ID: PMRREP32797| 200 Pages | 28 Apr 2025 | Format: PDF, Excel, PPT* | Healthcare

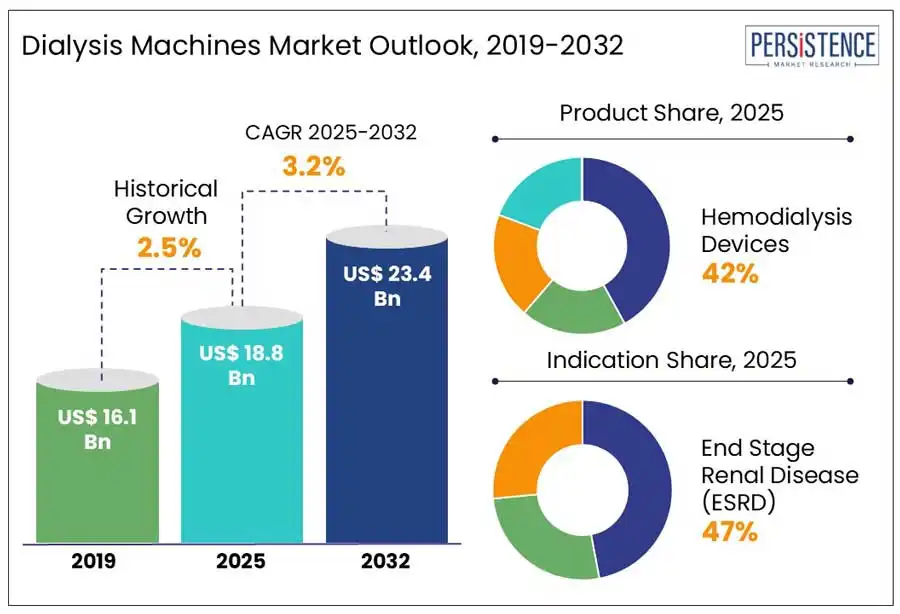

The global dialysis machines market size is projected to increase from US$ 18.8 Bn in 2025 to a staggering US$ 23.4 Bn to witness a CAGR of 3.2% by 2032. According to the Persistence Market Research report, the rising prevalence of chronic kidney disease and advancements in healthcare infrastructure encourage the need for medical equipment. Increasing awareness of kidney disorders and growing demand for home-based dialysis solutions fuel innovation and expansion. Emerging economies are witnessing heightened investments in medical technologies, creating new growth avenues. Additionally, integrating artificial intelligence (AI) and the Internet of Things (IoT) in dialysis systems revolutionizes patient monitoring and personalized treatment.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Dialysis Machines Market Size (2025E) |

US$ 18.3 Bn |

|

Market Value Forecast (2032F) |

US$ 23.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

2.5% |

The rising global prevalence of chronic kidney disease (CKD) is a major driver of the dialysis machines market, reflecting broader shifts in public health trends. CKD has become a significant global health concern, primarily due to the rising incidences of diabetes and hypertension, two of its leading causes. As lifestyle-related conditions such as obesity, poor diet, and physical inactivity continue to increase, so do the burden of CKD.

According to the International Society of Nephrology, over 850 million people suffer from CKD every year. This trend is especially pronounced in low- and middle-income countries, where access to early diagnosis and treatment is limited, often resulting in late-stage presentations that require dialysis or kidney transplantation. Moreover, CKD is now widely acknowledged as a critical non-communicable disease (NCD), joining the ranks of cardiovascular diseases, cancer, and diabetes. Its progression is often silent, with symptoms becoming apparent only in the advanced stages. Consequently, the sustained and lifelong need for renal replacement therapies, particularly dialysis, places an immense demand on healthcare systems and reinforces the need for accessible, efficient, and technologically advanced dialysis machines.

Dialysis machines incur substantial maintenance and operational demands that significantly impact the overall cost of care. These machines must run with high precision and reliability, which necessitates routine servicing, calibration, and replacement of critical components to ensure patient safety and treatment efficacy.

One of the major contributors to the ongoing costs is the water treatment system, a vital component that ensures ultra-pure water for dialysis, which requires maintenance, filtration replacement, and monitoring protocols. Additionally, dialysis procedures consume a large volume of disposable supplies, such as dialyzers, tubing sets, and dialysate solution, which must be replaced for each session to avoid cross-contamination and infection risks.

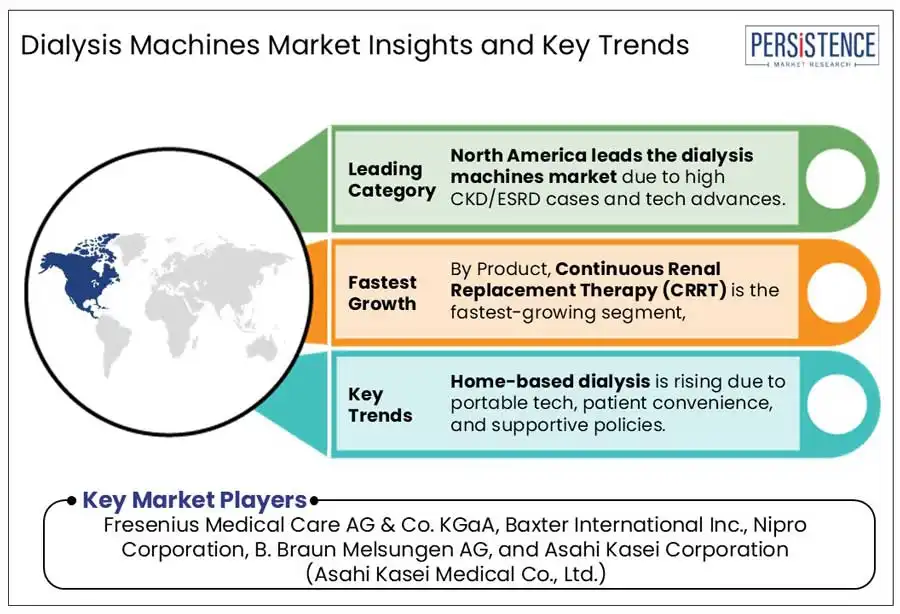

The expansion of home dialysis represents a transformative opportunity, driven by rising patient preference for convenience, improved quality of life, and reduced dependence on in-clinic treatments. Post-pandemic, at-home care has accelerated dramatically, with many governments and insurers supporting remote treatment options. Companies that offer integrated systems with remote monitoring, telehealth support, and automated reporting features stand to gain a significant competitive edge. For instance, a recent example of innovation in home dialysis is Outset Medical’s Tablo® Hemodialysis System, which has gained significant traction in clinical and home settings. In 2023, Outset received expanded FDA clearance, allowing the Tablo system to be used for home hemodialysis by a broader range of patients. Furthermore, the emotional and psychological benefits of home treatment, such as reduced disruption to daily life and improved mental well-being, proves equally influential in driving the adoption.

Hemodialysis devices dominate due to their widespread adoption, clinical reliability, and infrastructural support across global healthcare systems. As the primary treatment for end-stage renal disease (ESRD), hemodialysis is deeply embedded in nephrology care, with a vast network of hospitals and dedicated dialysis centers designed around its use. Unlike, other modalities, such as peritoneal dialysis or continuous renal replacement therapy (CRRT), hemodialysis offers faster toxin clearance suitable for acute and chronic kidney conditions. Technological advancements such as real-time monitoring, automated settings, and AI-assisted controls have further elevated the efficiency and safety of these machines.

End Stage Renal Disease (ESRD) stands as the leading indication category in the dialysis machine market due to its non-reversible nature and absolute dependence on renal replacement therapy. Unlike early-stage chronic kidney disease (CKD), which can often be managed through medication and lifestyle changes, ESRD signifies the complete failure of kidney function, requiring either lifelong dialysis or a transplant to sustain life.

