ID: PMRREP34604| 250 Pages | 2 Feb 2026 | Format: PDF, Excel, PPT* | Healthcare

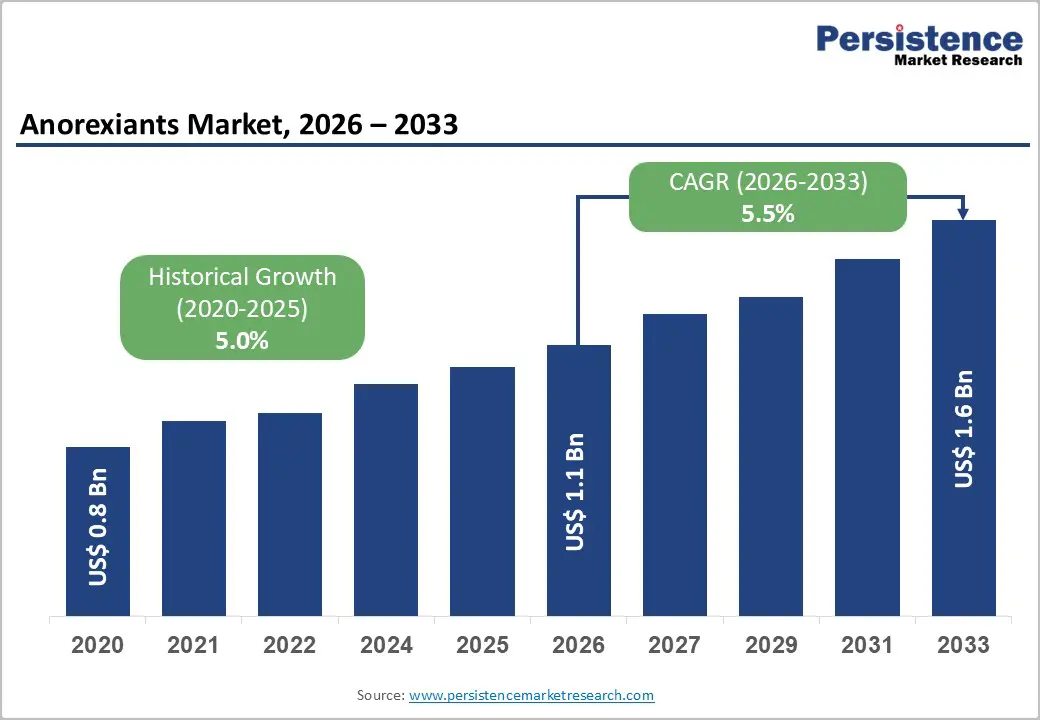

The global anorexiants market size is likely to be valued at US$1.1 billion in 2026, and is expected to reach US$1.6 billion by 2033, growing at a CAGR of 5.5% during the forecast period from 2026 to 2033, driven by the increasing prevalence of obesity and weight-related comorbidities, rising demand for prescription weight-loss pharmacotherapy, and growing acceptance of combination anorexiants for long-term management. Growing demand for effective, centrally-acting anorexiants, especially serotonin anorexiants for obesity and weight loss indications, is accelerating adoption across distribution channels. Advances in next-generation catecholamine anorexiants with improved safety profiles are further boosting uptake by offering better tolerability and sustained efficacy. Increasing recognition of anorexiants as critical adjuncts to lifestyle intervention in obesity treatment guidelines remains a major driver of market growth.

| Report Attribute | Details |

|---|---|

|

Anorexiants Market Size (2026E) |

US$1.1 Bn |

|

Market Value Forecast (2033F) |

US$1.6 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

5.5% |

|

Historical Market Growth (CAGR 2020 to 2025) |

5.0% |

Rising Demand for Obesity and Prescription Weight-Loss Pharmacotherapy

The rising demand for obesity and prescription weight-loss pharmacotherapy reflects a convergence of medical, social, and economic factors. Globally, obesity rates have surged due to sedentary lifestyles, high-calorie diets, urbanization, and stress-linked behaviors. More individuals are developing cardiometabolic conditions such as type 2 diabetes, hypertension, and dyslipidemia, which are directly linked to excess weight. This shift has pushed both patients and healthcare providers to seek effective, long-term solutions beyond lifestyle changes alone.

