- Executive Summary

- Global Generic Oncology Drugs Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Bn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Key Trends

- Macro-Economic Factors

- Global Sectorial Outlook

- Global GDP Growth Outlook

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Product Adoption Analysis

- Disease Epidemiology - Cancer Statistics

- Patent Expiration Analysis & Pipeline Analysis

- Recent Product Launches and Approvals Insights

- Generic and Biosimilar - Comparative Analysis

- Regulatory Landscape

- Promotional Strategies, By Key Players

- Porter’s Five Force Analysis

- PESTLE Analysis

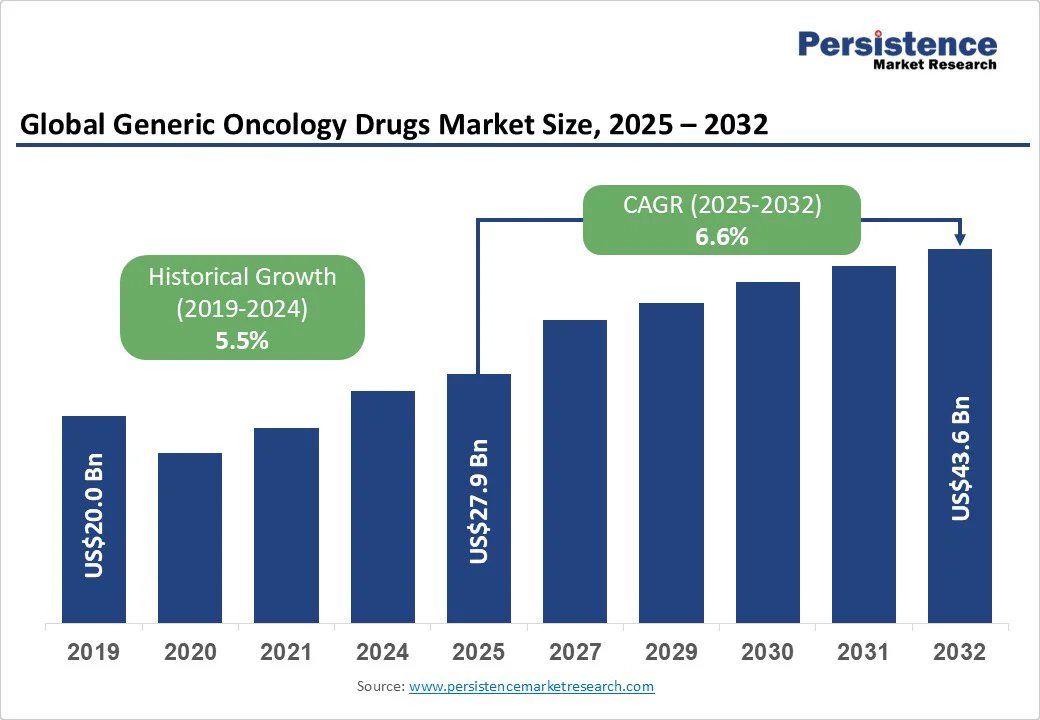

- Global Generic Oncology Drugs Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Market Size (US$ Bn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Bn) Analysis and Forecast

