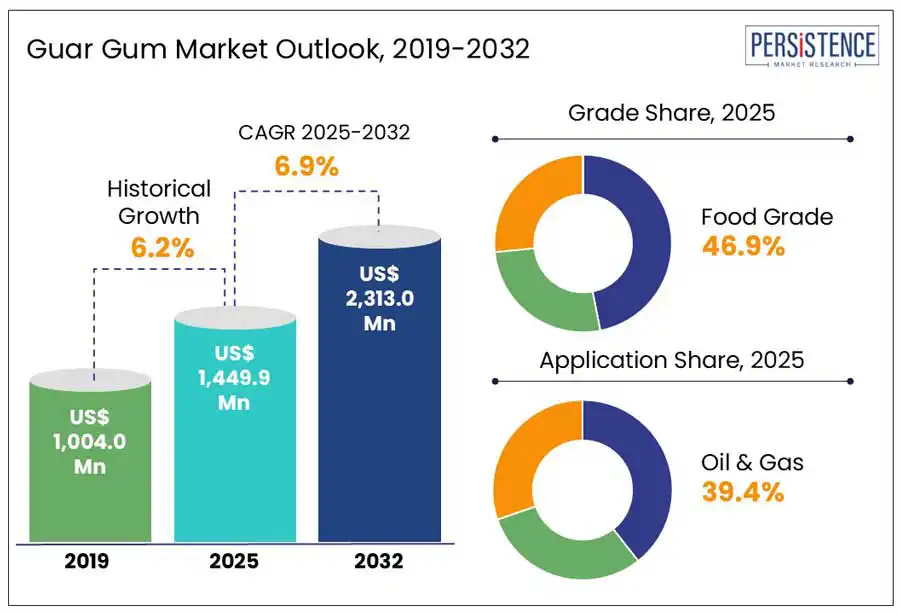

According to Persistence Market Research, the global guar gum market is poised to reach US$ 1,449.9 Mn and reach to US$ 2,313.0 Mn at a CAGR of CAGR of 6.9% by 2032. The market's upward trajectory is strongly driven by its indispensable role across industries. In the food and beverage sector, the ingredient serves as a stabilizer and thickener, with demand bolstered by the growing preference for gluten-free and low-calorie formulations.

The cosmetics and personal care segment is experiencing robust growth, influenced by a global shift toward organic and plant-based ingredient. India’s beauty market is evolving rapidly, with per capita revenue rising to US$ 21.86 in 2024, reflecting a surge in demand for Ayurvedic and sustainable products. Pharmaceutical applications continue to expand, supporting sustained demand as the global health and wellness industry embraces natural excipients and delivery agents.

For oil & gas, demand from hydraulic fracturing remains critical. Yet, the global market faces complex headwinds from plateauing demand in advanced economies to a projected surplus in crude oil capacity by 2025. Demand from economies like China and India continues to support market stability. The textile industry also fuels growth, especially in India, where it contributes 2.3% to GDP and employs 45 million people.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Guar Gum Market Size (2024A) |

US$ 1,356.3 Million |

|

Estimated Market Size (2025E) |

US$ 1,449.9 Million |

|

Projected Market Value (2032F) |

US$ 2,313.0 million |

|

Value CAGR (2025 to 2032) |

6.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.2% |

The increasing global oil production outlook offers strong momentum for hydraulic fracturing applications. As per projections, global liquid fuels production is forecast to increase by 1.3 million barrels/day in 2025 and 1.2 million barrels/day in 2026, primarily driven by the United States, Canada, Brazil, and Guyana. These nations are accelerating upstream investment and capacity addition, directly elevating demand for fracturing fluids where hydrocolloids serve as crucial viscosifying agents.

OPEC+ production is expected to rise by 0.5 million b/d in 2026, while non-OPEC+ nations are contributing 1.2 million b/d in 2025 and 0.7 million b/d in 2026. The revival of drilling activities and unconventional oil extraction in North America and parts of South America, supported by price stability measures, is propelling the usage of efficient and cost-effective additives used in hydraulic fracturing boosting demand from the energy sector.

Post-COVID recovery in the global pharmaceutical landscape has been restrained by tightening government health budgets. The World Bank projects that 41 governments will spend less on healthcare by 2027 than they did before the pandemic, severely affecting lower-income markets. With healthcare spending retrenchment prevalent across LMICs, pharma companies are scaling back production volumes, especially for non-essential formulations where stabilizers and excipients like polysaccharides are used.

