ID: PMRREP33189| 210 Pages | 26 Nov 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

The global catamaran market size is valued at US$5.2 billion in 2025 and is projected to reach US$8.5 billion, growing at a CAGR of 7.5% between 2025 and 2032. This acceleration reflects strengthening demand driven by rising disposable incomes among high-net-worth individuals, expanding marine tourism across emerging economies, and accelerating technological advancements in hull design and sustainable propulsion systems.

| Key Insights | Details |

|---|---|

|

Catamaran Market Size (2025E) |

US$5.2 Bn |

|

Market Value Forecast (2032F) |

US$8.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.5% |

Rising disposable incomes among global high-net-worth individuals are fundamentally reshaping demand patterns in the catamaran market. The outdoor recreation sector generated US$887 billion in annual consumer spending globally as of 2020, with this figure expanding substantially through 2025. Consumers in developed markets, particularly North America and Western Europe, are increasingly allocating capital toward premium leisure experiences, including luxury boating and water-based tourism.

The shift in consumer preferences from traditional monohulls to catamarans reflects the superior comfort and spatial advantages of dual-hull designs, which offer 20-30% greater internal volume compared to equivalent monohull vessels. This premium positioning supports higher margins and attracts affluent demographics seeking enhanced living spaces, advanced amenities, and extended blue-water cruising capabilities. The expansion of wealth in emerging markets, particularly among affluent urban populations in the Asia Pacific, is creating an additional growth vector for luxury catamaran sales.

Marine tourism expansion represents a critical growth catalyst, with governments across Europe, North America, and the Asia Pacific implementing strategic initiatives to develop coastal infrastructure and promote water-based recreational activities. The Outdoor Industry Association documented sustained growth in water sports participation, including kayaking, rafting, and sailing activities, which directly correlates with increased demand for recreational boating vessels. Sailing schools in Japan and Southeast Asian destinations report rising enrollment, driving demand for medium-sized sailing catamarans optimized for training and leisure cruising.

The tourism recovery post-pandemic demonstrates resilience, with charter companies implementing flexible booking policies and reduced down-payment requirements (10-15% versus historical 40-50%) to stimulate demand. Cruising tourism specifically shows strong momentum, with extended blue-water voyages requiring vessels with exceptional seaworthiness, comfort, and range attributes where catamarans substantially outperform traditional hull forms.

The regulatory landscape for food enzymes poses significant compliance challenges, particularly across geographically diverse markets with varying regulatory frameworks. The European Food Safety Authority (EFSA) operates a comprehensive authorization process requiring extensive safety documentation and efficacy data for each enzyme application and source strain. Unlike the United States, where regulatory pathways are more streamlined, the EU maintains distinct regulations governing food enzymes and processing aids, resulting in market fragmentation and increased compliance costs.

Different national regulatory standards across the Asia-Pacific, Latin America, and Middle East regions necessitate localized product registration and documentation, extending market entry timelines and increasing costs for manufacturers. These regulatory complexities particularly disadvantage smaller regional players while favoring multinational corporations with established regulatory and quality infrastructure.

The global catamaran market is witnessing a strong trend toward hybrid propulsion, advanced design, and sustainability-driven innovation. In December 2024, FPT Industrial and AS Labruna partnered with the Wider shipyard for the launch of the revolutionary hybrid catamaran WiderCat 92, which integrates a dual FPT N67 570 EVO engine system with twin 500 kW electric motors and LFP battery storage. This hybrid configuration allows cruising up to 1,700 nautical miles at 6 knots in hybrid mode and 24 nautical miles in full-electric mode with zero emissions, highlighting the rising adoption of eco-efficient propulsion and renewable energy integration, such as solar-powered recharging.

Similarly, the Lagoon 51 catamaran, introduced in February 2022, emphasizes sustainability with extensive solar panels installed on its flybridge and roof, reinforcing the industry’s focus on energy self-sufficiency and carbon reduction. Moreover, design innovation and customization are becoming key market trends, as seen in Two Oceans Marine’s 27-meter 870 Power Catamaran launched in November 2024, featuring record-breaking dimensions and bespoke engineering. Complementing this, Fountaine Pajot’s 2025 launch of a new sailing catamaran model showcases immersive design experiences and enhanced comfort features, reflecting growing consumer demand for luxury, technology integration, and green marine solutions in the catamaran sector.

The convergence toward hybrid propulsion as an industry standard creates substantial opportunities for technology providers, component manufacturers, and innovative shipyards. Current market penetration of hybrid systems remains limited to premium segments. Still, the declining cost trajectory of lithium-iron phosphate battery technology and regulatory pressure to reduce emissions are accelerating mainstream adoption.

