ID: PMRREP26443| 210 Pages | 7 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

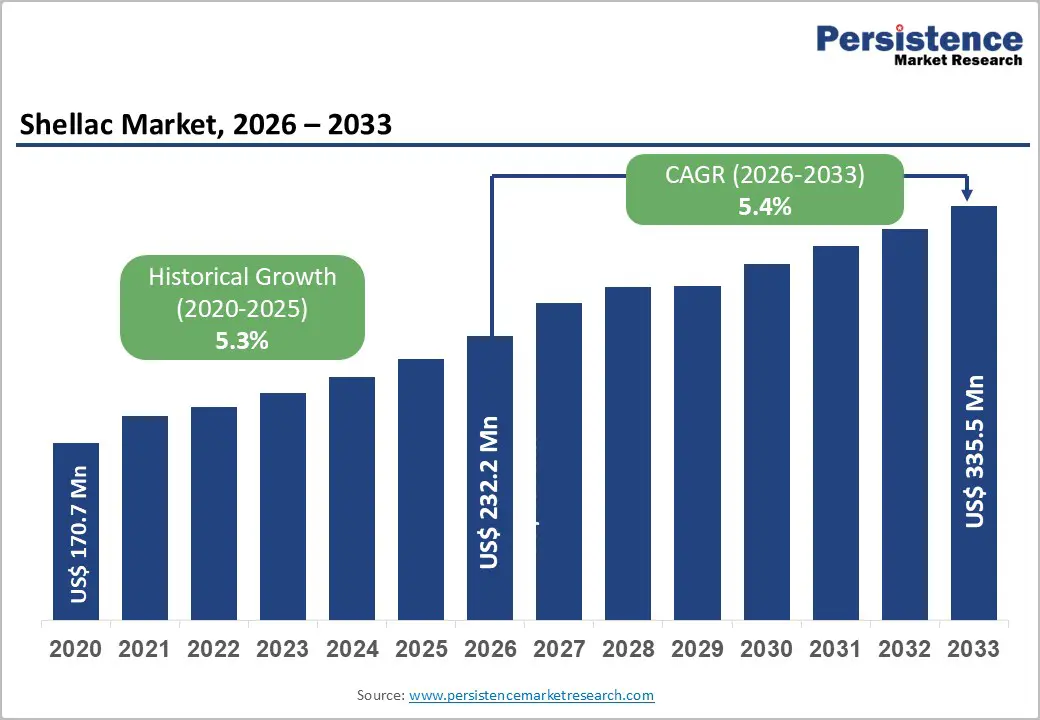

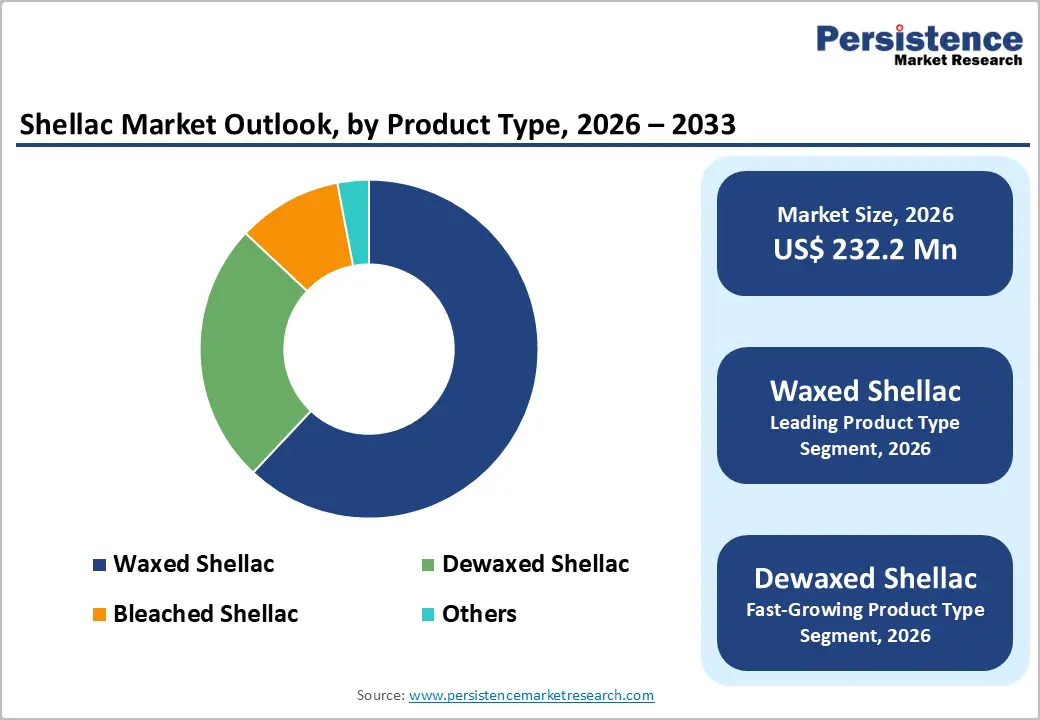

The global shellac market size is likely to be valued at US$ 232.2 million in 2026, and is projected to reach US$ 335.5 million by 2033, growing at a CAGR of 5.4% during the forecast period 2026−2033. Market expansion is characterized by steady, structurally supported growth driven by rising demand for natural, bio-based, and food-grade coating materials across food, pharmaceutical, cosmetic, and woodworking applications.

Shellac has regulatory acceptance as a Generally Recognized as Safe (GRAS) substance by agencies such as the United States Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), which reinforces adoption, particularly in edible coatings and pharmaceutical encapsulation. Growth momentum is further supported by increasing clean-label initiatives in packaged food and beverage products, where shellac is used as a glazing and protective agent.

| Key Insights | Details |

|---|---|

|

Shellac Market Size (2026E) |

US$ 232.2 Mn |

|

Market Value Forecast (2033F) |

US$ 335.5 Mn |

|

Projected Growth (CAGR 2026 to 2033) |

5.4% |

|

Historical Market Growth (CAGR 2020 to 2025) |

5.3% |

The pharmaceutical and food industries have consistently driven demand for shellac due to their structural reliance on safe, compliant, and naturally derived coating materials that ensure product integrity and regulatory alignment. Pharmaceutical manufacturers have prioritized coating solutions that provide moisture protection, taste masking, and controlled release, while also ensuring compatibility with active pharmaceutical ingredients. Shellac has supported these requirements by offering strong film formation, stability across various dosage forms, and regulatory approval for human consumption. Its integration into routine formulation processes has enabled consistent material demand, aligning with the ongoing expansion of healthcare access and rising medicine consumption worldwide.

The food industry has reinforced this demand by emphasizing clean labeling, ingredient transparency, and natural surface protection methods. Shellac has been widely used to enhance shelf life, maintain appearance consistency, and protect products from environmental exposure in confectionery, fresh produce, and nutraceuticals. Food processors have adopted shellac to align their formulations with regulatory standards and evolving consumer expectations for natural ingredients. Its regular application in high-volume food processing operations has established stable procurement patterns. The combined dependence from pharmaceutical and food manufacturing systems has positioned shellac as a structurally embedded material, supporting long-term industry growth and uninterrupted supply continuity.

Competition from synthetic alternatives has emerged as a significant restraint for natural coating materials, driven by their cost efficiency, reliable supply, and formulation flexibility that appeal to large-scale manufacturers. Synthetic coatings have delivered predictable quality, uniform composition, and stable availability, which are not affected by agricultural or climatic factors. Industrial buyers have prioritized these materials to maintain uninterrupted production schedules and standardized output, which has strengthened their preference for synthetic substitutes in high-volume operations.