Rising inflation, health sector debt, and aging population burdens are reducing the adoption of thickening agents in OTC drugs and supplements. Formulation optimization now prioritizes cost-efficiency over product enhancement in various therapeutic categories.

Reduced procurement by hospitals and lower public drug inventories may dampen industrial demand from the pharma vertical, especially in price-sensitive economies.

The European food and drink sector is undergoing rapid transformation driven by sustainability targets. According to FoodDrinkEurope, the industry contributes €1.2 trillion in turnover and €250 billion in value-added, employing 4.7 million people. With 65% of food and beverage exports remaining within the EU and external exports hitting €182 billion, ingredient manufacturers are well-positioned to capitalize on reformulation needs arising from regulatory and consumer pressure for clean labels and bio-based additives.

A shift toward natural texturizers and gelling agents aligns with evolving EU regulations and sustainability targets. The transition cost pressures and the drive to replace synthetic emulsifiers with functional, plant-derived ingredients offer long-term growth prospects for suppliers of bio-polymers, particularly those offering biodegradable, traceable, and scalable food-grade additives.

India’s textile industry is undergoing a structural shift toward high-margin segments. Home textiles are growing at a CAGR of 8.9% through 2032, while technical textiles are expanding at a CAGR of 10%, and medical textiles at 15%.

This evolution is transforming demand patterns for textile processing aids, where viscosity-controlling agents find usage in printing and finishing formulations.

Backed by policy support from schemes such as TUFS, SITP, and PM-MITRA, India's textile production is scaling toward US$ 350 billion by 2030. Rising production of cotton (forecast at 34.6 million bales) and yarn output (5.2 billion kg) is further catalyzing demand for auxiliaries used in sizing, dyeing, and softening applications. This growth underlines the material’s expanding role in enabling sustainable and efficient textile manufacturing processes.

Shifting consumer preferences toward natural and clean-label ingredients are fostering demand for multifunctional plant-based additives.

In Europe, the food and beverage sector’s exports outside the bloc reached €182 billion, showing global traction for safe and sustainable products. Concurrently, sustainability compliance requirements are prompting manufacturers to replace synthetic emulsifiers and thickeners in processed food applications.

This transformation is evident across bakery, dairy, and convenience food categories, where bio-based agents are being adopted for moisture retention, improved texture, and extended shelf life. Ingredient functionality that aligns with sustainability claims, nutritional enhancement, and E-number reduction is driving innovation in the formulation space, encouraging adoption from food processors and CPG majors across Europe and North America.

