ID: PMRREP33153| 169 Pages | 16 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

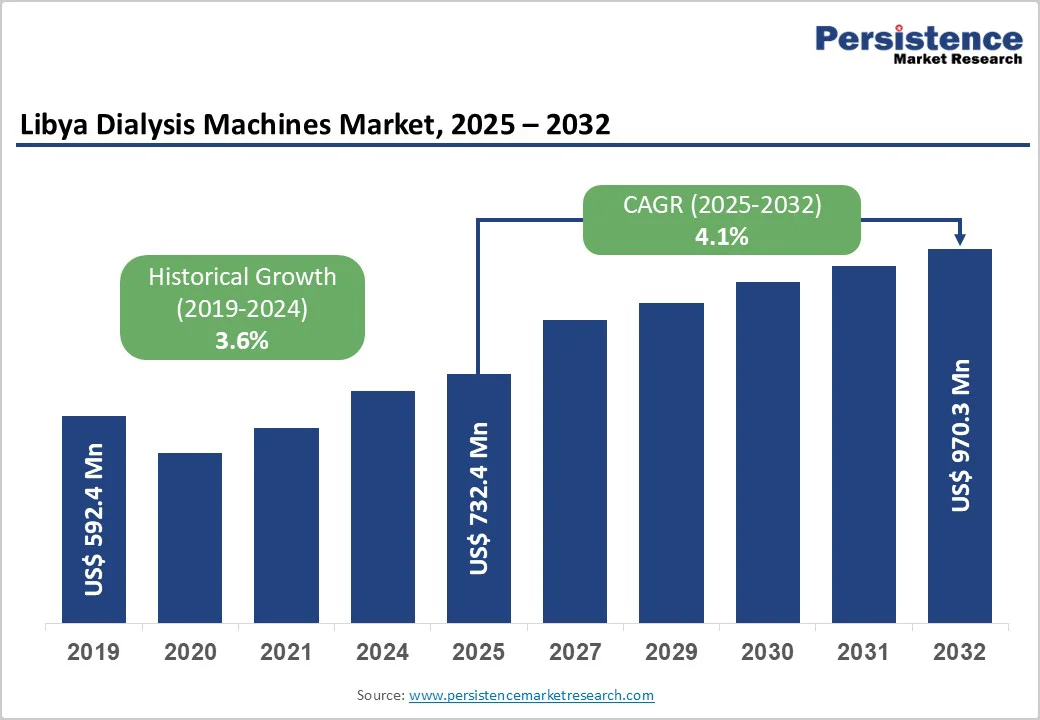

The Libya dialysis machines market size is valued at US$ 732.4 million in 2025 and projected to reach US$ 970.3 million growing at a CAGR of 4.1% during the forecast period from 2025 to 2032. CKD, or chronic kidney disease, refers to varying degrees of decline in renal function. The final and most severe stage of CKD is end-stage renal disease (ESRD). Patients must inevitably rely on haemodialysis or kidney transplantation to survive this dysfunction.

The need for a more thorough examination of individuals with CKD and ESRD arises from the significant burden of expensive treatment, pain, and daily challenges faced by patients undergoing haemodialysis. According to the WHO Non-Communicable Diseases Country Profile, cardiovascular disease and diabetes mellitus are the main causes of morbidity and mortality in Libya, both of which are risk factors for CKD.

| Key Insights | Details |

|---|---|

|

Libya Dialysis Machines Market Size (2025E) |

US$ 732.4 Mn |

|

Market Value Forecast (2032F) |

US$ 970.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

4.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.6% |

The government's focus on healthcare infrastructure is one of the strongest drivers of growth in the Libyan dialysis machines market. In recent years, a significant share of national healthcare expenditure has been channeled toward expanding and improving hospital networks, with a clear emphasis on upgrading renal care capacity. Public hospitals continue to receive priority funding for critical equipment, including dialysis units, as the number of patients with kidney failure rises.

