ID: PMRREP4274| 187 Pages | 25 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

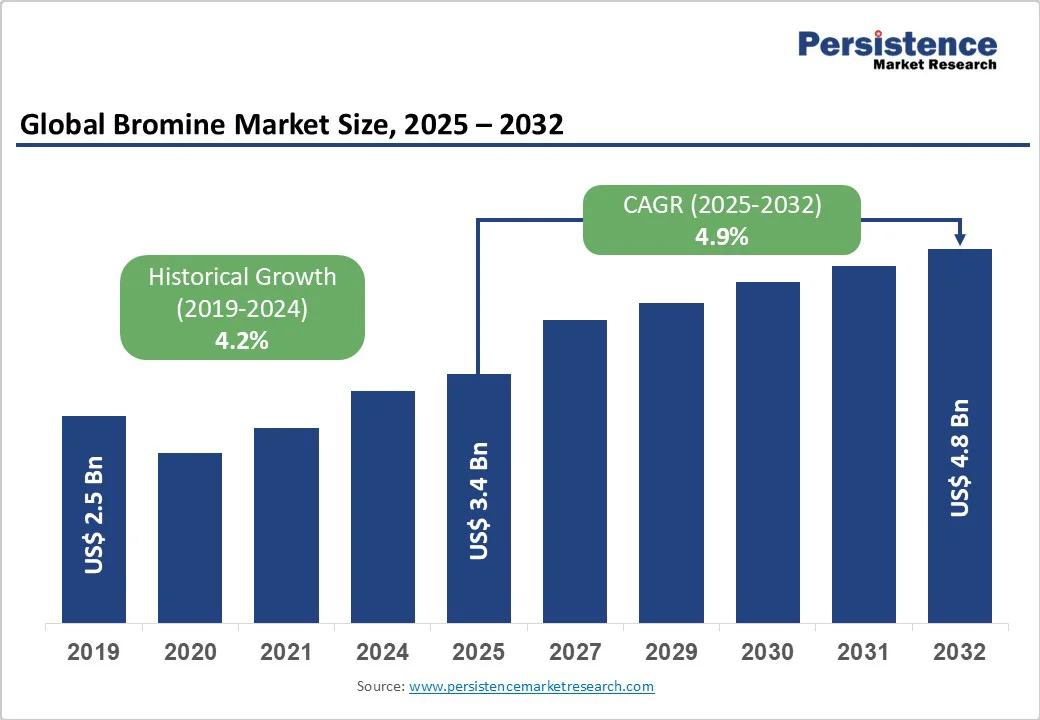

The global bromine market size was valued at US$3.4 Bn in 2025 and is projected to reach US$4.8 Bn by 2032, growing at a CAGR of 4.9% between 2025 and 2032. The market growth is largely contributed to by stringent fire safety regulations, increasing demand for flame retardants across electronics, construction, and automotive sectors, and expanding oil & gas drilling activities.

| Key Insights | Details |

|---|---|

|

Estimated Market Size (2025E) |

US$3.4 Bn |

|

Projected Market Value (2032F) |

US$4.8 Bn |

|

Value CAGR (2025 to 2032) |

4.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.2% |

Stringent Fire Safety Regulations and Flame Retardant Demand

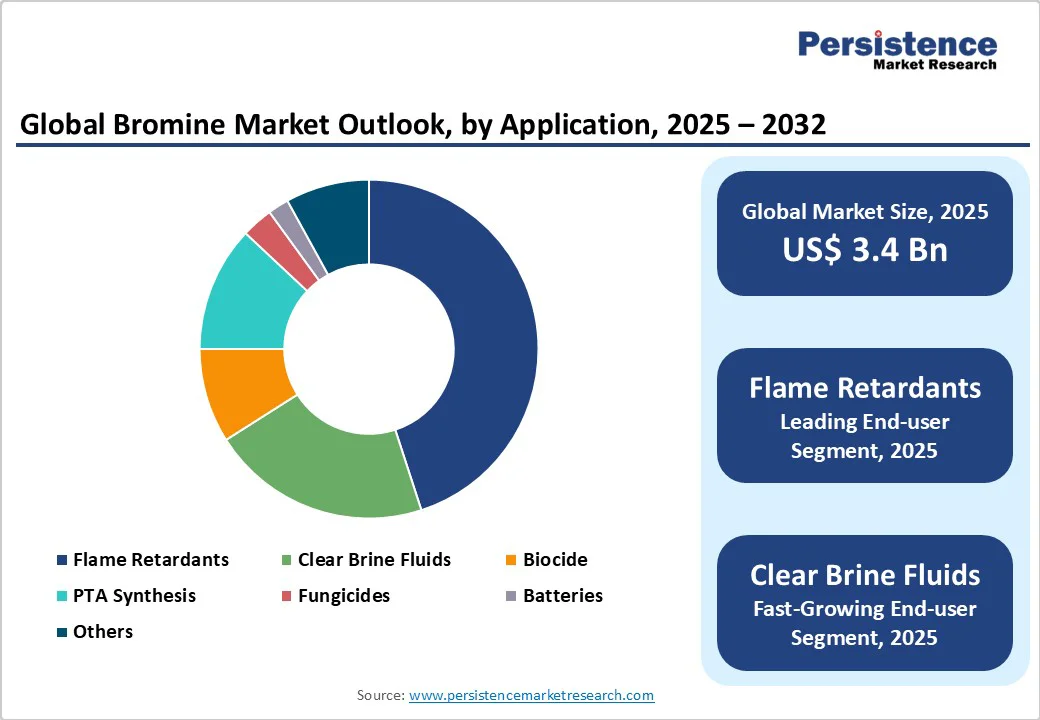

Global fire safety regulations are becoming increasingly stringent, particularly in electronics and construction sectors, driving bromine-based flame-retardant consumption. The flame retardants segment accounts for more than 2/5th of global bromine market consumption in 2025, with tetrabromobisphenol A (TBBPA) leading applications in circuit boards, cables, and plastic housings. The United States Environmental Protection Agency (U.S. EPA) and the European Chemicals Agency have implemented comprehensive policies requiring effective flame-retardant solutions in consumer products, electronics, and building materials.

Consumer electronics demand, including smartphones and laptops, propels bromine-based flame-retardant usage, with manufacturers required to meet UL Yellow Card certification and V0/5VA ratings for electrical applications. The market growth is further supported by automotive industry growth, where bromine compounds ensure compliance with fire safety standards while maintaining lightweight material performance characteristics essential for modern vehicle design.

Oil and Gas Industry Expansion and Clear Brine Fluids Demand

The global oil and gas industry's continued expansion, particularly in offshore and deepwater drilling operations, significantly drives the bromine market demand through clear brine fluids applications. Bromine-based clear brine fluids are essential for maintaining wellbore stability, preventing formation damage, and enabling efficient drilling in high-pressure environments.

The global offshore drilling industry's recovery has significantly boosted demand for bromine-based clear brine fluids (CBFs), essential for wellbore stabilization and hydraulic fracturing operations. The global clear brine fluids market size is projected to hit US$2.5 billion by 2032. In 2024, bromine imports into Asia rose nearly 30% to over 109,000 tons, with China accounting for 78% of this volume, primarily driven by increased drilling activities in the South China Sea and expanded shale gas exploration.

