ID: PMRREP22990| 216 Pages | 28 May 2025 | Format: PDF, Excel, PPT* | Healthcare

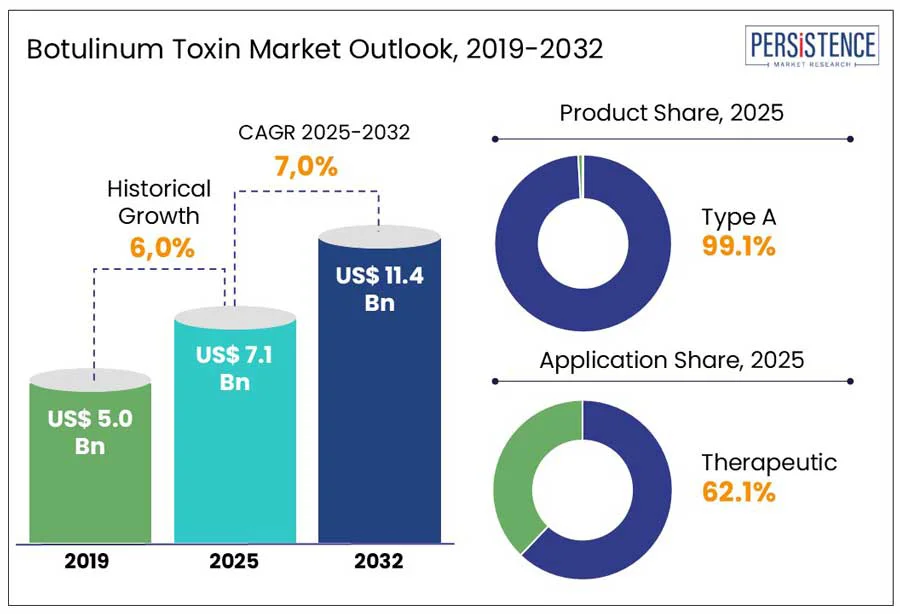

According to the Persistence Market Research report, the global botulinum toxin market size is expected to account for US$ 7.1 Bn at the end of 2025. The global market is estimated to surge ahead at a CAGR of 7.0% to reach a valuation of US$ 11.4 Bn by the end of 2032.

Botulinum toxin is a neurotoxic protein used in both aesthetic and medical treatments. It functions by temporarily blocking nerve signals to muscles, reducing wrinkles and treating conditions such as migraines, spasticity, and dystonia. Growing global demand, technological advancements, and expanding indications make botulinum toxins a key contributor in the minimally invasive procedures.

Key Highlights

Key Highlights

|

Global Market Attribute |

Key Insights |

|

Botulinum Toxin Market Size (2025E) |

US$ 7.1 Bn |

|

Market Value Forecast (2032F) |

US$ 11.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.0% |

Numerous botulinum toxin products are frequently getting approved, which makes them more readily available and more reasonably priced for consumers to choose from. As a result, demand for all kinds of Botox procedures is anticipated to increase globally. The minimally invasive nature of these treatments, especially in therapeutic applications, continues to attract a broad patient base.

In April 2025, AbbVie submitted a Biologics License Application (BLA) to the U.S. FDA for trenibotulinumtoxinE (TrenibotE) for the treatment of moderate to severe glabellar lines. Similarly, in January 2024, Galderma announced positive Phase III results from its READY-3 clinical trial demonstrating significant improvement in glabellar lines (frown lines) and lateral canthal lines (crow’s feet) using RelabotulinumtoxinA.

Further advancing the pipeline, MingMed’s subsidiary Claruvis Pharmaceutical received Investigational New Drug (IND) approval from the U.S. FDA in September 2024 for YY003, a novel recombinant liquid botulinum toxin candidate, BoNT/A, in a prefilled device. These innovations are accelerating global market growth and driving increased adoption.

The global botulinum toxin market faces several challenges, including regulatory hurdles, high development costs, and intense competition. Market saturation, competitive pricing, and the ability to demonstrate consistent efficacy significantly influence market dynamics.

Manufacturing challenges and regulatory setbacks further add to the restraints in the botulinum toxin market. For instance, in October 2023, the FDA issued a Complete Response Letter (CRL) to Galderma regarding its biologics license application for RelabotulinumtoxinA, citing issues in the chemistry, manufacturing, and controls (CMC) processes. The company identified necessary changes; however, such regulatory hurdles ultimately affect market competitiveness, increase developmental costs, and limits timely access to innovative treatments.