Recent advances in pharmacotherapy have introduced medications that not only support weight reduction but also improve metabolic health markers. These drugs, often based on hormones such as GLP-1 analogs, offer clinically significant results when combined with lifestyle interventions. Their emergence has increased patient interest as awareness grows through physician advocacy and media coverage. Broader acceptance of obesity as a chronic disease rather than a lifestyle choice has reduced stigma and encouraged insurance coverage in some regions. This cultural shift empowers individuals to pursue medical treatment.

Safety Concerns and Regulatory Scrutiny

Safety concerns and regulatory scrutiny around obesity and prescription weight-loss pharmacotherapy stem from the complex balance between treatment benefits and potential risks. Weight-loss drugs act on physiological pathways that influence appetite, metabolism, or nutrient absorption, meaning even small disruptions can impact multiple organ systems. Historically, some weight-loss medications were linked to serious adverse effects such as cardiovascular issues, psychiatric symptoms, or gastrointestinal complications, which raised alarms in the medical community and among regulators. These outcomes highlight that pharmacotherapy is not inherently risk-free and must be carefully evaluated in diverse patient populations.

Regulatory agencies such as the U.S. FDA and Europe’s EMA have responded by tightening approval pathways, requiring more comprehensive safety data from long-term clinical trials. Post-marketing surveillance has also intensified, with requirements for risk evaluation and mitigation strategies, transparent reporting of adverse events, and periodic safety updates. Regulators are particularly cautious about off-label use and the potential for misuse in individuals without clear clinical indications. Physicians and patients share these safety concerns. Clinicians are vigilant about contraindications and drug–drug interactions, especially in individuals with complex health conditions.

Innovations in Next-Generation Combinations and Personalized Obesity Pharmacotherapy

Innovations in next-generation combinations and personalized obesity pharmacotherapy are reshaping how clinicians approach weight management by tailoring treatments to individual biology and improving therapeutic outcomes. Traditional obesity drugs often act through single mechanisms such as appetite suppression or nutrient absorption, but human metabolism is highly complex, involving hormonal regulation, neural pathways, and genetic factors. Next-generation combination therapies strategically target multiple pathways at once, enhancing effectiveness while potentially reducing side effects by allowing lower doses of each component. For example, pairing agents that reduce hunger signals with those that enhance energy expenditure can produce synergistic effects that better reflect the body’s integrated systems.

Personalization is another major advancement. Rather than a one-size-fits-all model, clinicians increasingly consider genetic profiles, metabolic rates, lifestyle factors, and comorbid conditions when selecting or adjusting pharmacotherapy. Advances in biomarkers and digital health tools, such as continuous glucose monitors and AI-driven metabolic assessments, help identify which patients are most likely to respond to specific drug combinations. This reduces trial-and-error prescribing and improves patient satisfaction.