- Historical Market Size (US$ Bn) Analysis, 2019 - 2024

- Market Size (US$ Bn) Analysis and Forecast, 2025 - 2032

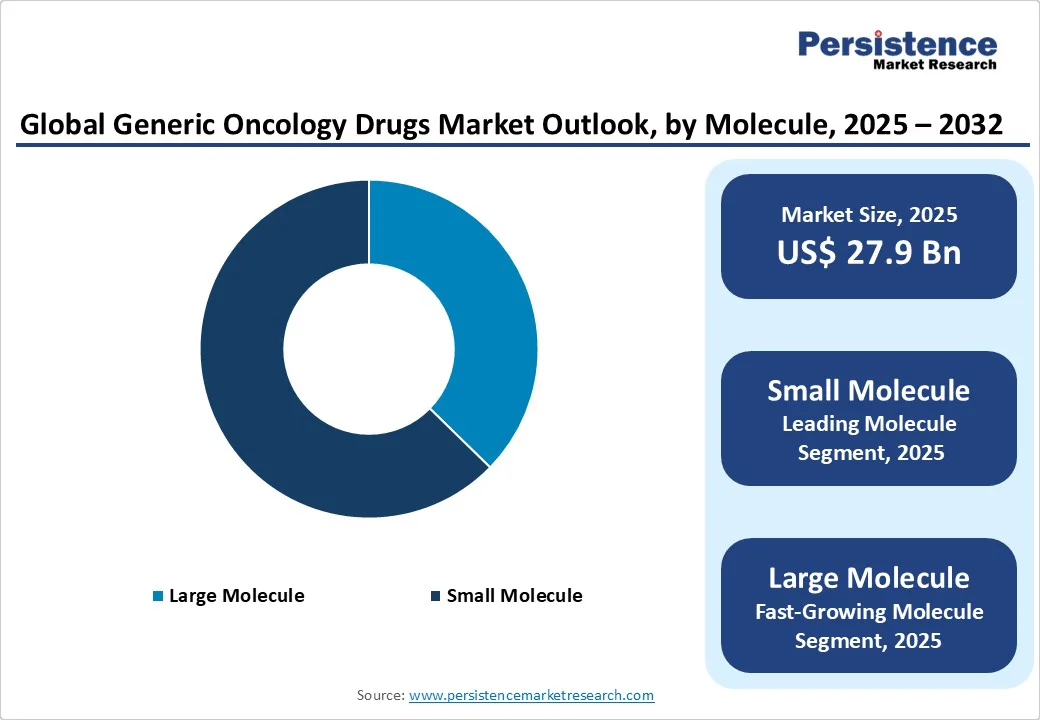

- Global Generic Oncology Drugs Market Outlook: Molecule

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis, By Molecule, 2019 - 2024

- Market Size (US$ Bn) Analysis and Forecast, By Molecule, 2025 - 2032

- Large Molecule

- Small Molecule

- Market Attractiveness Analysis: Molecule

- Global Generic Oncology Drugs Market Outlook: Route of Administration

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Route of Administration, 2019 - 2024

- Market Size (US$ Bn) Analysis and Forecast, By Route of Administration, 2025 - 2032

- Oral

- Parenteral

- Market Attractiveness Analysis: Route of Administration

- Global Generic Oncology Drugs Market Outlook: Distribution Channel

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Distribution Channel, 2019 - 2024

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025 - 2032

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Market Attractiveness Analysis: Distribution Channel