Synthetic alternatives have also benefited from ongoing innovation in polymer science, enabling tailored performance characteristics such as enhanced durability, precise solubility control, and extended shelf stability. These attributes have aligned with evolving technical requirements across pharmaceuticals, food processing, and industrial applications. Synthetic materials have supported simplified storage, longer usability periods, and broader compatibility in formulations, reducing operational complexity for manufacturers. Companies have favored materials with scalable supply chains and minimal risks of variability, further reinforcing the competitive position of synthetic coatings in the market.

Innovations in sustainable product engineering have emerged as a prime opportunity, fueled by growing corporate dedication to eco-friendly materials and sustained regulatory compliance. Manufacturers in the food, pharmaceutical, and personal care sectors have favored renewable resources that advance sustainability goals and ethical sourcing practices. Shellac has fulfilled these needs via its inherent natural composition, full biodegradability, and adherence to food-grade as well as pharmaceutical regulations. Targeted advancements in purity enhancement, advanced processing methods, and tailored application variants have elevated its value in high-end, regulation-focused markets.

Momentum in research and development is forging routes to superior functionality independent of synthetic components. Scientists have concentrated on refining solubility rates, boosting film pliability, and amplifying moisture barriers to widen deployment in sophisticated coating and encapsulation technologies. Principles of green design have facilitated shellac's incorporation into clean-label offerings, plant-derived recipes, and minimal-chemical workflows. Companies have harnessed such materials to foster market distinction, curb operational risks, and prepare for stricter oversight. This synergy of ecological responsibility and technical efficacy is cultivating ideal scenarios for broader market uptake and enduring viability.

Waxed shellac is poised to establish clear market leadership by capturing approximately 62% of total revenue share in 2026. Strong demand from woodworking, furniture finishing, and traditional surface protection applications has reinforced this dominant position. Cost efficiency, straightforward processing, and reliable availability have sustained widespread adoption across non-pharmaceutical industries. Its dependable sealing performance and surface enhancement capabilities have aligned perfectly with high-volume usage requirements. Well-established supply chains have cemented steady consumption patterns, making waxed shellac a structurally embedded choice for manufacturers.

Dewaxed shellac is anticipated to become the fastest-growing segment from 2026 to 2033, propelled by expanding pharmaceutical and cosmetic manufacturing activities. Rising demand for high-purity coating materials has opened new market opportunities. Superior solubility, wax-free composition, and regulatory compliance have enabled applications in enteric coatings, nutraceutical encapsulation, and premium cosmetic formulations. Technological advancements in filtration and solvent recovery processes have improved yield efficiency and production scalability. This positions dewaxed shellac as a strategic material for companies seeking premium, compliant coating solutions.

The food and beverage segment is poised to dominate with a forecasted 58% of the shellac market revenue share in 2026, supported by the extensive use of the material in confectionery glazing, fruit coatings, and edible films. Shellac ensures visual appeal, shelf-life extension, and protection against moisture and oxidation, supporting high-volume production requirements. Regulatory approvals across major economies reinforce consistent adoption among multinational food processors. Established supply chains and standardized application processes strengthen its integration into routine manufacturing, making the food and beverage segment the primary revenue contributor in global consumption.

The pharmaceutical segment is estimated to be the fastest-growing segment from 2026 to 2033, driven by rising tablet and capsule production and increasing demand for controlled-release formulations. Moisture resistance, functional coating properties, and regulatory compliance make shellac indispensable in solid dosage forms, particularly in generics manufacturing hubs. The adoption of shellac in the pharmaceutical formulations is likely to be further accelerated by the growing need for stable, high-quality coatings in enteric and nutraceutical products.

Specialty stores are anticipated to secure around 35% of the market revenue in 2026, powered by their ability to provide expert guidance and curated shellac grades for woodworking, cosmetic, and specialty applications. Industrial buyers rely on these stores for consistent quality, technical support, and application-specific solutions. Wholesalers within this segment also facilitate bulk supply for pharmaceutical and food industries, ensuring uninterrupted production. Strong trust, long-term supplier relationships, and product expertise reinforce specialty stores as the primary channel for high-value and precision-dependent applications.

Online stores are expected to be the fastest-growing segment during the 2026–2033 forecast period, propelled by increased adoption among small and medium-sized enterprises seeking niche shellac grades. E-commerce platforms enhance accessibility, reduce procurement lead times, and lower operational costs. Small & medium enterprises (SMEs) benefit from convenient ordering, flexible quantities, and assured quality, enabling agile production processes. Expanding digital infrastructure and growing comfort with online sourcing establish this segment as a high-growth channel within decentralized and emerging market applications.

North America holds a significant position in the shellac market due to well-established pharmaceutical, food, and personal care industries that prioritize natural and functional coating materials. Strong regulatory frameworks support safe and compliant use of shellac in edible and pharmaceutical applications. High consumer awareness around clean-label and sustainable ingredients encourage adoption across packaged food, nutraceuticals, and cosmetic products. Established industrial infrastructure and advanced manufacturing facilities ensure consistent production and supply of high-quality shellac for large-scale applications. Strategic partnerships between suppliers and manufacturers support reliability in procurement and integration into routine production processes. Demand from pharmaceutical manufacturers, particularly for tablet and capsule coatings, reinforces leadership by providing stable consumption channels.

North America is also expected to witness steady growth in the shellac market with expanding applications in food processing, pharmaceuticals, and personal care segments. Rising interest in natural and renewable materials encourages manufacturers to replace synthetic coatings with shellac for sustainability and compliance purposes. Investment in modern processing technologies improves product consistency, enhances functional performance, and reduces production inefficiencies. Retail and distribution networks facilitate efficient access to both large manufacturers and small-scale formulators, supporting broad adoption. Increasing focus on innovation in specialty coatings and high-value end-use applications creates opportunities for product differentiation and higher margins.

Europe holds a key position in the shellac market due to mature pharmaceutical, food, and cosmetic industries that emphasize natural and bio-based coating materials. Regulatory frameworks across multiple countries ensure compliance with food safety and pharmaceutical standards, supporting widespread adoption in edible coatings, tablet and capsule formulations, and cosmetic finishes. Strong consumer demand for clean-label and sustainable products encourages manufacturers to integrate shellac into high-value applications. Advanced manufacturing capabilities and established supply chains provide reliable access to high-quality shellac, ensuring consistent production for large-scale industrial use.

Increasing consumer preference for natural and biodegradable materials encourages adoption across confectionery, tablet coatings, and surface finishes. Investment in research and development enables improvements in shellac purity, solubility, and application-specific performance, opening opportunities for premium product offerings. Efficient logistics, e-commerce adoption, and collaboration among suppliers and manufacturers improve market accessibility for both large and small-scale producers.