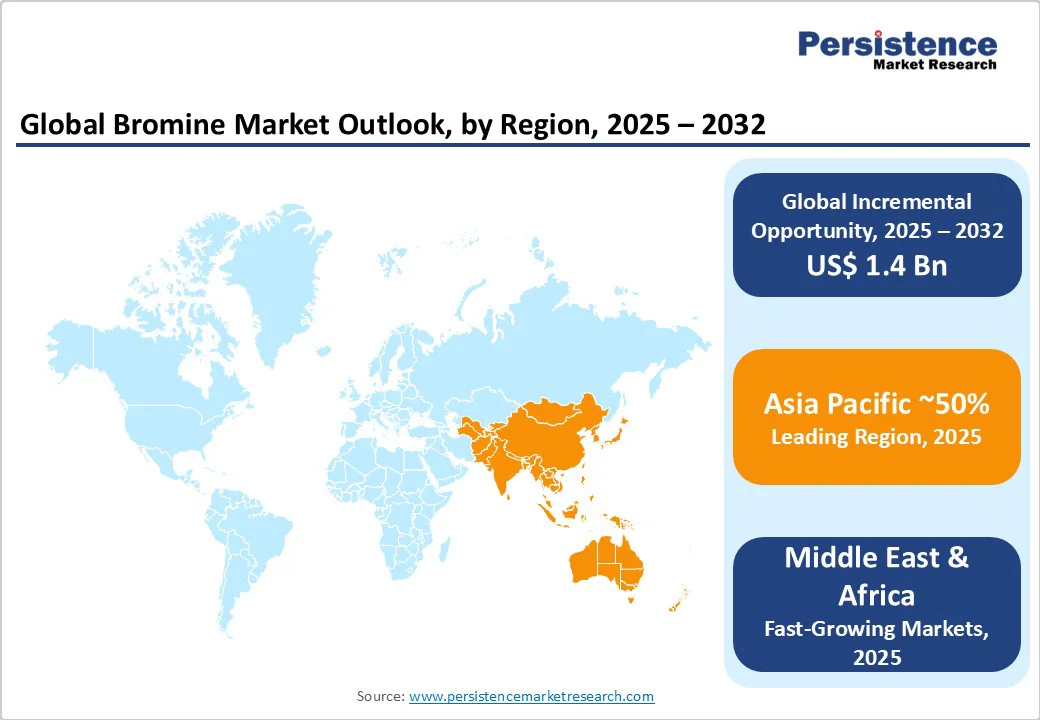

The Middle East and Africa region witnessed substantial growth in bromine consumption for drilling applications, supported by new offshore projects in Egypt and expanded exploration activities across the Suez Canal Economic Zone.

Environmental Regulations and Sustainability Concerns

Environmental regulations pose significant challenges to the bromine market growth, particularly regarding brominated compound persistence and potential toxicity. The United States Environmental Protection Agency (U.S. EPA) and European Chemicals Agency have restricted or banned specific brominated flame retardants in consumer products due to concerns over bioaccumulation and toxicity. Brominated compounds can accumulate in soil, water bodies, and human tissues over time, raising questions about long-term environmental impact and human health effects.

The European bromine market particularly emphasizes developing environmentally friendly alternatives, with regulatory frameworks encouraging safer bromine compound development and transparent communication to build consumer trust. These regulatory pressures force manufacturers to invest significantly in R&D for alternative chemical compositions, potentially limiting traditional bromine applications and increasing production costs.

Raw Material Price Volatility and Supply Chain Constraints

Bromine production faces significant challenges from raw material price fluctuations and geographical supply concentration. The industry relies heavily on specific brine sources, with the Dead Sea accounting for approximately 50% of global bromine supply, creating supply chain vulnerabilities due to geopolitical factors.

Chinese bromine production, representing about 15% of global capacity, faces declining output due to continued brine well depletion and stricter environmental enforcement, affecting global supply stability. Energy-intensive extraction processes make bromine production sensitive to energy cost fluctuations, impacting overall production economics.

The industry's oligopolistic structure, with four major producers controlling 85% of global capacity, can create price volatility and supply constraints. Transportation costs for bromine derivatives, given their hazardous material classification, add additional cost pressures, particularly affecting international trade and market accessibility in emerging economies.

Energy Storage and Renewable Technologies Integration

Emerging energy storage applications present substantial growth opportunities for bromine-based technologies, particularly in renewable energy integration. Bromine-based flow batteries offer high energy density, scalability, and cost-effectiveness for grid-scale energy storage applications, supporting solar and wind energy intermittency management.

The expanding electric vehicle market further highlights effective energy storage solution needs, with bromine technologies offering lower carbon footprints compared to traditional lithium-ion batteries, aligning with global sustainability objectives. The growth opportunities extend to grid stabilization requirements, where bromine-based systems provide reliable supply and demand balancing capabilities essential for renewable energy integration.

Water Treatment and Disinfection Applications

Growing concerns over water scarcity and quality standards are boosting demand for bromine in municipal and industrial water treatment applications. The compound's effectiveness in biological contaminant control and compliance with stringent environmental standards positions it as a preferred alternative to traditional chlorine-based treatments.

Industrial water treatment applications, particularly in power generation and chemical processing, represent expanding market segments with significant growth potential. The global emphasis on sustainable water management practices creates opportunities for innovative bromine-based solutions.

Sustainable Product Innovation and Circular Economy

Major trends include a shift toward eco-friendly flame retardants and bromine recycling technologies, creating opportunities for companies developing sustainable solutions. Innovation in bromine derivatives focuses on creating more efficient, environmentally friendly products with enhanced recyclability and reduced environmental impact.

Companies investing in R&D for cost-effective solutions that align with environmental goals are positioned to capture market share in developed regions with strict sustainability requirements. The circular economy approach to bromine applications presents new business models and value creation opportunities.

Organobromine compounds hold more than 35% of the global bromine market share in 2025, representing the largest derivative segment due to their widespread applications in flame retardants and pharmaceutical synthesis. These highly reactive compounds serve as valuable intermediates in chemical reactions across multiple industries.

The segment's dominance stems from its critical role in producing tetrabromobisphenol A (TBBPA), ethylene dibromide, and other specialty chemicals essential for modern industrial processes. Manufacturers focus on developing high-performance organobromine materials that meet stringent fire safety standards while offering thermal stability, durability, and environmental sustainability. Market expansion is supported by continued technological advancement and increasing regulatory requirements for effective flame-retardant solutions across developed and developing economies.

Bromine Fluids represent the fastest-growing bromine derivative segment, with significant expansion driven by increasing oil and gas drilling activities globally. These salt-based solutions are essential for drilling and well completion processes, providing density control, borehole stabilization, and formation damage prevention in high-temperature, high-pressure reservoir conditions. The segment benefits from expanding shale gas exploration, offshore drilling operations, and deepwater production activities requiring specialized fluid systems.

Flame retardants account for more than 45% of the global bromine market share in 2025, representing the dominant application due to stringent fire safety regulations and widespread industrial adoption. The segment spans electronics, construction materials, automotive applications, and consumer goods, with bromine-based compounds providing effective fire resistance while maintaining product performance characteristics.

Electronics and electrical applications account for over 40% of flame retardant consumption, driven by circuit board, cable, and housing requirements for fire safety compliance.

Tetrabromobisphenol A (TBBPA) dominates the flame-retardant segment due to its versatility, effectiveness, and cost-competitiveness, while new developments focus on halogen-free alternatives addressing environmental concerns. The market growth is supported by expanding construction activities, increasing automotive production, and electronics manufacturing growth across developed and emerging markets.

Oil and gas drilling fluids represent a high-growth application segment, driven by expanding exploration activities and technological advancements in drilling operations. Bromine-based clear brine fluids are crucial for stabilizing wellbores, preventing shale swelling, and improving drilling fluid performance in challenging environments. The segment benefits from horizontal drilling and hydraulic fracturing technique adoption, with bromine derivatives enhancing drilling efficiency and operational safety.

The electrical and electronics industry represents the leading bromine end-use segment, accounting for more than 30% share in 2025, owing to growing demand for flame-retardants and fire safety compliance. The segment benefits from excessive bromine-based flame-retardant popularity in circuit boards, cables, and plastic housings, with stringent fire safety requirements driving consistent demand.

Manufacturing growth in the Asia Pacific regions, particularly China and Southeast Asian countries, creates substantial demand for bromine derivatives in electronics production. The segment supports innovation in electronic device safety, with manufacturers developing advanced bromine formulations meeting performance requirements while addressing environmental considerations. The growth aligns with digital transformation trends, 5G technology deployment, and smart device proliferation, requiring effective flame-retardant solutions.

The pharmaceutical industry represents the fastest-growing end-use segment for bromine derivatives, driven by increasing demand for active pharmaceutical ingredients (API) and chemical synthesis applications. Bromine compounds serve as essential reactants and catalysts in pharmaceutical intermediate production, supporting sedative, antiseptic, and anesthetic manufacturing. The segment benefits from rising chronic disease prevalence globally and pharmaceutical industry expansion in emerging markets.

North America captured a 31% share of the global bromine market in 2023, with the United States leading regional consumption through dominant oil and gas companies and advanced industrial infrastructure.

The U.S. bromine market size is projected to surpass US$1.2 Bn by 2032, driven by increasing demand in flame retardants, oil and gas drilling, and water treatment applications. The region benefits from the Smackover Formation in Arkansas, representing the only commercial bromine source in the U.S. and home to a major production facility distributing bromine globally.

The United States Energy Information Administration (EIA) predicts crude oil production to reach 13.4 million barrels per day in 2025, directly correlating with increased bromine demand. Calcium bromide-based brine fluids provide a density range from 8.4 to 15.2 lb/gal, suitable for improved drilling operations, while their resistance to chloride ion formation makes them preferred for completion and workover operations.