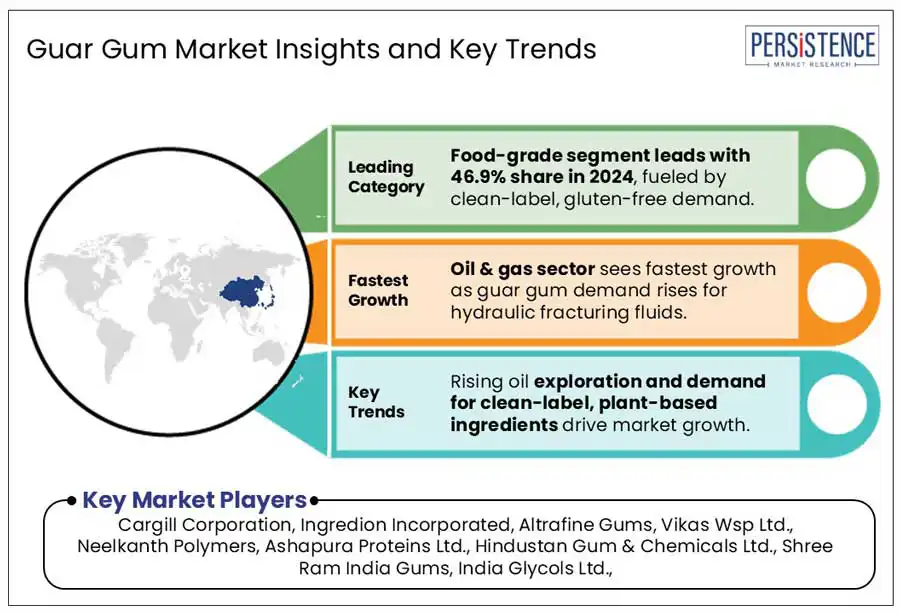

Food-grade accounts for the highest share of 46.9%, driven by the rising preference for natural additives and clean-label ingredients across food and beverage applications. Increasing global awareness of gut health, texture enhancement, and dietary fiber has strengthened demand from manufacturers of dairy, bakery, confectionery, and gluten-free products. Regulatory acceptance across the U.S., EU, and APAC adds to its widespread use. The surge in processed food consumption in developing countries further boosts volumes. Rapid urbanization, rising disposable incomes, and the expansion of organized retail formats are also contributing factors. Growth remains robust in markets emphasizing natural food stabilizers and thickeners.

Oil & gas accounts for the largest share among application segments, reflecting the sector’s deep reliance on this resource in hydraulic fracturing operations. Surging energy demand and infrastructure investments across North America, the Middle East, and India continue to boost consumption in drilling and enhanced oil recovery (EOR). India’s refining capacity rose to 253.9 MMT as of March 2024 and is projected to reach 309.5 MMT by 2028, creating a strong pull for inputs used in well stimulation. Export activity, such as 62.4 MMT of petroleum products in FY24, also drives upstream activity. A global supply cushion of 8 mb/d by 2030 further fuels E&P investments, sustaining demand. The U.S., India, and Gulf countries remain focal regions for future volume growth.

In 2024, East Asia accounted for 34.6% of the global demand, driven by evolving industrial needs across China, Japan, and South Korea. China experienced a decline in gasoline, diesel, and jet fuel consumption as the economy transitioned toward services and electric vehicles. This shift supported a nearly 5% rise in demand for petrochemical feedstocks, boosting applications in textiles, oilfield services, and processed food industries.

Japan emphasized food processing and personal care sectors, aligning with its reduced crude requirements and rising overseas LNG output. Government financial support for upstream projects encourages the adoption of natural additives in energy-related industries.

South Korea continues to focus on advanced food and cosmetics manufacturing, where plant-based stabilizers are gaining preference in formulations and production processes. The regional trajectory highlights a clear pivot toward sustainable and high-performance materials across diverse industrial verticals.

North America is projected to account for 28.8% market share in 2025. The demand is primarily driven by the booming oil and gas industry, particularly in hydraulic fracturing. The expansion of natural gas exports from the U.S., projected to rise by 18% in the next few years, is a key driver. With the rapid development of LNG export facilities and advancements in shale gas exploration, guar continues to play a significant role in oilfield applications. Additionally, sectors like textiles and personal care further contribute to demand, especially with the U.S. being a major consumer of guar in food formulations and cosmetic products.

The global guar gum market remains fragmented, with numerous regional and global players competing on pricing, quality, and customization. Manufacturers focus on building strong supply chains and expanding processing capacities to meet demand from food, oil and gas, and pharmaceutical industries. Several players are also enhancing application-specific formulations to target niche segments.

Companies increasingly prioritize sustainability, sourcing traceable raw materials and investing in eco-friendly processing methods. They target growth through product diversification, especially in clean-label and vegan applications across food and personal care sectors. Branding and direct collaboration with end-use industries also form a key part of their strategies.

The global market is projected to value at US$ 1,449.9 Million in 2025.

The food grade segment is set to capture 48.9% of the market in 2025, driven by rising demand for natural thickeners and stabilizers in processed and convenience foods.

The market is poised to witness a CAGR of 6.9% from 2025 to 2032.

Rising oil & gas exploration alongside growing demand for clean-label, plant-based ingredients in the food and beverage industry drives the market, supported by increased shale recovery efforts and consumer shifts toward natural and sustainable products.

Accelerating innovation in sustainable food systems across Europe, driven by regulatory support and rising consumer demand for eco-friendly, plant-based alternatives.

Cargill Corporation, Ingredion Incorporated, Altrafine Gums, Vikas Wsp Ltd., Neelkanth Polymers, Ashapura Proteins Ltd., Hindustan Gum & Chemicals Ltd., Shree Ram India Gums, and India Glycols Ltd.

|

Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value, Tons for Volume |

|

Key Regions Covered |

|

|

Key Companies Covered |

|

|

Report Coverage

|

|

|

Customization and Pricing |

|

By Grade

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author