Indication Insights

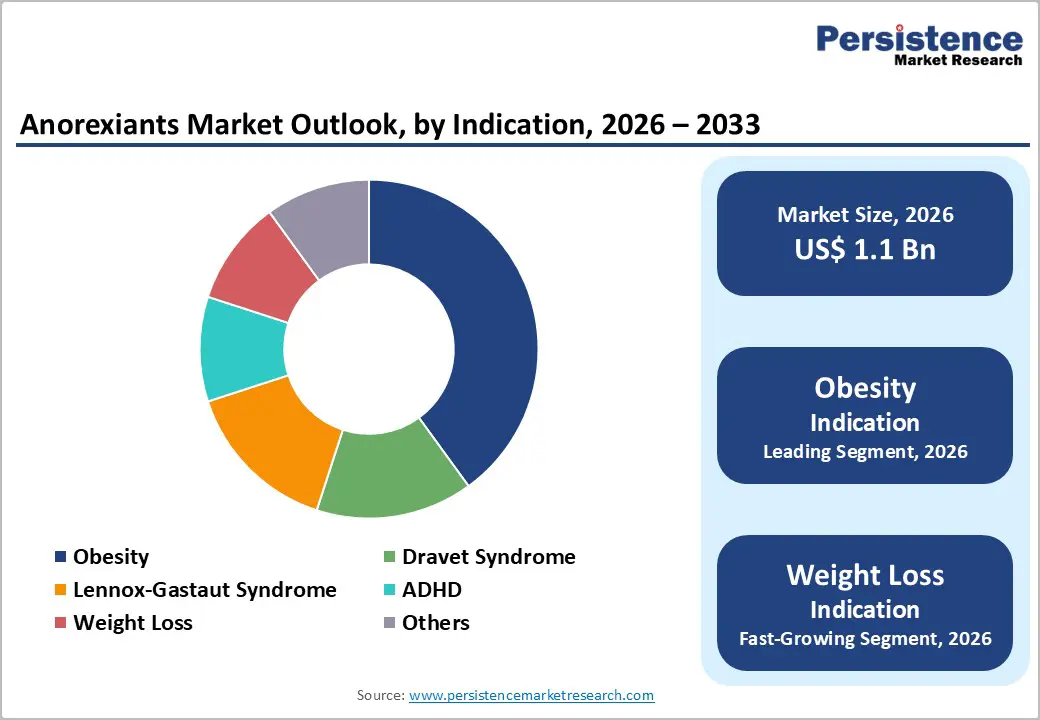

Obesity is anticipated to lead the market, holding 65% of the share in 2026, driven by its rapidly growing prevalence and its strong association with multiple chronic health conditions. Rising rates of sedentary lifestyles, calorie-dense diets, and urbanization have expanded the obese population across both developed and emerging economies. Healthcare providers increasingly recognize obesity as a chronic, treatable disease, driving higher diagnosis and treatment rates. Eli Lilly’s weight-loss drug Mounjaro (tirzepatide) rapidly became a top seller in India’s obesity treatment market after its launch in March 2025. Within months, it recorded sales worth around ?100 crore (≈ US$11.4 million) in October 2025, surpassing many traditional medicines to become one of the highest-selling drugs in the country by value. This strong uptake reflects both high demand for effective obesity pharmacotherapy and shifting prescriber preferences toward GLP-1 and related agents that significantly reduce body weight in obese patients.

Weight loss is likely to be the fastest-growing indication, and rising health awareness is driving individuals to actively seek medical support for sustainable weight reduction. Lifestyle changes alone often fail to deliver long-term results, increasing reliance on prescription therapies that offer clinically meaningful outcomes. Advances in drug efficacy and tolerability have expanded use beyond severe obesity to overweight individuals with metabolic risk factors. Social acceptance of medical weight management, growing physician confidence, and wider access through specialty clinics and digital healthcare platforms are accelerating adoption. The oral version of Novo Nordisk’s Wegovy (semaglutide) has seen an exceptional launch in the U.S. since it hit the market in early 2026. In just a few weeks, weekly prescriptions surged from about 4,286 to over 20,392, a nearly five-fold increase in demand following the introduction of the weight-loss pill, far exceeding typical adoption rates for new therapies.

Drug Class Insights

Serotonin anorexiants are expected to lead the market, holding 58% of the share in 2026, driven by their direct action on brain pathways that regulate appetite and satiety, making them effective for reducing food intake. These drugs influence serotonin receptors to suppress hunger signals, helping patients achieve meaningful weight loss when combined with lifestyle changes. Their pharmacological profile often offers better tolerability and adherence compared with older stimulant-based agents, encouraging broader clinician use. Lorcaserin, developed by Arena Pharmaceuticals and marketed in the U.S. under the brand name Belviq®. Lorcaserin is a selective serotonin 5-HT?C receptor agonist that works by activating serotonin pathways in the brain to increase feelings of fullness and reduce food intake, leading to clinically meaningful weight loss in patients with obesity when combined with diet and exercise.

Catecholamine anorexiants are likely to be the fastest-growing drug class, as they act on the body’s sympathetic nervous system to reduce appetite and modestly increase energy expenditure. By enhancing the levels of neurotransmitters such as norepinephrine and dopamine, these drugs help suppress hunger signals more effectively than many older agents, making them attractive to clinicians and patients seeking rapid initial results. Their growing popularity also reflects improvements in safety profiling and formulation, which reduce cardiovascular and central nervous system side effects that previously limited their use. Qsymia® is a combination product developed by VIVUS, Inc. that includes phentermine (a catecholamine/adrenergic stimulant) and topiramate. Phentermine works by increasing norepinephrine signaling in the central nervous system, reducing appetite and supporting weight loss, while topiramate enhances satiety and caloric reduction.

