ID: PMRREP2807| 210 Pages | 17 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

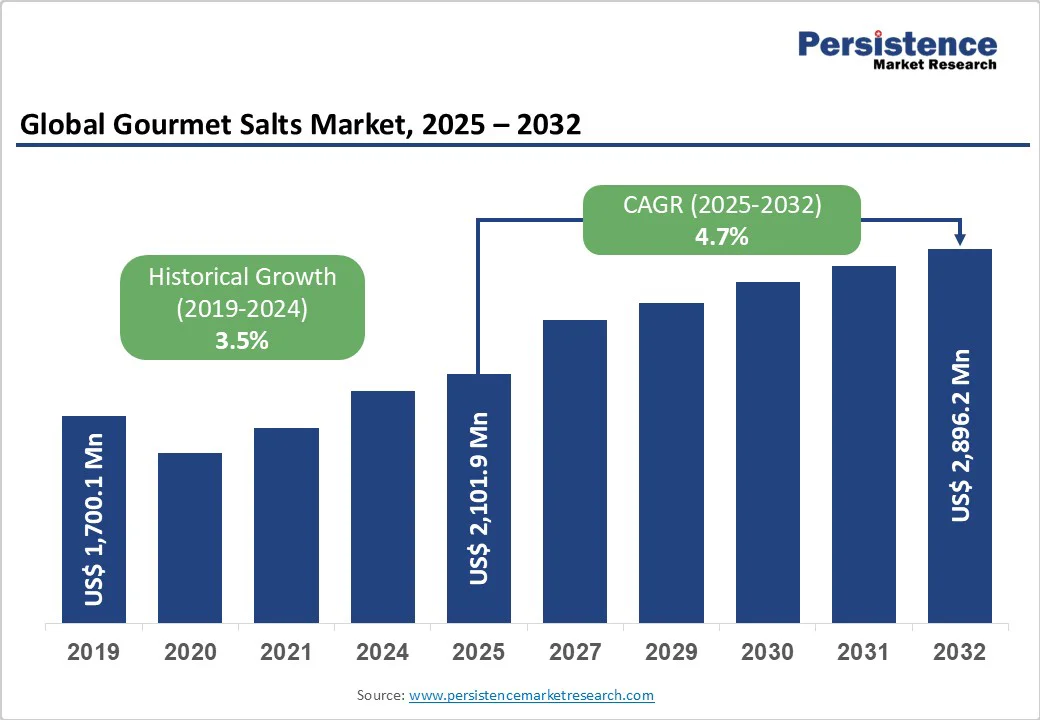

The Global Gourmet Salts Market is estimated to grow from US$ 2,101.9 million in 2025 to US$ 2,896.2 million by 2032. The market is projected to record a CAGR of 4.7% during the forecast period from 2025 to 2032.

| Key Insights | Details |

|---|---|

|

Global Gourmet Salts Market Size (2025E) |

US$ 2,101.9 Mn |

|

Market Value Forecast (2032F) |

US$ 2,896.2 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

3.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.7% |

The increasing use of gourmet salt in exotic food preparations is a significant driver in the gourmet salt market, fueled by rising consumer interest in diverse and globally inspired cuisine. Gourmet salts, with their varied mineral compositions, textures, and origins, offer nuanced flavor profiles that elevate specialty dishes far beyond what standard table salt can achieve. In high-end dining experiences, chefs intentionally select salts to complement specific ingredients, enhancing not just taste but also visual appeal and mouthfeel.

For example, at the Mediterranean restaurant Deme in Los Angeles, head chef Blake Shailes incorporates two different gourmet salts into signature dishes. Such a deliberate usage underscores the growing role of salt as a curated ingredient, not merely a seasoning, in fine and exotic culinary preparations.

High price sensitivity among mass consumers remains a critical restraint in the growth trajectory of the gourmet salt market. Unlike standard table salt, gourmet varieties such as fleur de sel, Himalayan pink salt, or smoked sea salt command premium pricing due to artisanal harvesting, regional specificity, and value-added characteristics. However, for the average consumer accustomed to low-cost culinary staples, the price-to-perceived-benefit ratio of gourmet salts often appears unjustified.

In price-sensitive markets, particularly across developing economies, consumers prioritize affordability and functionality over gourmet indulgence. This limits the volume growth outside of niche or affluent demographics. Additionally, limited consumer awareness about the nuanced culinary and health benefits of gourmet salts further reduces their willingness to pay a premium.

Collaborating with high-end chefs and premium restaurants presents a powerful growth opportunity for gourmet salt producers aiming to enhance brand prestige and consumer trust. Such partnerships allow salt brands to showcase the depth of flavor, texture, and culinary versatility of their products in real-world, fine-dining contexts. This often transforms gourmet salt from a pantry curiosity into a must-have ingredient.

For instance, Maldon Crystal Salt Company Ltd exemplified this strategy by partnering South London's brewery Anspach & Hobday for a limited-edition beer brewed with Maldon salt, celebrating the salt company's 140th anniversary. This collaboration merged culinary heritage with innovation and reinforced Maldon's brand narrative of artisanal quality and relevance in contemporary food culture.

