ID: PMRREP3704| 215 Pages | 5 Mar 2025 | Format: PDF, Excel, PPT* | Healthcare

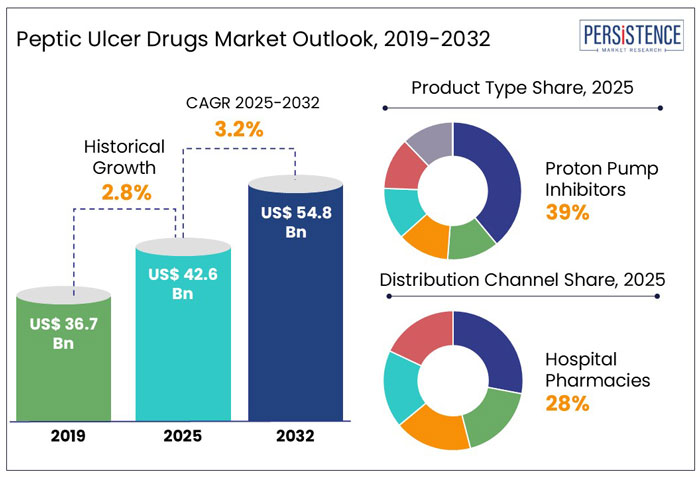

The global peptic ulcer drugs market size is anticipated to rise from US$ 42.6 Bn in 2025 to US$ 54.8 Bn by 2032. It is projected to witness a CAGR of 3.2% from 2025 to 2032.

A significant driver for the market's growth is the increasing prevalence of Helicobacter pylori infections, a known culprit in peptic ulcer disease.

In response to the high prevalence of infections, pharmaceutical companies are intensifying their research efforts.

With cutting-edge research, new drug discoveries, and personalized treatment approaches, millions of patients worldwide may soon find relief from this painful condition.

As the market progresses, a blend of innovative treatments and strategic collaborations among key players is anticipated to shape the landscape of peptic ulcer disease management.

Key Highlights of the Peptic Ulcer Drugs

|

Global Market Attributes |

Key Insights |

|

Peptic Ulcer Drugs Market Size (2025E) |

US$ 42.6 Bn |

|

Market Value Forecast (2032F) |

US$ 54.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

2.8% |

Widespread Use of Nonsteroidal Anti-Inflammatory Drugs Aided Market’s Growth

During the historical period from 2019 to 2024, the peptic ulcer drugs market has experienced notable growth, influenced by the increasing prevalence of helicobacter pylori infections and the widespread use of nonsteroidal anti-inflammatory drugs (NSAIDs).

Apart from this, lifestyle factors such as stress, smoking, and unhealthy dietary habits contributed to the rising incidence of peptic ulcers, thereby escalating the demand for effective treatments.

Research & Development Activities in Targeted Therapies to Boost Market Growth by 2032

Over the forecast period, the peptic ulcer drugs market is poised for continued expansion, driven by demographic shifts, medical advancements, and heightened health awareness.

As the global population ages, the incidence of peptic ulcers is expected to rise, leading to increased demand for therapeutic interventions.

Ongoing research and development efforts are anticipated to yield more effective targeted therapies, enhancing patient outcomes and expanding the market.

Improved awareness and diagnostic capabilities will likely lead to earlier detection and treatment of peptic ulcers, further driving market growth.

Growth Drivers

Advancements in Drug Development and Personalized Medicine Augment Market Growth

A few decades ago, treating peptic ulcers meant extended hospital stays, restrictive diets, and limited drug options. Today, the landscape has changed dramatically due to advancements in pharmaceutical research.

New drug formulations are designed to reduce side effects, increase efficacy, and shorten recovery times. For example, hybrid drug combinations targeting multiple ulcer formation aspects, such as acid suppression and bacterial eradication, are gaining traction. Additionally, the rise of personalized medicine is revolutionizing treatment approaches.

By leveraging genetic profiling and AI-driven diagnostics, doctors can tailor treatments based on an individual's genetic makeup, ensuring better outcomes and fewer complications.

The shift towards precision medicine enhances patient recovery rates and increases the demand for highly specialized peptic ulcer drugs.

As biotechnology continues to evolve, the future of peptic ulcer treatment looks promising, with a growing market for innovative therapies and next-generation drugs designed to offer long-lasting relief.

Rising Antibiotic Resistance Poses Major Challenge for Market

Imagine a patient diagnosed with Helicobacter pylori (H. pylori) infection, the leading cause of peptic ulcers, for which doctors prescribe a combination of antibiotics and proton pump inhibitors (PPIs) to eliminate the bacteria and heal the ulcer. However, a growing concern is antibiotic resistance, which is making treatments less effective.

The resistance forces doctor to prescribe stronger, often more expensive, second-line or third-line therapies, increasing patient costs and the burden on healthcare systems.

As bacteria evolve, pharmaceutical companies must invest heavily in new drug formulations, but the lengthy approval processes and high R&D costs slow down progress, restricting market growth. If resistance trends continue, the effectiveness of current peptic ulcer treatments could decline further, posing a significant hurdle to the market.