- Key Highlights

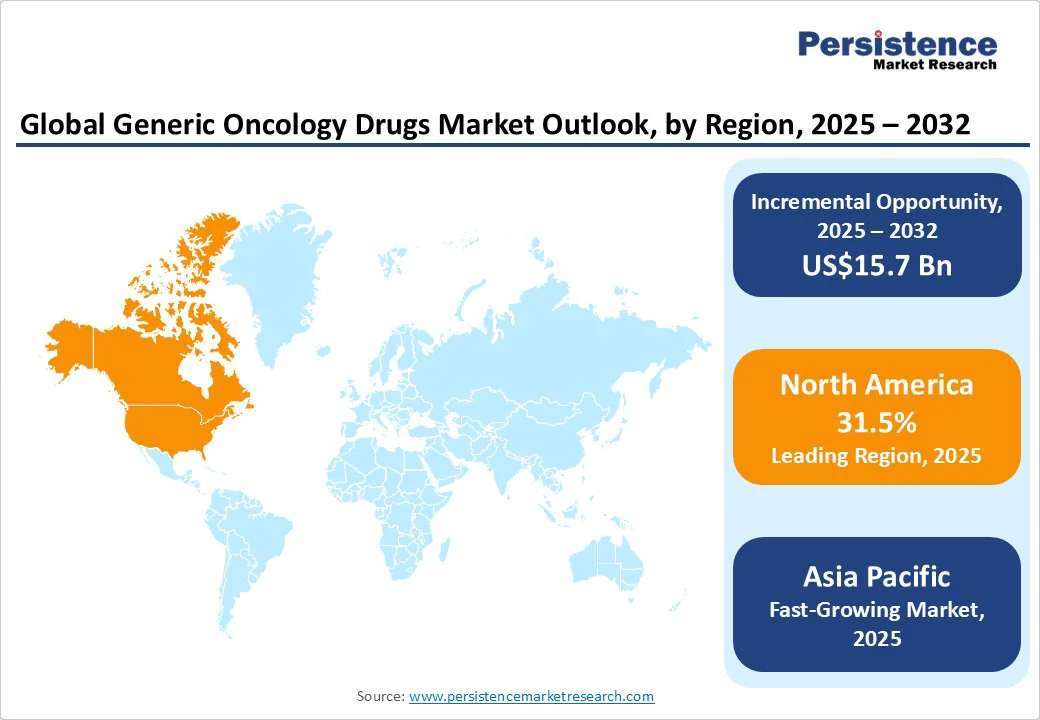

- Global Generic Oncology Drugs Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Region, 2019 - 2024

- Market Size (US$ Bn) Analysis and Forecast, By Region, 2025 - 2032

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Generic Oncology Drugs Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Molecule

- By Route of Administration

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- U.S.

- Canada

- Market Size (US$ Bn) Analysis and Forecast, By Molecule, 2025 - 2032

- Large Molecule

- Small Molecule

- Market Size (US$ Bn) Analysis and Forecast, By Route of Administration, 2025 - 2032

- Oral

- Parenteral

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025 - 2032

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Market Attractiveness Analysis

- Europe Generic Oncology Drugs Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Molecule

- By Route of Administration

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Rest of Europe

- Market Size (US$ Bn) Analysis and Forecast, By Molecule, 2025 - 2032

- Large Molecule

- Small Molecule

- Market Size (US$ Bn) Analysis and Forecast, By Route of Administration, 2025 - 2032

- Oral

- Parenteral

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025 - 2032

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Market Attractiveness Analysis

- East Asia Generic Oncology Drugs Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Molecule

- By Route of Administration

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- China

- Japan

- South Korea

- Market Size (US$ Bn) Analysis and Forecast, By Molecule, 2025 - 2032

- Large Molecule

- Small Molecule

- Market Size (US$ Bn) Analysis and Forecast, By Route of Administration, 2025 - 2032

- Oral

- Parenteral

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025 - 2032

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Market Attractiveness Analysis

- South Asia & Oceania Generic Oncology Drugs Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Molecule

- By Route of Administration

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Market Size (US$ Bn) Analysis and Forecast, By Molecule, 2025 - 2032

- Large Molecule

- Small Molecule

- Market Size (US$ Bn) Analysis and Forecast, By Route of Administration, 2025 - 2032

- Oral

- Parenteral

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025 - 2032

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Market Attractiveness Analysis

- Latin America Generic Oncology Drugs Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Molecule

- By Route of Administration

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- Brazil

- Mexico

- Rest of Latin America

- Market Size (US$ Bn) Analysis and Forecast, By Molecule, 2025 - 2032

- Large Molecule

- Small Molecule

- Market Size (US$ Bn) Analysis and Forecast, By Route of Administration, 2025 - 2032

- Oral

- Parenteral

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025 - 2032

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Market Attractiveness Analysis

- Middle East & Africa Generic Oncology Drugs Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Molecule

- By Route of Administration

- By Distribution Channel

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- GCC Countries

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Market Size (US$ Bn) Analysis and Forecast, By Molecule, 2025 - 2032

- Large Molecule

- Small Molecule

- Market Size (US$ Bn) Analysis and Forecast, By Route of Administration, 2025 - 2032

- Oral

- Parenteral

- Market Size (US$ Bn) Analysis and Forecast, By Distribution Channel, 2025 - 2032

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Market Attractiveness Analysis

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Teva Pharmaceutical Industries Ltd.

- Overview

- Segments and Products

- Key Financials

- Market Developments

- Market Strategy

- Mylan N.V. (Viatris)

- Sandoz Group AG

- Fresenius Kabi AG

- Apotex Inc.

- Zydus Cadila

- Hikma Pharmaceuticals

- Sun Pharmaceutical Industries Ltd.

- Cipla Limited

- Lupin Pharmaceuticals

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment