ID: PMRREP34482| 180 Pages | 9 Jul 2024 | Format: PDF, Excel, PPT* | Chemicals and Materials

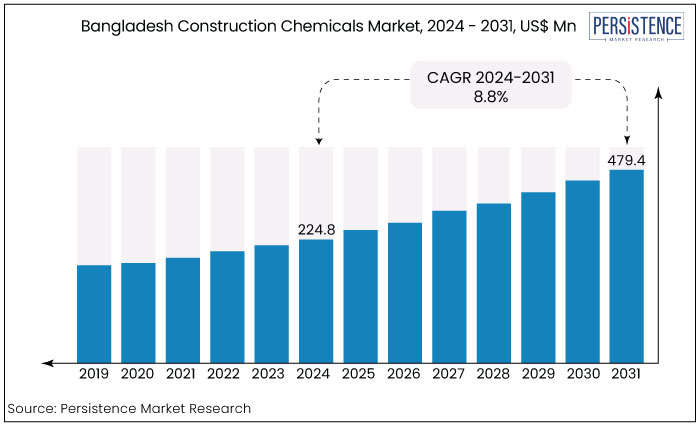

The Bangladesh construction chemicals market size is anticipated to rise from US$224.8 Mn in 2024 to US$479.4 Mn by 2033. The market is expected to exhibit a CAGR of 8.8% during the projection period from 2024 to 2033.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$224.8 Mn |

|

Projected Market Value (2033F) |

US$479.4 Mn |

|

Forecast Growth Rate (CAGR 2024 to 2033) |

8.8% |

|

Historical Growth Rate (CAGR 2018 to 2023) |

5.6% |

The Bangladesh construction chemicals market is growing significantly. This surge in the market is fueled by the rapid development of infrastructure and increasing urbanization in the country.

As economic growth and population rises, the need for modern infrastructure, such as bridges, roads, and residential complexes, also increases. These factors are pushing the construction chemicals market in Bangladesh.

The striking construction landscape has pushed the market for construction chemicals. These chemicals are major elements in enhancing the strength, durability, and performance of a wide range of construction materials.

The construction chemicals list entails a diverse range of products, such as waterproofing chemicals, sealants, admixtures, adhesives and coatings. These chemicals offer several benefits to the construction industry, including improved workability, enhanced strength, lowered permeability, and improved resistance to corrosion.

Moreover, due to the consciousness about environmental sustainability, consumer interest in eco-friendly chemicals that lower the impact of chemicals on the environment has risen.

The market shows lucrative opportunities for multinational and local manufacturers, and construction chemicals suppliers in Bangladesh. Companies are currently focusing on technological advances, innovations in products, and strategic collaborations to stay competitive and grow the business in the captive construction sector.

Further, government initiatives and regulatory support aim to develop infrastructure, which makes the construction chemicals market a key sector in Bangladesh.

The Bangladesh construction chemicals market has been growing significantly over the past few years. The market steadily rose with a 5.6% CAGR from 2019 to 2023. The market expansion is attributed to rapid infrastructure development, urbanization, and increasing focus on environmental sustainability.

The increasing infrastructure requires robust chemicals that enhance the durability, strength, and performance of construction materials. This burgeoning demand is driving demand in Bangladesh.

The growing awareness of environmental concerns favors eco-friendly construction chemicals. Government initiatives and regulatory support are playing a major role in promoting the environmental practices that drive market growth exponentially.

These all factors are expected to fuel the market remarkably. The market for Bangladesh construction chemicals is expected to reach US$479.4 Mn by 2033, which highlights the notable expansion of market shares.

Rising Infrastructure Development and Urbanization

Bangladesh is witnessing a significant increase in urbanization due to the huge number of people migrating to cities for better job opportunities.

This migration has impelled the demand for several infrastructures, including commercial, residential, and industrial, pushing the building construction chemicals industry forward.

With increasing government focus on the development of infrastructure like roads, airports, bridges, railways, and ports, the need for high-quality products that can withstand harsh weather conditions has surged.

As urbanization continues to grow, the Bangladesh construction chemicals market is likely to undergo upheld growth, highlighting lucrative opportunities in this sector.