Distribution Channel Insights

Retail pharmacy is expected to dominate the market, contributing nearly 52% of revenue in 2026, as it provides the most direct and accessible channel for patients to obtain prescription medications. Retail pharmacies offer widespread geographic coverage, extended operating hours, and immediate dispensing, making them convenient for individuals seeking chronic weight?management treatments. Pharmacists are crucial in offering counseling, monitoring medication adherence, and providing guidance on potential side effects, which helps enhance patient confidence in their treatment. Retail pharmacies, such as Kroger, Walmart, and Rite Aid, have seen a substantial rise in sales due to prescriptions for weight-loss medications such as Wegovy and Ozempic from Novo Nordisk. These GLP-1-based drugs, commonly prescribed for obesity and weight management, are mainly dispensed through these pharmacies, where patients also benefit from counseling and ongoing support.

The online pharmacy segment represents the fastest-growing distribution channel, due to its convenience, accessibility, and discreet service. Patients can order prescription drugs from home, schedule recurring deliveries, and access telehealth consultations for prescriptions, eliminating the need for frequent in-person visits. The COVID-19 pandemic accelerated the adoption of digital healthcare solutions, creating lasting shifts in patient behavior. Online platforms often offer wider geographic reach, including rural or underserved areas, and integrate digital adherence tools and reminders, which enhance treatment compliance. Hims & Hers Health, Inc., a U.S. telehealth and online pharmacy company, has expanded its offerings to include access to prescription weight?loss medications such as Wegovy from Novo Nordisk through its digital platform. Patients can complete an online consultation with a licensed clinician and have prescriptions filled and shipped directly to their homes, bypassing traditional retail pharmacy visits.

North America Anorexiants Market Trends

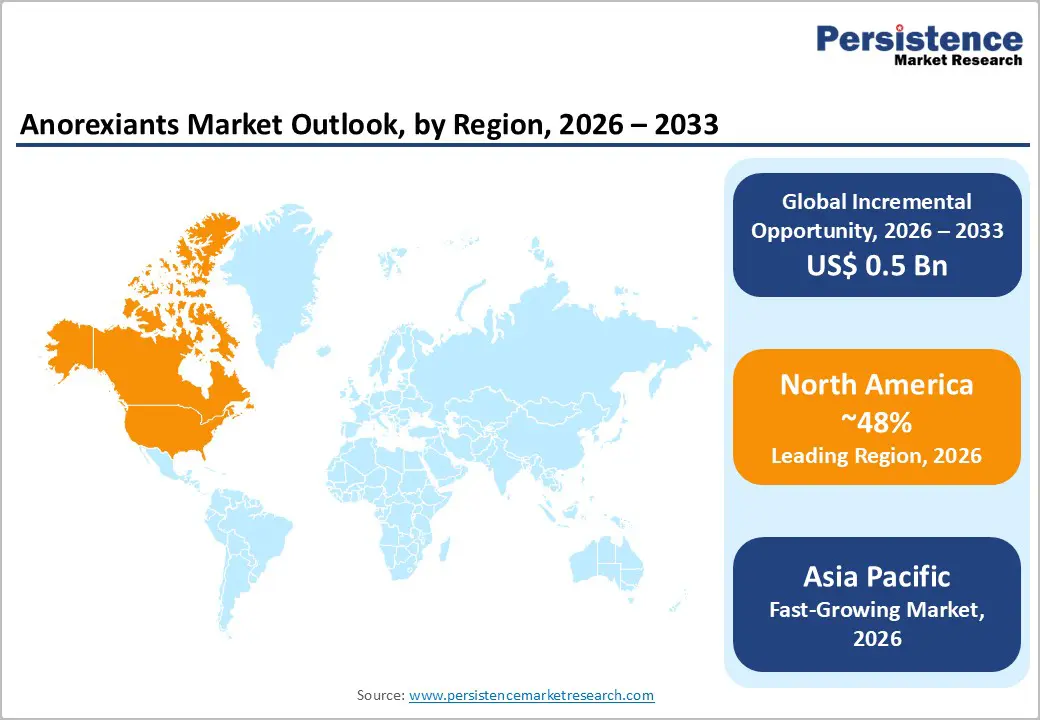

North America is projected to lead the market, accounting for nearly 48% of the share in 2026, driven by the region’s high obesity prevalence, strong reimbursement support for chronic pharmacotherapy, and high public awareness of prescription weight-loss benefits. Distribution systems in the U.S. and Canada provide extensive support for anorexiants programs, ensuring wide accessibility across obesity, weight loss, and ADHD populations. Increasing demand for serotonin anorexiants, convenient, and easy-to-prescribe forms is further accelerating adoption, as these formats improve adherence and reduce barriers associated with lifestyle-only management. Qsymia has been approved by the U.S. FDA as a long-term treatment for obesity and overweight adults with comorbidities, demonstrating significant weight loss compared with placebo in clinical trials and prompting increased prescriptions as clinicians expand pharmacologic options for obesity management.