Growing demand for facial aesthetics and expanding therapeutic applications drive the demand for botulinum toxin products. Advancements in formulation technologies, such as ready-to-use liquid toxins and recombinant products, enhance safety, convenience, and efficacy. For instance, in July 2024, the Therapeutic Goods Administration (TGA) approved Relfydess (relabotulinumtoxinA), a purified botulinum toxin type A, for the treatment of moderate-to-severe glabellar and lateral canthal lines. The approval was based on comprehensive clinical studies demonstrating its safety and efficacy.

Furthermore, TGA included Relfydess in the TGA Black Triangle Scheme, which signifies ongoing safety monitoring of newly approved medicines. Such programs help ensure transparency, encourage responsible use, and boost consumer confidence in adopting new botulinum toxin products. This evolving landscape, supported by regulatory oversight, creates a favourable environment for product uptake and long-term market growth.

Type A botulinum toxin products are expected to dominate the global market with a revenue share of 99.1% in 2025. Key driving factors include its proven efficacy, long-standing clinical acceptance, and broad applicability in therapeutic and aesthetic procedures. Several Type A products have gained widespread clinical acceptance and are supported by robust clinical data. Their efficacy in treating conditions like glabellar lines, cervical dystonia, and chronic migraines contributes to their continued preference among practitioners.

Additionally, new entrants in the Type A category are further strengthening the segment. Nuceiva (prabotulinumtoxinA-xvfs) demonstrated its safety and efficacy through the TRANSPARENCY program, the most extensive head-to-head pivotal trial against BOTOX® in April 2024. Similarly, Letybo (letibotulinumtoxin A) showed consistent efficacy and tolerability results with a 94 % response rate four weeks’ post-injection, demonstrating high patient satisfaction. These advancements highlight the continued innovation and growing competitiveness within the Type A segment.

Therapeutic segment is expected to be the dominating segment with 62.1% value share in 2025. Botulinum toxin is used therapeutically to treat a variety of conditions, such as cervical dystonia, spasticity, hyperhidrosis, overactive bladders, chronic migraines, and muscle stiffness. Additionally, ongoing clinical research and regulatory approvals continue to broaden its therapeutic applications.

In October 2024, Allergan Aesthetics (AbbVie) received U.S. FDA approval for its BOTOX® Cosmetic (onabotulinumtoxinA) to temporarily improve moderate to severe vertical bands (platysma bands) connecting the jaw and neck in adults. It is the first aesthetic neurotoxin approved for four treatment areas: frown lines, forehead lines, platysma bands, and crow’s feet. In July 2024, Galderma completed its European decentralized procedure for Relfydess™ (RelabotulinumtoxinA), a purified botulinum toxin type A, and received approval for treating moderate-to-severe glabellar and crow’s feet lines in adults under 65.

The reliability, efficacy, and long-term safety profile of botulinum toxin in managing various neuromuscular and pain-related disorders reinforce its strong demand in the therapeutic segment.

