ID: PMRREP35408| 190 Pages | 10 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

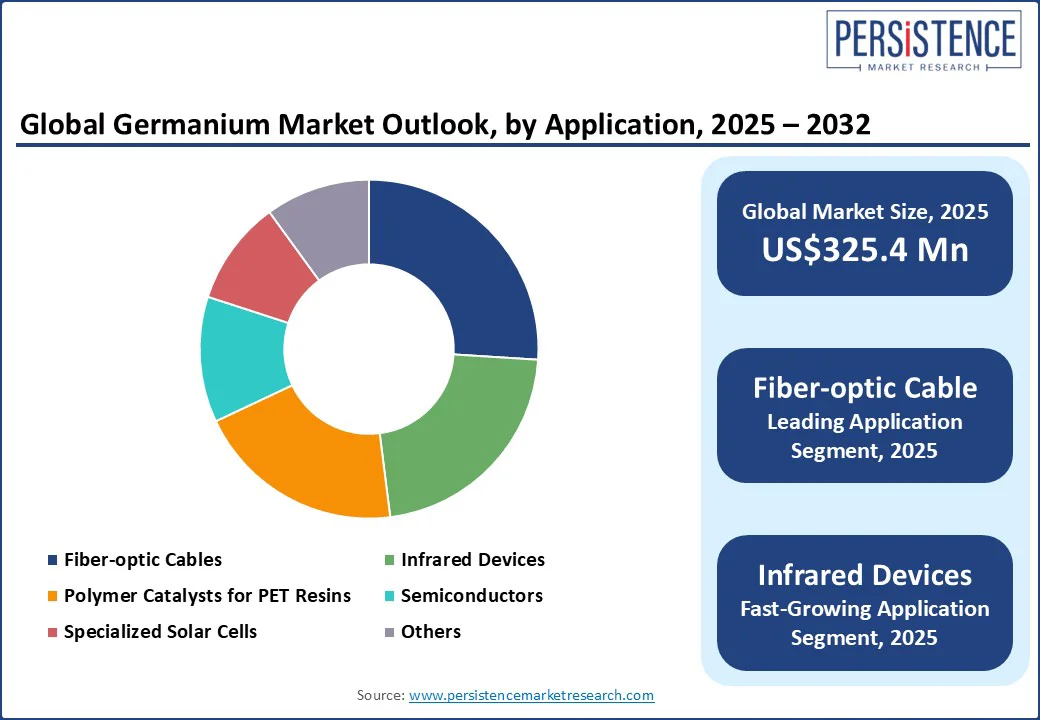

The global germanium market size is likely to be valued at US$325.4 Mn in 2025 and is expected to reach US$434.0 Mn by 2032, growing at a CAGR of 3.8% during the forecast period from 2025 to 2032.

Key Industry Highlights:

|

Global Market Attribute |

Details |

|

Market Size (2024A) |

US$312.3 Mn |

|

Estimated Market Size (2025E) |

US$325.4 Mn |

|

Projected Market Value (2032F) |

US$434.0 Mn |

|

Value CAGR (2025 to 2032) |

4.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.7% |

Strong demand from fiber-optic networks, solar photovoltaic cells, and advanced semiconductor applications drives adoption, supported by superior infrared light transmission, electronic performance, and catalytic efficiency. Its classification as a critical raw material further underscores its strategic importance across high-tech industries, including telecommunications, defense, and clean energy.

Demand for germanium is rising as fiber-optic networks and infrared technologies increasingly form the backbone of global telecommunications, defense, aerospace, and renewable energy systems. Fiber connectivity has been expanding worldwide, with the U.S. passing over half of primary homes with fiber broadband in 2023, while Asia Pacific holds a 28.8% revenue share.

According to the United States Geological Survey (USGS), imports of metal and dioxide reached 38,000 kilograms in 2023, valued at US$45 Mn, highlighting its critical role in infrared optics, solar cells, and high-performance semiconductors. Technological advances are reinforcing this momentum through new wafer production in Utah for satellites and semiconductor devices, alongside scrap recovery in Oklahoma that supplies high-purity feedstock for optical fiber manufacturing.