The December 2024 Wider WiderCat 92 project demonstrates the commercial viability of a serial-hybrid architecture that delivers zero-emission cruising capability with practical operational ranges. Market sizing suggests the hybrid catamaran segment could expand from current negligible volumes to account for 15-20% of total production by 2032, creating an addressable opportunity of US$1.3-1.7 billion. Opportunities exist for battery manufacturers, electric motor suppliers, and software developers to build integrated propulsion management systems that optimize diesel-electric performance trade-offs.

Sailing Catamarans Anchor Market Leadership as Power Catamarans Accelerate Growth Through Luxury, Speed, and Technological Innovation

Sailing catamarans continue to dominate the global market with a revenue share exceeding 55%, underpinned by their widespread adoption across recreational, competitive, and long-distance cruising applications. These vessels offer 20–30% more interior volume than traditional monohulls, superior stability, and better fuel efficiency, making them ideal for extended voyages. Modern innovations such as automated sail systems, lightweight composites, and solar-assisted designs are enhancing their appeal among both seasoned and novice sailors. The Lagoon 51, introduced in 2022 with solar-integrated flybridge systems, and Fountaine Pajot’s 2025 sailing lineup exemplify the blend of sustainability and luxury driving this segment. Europe and North America remain key markets, supported by mature sailing infrastructures and charter networks.

Conversely, power catamarans are experiencing rapid expansion, growing at a 6.2% CAGR through 2032. These vessels combine high speed (20–25 knots), shallow draught operation, and luxury-oriented designs. The Two Oceans Marine 870 Power Catamaran, a 27-meter custom-built yacht, demonstrates technological breakthroughs in scale and comfort. With features such as smart-home automation, advanced HVAC, and premium materials, power catamarans cater to affluent buyers seeking personalized marine luxury. Their premium pricing and profitability are prompting manufacturers to increase investments in this high-margin segment.

Diesel Retains Market Command as Hybrid-Electric Catamarans Redefine the Next Wave of Sustainable Marine Propulsion

Diesel propulsion continues to dominate the global catamaran market, capturing over 70% of total revenue in 2025. This leadership stems from its long-established reliability, robust supply chain infrastructure, and cost-effective performance across diverse marine environments. Diesel engines are favored for their endurance, high energy efficiency, and compatibility with global refueling networks, making them the preferred choice for both commercial operators and leisure users. Leading manufacturers such as Wider and Fountaine Pajot, along with regional shipbuilders, rely heavily on proven engine platforms from Volvo Penta, FPT Industrial, and Caterpillar, ensuring consistent performance, technical support, and ease of maintenance. However, as the International Maritime Organization (IMO) and the European Union enforce stricter emission standards, the industry is witnessing a gradual yet inevitable transition toward cleaner propulsion technologies. This transition is paving the way for hybrid and electric propulsion systems, which are rapidly gaining traction as the next phase of market evolution.

The FPT Industrial–Wider WiderCat 92 project exemplifies this technological shift, combining twin diesel engines and dual electric motors to achieve a 1,700-nautical-mile hybrid range, zero-emission silent cruising, and solar-assisted power generation. Hybrid catamarans, positioned as premium offerings, command a 15–20% price premium over traditional diesel platforms driven by growing demand among affluent, sustainability-focused consumers in Europe and North America. Although pure-electric propulsion remains confined to smaller recreational models due to current battery limitations, advancements in energy density are expected to make fully electric 40–60 ft leisure catamarans commercially viable by 2030–2035.