Investment trends focus on facility expansion and modernization, with Albemarle's US$540 million planned investment in Magnolia, Arkansas, facilities representing strategic capacity enhancement with the project running through 2027.

Europe's growth is primarily driven by the automotive and pharmaceutical industries in Europe. Bromine compounds are widely used in manufacturing a range of pharmaceutical drugs, including analgesics, sedatives, etc. Key countries, including Germany, the U.K., France, Spain, and Italy, contribute significantly to regional demand, with developed Western European nations prioritizing bromine consumption across automotive, electronics, and construction sectors. The region emphasizes sustainability initiatives and environmental compliance, driving demand for eco-friendly bromine derivatives that meet strict regulatory requirements

Germany is one of the largest consumers of bromine in the European region. The German Bromine market size was valued at US$150 Mn in 2024 and is expected to grow with a CAGR of 3%, demonstrating a robust growth driven primarily by flame-retardant applications, particularly in the automotive, electronics, and construction industries. The country's advanced manufacturing capabilities and stringent fire safety regulations create sustained demand for brominated compounds across multiple industrial sectors.

Regulatory harmonization across European Union member states creates consistent market conditions, supporting standardized product development and distribution efficiency. Innovation focus extends to circular economy principles, with specialized firms achieving >95% brominated flame-retardant removal in waste electrical and electronic equipment plastics.

Asia Pacific controls over 50% of the global bromine consumption in 2025, with China being the major contributor, representing the largest and fastest-growing regional market. Strong demand for flame retardants, oil and gas drilling applications, and robust industrial growth across multiple sectors have been the major contributors to the region’s growth.

China's dominance in the bromine industry stems from vast manufacturing capabilities, abundant raw material availability, and strong domestic market demand, particularly in electronics manufacturing and construction industries. China's consumer electronics market is expected to surpass US$350 billion by 2032. China's proactive approach toward environmental regulations and technological innovation positions the country as a key player in developing greener, more efficient bromine formulations.

The region hosts nearly half of the world's electronics output and a growing automotive industry, creating substantial demand for specialty chemicals supporting innovation and environmental compliance.

India's bromine market consumption is likely to surpass 50,000 metric tons by 2025, exhibiting a significant CAGR growth through 2032, driven by renewable energy initiatives and energy storage solution demand. Regional investment trends focus on production capacity expansion, technology advancement, and sustainable manufacturing processes, addressing both domestic demand growth and export market opportunities across developed economies.

Rapid industrialization, urbanization, and infrastructure development in countries including India, Japan, and ASEAN nations drive bromine consumption across flame retardants, water treatment, and pharmaceutical applications in the region.

The global bromine market exhibits a highly consolidated structure, with four major producers controlling approximately 80-85% of total global production capacity. ICL, Albemarle, LANXESS AG, and Jordan Bromine together hold more than 80% of the global bromine production capacity, creating an oligopolistic market environment with significant barriers to entry. These leading companies leverage strategic advantages, including access to high-concentration brine sources, particularly the Dead Sea region, advanced extraction technologies, and established distribution networks serving global markets.

Market concentration benefits from vertical integration strategies, with approximately 60% of bromine produced being captively consumed by producers for derivative manufacturing. The industry structure supports premium pricing power and operational efficiency through economies of scale, while geographic concentration in key brine-rich regions creates natural supply advantages for established players.

Dominant strategic themes include vertical integration, technological innovation, and geographic market expansion. Leading bromine producers emphasize the development of sustainable, environmentally friendly bromine alternatives that address regulatory compliance requirements while maintaining operational performance.

Key differentiators employed by market leaders include proprietary extraction technologies, diversified product portfolios, and strategic partnerships supporting supply chain optimization.

The bromine market size is US$3.4 Bn in 2025.

The bromine market is projected to grow at a 4.9% CAGR by 2032.

The bromine market growth drivers include stringent fire safety regulations, increasing demand for flame retardants, and expanding oil & gas drilling activities.

Asia Pacific is a dominating region for the bromine market, accounting for over 50% share in 2025.

ICL, Albemarle, LANXESS, Jordan Bromine, and TETRA Technologies are some leading industry players in the bromine market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Derivative

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author