Demand for Enhanced Performance and Sustainability

The burgeoning demand for construction materials and chemicals that can enhance material performance and meet sustainability goals. Increasing environmental concerns and rigid regulations associated with them have pressed builders and developers to opt for eco-friendly solutions that have the ability to lower negative impacts on the environment.

To address these concerns, adoption of green construction chemicals is taking the peak. These chemicals include water-based solutions and solvents, low-volatile organic compound (VOC) formulations, and bio-based additives.

Further, government plays a central role in promoting sustainable construction practices by offering incentives and green building certifications. These all efforts are propelling the adoption of eco-friendly chemicals in construction in Bangladesh.

Limited Awareness

The major challenge hampering the expansion of the Bangladesh construction chemicals market is insufficient knowledge and awareness among consumers about the advantages and proper use.

Many builders, developers, contractors, and other stakeholders may not have complete information on the available types, their features, and their applications.

Lack of knowledge about these chemicals leads to improper use or complete deletion from construction projects, which results in a lack of structural integrity and durability of infrastructure and buildings. Several Bangladesh construction chemical companies provide seminars and training programs.

For instance, in October 2023, Uttara University's Civil Engineering Department held a seminar on the use of construction chemicals in durable concrete in collaboration with ABC Construction Chemical Company Limited. The event aimed to educate construction professionals and increase awareness about the importance of construction chemicals.

Cost Sensitivity, and Budget Constraints

Bangladesh faces challenges in promoting the widespread adoption of construction chemicals due to cost sensitivity, and budget constraints. Despite long-term benefits, initial procurement and application costs may be perceived as prohibitive, leading to cheaper conventional methods and materials being preferred. This approach is impeding the awareness of advanced construction chemicals that are more beneficial for robust construction.

Further, raw material prices and currency exchange rates are continuously changing, which influences the affordability and Bangladesh construction chemical sales, making it difficult for small and medium-sized enterprises to invest and gain profit.

Growing Adoption of Advanced Construction Technologies

One of the most prominent factors emerging in the Bangladesh construction chemicals market as a game changer is the adoption of advanced and innovative technologies in construction.

As the construction chemical industry evolves, innovative technologies such as 3D printing, modular construction techniques, prefabrication, and Building Information Modeling (BIM) are integrated. These technologies offer several advantages, such as enhanced accuracy, accelerated project timelines, cost savings, and improved sustainability.

Manufacturers would seize this opportunity to offer tailored solutions to cater to the changing needs and preferences of consumers. The invention of innovative technologies is expected to propel the Bangladesh construction chemicals market shares exceptionally.

Increasing Focus on Sustainable Construction Approaches

The Bangladesh construction chemicals market highlights another notable opportunity that can take the market to the next level. This is the rising awareness of environmental problems and the need for construction solutions that lower the carbon footprint. This has increased the demand for sustainable and eco-friendly construction materials and chemicals.

Some of the primary sustainable construction chemicals include bio-based additives, low-VOC formulations, recycled materials, water-based solvents, and eco-friendly coatings.

Concrete Admixtures Lead Sales of Construction Chemicals

Based on product type, concrete admixtures such as plasticizers, and accelerators are leading the market. As these admixtures help improve infrastructure projects by improving the performance and properties of concrete.

Plasticizers, a leading segment, was held at US$17.1 Mn in 2022 and is expected to grow stably with a CAGR of 5.8% in the forecast period.

Plasticizers, like lingo, SNF, and PCE, are mainly used in construction to enhance the functionality and flowability of concrete mixtures, allowing for easy application and compaction.

Accelerators, on the other hand, quickly set and cure processes of concrete, which enable faster construction and boost productivity. These concrete admixtures offer several benefits, such as improved strength, durability, and decreased water content in the concrete. This saves the expense and enhances construction efficiency.

Waterproofing Chemical to Grow Stronger

Waterproofing chemicals held the good market share of 31.9% in 2024 with about US$ 76.6 Mn revenue. The market is expected to expand at a CAGR of 8.4% in the forecast period.

Waterproofing chemicals, including bitumen and PVC, are crucial chemicals that ensure the longevity and durability of buildings by providing compelling protection against water ingress and moisture. Bitumen is mainly applied as a coating for roofs and basements to prevent water leakage.

On the other hand, PVC provides benefits such as flexibility, durability, and resistance to biological and chemical degradation. that are suitable for horizontal and vertical waterproofing systems.