The chronicity and inevitability of treatment make ESRD patients the most consistent and high-frequency users of dialysis machines. Typically undergoing dialysis three times per week, each patient contributes to a high utilization rate, fueling sustained demand for both in-center and home-based dialysis systems.

Hospitals and clinics are dominant owing to their centralized infrastructure, advanced medical resources, and capacity to handle large patient volumes. These settings offer comprehensive care, including emergency response and multi-disciplinary support, crucial for patients with chronic kidney disease and comorbidities. Hospitals also house specialized nephrology units, allowing for consistent monitoring, precise treatment adjustments, and immediate intervention if complications arise during dialysis.

North America leads the global dialysis machines market due to its advanced healthcare infrastructure, high disease prevalence, and strong policy support. The region has a significant population suffering from chronic kidney disease (CKD) and end-stage renal disease (ESRD), driving consistent demand for dialysis treatments.

U.S. in particular, benefits from comprehensive reimbursement systems like Medicare, which cover dialysis services and encourage early adoption of both in-center and home-based machines. Additionally, the rising incidence of CKD affecting more than 1 in 7 adults in the U.S. continues to fuel demand for timely diagnosis and effective treatment protocols.

A distinct European trend is the focus on sustainability regulations from the European Union are pushing dialysis providers to adopt machines that reduce water consumption, power usage, and plastic waste. Manufacturers are responding with eco-efficient systems designed to meet EU environmental standards. Additionally, countries such as Sweden and the Netherlands are pioneers in home-based dialysis programs, supported by robust reimbursement schemes and digital health integration.

AI-enhanced dialysis machines are gaining traction in university hospitals and specialized renal centers, improving personalized care delivery. The researchers at UCL’s Institute for Liver and Digestive Health invented DIALIVE device for patients with acute-on-chronic liver failure (ACLF). In May 2023, UCL announced that the treatment using DIALIVE proved safer with a significant reduction in endotoxins and effective in treating liver failure. Europe's commitment to green healthcare, strong public funding, and patient-centered care models makes it unique.

Asia Pacific dialysis machines market is rapidly emerging as a dynamic growth hub, driven not just by population size but by transformative shifts in healthcare access, policy, and technology. Southeast Asian nations, such as Vietnam and the Philippines, are adopting mobile dialysis units to reach remote populations, showcasing innovation tailored to local geography. Meanwhile, domestic manufacturers in South Korea and Japan are advancing compact, AI-integrated machines optimized for space-constrained settings. In October 2024, Nephro Care India Limited (NCIL) developed a prototype of a remotely monitored AI-enabled Smart Haemodialysis Machine in collaboration with the National Institute of Technology, Silchar, according to a senior company official. There's also a growing emphasis on cost-effective, solar-compatible machines to overcome electricity issues in remote areas. These factors highlight Asia Pacific as an emerging and strategical market.

The global dialysis machines market features intense competition, driven by rapid technological innovation, evolving patient preferences, and expanding healthcare infrastructure. Companies are increasingly focusing on developing compact, user-friendly machines suitable for both clinical and home settings. The market is witnessing a shift toward AI-powered systems that offer personalized treatment and remote monitoring capabilities. Sustainability is also emerging as a key differentiator, with manufacturers designing machines that reduce water and energy consumption.

The global dialysis machines market is estimated to increase from US$ 18.8 Bn in 2025 to US$ 23.4 Bn in 2032.

The increasing incidence of CKD, particularly due to diabetes, hypertension, and an aging population, is driving the demand for dialysis treatments globally.

The market is projected to record a CAGR of 3.2% during the forecast period from 2025 to 2032.

The growing preference for home-based care offers a significant opportunity. Advances in portable dialysis systems and remote monitoring technology are making home dialysis more accessible, providing patients with greater flexibility and independence.

North America dominates the global dialysis machines market.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn/Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Indication

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author