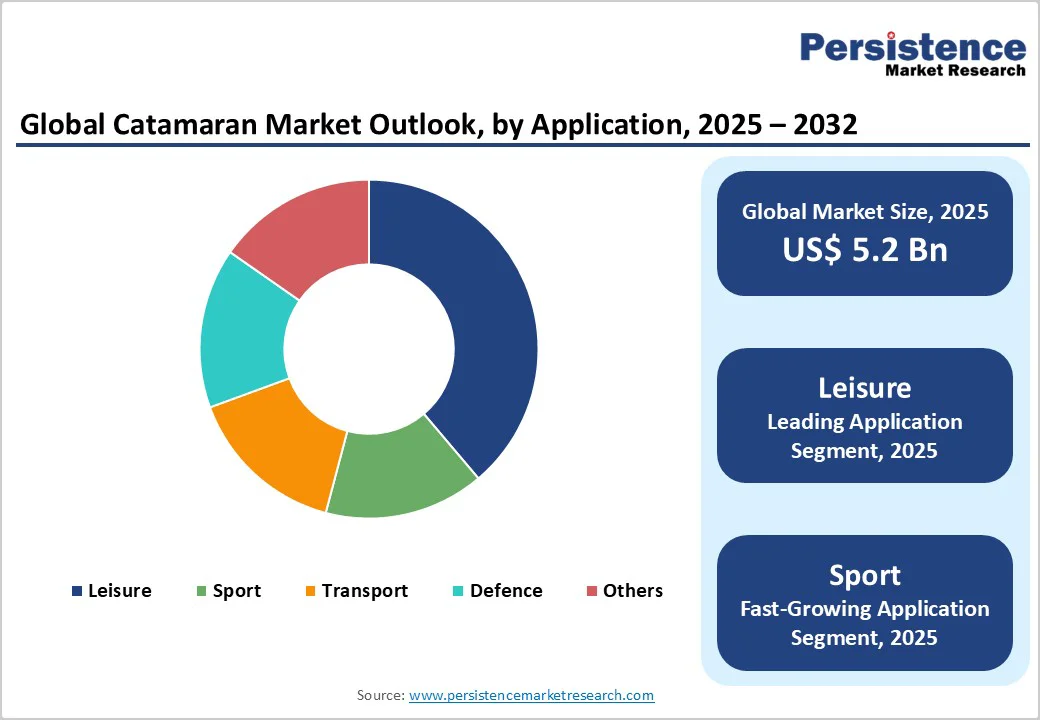

Leisure and Sport Catamarans Emerge as Dual Growth Engines, Driving Profitability and Market Expansion Through Luxury Travel and High-Performance Demand

Leisure catamarans dominate the global market, accounting for over 35% of revenue, supported by rising consumer spending on experiential luxury travel and premium water-based recreation. These vessels cater to affluent travelers seeking exclusive nautical adventures that merge comfort, performance, and style. Key categories include luxury charter yachts for family vacations, resort-based leisure platforms, and liveaboard cruising models designed for extended stays at sea. Growing demand for wellness-oriented tourism, gourmet experiences, and personalized marine exploration further accelerates adoption. Government initiatives in the Mediterranean, Caribbean, and Southeast Asia focused on tourism infrastructure, tax incentives, and destination marketing to strengthen the segment’s growth. Despite economic fluctuations, the leisure catamaran segment remains price inelastic and consistently profitable.

Sport catamarans represent the fastest-growing application, expanding at a 6.6% CAGR through 2032. These high-performance vessels cater to competitive sailors and water sports enthusiasts engaged in racing, wakeboarding, diving, and fishing. Manufacturers such as Procat Yachts are integrating hydrodynamic optimization, lightweight composites, and advanced propulsion systems to enhance speed and manoeuvrability. The combination of lifestyle appeal, technical excellence, and rising participation in global racing events positions sport catamarans as a dynamic growth engine within the market.