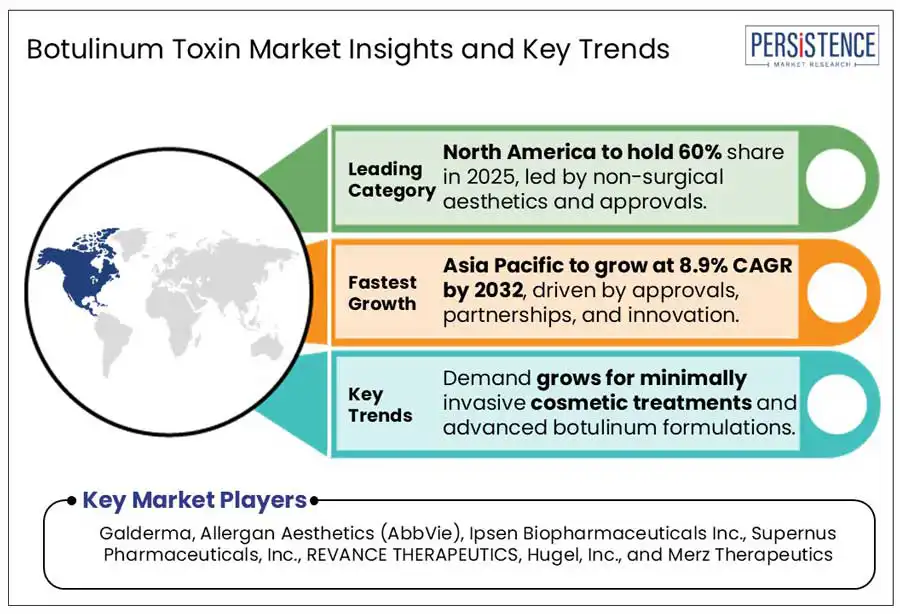

North America is anticipated to continue dominating the global botulinum toxin market at the end of 2025 and over the forecast duration. The rising number of non-surgical aesthetic procedures and growing approvals by regulatory bodies are driving the U.S. botulinum toxin market. The 2023 Plastic Surgery Statistics report by the American Society of Plastic Surgeons revealed a consistent demand for cosmetic and minimally invasive procedures in the U.S. There has been a five percent increase in the overall cosmetic procedures within a year, while minimally invasive procedures grew by seven percent.

In 2023, around 4.7 million procedures took place using botulinum toxin type A, a six percent rise from 2022. Meanwhile, dermal fillers saw 3.44 million procedures, marking a 4% year-over-year increase. These trends highlight the strong and growing consumer preference for minimally invasive treatments, reinforcing North America as a key market for botulinum toxin-based aesthetic procedures.

Europe stands as a pivotal market for players driven by a combination of regulatory advancements, increasing consumer demand, and growing product approvals. Dermal fillers and Botox procedures are very popular in Germany due to their low cost. Additionally, a lot of dermatology clinics, salons, and spas offer these cosmetic procedures at competitive prices, coupled with high success rates, which fosters steady demand for advanced and repeat procedures. These factors contribute to the Germany botulinum toxin market’s growth.

Meanwhile, the U.K. botulinum toxin market shows a steady growth in the adoption of medical aesthetics, including botulinum toxin treatments. Increasing consumer awareness and the growing acceptance of non-surgical aesthetic procedures are driving this trend. Furthermore, to address the growing concerns over unregulated treatments and promote safety and standardization, European governments are taking essential steps towards regulation. The Scottish Government, for instance, introduced the Non-Surgical Cosmetic Procedures Bill in May 2025, aimed at regulating aesthetic treatments such as botulinum toxin and dermal fillers.

The bill includes provisions for licensing practitioners, setting qualification standards, and mandating insurance coverage. This initiative not only supports public safety but is expected to enhance consumer trust and drive greater adoption of cosmetic procedures across Europe, further propelling the Europe botulinum toxin market.

Asia Pacific market is projected to be highly lucrative for the botulinum toxin manufacturers. Surge in product approvals, collaborative ventures, and a strong pipeline of innovative products, all contribute to the regional market growth.

Strategic moves such as the collaboration and licensing agreement between Sinclair Pharma and ATGC Co., Ltd., in October 2023, to globally develop and commercialize ATGC’s botulinum toxin product, ATGC-110, approved for both aesthetic and therapeutic use, highlight growing investment in the region. The agreement excludes India and is non-exclusive for South Korea, however, it underscores Asia’s central role in global expansion plans. Additionally, MingMed’s YY001, a recombinant botulinum toxin candidate under clinical development, reflects the region’s focus on developing advanced, globally compliant products. These developments make Asia Pacific a key growth engine for industry developments.

Key players in the botulinum toxin industry are focusing on obtaining approval from numerous regulatory bodies around the world and establishing joint ventures to increase their market position. Established product portfolios, ongoing clinical research, and widespread distribution channels of leading firms continue to strengthen their competitive edge and sustain their dominance in the global industry.

The global market is set to reach US$ 7.1 Bn in 2025.

The market is projected to record a CAGR of 7.0% during the forecast period from 2025 to 2032.

Rising demand for minimally invasive aesthetic procedures and expanding therapeutic applications across neurology, dermatology, and pain management is expected to drive the global market.

Galderma, Allergan Aesthetics (AbbVie), Ipsen Biopharmaceuticals Inc., Supernus Pharmaceuticals, Inc., REVANCE THERAPEUTICS, Hugel, Inc., and Merz Therapeutics are a few leading players.

North America is projected to dominate the global market in 2025.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis Units |

Value: US$ Mn/Bn Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author