International support and medical aid programs have further accelerated the procurement of modern machines, the installation of new dialysis stations, and the renovation of older treatment centers. Along with physical upgrades, hospitals are investing in the training of nephrology teams, nursing staff, and biomedical engineers to improve the management and maintenance of dialysis equipment. These improvements increase patient access to treatment, reduce long travel distances for care, and help manage the chronic shortage of dialysis capacity. With hospitals accounting for nearly two-thirds of dialysis machine deployments in Libya, continued government-backed modernization is set to fuel sustained market demand.

Africa was badly impacted by the coronavirus outbreak, particularly in war-torn nations such as Libya. Several elements have been identified as risk factors for the severity of COVID-19, including old age, the existence of other comorbidities, and anomalies in certain laboratory results. It has been noted that patients who need ICU hospitalization have greater rates of mortality and morbidity within the setting.

In a country like Libya that is embroiled in civil conflict, differences in local environments as well as variations in predisposing factors play a significant role in raising mortality and morbidity.

ICUs around the world have faced unprecedented difficulties due to the COVID-19 pandemic. Due to resource constraints, equipment shortages, and inadequately qualified healthcare personnel, these issues have a wide impact across Africa. In comparison to the rest of the world, Africa has the greatest ICU mortality due to these significant challenges. Bruce et al study, which was published in the Public Library of Science in 2021, found that after 30 days in the intensive care unit, 54.7% of African patients had died.

Due to hepatic cirrhosis and hepatocellular carcinoma, chronic infections with the hepatitis B virus (HBV) and hepatitis C virus (HCV) are linked to substantial health hazards. In comparison to the general population, patients receiving maintenance haemodialysis are more likely to contract HBV and HCV in Libya.

To prevent the spread of nosocomial infections, strict infection control procedures are required. Given the potential for nosocomial infection, it is advised that stringent infection control measures be implemented in haemodialysis units. Patients with blood-borne viral infections should be kept apart from seronegative patients during dialysis, and both patients and staff should receive hepatitis B vaccinations. In several nations, the frequency of new HCV infections among haemodialysis patients has been drastically reduced through the implementation of blood donor screening and a reduction in blood transfusions, facilitated by the availability of recombinant erythropoietin.

Manufacturers of dialysis machines are thus presented with lucrative opportunities to expand their reach across nations such as Libya and to promote the accessibility of medical devices to enhance treatment outcomes.