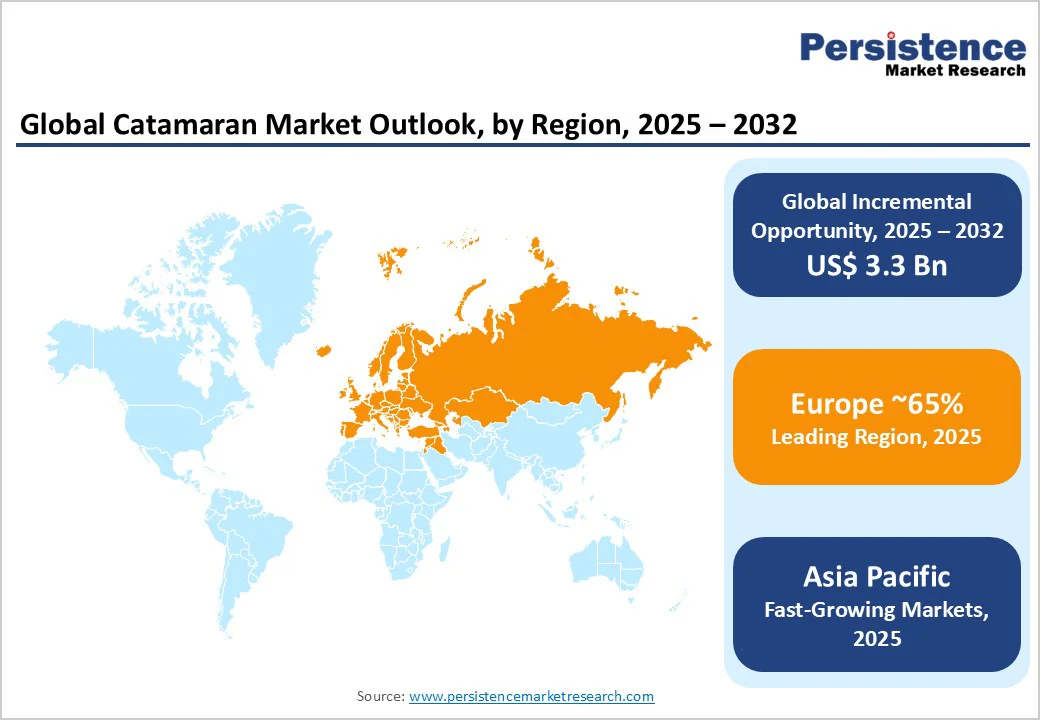

Europe holds the dominant position in the global catamaran market, accounting for over 65% of total revenue, supported by leading manufacturers in France (Fountaine Pajot, Lagoon, Beneteau), Germany (Bavaria Catamarans), and Italy (Wider, Nautitech). The region’s leadership stems from its rich maritime heritage, advanced yacht-building infrastructure, and affluent consumer base with strong discretionary spending on luxury marine vessels.

Key markets include Germany, the United Kingdom, France, and Spain, with the Mediterranean, particularly the French Riviera, Costa Brava, and Italian coastlines, serving as prime hubs for luxury yacht charters. European buyers favor mid- to large-sized sailing catamarans ideal for Mediterranean cruising, while established charter networks sustain tourism-linked revenues. EU environmental regulations on sulfur emissions and noise pollution are accelerating the adoption of hybrid and electric propulsion, with regional manufacturers at the forefront of these innovations. European shipyards are modernizing through composite hull construction, 3D printing, and integrated systems assembly. Growing demand from high-net-worth retirees and younger affluent buyers (35–50) seeking hybrid models sustains market momentum. Despite rising competition from Asia, European builders retain a competitive edge through legacy craftsmanship, certified production, and strong regulatory expertise that supports new-model commercialization.

Asia Pacific stands out as the fastest-growing regional segment in the catamaran market, registering a robust 8.1% CAGR through 2032. Growth is fueled by expanding tourism infrastructure, rising disposable incomes, and strong government initiatives to develop marine and coastal tourism. The region combines mature and emerging markets, Japan’s established sailing culture, China’s rising luxury segment, and Southeast Asia’s tourism-driven expansion.

Japan continues to demonstrate strength through its deep-rooted sailing heritage, supported by certified sailing schools and premium coastal destinations such as Enoshima Islands and Hayama Port. Meanwhile, China’s ultra-high-net-worth population is driving rapid adoption of luxury power catamarans, with increasing custom orders concentrated in affluent coastal hubs such as Shanghai and Shenzhen.

In Southeast Asia, nations such as Thailand, Vietnam, and Indonesia are heavily investing in marinas, anchorage facilities, and maintenance infrastructure to support catamaran charters and resort tourism. Additionally, regional shipyards, particularly in Vietnam and Thailand, are emerging as competitive manufacturing hubs, offering cost-effective alternatives to European builders.

Key regional growth drivers include GDP expansion, rising entrepreneurship-led wealth, eco-conscious propulsion adoption, and accelerated capital inflows into marina and fleet development projects across the Asia Pacific.

The global catamaran market is highly fragmented, with no single manufacturer dominating. The top five players account for roughly 35–40% of total revenue, while the rest is shared among 50+ regional and niche builders. Tier 1 leaders such as Fountaine Pajot, Lagoon, Beneteau, Bavaria, and Nautitech hold about 25–30% share, driven by strong heritage, diversified portfolios, and brand loyalty.

Tier 2 competitors sWider, Seawind, Leopard, and Outremer, capture 30–35% through specialized designs and performance-oriented models. Tier 3 emerging players from Vietnam, Thailand, and Indonesia focus on cost leadership, expected to expand their collective share to 35–40% by 2032.

The Catamaran market is estimated to be valued at US$ 5.2 Bn in 2025.

The key demand driver for the global catamaran market is the rising disposable income and growing luxury consumer spending among high-net-worth individuals and affluent travelers.

In 2025, the Europe region will dominate the market with an exceeding 65% revenue share in the global Catamaran market.

Among applications, leisure has the highest preference, capturing beyond 35% of the market revenue share in 2025, surpassing other applications.

African Cats, Bavaria Catamarans, Beneteau Group, Fountaine Pajot, Lagoon, Bavaria, and Nautitech are a few leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Application

By Fuel Type

By Size

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author