Recycling streams are retrieving it from decommissioned military optics, solar substrates, and fiber waste, ensuring continuity of supply in a circular system. Teck Resources’ collaboration with DLT Labs has also introduced blockchain traceability, embedding ESG certifications and emissions data into supply chains. These developments, paired with global broadband rollout and innovation in infrared imaging technologies, position it as a cornerstone for next-generation communications, defense systems, and clean energy infrastructure.

The germanium market faces significant restraints due to limited supply availability and high production costs. With China dominating global production and imposing strict export licensing rules, international buyers face rising uncertainty in securing a consistent material flow. This supply concentration impacts critical industries, including fiber optics, infrared imaging, defense systems, aerospace, and renewable energy technologies, where stable access is essential.

High production and refining costs further limit market expansion. Complex extraction and recycling processes have kept germanium metal prices near US$1,550/kg and germanium dioxide prices at US$940/kg in 2023, making raw materials expensive for use in semiconductors, infrared optics, solar cells, and high-performance electronics. This cost pressure, combined with restricted supply chains, continues to limit wider adoption and scalability across advanced applications.

The growing adoption of renewable energy technologies presents a significant opportunity for advanced materials used in solar, wind, and clean energy systems. High-performance materials are essential for solar photovoltaic cells, fiber-optic applications, and semiconductor substrates, as global renewable electricity generation is projected to exceed 17,000 TWh by 2030. Solar PV is expected to surpass hydropower, becoming the largest renewable power source, while wind energy will also overtake hydroelectric generation, driving demand for efficient semiconductor components.

Technological advancements and policy support in major regions are enhancing capacity, installation, and energy output. India’s renewable energy sector achieved 190.57 GW of installed capacity by 2023-24, with solar, wind, and bio-power systems increasing by over 250% since 2014-15.

In the U.S., renewable sources contributed 21% of electricity generation in 2023, while the EU reached a 24.5% share of energy consumption from renewables. These developments underscore the strategic role of advanced materials in enabling sustainable energy solutions and meeting global low-carbon energy targets.

The focus on recycling and sustainable sourcing has become a defining trend in the materials industry, particularly for high-tech metals used in renewable energy and electronics. Companies are implementing circular economy practices to recover germanium from industrial by-products and scrap, reducing dependency on coal-derived sources.

Leading firms report that recycled metal achieves a 95% smaller carbon footprint compared to coal-sourced alternatives, while zinc-derived production reduces emissions by 85%. Technological innovations and regulatory frameworks in Europe, the U.S., and Asia are accelerating this shift. EU policies and programs such as the Responsible Sourcing Lighthouse and RawMatCop Academy leverage satellite data and ESG compliance to optimize raw material extraction and recycling.

Industry partnerships focus on cost-effective recovery processes, sustainable supply agreements, and circular production models, ensuring reliable, environmentally responsible sourcing. These measures enhance operational efficiency, strengthen supply chain resilience, and position it as a circular resource for renewable energy and advanced semiconductor applications.

Zinc is projected to capture a 70% market share in 2025, underpinning its vital role as the main feedstock for high-purity germanium and semiconductor-grade materials. Leading extraction centers, including China, the U.S., and Canada, recover it as a by-product during zinc smelting, particularly from sphalerite-rich ores and metallurgical concentrates.

Strategic facilities such as Tennessee’s Clarksville smelter refine zinc concentrates from the Middle Tennessee Zinc Complex, while imports from China, Germany, and Belgium support industrial demand. Zinc ore continues to serve as a cornerstone for high-performance fiber-optic cables, infrared optics, optical lenses, and polymer catalysts, reinforcing its critical importance in photonics, optoelectronics, and semiconductor manufacturing. Advanced metallurgical processes, precision by-product recovery, and recycling innovations boost extraction yields from zinc ores, ensuring steady production for high-tech applications. China supplies 60% through zinc concentrates and 40% via coal fly ash, reflecting strategic resource diversification and supply security.