Innovation in anorexiants technology, including stable combination, improved tolerability, delivery, and targeted personalized enhancement, is attracting significant investment from both public and private sectors. Government initiatives and CMS campaigns continue to promote use against obesity risks, comorbidity burden, and emerging metabolic threats, creating sustained market demand. The growing focus on weight-loss grades and specialty uses, particularly for binge-eating and others, is expanding the target applications for anorexiants.

Europe Anorexiants Market Trends

Market growth in Europe is propelled by increasing awareness of pharmacotherapy benefits, strong regulatory systems, and government-led obesity-control programs. Countries, such as Germany, France, Italy, and Spain, have well-established healthcare frameworks that support routine anorexiants prescribing and encourage the adoption of innovative drug delivery methods, including anorexiants. These effective formulations are particularly appealing for obesity populations, regulation-conscious physicians, and weight-loss users, improving outcomes and coverage rates.

Technological advancements in anorexiants development, such as enhanced combination regimens, application-targeted delivery, and improved safety grades, are further boosting market potential. European authorities are increasingly supporting research and trials for anorexiants against both routine and specialized needs, strengthening market confidence. The growing emphasis on convenient, monitored options is aligned with the region’s focus on preventive metabolic care and reducing healthcare burden. Public awareness campaigns and promotion drives are expanding reach in both urban and rural areas, while sponsors are investing in real-world evidence and novel variants to increase adoption.

Asia Pacific Anorexiants Market Trends

Asia Pacific is likely to be the fastest-growing market for anorexiants in 2026, driven by rising obesity awareness, increasing government initiatives, and expanding application programs across the region. Countries such as China, India, Japan, and South Korea are actively promoting anorexiants campaigns to address metabolic growth and emerging weight-management needs. Anorexiants are particularly attractive in these regions due to their scalable administration, ease of access, and suitability for large-scale obesity drives in both urban and rural populations.

Technological advancements are supporting the development of stable, effective, and easy-to-prescribe anorexiants, which can withstand challenging reimbursement conditions and minimize adherence dependence. These innovations are critical for reaching domestic patients and improving the overall treatment coverage. The growing demand for obesity, weight loss, and ADHD applications is contributing to market expansion. Public-private partnerships, increased healthcare expenditure, and rising investments in anorexiants research and distribution capacity are further accelerating growth. The convenience of anorexiants' delivery, combined with improved efficacy and reduced risk of non-response, positions them as a preferred choice.

The global anorexiants market features competition between established metabolic giants and emerging specialty players. In North America and Europe, Novo Nordisk A/S and Eisai Co., Ltd. lead through strong R&D, distribution networks, and guideline inclusion, bolstered by innovative GLP-1 combination and serotonin programs. In Asia Pacific, domestic generics advance with cost-competitive solutions, enhancing accessibility. Combination delivery boosts efficacy, cuts monotherapy risks, and enables mass integrations across prescribers. Strategic partnerships, collaborations, and acquisitions merge expertise, expand portfolios, and speed commercialization. Personalized formulations solve response issues, aiding penetration in refractory obesity areas.

Key Industry Developments

The global anorexiants market is projected to reach US$1.1 billion in 2026.

Rising obesity prevalence and demand for prescription weight-loss pharmacotherapy are key drivers.

The anorexiants market is poised to witness a CAGR of 5.5% from 2026 to 2033.

Next-generation combinations and personalized obesity pharmacotherapy are key opportunities.

Novo Nordisk A/S, Eisai Co., Ltd., Arena Pharmaceuticals, Inc., Vivus, Inc., and Rhythm Pharmaceuticals, Inc. are the key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020–2025 |

|

Forecast Period |

2026–2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Indication

By Drug Class

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author