ID: PMRREP31531| 250 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

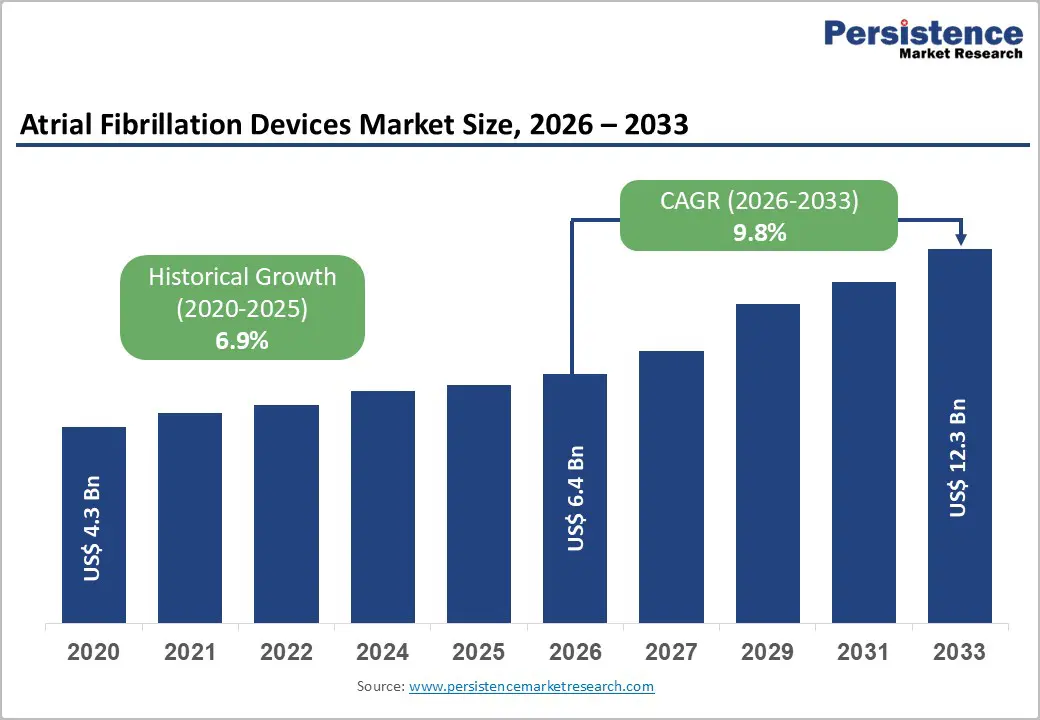

The global Atrial Fibrillation Devices market size is expected to be valued at US$ 6.4 billion in 2026 and is projected to reach US$ 12.3 billion by 2033, growing at a CAGR of 9.8% between 2026 and 2033.

The Atrial Fibrillation (AF) Devices Market is driven by the rising global prevalence of atrial fibrillation, increasing elderly population, and growing adoption of minimally invasive cardiac procedures. AF devices are widely used for diagnosis, monitoring, and treatment, including ablation, mapping, and rhythm monitoring technologies. Technological advancements such as improved catheter designs, advanced imaging, and remote monitoring systems are enhancing clinical outcomes and procedural efficiency. Hospitals and specialized cardiac centers remain the primary end users due to the availability of skilled electrophysiologists and advanced infrastructure.