Limited transparency in zinc-based reserves highlights the need for optimized smelting technologies, circular recovery solutions, and sustainable sourcing. These dynamics cement zinc ore’s role as a strategic raw material for optical communication, VCSEL wafers, infrared sensors, and next-generation electronics, supporting digital infrastructure, photonics innovation, and global semiconductor value chains.

Fiber-optic cables are expected to capture a 26.5% share of the market in 2025, driven by surging demand for ultra-high-speed broadband, next-generation telecom networks, and resilient digital infrastructure.

Cutting-edge innovations in germanium wafers are revolutionizing photonics and high-performance data applications. Ultra-low resistivity n-type wafers engineered for Vertical Cavity Surface Emitting Lasers (VCSELs) enhance electrical conduction, crystal integrity, and thermal stability, supporting LiDAR systems, 3D sensing technologies, high-capacity datacenters, and optical communication networks.

High-purity GeCl? amplifies light transmission efficiency within optical fiber cores, while dynamic metals management solutions provide manufacturers with risk mitigation, price stabilization, and optimized material reuse. Accelerating FTTH/B deployment in Europe, with 244 million homes passed and 121 million subscribers, emphasizes the role of fiber-optic cables as a backbone for digital transformation, smart cities, and connected infrastructure.

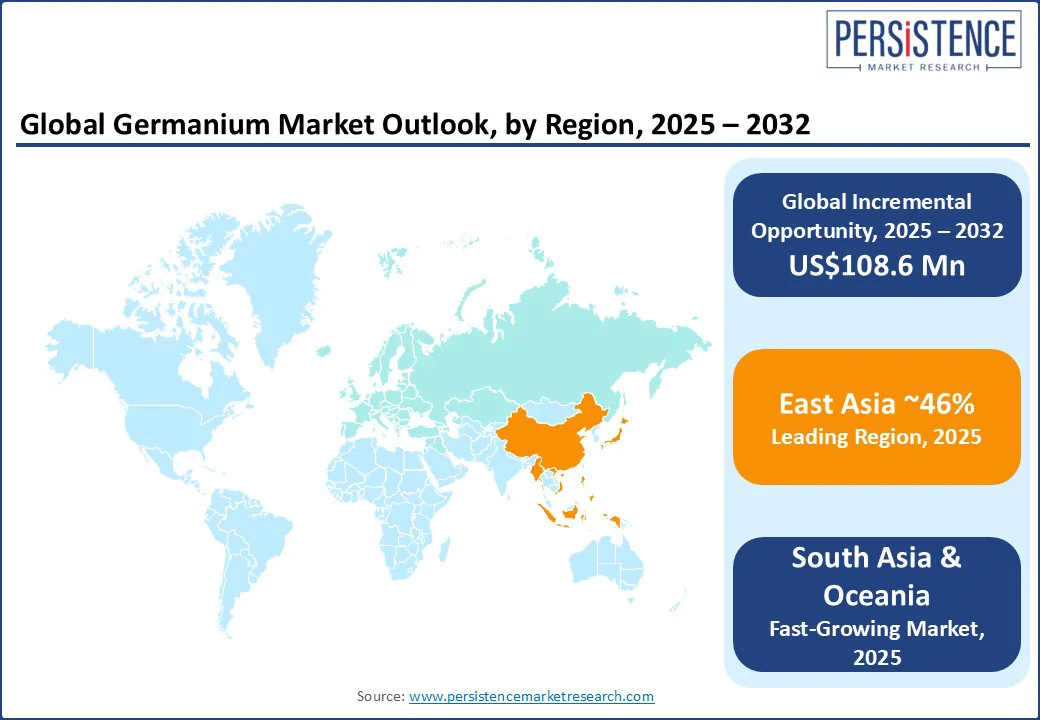

East Asia is anticipated to hold a market share of around 46% in 2025, driven by substantial investments in solar PV manufacturing, semiconductor production, and renewable energy infrastructure. China dominates the region with over USD 50 billion invested in solar PV supply capacity, creating more than 300,000 manufacturing jobs across the photovoltaic value chain since 2011. The country contributes to more than 80% of all solar panel manufacturing stages, including polysilicon, wafers, cells, and modules, enhancing the availability of high-purity materials required for electronics and fiber optics.