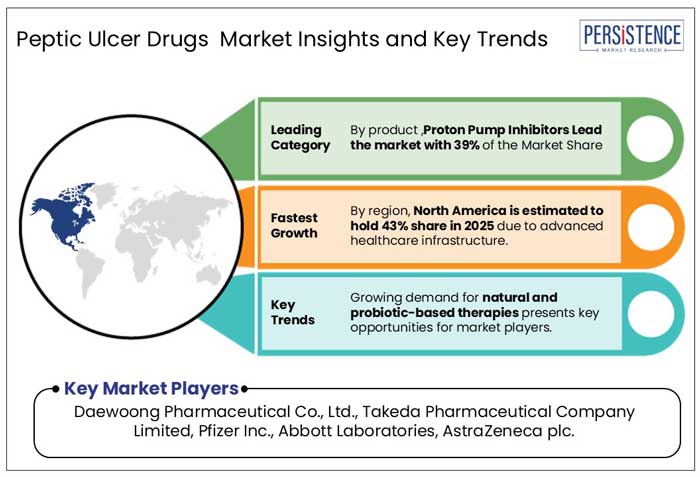

Growing Demand for Natural and Probiotic-Based Therapies Presents Key Opportunities for Market Players

A shift in consumer preferences towards natural and holistic healthcare solutions is creating a significant opportunity in the peptic ulcer drugs market.

With growing concerns over antibiotic resistance and long-term side effects of PPIs, many patients are looking for safer alternatives, such as probiotic-based therapies and plant-derived medications.

Herbal formulations such as licorice root extracts and mastic gum are gaining traction as complementary therapies due to their ability to soothe the stomach lining and reduce ulcer recurrence.

As pharmaceutical and nutraceutical companies recognize this shift, they are investing in research and development of natural-based drugs, paving the way for a future where treatments are effective and gentle on the body.

Product Type Insights

Proton Pump Inhibitors Lead the Product Type Segmentation with 39% of the Market Share

PPIs have become the cornerstone in the treatment of peptic ulcers as these medications work by reducing the production of stomach acid, allowing ulcers to heal, and preventing new ones from forming.

PPIs effectiveness and safety profile have made them a preferred choice among healthcare providers and patients. One of the most commonly prescribed PPIs is omeprazole. Its widespread use and availability have solidified its place in treatment protocols.

As the medical community continues to recognize the benefits of PPIs, their role in peptic ulcer treatment remains pivotal, offering hope and healing to countless individuals worldwide.

Distribution Channel Insights

Hospital Pharmacies Dominate the Distribution Channel Segment with 28% of the Market Share

Hospital pharmacies dominated the distribution channels for peptic ulcer drugs, accounting for 28% of the market share. Several factors contribute to the segment's dominance, as hospitals provide comprehensive care, specialized medication management, and integrated healthcare services.

The accessibility and support provided by hospital pharmacies not only streamline the treatment process but also offer reassurance during a challenging health journey.

As the healthcare landscape continues to evolve, the integral role of hospital pharmacies in the distribution of peptic ulcer medications remains steadfast, ensuring patients receive comprehensive and coordinated care.

North America Dominates the Global Peptic Ulcers Drugs Market Due to Advanced Healthcare Infrastructure, with 43% of the Market Share

North America led the global peptic ulcer drugs market, capturing approximately 43% of the total revenue share. The dominance of the region is largely attributed to its advanced healthcare infrastructure, high awareness levels, and significant healthcare expenditure.

The United States, in particular, plays a pivotal role, accounting for about 85% of the North American peptic ulcers market. The widespread availability of over-the-counter (OTC) medications and a robust pharmaceutical industry further bolster the market in this region.

Robust Healthcare Sector and Evolving Medical Practices Make Europe the Second Leading Region in the Global Market

Europe peptic ulcer drugs market holds a significant position, accounting for the second-largest share globally. A combination of healthcare infrastructure, demographic trends, and evolving medical practices drive the region's prominence.

Europe's advanced healthcare system ensures that patients can access various treatment options.

The presence of leading pharmaceutical companies fosters continuous research and development, resulting in innovative therapies and improved patient outcomes.

Rapid Expansion Fuelled by Lifestyle Changes Propels Asia Pacific as the Fastest Growing Region

Asia Pacific region is experiencing the fastest growth in the global peptic ulcer drug market. The surge is primarily due to rapid urbanization, changing dietary habits, and increased stress levels, leading to a higher incidence of peptic ulcers.

The region's expanding middle class and improving healthcare infrastructure also contribute to the growing demand for effective peptic ulcer treatments. Countries like India and China are at the forefront of the region's growth, and China holds the largest share, driven by its vast population and improved healthcare infrastructure.

Demonstrating the fastest growth rate in the region, India's market is propelled by increasing healthcare awareness, economic development, and a rising prevalence of PUD. The government's initiatives to enhance healthcare accessibility further support this growth, eventually aiding the region's growth.

The Peptic Ulcer Drugs Market is highly competitive, with leading pharmaceutical companies and emerging players striving to provide effective treatment solutions. Top industry leaders dominate the market with advanced research, innovative therapies, and substantial market reach.

With the rising prevalence of peptic ulcer disease (PUD) and increasing cases of Helicobacter pylori infections, companies are investing heavily in R&D, drug development, and clinical trials. The market is also witnessing strategic mergers, acquisitions, and collaborations to expand product portfolios and enhance accessibility.

The growing presence of generic drug manufacturers intensifies competition by offering affordable ulcer medications. As demand for effective ulcer treatments grows, the market remains dynamic, ensuring better healthcare outcomes for patients worldwide.

Key Industry Developments

The market is set to reach US$ 42.6 Bn in 2025.

Daewoong Pharmaceutical Co., Ltd., Takeda Pharmaceutical Company Limited, Pfizer Inc. are a few leading players.

The industry is estimated to rise at a CAGR of 3.2% through 2032.

North America is projected to hold the largest share of the industry in 2025.

The market for is anticipated to reach a valuation of US$ 54.8 billion by 2032.

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Indication

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author