| Global Market Attributes | Key Insights |

|---|---|

| Atrial Fibrillation Devices Size (2026E) | US$ 6.4 billion |

| Market Value Forecast (2033F) | US$ 12.3 billion |

| Projected Growth CAGR(2026-2033) | 9.8% |

| Historical Market Growth (2020-2025) | 6.9% |

Market Growth Drivers

Rising Prevalence of Atrial Fibrillation

Rising Prevalence of Atrial Fibrillation is a primary driver of the Atrial Fibrillation Devices Market, as the condition has become one of the most common sustained cardiac arrhythmias worldwide. The growing burden of atrial fibrillation is closely linked to aging populations, increasing life expectancy, and a higher incidence of lifestyle-related risk factors such as hypertension, diabetes, obesity, and cardiovascular disease. As more patients are diagnosed at earlier and more advanced stages, the demand for accurate diagnostic, continuous monitoring, and effective interventional treatment devices continues to rise. Additionally, improved awareness among patients and physicians, along with expanded screening programs and wearable monitoring technologies, is leading to higher detection rates of previously undiagnosed cases. The chronic and progressive nature of atrial fibrillation often requires long-term management, driving repeated use of monitoring systems and advanced ablation technologies. Furthermore, the rising risk of AF-related complications such as stroke and heart failure is encouraging timely device-based interventions, reinforcing sustained demand for atrial fibrillation devices across hospitals and cardiac care centers globally.

Advancements in Ablation Technologies

Advancements in ablation technologies are a major driver of growth in the atrial fibrillation devices market, as they continue to improve treatment precision, safety, and long-term clinical outcomes. Innovations in energy delivery systems, such as next-generation radiofrequency and cryoablation platforms, enable more controlled lesion formation while minimizing damage to surrounding cardiac tissue. The integration of advanced mapping and imaging technologies allows electrophysiologists to accurately identify arrhythmogenic pathways, reducing procedure time and repeat interventions. Improved catheter flexibility, contact-force sensing, and real-time feedback mechanisms have enhanced procedural success rates and operator confidence. Additionally, the shift toward minimally invasive and single-shot ablation systems has simplified workflows, making procedures more accessible across a wider range of healthcare settings. These technological improvements have expanded the eligible patient population, including those with persistent or complex atrial fibrillation. As clinical evidence increasingly supports the effectiveness of advanced ablation techniques over long-term drug therapy, physicians are adopting device-based interventions earlier in the treatment pathway, directly contributing to sustained demand for atrial fibrillation ablation devices worldwide.

Market Restraints

High Costs of Procedures and Devices

The high costs of procedures and devices act as a significant restraint for the atrial fibrillation (AF) devices market, limiting widespread adoption, particularly in developing regions. Ablation procedures, advanced mapping systems, and implantable monitoring devices require substantial investment in technology, infrastructure, and skilled personnel, which increases the overall treatment cost for patients. Additionally, consumables such as specialized catheters and closure devices are expensive, often placing a financial burden on hospitals and healthcare providers. Limited reimbursement coverage and low insurance penetration in many countries further exacerbate affordability challenges, discouraging patients from opting for device-based interventions. High costs also slow adoption in smaller clinics and emerging markets, where budgets and resources are constrained. Consequently, despite the proven clinical benefits and increasing prevalence of atrial fibrillation, the economic barrier posed by expensive devices and procedures remains a critical factor restraining market growth, creating a disparity in access to advanced AF treatments across different regions.

Market Opportunities

Pulsed Field Ablation Expansion

Pulsed Field Ablation (PFA) expansion presents a compelling opportunity within the atrial fibrillation devices market, driven by its potential to transform treatment paradigms through enhanced safety and efficiency. Unlike traditional thermal energy sources such as radiofrequency or cryoablation, PFA uses non-thermal electric fields to selectively target cardiac tissue while sparing surrounding structures like the esophagus and phrenic nerve. This selectivity significantly reduces the risk of collateral damage and procedural complications, making it an attractive option for both clinicians and patients. Early clinical studies have demonstrated promising outcomes with shorter procedure times, rapid lesion formation, and a favorable safety profile, encouraging broader adoption. As more regulatory approvals are granted and long term data accumulate, PFA technology is poised to gain traction among electrophysiology practices seeking streamlined workflows and improved patient experiences. Manufacturers are investing in PFA system development and expanding their portfolios, further stimulating competition and innovation. With rising demand for safer, more effective AF treatment options, the expansion of pulsed field ablation represents a high growth avenue that could redefine standards of care in atrial fibrillation management.