The region’s semiconductor industry maintains strong momentum, with China, Japan, and South Korea collectively contributing significant sales growth. Japan generates 32% of its electricity from low-carbon sources, with solar as the leading contributor, while South Korea targets 33% renewable energy by 2038, adding 40 GW capacity.

Technological developments in semiconductor processing, fiber optic integration, and renewable energy applications support the demand for high-purity materials. These advancements consolidate East Asia as a pivotal hub for high-performance materials in electronics, solar PV, and optoelectronic applications, sustaining its dominant market position.

South Asia & Oceania stands out as the fastest-growing market for germanium, as the demand for germanium across fiber-optic cables, semiconductors, solar cells, and infrared devices accelerates. India has become the world’s third-largest solar power producer with 108,494 GWh generation and solar module capacity scaling to 74 GW in FY 2024–25, driving strong adoption of germanium substrates in specialized solar cells.

Fiber-optic connectivity is also advancing, with submarine cables linking Chennai to Andaman & Nicobar and new high-capacity transpacific cables such as Southern Cross NEXT delivering 1 Tb/s channel speeds across Oceania. Broadband initiatives under BharatNet and partnerships such as STL with Vocus in Australia, are further strengthening the region’s digital infrastructure.

With its leadership in renewable energy, semiconductor growth, and large-scale optical network deployments, this region creates a strong demand base for germanium across various applications, including PET polymer catalysts and infrared technologies.

Europe holds the market share of around 22% in 2025, driven by strong demand for high-purity germanium for semiconductors, optoelectronics, fiber optics, infrared optics, and solar PV applications. Renewable energy adoption supports the market, with renewables contributing 24.5% of total energy consumption and 45.3% of electricity consumption in 2023.

Wind, hydro, and solar power dominate electricity generation, with solar PV emerging as a key driver for high-performance materials. Sweden and Denmark lead in renewable energy shares at 66.4% and 88.4%, respectively, increasing the need for semiconductor-grade material and related advanced materials.

Europe’s semiconductor sector, critical for photodetectors, infrared sensors, and electronic wafers, experienced a 6.4% year-on-year sales decline in January 2025, reflecting global adjustments. FTTH/B expansion with 70% coverage and 121 million subscribers enhances fiber optic deployment, fueling demand for high-purity electronic-grade compounds. Technological developments in solar PV equipment, infrared optics, and semiconductor materials strengthen Europe’s role in advanced germanium-based applications, including fiber optic communications, infrared sensing, and renewable energy technologies.

The global germanium market exhibits a consolidated structure, where a few leading manufacturers dominate production, refining, and supply of high-purity material for electronics, fiber optics, infrared optics, and solar photovoltaics.

Key players such as Umicore, Teck Resources Limited, JSC Germanium, PPM Pure Metals GmbH, Indium Corporation, and China Germanium Co., Ltd. focus on producing high-quality substrates, wafers, and specialty compounds, catering to semiconductor, photonics, and telecommunications applications. Companies leverage advanced processing, refining expertise, and proprietary production technologies to ensure a consistent supply and meet stringent quality standards.

The germanium market is projected to be valued at US$325.4 Mn in 2025.

Fiber-optic cables are expected to hold a 26.5% market share in 2025, driven by increasing demand for high-purity germanium in optical communication and photonics applications.

The germanium market is poised to witness a CAGR of 4.2% from 2025 to 2032.

Strong demand from fiber-optic networks and infrared applications in telecommunications, defense, aerospace, and high-performance semiconductors is accelerating market growth.

Expanding adoption of renewable energy technologies, including solar and wind, is driving demand for germanium-based high-performance materials in PV cells, fiber optics, and semiconductor substrates.

Key players in the germanium market include Umicore, Teck Resources Limited, JSC Germanium, PPM Pure Metals GmbH, Indium Corporation, and China Germanium Co., Ltd.

|

Report Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data/Actuals |

2019 to 2024 |

|

Market Analysis |

US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Landscape |

|

|

Report Highlights

|

|

By Source

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author