By aligning with culinary influencers and celebrated establishments, gourmet salt brands can elevate their profile, gain media exposure, and educate consumers, ultimately converting aspirational usage into routine culinary adoption across upscale and mainstream markets alike.

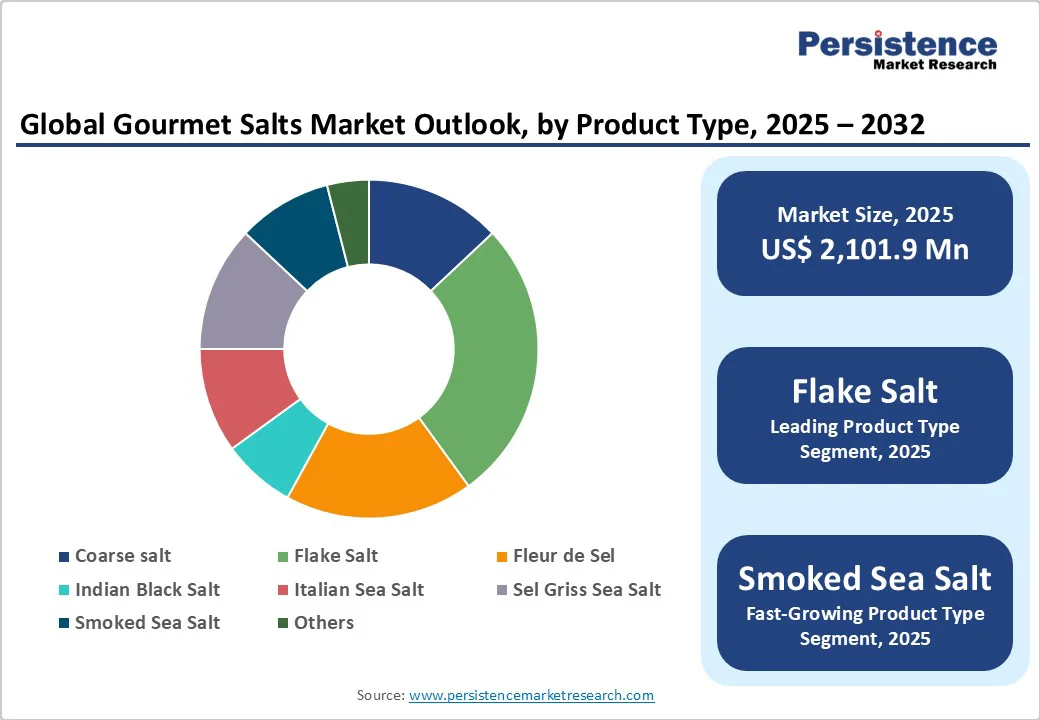

The food processing segment holds a substantial 43% share in the gourmet salt market, underscoring its pivotal role. This dominance stems from the widespread application of gourmet salts in enhancing the flavor, texture, and visual appeal of premium packaged and artisanal foods. Manufacturers leverage the unique mineral compositions and crystal structures of salts like Fleur de Sel or Himalayan pink salt to create differentiated products from high-end chocolates and specialty cheeses to gourmet snack foods and cured meats.

Gourmet salts result in flavor layering and a distinct mouthfeel that appeals to discerning consumers who seek elevated culinary experiences as a part of daily life. The foodservice sector also heavily uses gourmet salts for plating aesthetics and subtle flavor nuances in high-end restaurant dishes, contributing significantly to demand. Meanwhile, household consumption of gourmet salts continues to grow, driven by adventurous home cooks seeking to replicate restaurant-quality flavors and experiment with global cuisines.

Specialty food stores are experiencing promising growth, with a projected CAGR of 6.8% during the forecast period from 2025 to 2032, primarily because they excel at storytelling and cultivating genuine consumer connections. These retailers move beyond merely stocking products; they meticulously curate selections, offering compelling narratives about a gourmet salt's origin, artisanal production methods, and unique culinary uses. This kind of engagement fosters trust and transforms a simple transaction into an educational, aspirational experience, appealing to discerning food enthusiasts and home cooks seeking unique, high-quality ingredients.

Online retail is witnessing significant expansion in the gourmet salt market, providing convenience and broader access to niche brands for consumers globally. Furthermore, Hypermarkets and supermarkets continue to expand their gourmet aisles, driven by their vast reach and ability to introduce these premium items to a wider, more mainstream audience.