Ambulatory Surgical Center Proliferation

The proliferation of ambulatory surgical centers (ASCs) presents a significant growth opportunity for the atrial fibrillation (AF) devices market, driven by the global shift toward outpatient care and cost-effective treatment models. ASCs offer a streamlined, patient-centric environment for minimally invasive cardiac procedures, including catheter ablations and device implantations, reducing hospital stays and overall healthcare costs. The increasing number of ASCs, particularly in North America and Asia Pacific, allows for greater accessibility to advanced AF treatments, even in regions with limited hospital infrastructure. These centers are increasingly equipped with state-of-the-art electrophysiology labs, advanced imaging, and monitoring technologies, enabling complex procedures with high efficiency and safety. Moreover, ASCs provide flexible scheduling, shorter waiting times, and lower procedural costs compared to traditional hospitals, attracting both patients and healthcare providers. This expansion encourages device manufacturers to tailor their offerings for outpatient settings, such as compact mapping systems, single-shot ablation catheters, and portable monitoring devices. As a result, the growth of ASCs not only enhances patient access to atrial fibrillation therapies but also drives increased adoption of advanced AF devices globally.

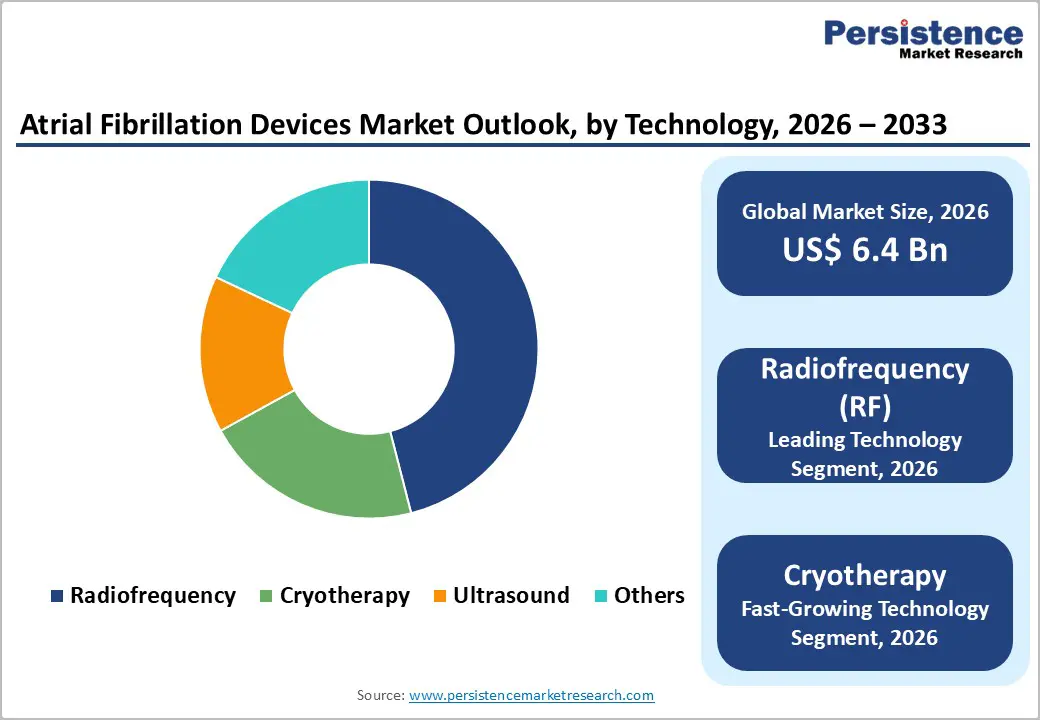

Technology Analysis

Radiofrequency (RF) technology accounts for the highest share in the atrial fibrillation (AF) devices market due to its long-standing clinical acceptance, proven efficacy, and versatility in treating diverse AF cases. RF ablation delivers controlled thermal energy to targeted cardiac tissue, creating precise lesions that disrupt abnormal electrical pathways responsible for arrhythmias. Its widespread adoption is supported by extensive clinical evidence demonstrating high success rates, low complication risks, and durable outcomes, making it the preferred choice among electrophysiologists worldwide. Additionally, continuous