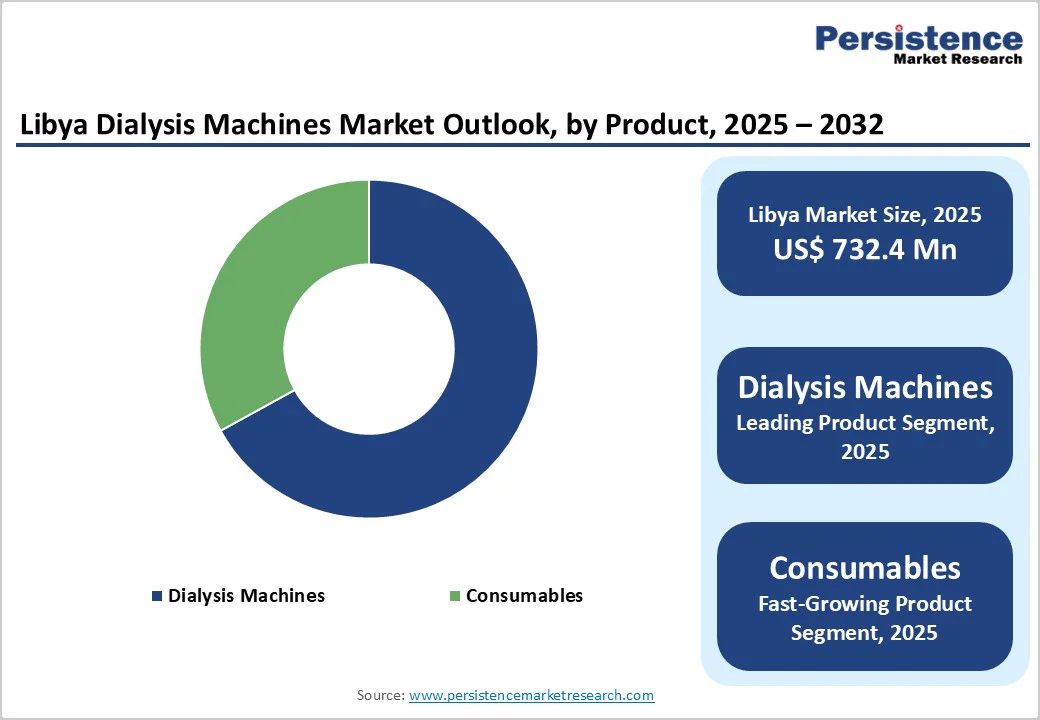

Dialysis machines dominate the Libyan market accounting for 67% share in 2025, reflecting their central role in delivering renal replacement therapy across the country. The rising prevalence of chronic kidney disease and continued dependence on hemodialysis as the primary treatment modality have made machine procurement a top priority for hospitals and dialysis centers. Government-led infrastructure upgrades and international aid programs have supported the installation of advanced hemodialysis systems, particularly in public hospitals where patient inflow is highest. Demand is largely concentrated around high-performance machines that deliver safety, efficiency, and compatibility with a wide range of consumables. Procurement teams increasingly prefer devices that offer simplified maintenance, real-time monitoring, and lower operational costs, helping healthcare facilities manage heavy dialysis workloads.

While machines currently dominate, consumables such as dialyzers, bloodlines, and concentrates represent the fastest-growing product segment. Their continued use across every treatment session drives recurring purchases and significant revenue potential. As patient volumes rise and treatment frequency remains high, the consumables category is expected to grow rapidly, as it is essential to ongoing dialysis care.

Hospitals held the highest market share of 62.1% in 2024 as end-users in the Libyan dialysis machines market, and their dominance is expected to continue. The rapid spread of chronic diseases in the country, particularly kidney disorders, intensified during and after the COVID-19 pandemic, which placed additional pressure on the healthcare system. As complications from both chronic kidney disease and infection-related morbidity increased, hospitals became the primary treatment centers for patients requiring dialysis support.

To prevent further gaps in care, the government prioritized strengthening the hospital ecosystem and secured dialysis equipment from established global manufacturers. Most investments in renal care infrastructure, including the expansion of dialysis wards, installation of modern machines, and availability of skilled staff, were concentrated within public and major urban hospitals. Patients also prefer hospitals due to the assurance of better monitoring, access to critical care resources, and emergency support during dialysis. Given the persistent rise in renal disease incidence and the central role of hospitals in managing high-risk patients, this segment is expected to retain its leading position in Libya’s dialysis equipment market.

Manufacturers of dialysis machines have three things in common: they understand the market, choose the best partner, and continue to assist that partner. It is crucial to understand the Libyan competitive context for a product or service, including competitors, standards, regulations, distribution channels, and applications. Key market players will need to hire a Libyan distributor or build up a local subsidiary to succeed in this market. They will also need to establish a local sales presence.

The Libya dialysis machines market is valued at US$ 732.4 Mn in 2025.

Rising chronic kidney disease burden, increasing dialysis patient pool, expanding hospital infrastructure, government supply programs, and growing procurement of advanced hemodialysis systems.

The Libya dialysis machines market is poised to witness a CAGR of 4.1% between 2025 and 2032.

High demand for modern hemodialysis machines, scope for public-private partnerships, service and maintenance expansion, local distribution strengthening, and affordable consumables solutions.

Key companies include Fresenius, Baxter, B. Braun Melsungen AG, Medtronic Plc., C. R. Bard (Becton, Dickinson & Company), among others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn and Volume (if Available) |

|

Country Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By End-user

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author