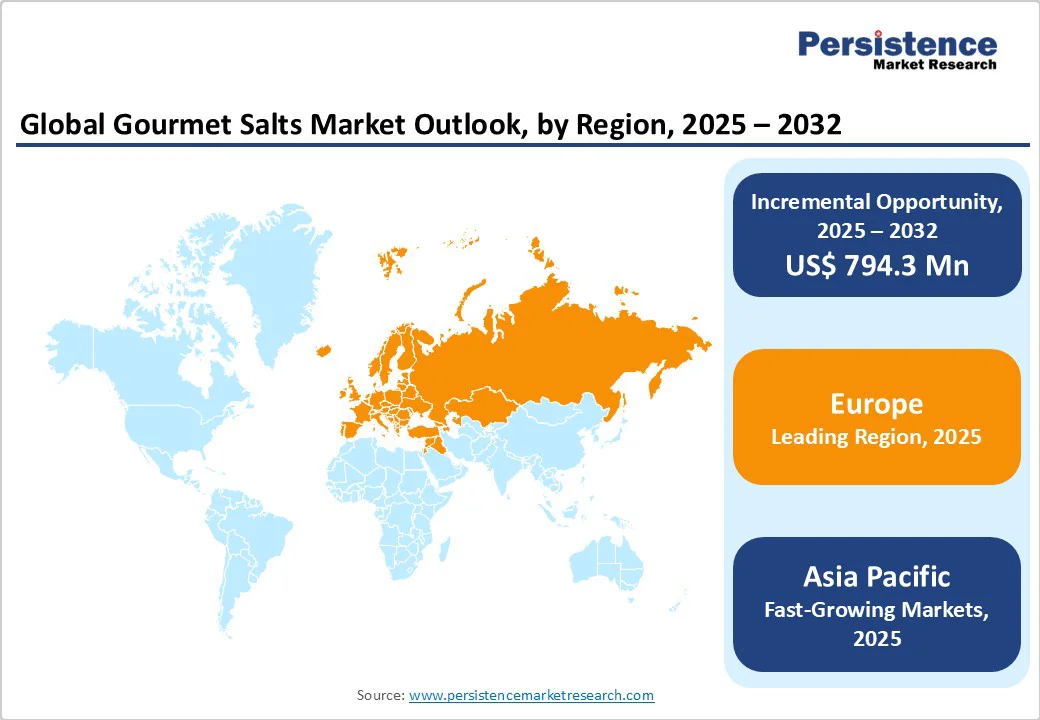

The North America gourmet salts market is witnessing robust growth, largely fueled by evolving consumer preferences across the U.S. and Canada. A prominent trend is the escalating demand for "clean label" products and a heightened focus on health, as U.S. consumers increasingly seek more natural alternatives to conventional salt. This shift is strongly supported by a sustained interest in home cooking and culinary experimentation, with U.S. households exploring diverse and global cuisines.

The expansion of premium and artisanal packaged foods also significantly drives demand, as manufacturers incorporate unique salts to enhance flavor and texture in new offerings. E-commerce platforms are proving pivotal, broadening access to a wider array of specialty varieties. Furthermore, the U.S. foodservice sector continues to embrace gourmet salts for elevated dining experiences, while sustainable sourcing practices are gaining considerable traction with environmentally conscious consumers in both the U.S. and Canada. This convergence of trends promises continued market expansion within the region.

Europe is projected to achieve a CAGR of 6.6% during the forecast period 2025-2032, driven by its rich culinary heritage and sophisticated consumer base. Countries like France and Italy, with their deep-rooted food traditions and abundance of Michelin-starred restaurants, are central to this growth, leveraging gourmet salts for precise flavor enhancement in fine dining. Germany and the U.K. are witnessing an increased adoption fueled by a strong "farm-to-table" movement and a rising interest in artisanal foods and home cooking. The demand for pure, high-quality ingredients, alongside the resurgence of preservation techniques, further elevates the market. Consumers in Spain and across the continent are increasingly seeking unique, ethically sourced salts available through well-established specialty retail channels and growing food tourism.

The global gourmet salt market is highly fragmented, comprising artisanal producers, niche brands, and a few established players competing through authenticity and product innovation. Companies are expanding portfolios with flake, smoked, and infused salts, often linked to specific regions or traditional techniques. Brand storytelling and consumer education are critical, emphasizing sourcing, mineral profiles, and sustainable practices to justify premium pricing.

Partnerships with chefs and upscale restaurants enhance credibility, while e-commerce platforms broaden reach. Sustainability, ethical harvesting, and distinctive packaging are emerging as key differentiators. Some companies pursue vertical integration to control quality and costs, whereas others target bulk supply for foodservice. Additional strategies include curated gift sets, participation in culinary events, and acquisition of smaller artisanal labels. Success depends on craftsmanship, traceability, and engagement with evolving culinary trends.

The global Gourmet Salts market is projected to be valued at US$ 2,101.9 Mn in 2025.

Increasing use of gourmet salt in exotic food preparations drives the demand for Gourmet Salts.

The Global Gourmet Salts market is poised to witness a CAGR of 4.7% between 2025 and 2032.

Collaborating with high-end chefs and restaurants is the key market opportunity.

Major players in the Global Gourmet Salts market include Jacobsen Salt Co., Cargill, Incorporated, SaltWorks®, Morton Salt, Inc, Maldon Crystal Salt Company Ltd, Himalayan Salt Company, Murray River Salt, and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author