technological enhancements, such as contact-force sensing catheters, 3D electroanatomical mapping integration, and improved energy delivery systems, have further increased procedural accuracy and safety. RF devices are compatible with a broad range of AF patient profiles, including paroxysmal and persistent cases, which expands their clinical applicability. Compared to alternative technologies like cryoablation or emerging modalities, RF systems benefit from established training programs, global availability, and familiarity among healthcare providers. These factors collectively reinforce RF technology’s dominance, driving sustained market share growth and solidifying its position as the leading choice in AF ablation therapies worldwide.

End User Analysis

Hospitals dominate the end-use segment in the atrial fibrillation (AF) devices market due to their comprehensive infrastructure, availability of skilled specialists, and ability to perform complex cardiac procedures. Treating atrial fibrillation often requires advanced electrophysiology labs, high-end imaging systems, and real-time monitoring, which hospitals are best equipped to provide. They also offer multidisciplinary care, including cardiologists, anesthesiologists, and nursing staff, ensuring patient safety and better procedural outcomes during ablations, device implantations, and monitoring interventions. Moreover, hospitals can manage high-risk or complicated cases, such as persistent or recurrent AF, which may involve prolonged observation or follow-up. High patient footfall, insurance coverage, and established referral networks further strengthen hospitals’ position as the primary end user for AF devices. Additionally, hospitals often invest in the latest ablation technologies, mapping systems, and implantable monitoring devices, enabling them to adopt innovative solutions faster than smaller clinics or outpatient centers. Collectively, these factors make hospitals the most significant contributor to market revenue, accounting for the highest share in the atrial fibrillation devices segment globally.