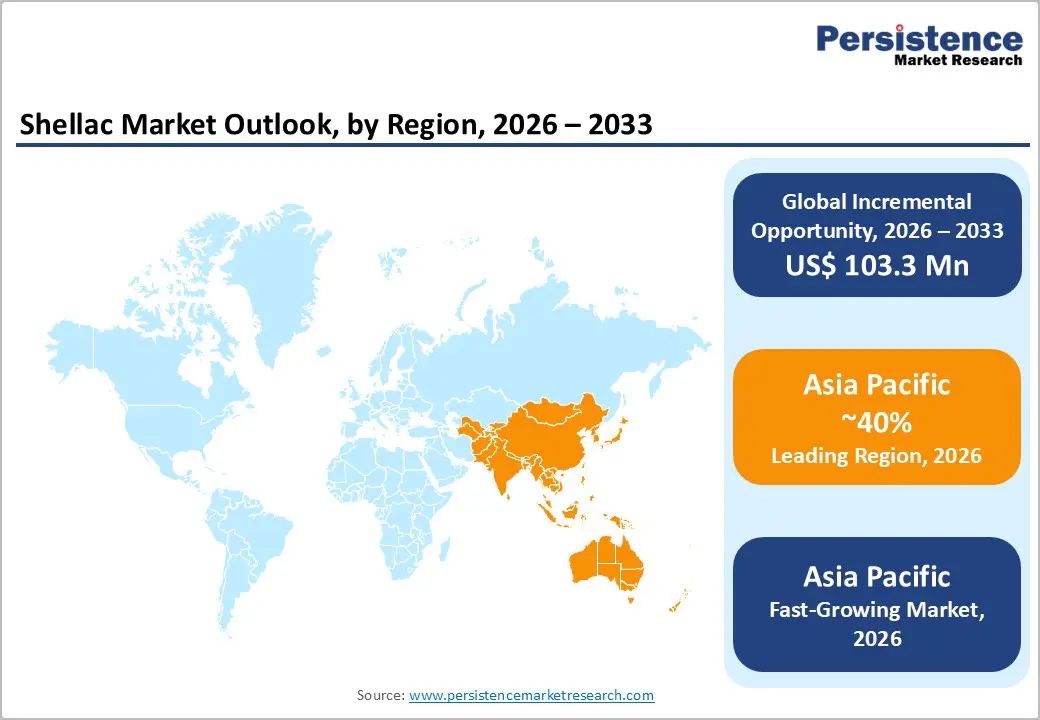

By 2026, Asia Pacific is expected to lead with an estimated 40% of the shellac market share, propelled by expansive industrial base, growing food and pharmaceutical manufacturing, and increasing adoption of natural and functional coatings. High-volume production hubs in countries such as India and China benefit from local raw material availability, cost-effective supply chains, and regulatory alignment with international standards. Rising urbanization, strong consumer demand for processed foods, nutraceuticals, and cosmetics, and robust agricultural lac production further reinforce Asia Pacific dominance in shellac consumption.

Asia Pacific is also poised to be the fastest-growing market for shellac during the 2026–2033 forecast period, driven by strategic industrial expansion, investments in healthcare and personal care sectors, and the proliferation of small and medium-sized enterprises adopting natural coatings. Rising awareness of clean-label and natural ingredient formulations is encouraging adoption across food, beverage, and cosmetic segments. Advances in local processing technologies, including filtration and solvent recovery, enhance product quality and production efficiency. Expansion of modern distribution networks and e-commerce platforms supports wider accessibility, while policy incentives for sustainable and renewable materials further accelerate growth.

The global shellac market structure exhibits moderate consolidation, with key players controlling a significant portion of supply through specialized production and processing capabilities. Mantrose-Haeuser Co., Inc., Stroever GmbH & Co. KG, G.K. Shellac Industries, S.S. Shellac Industries, and Shellac Export Promotion Council Members lead the industry by offering high-quality shellac grades for food, pharmaceutical, and industrial applications. Their scale and technical expertise allow them to serve diverse end-use sectors efficiently, ensuring consistent quality and functional performance across regional and international markets.

These leading players benefit from integrated supply chains and established distribution networks, providing reliable delivery to manufacturers in pharmaceuticals, food processing, cosmetics, and woodworking applications. Strategic investments in processing technologies, filtration, and solvent recovery optimize operational efficiency and reduce production losses. Collaboration within the Shellac Export Promotion Council and partnerships with downstream manufacturers enhance market reach and adoption.

The global shellac market is projected to reach US$ 232.2 million in 2026.

Rising demand for natural, bio-based, and food-grade coatings across food, pharmaceutical, cosmetic, and industrial applications drive the market.

The market is poised to witness a CAGR of 5.4% from 2026 to 2033.

Expansion of specialty applications in pharmaceuticals, cosmetics, and eco-friendly packaging offers significant growth opportunities for shellac.

Some of the key market players include Mantrose-Haeuser Co., Inc., Stroever GmbH & Co. KG, G.K. Shellac Industries, and S.S. Shellac Industries.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author