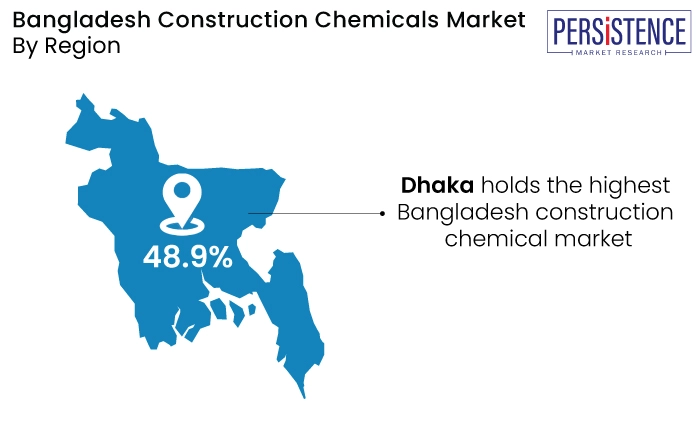

Demand Influenced by Divisional Distribution

Based on the region, Bangladesh is distributed into several divisions. Each division highlights different geographical areas with their unique soil compositions, climatic conditions, and construction practices.

Based on the division, Dhaka holds the highest Bangladesh construction chemical market share of 48.9%. The market was estimated for US$110.0 Mn in 2024, increasing with a robust CAGR of 9.0%. The Dhaka and Chittagong divisions show growth opportunities for Bangladesh of construction chemicals suppliers in the resident, urban centers, and industrial sectors. This expansion is attributable to increasing urbanization, disposable incomes, and rising investments in real estate businesses.

Divisions such as Rajshahi and Rangpur include most of the rural populations that depend on agriculture-based lifestyles, which may need relatively lower demand for advanced construction chemicals. In this area, suppliers focus on proposing reasonable and reliable products to cater to the distinctive requirements of rural construction projects.

Some divisions in Bangladesh, like Khulna, entail substantial export-oriented businesses and are expected to experience a remarkable demand. The increasing use in industrial parks, export-processing zones, and port facilities shows the link between global trade dynamics and local infrastructure development.

2024

Pidilite Industries Limited, a leading manufacturer of adhesives, sealants, and construction chemicals, partnered with Italy-based Syn-Bios to offer eco-friendly leather chemicals in India, Bangladesh, Vietnam, Nepal, and Sri Lanka. The partnership will enable Pidilite to handle sales and distribution of Syn-Bios products in Bangladesh and other countries. The collaboration aims to set new standards in the leather industry, as the country's footwear, leather, and leather product exports show significant growth potential.

2023

German chemical firm Rudolf GmbH invested in Bangladesh's textile market by constructing a new production facility in 2023. Rudolf, the well-known leading company, delivers high-quality textile auxiliaries and solutions for textile care and construction chemicals. The new plant will focus on customer service and workplace quality and will be part of Rudolf's global services as a secure and transparent fulfilment partner for brands and their supply chain partners. The investment is a strong sign of increasing facilities for construction chemicals in Bangladesh to be one of the largest contributors to the global chemical and textile industry.

The market analysis showcases the great competition among the manufacturers and suppliers. These companies are focusing on recent trends and innovations to expand their business.

Some of the Bangladesh construction chemicals market players like Sika, Pidilite Industries Ltd., Fosroc, Inc., Dow, and Akzo Nobel N.V. aim to boost their sales and market size by embracing business strategies.

Market trends are expected to fuel the market significantly, which will open novel growth opportunities in the market. Companies employ several activities, such as joint ventures, acquisitions, partnerships, and mergers, to expand their portfolio and market reach.

By Product Type

By Water Proofing Chemicals

By Adhesives & Grouts

By Flooring Compounds

As of 2024, the market is nearly US$224.8 Mn.

The market has been projected to exhibit a CAGR of 8.8% during 2023-2033.

Based on product type, concrete admixtures such as plasticizers, and accelerators are leading the market.

Based on the division, Dhaka holds the highest Bangladesh construction chemical market share of 48.9%.

Some of the leading market players include Sika, Pidilite Industries Ltd., Fosroc, Inc., Dow, and Akzo Nobel N.V.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2033 |

|

Historical Data Available for |

2018 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author