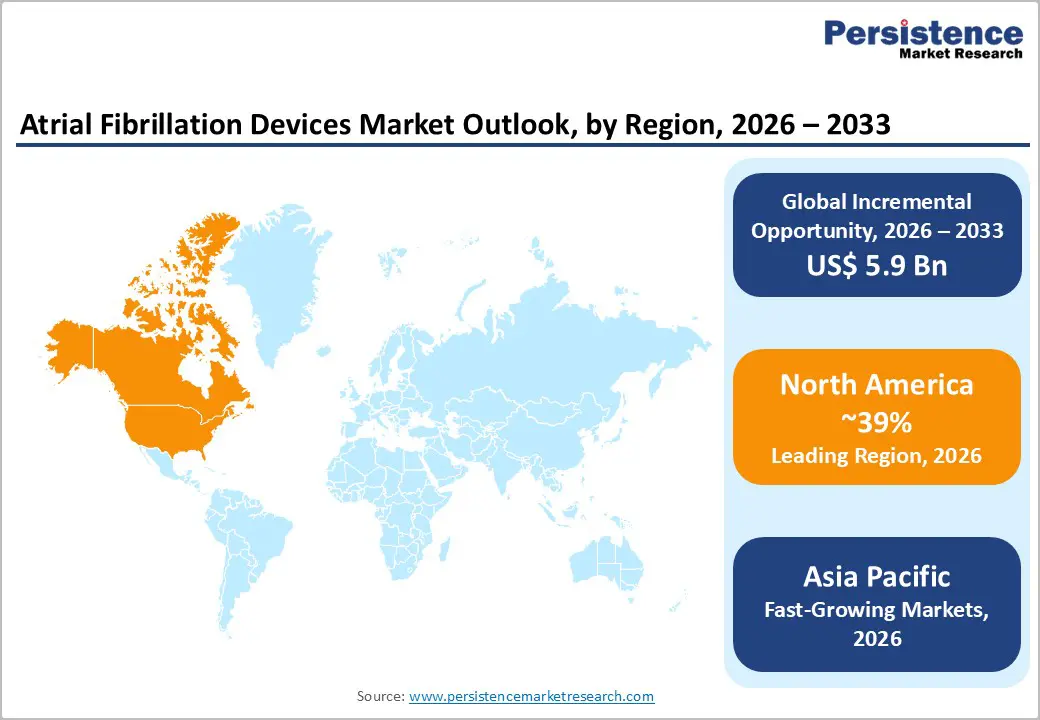

North America Atrial Fibrillation Devices Market Trends

North America leads the atrial fibrillation (AF) devices market due to its advanced healthcare infrastructure, high prevalence of cardiovascular disorders, and early adoption of innovative technologies. The region benefits from a strong network of specialized cardiac centers and hospitals equipped with state-of-the-art electrophysiology labs, enabling widespread use of ablation devices, mapping systems, and implantable monitoring solutions. Technological innovation is a key trend, with manufacturers introducing next-generation radiofrequency and cryoablation catheters, wearable ECG monitors, and remote monitoring platforms, driving procedural efficiency and improved patient outcomes. Favorable reimbursement policies and high insurance coverage further support patient access to device-based AF therapies. Additionally, North America is witnessing a growing emphasis on minimally invasive procedures, outpatient ablations, and integration of AI-driven mapping and imaging solutions, enhancing procedural precision. The aging population, coupled with rising awareness of atrial fibrillation and proactive cardiac care, is sustaining market demand. Strategic collaborations between device manufacturers, hospitals, and research institutions are also accelerating clinical adoption, solidifying North America’s position as the leading region in the global atrial fibrillation devices market.

Asia Pacific Atrial Fibrillation Devices Market Trends

The Asia Pacific is emerging as a high-growth region in the atrial fibrillation (AF) devices market, driven by rising prevalence of cardiovascular disease, expanding healthcare infrastructure, and increasing awareness of advanced cardiac care. Countries such as China, India, Japan, and South Korea are witnessing rapid growth in the adoption of ablation devices, implantable monitors, and mapping systems due to improvements in hospital capabilities and the establishment of specialized cardiac centers. Government initiatives to enhance healthcare access, coupled with rising insurance penetration, are making device-based AF therapies more affordable and accessible to a broader patient population. Minimally invasive procedures, outpatient ablations, and remote monitoring solutions are gaining traction, aligning with patient preferences for convenient and efficient care. Furthermore, increasing collaborations between global device manufacturers and regional healthcare providers are accelerating technology transfer and clinical adoption. With the combination of a growing patient pool, favorable policies, and technological expansion, Asia Pacific is poised to witness robust demand and represents one of the fastest-growing markets for atrial fibrillation devices globally.

Market Structure Analysis

The competitive landscape of the atrial fibrillation (AF) devices market is characterized by intense rivalry among key players focusing on innovation, product differentiation, and strategic partnerships. Companies are investing heavily in research and development to introduce advanced ablation catheters, mapping systems, and implantable monitoring devices that improve procedural efficiency and patient outcomes. Strategic initiatives such as collaborations with hospitals, acquisitions, and geographic expansion are common to strengthen market presence. Continuous technological advancements, including minimally invasive systems, remote monitoring, and AI-driven solutions, are shaping competition.

Key Market Developments

Valued at US$ 6.4 billion in 2026, reaching US$ 12.3 billion by 2033 at 9.8% CAGR.

AF prevalence surge to 60 million cases globally drives diagnostics and ablations.

North America at 39% 2025 share, via U.S. regulatory and innovation edge.

PFA expansion with 32% CAGR, safer ablation for wider patient access.

Biosensense Webster, Inc. (Johnson & Johnson), Abbott Laboratories, Medtronic Plc, Boston Scientific Corporation

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Product

Technology

End User

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author