ID: PMRREP20314| 199 Pages | 13 Jun 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

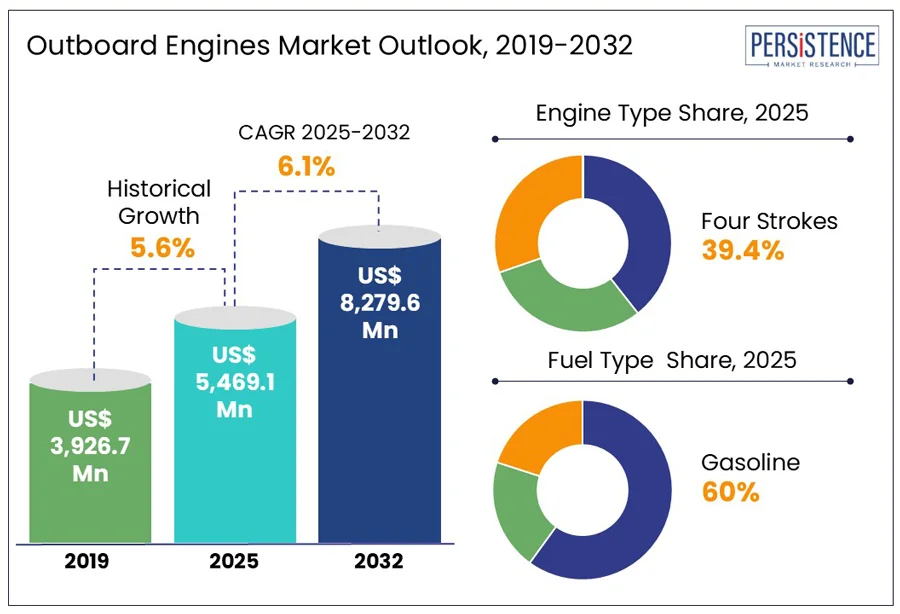

The global outboard engines market size is expected to grow from US$ 5,469.1 Mn in 2025 from US$ 8,279.6 Mn by 2032, with a staggering CAGR of 6.1% by 2032. Persistence Market Research anticipates that the rise in coastal tourism, electrification trends, and advancements in marine propulsion technology are driving the growth. The demand for clean, efficient, and high-performance propulsion systems is accelerating as manufacturers integrate electric outboards, smart diagnostics, and hybrid solutions, boosting investments in sustainable marine mobility and next-generation boating technologies.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Outboard Engines Market Size (2025E) |

US$ 5,469.1 Mn |

|

Market Value Forecast (2032F) |

US$ 8,279.6 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

6.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.6% |

The growing significance of coastal and marine tourism, accounting for over 50% of global tourism is a powerful driver for the outboard engines market. According to the World Economic Forum, this sector is a key economic pillar for many small island developing states (SIDS) and contributes significantly to global GDP, with tourism representing a US$9.5 trillion industry and generating one in every 11 jobs worldwide.

As travel and tourism rebound globally, the demand for water-based recreational activities such as boating, yachting, and eco-tourism excursions continues to climb. This has led to increased investments in motorized watercraft particularly small to medium-sized boats powered by outboard engines, to support marine transport, tours, and leisure operations.

As stakeholders map ocean health with long-term sustainability goals, there's a parallel push for cleaner, fuel-efficient outboard engines that align with eco-conscious tourism development. The sector's reliance on healthy marine ecosystems also creates opportunities for innovation in quiet, low-emission outboard technologies that can operate in protected and sensitive waters. As a result, the expansion of coastal tourism is directly fueling outboard engine adoption and shaping its evolution toward sustainable marine mobility

The total cost of ownership for outboard engines, including regular maintenance, parts replacement, and fuel consumption, can be high, particularly for larger or high-horsepower models. Beyond maintenance, the initial purchase price also escalates significantly with horsepower. For example, outboard motors in the 2–20 HP range typically cost between $900 and $5,600, while 25–100 HP engines can range from $3,600 to $12,000. For 115–600 HP models, prices can soar up to $100,000, especially among premium brands such as Evinrude, Honda, Mercury, Suzuki, and Yamaha.

These high capital costs pose a significant challenge for individual buyers, small-scale fishers, and rental operators. The impact is more pronounced in developing regions like Southeast Asia and parts of Latin America, where income constraints and limited access to financing further restrict the market's ability to absorb such expensive equipment. As a result, the cost barrier remains a critical restraint to widespread adoption, especially in price-sensitive markets.

The rapid expansion and innovation in electric outboard technology present a significant opportunity for manufacturers and market stakeholders to establish a stronghold in the evolving marine propulsion segment. Tohatsu’s 2024 partnership with Ilmor Marine marks a strategic entry into the electric outboard space with the upcoming launch of a 6kW (≈8.2 HP) electric motor for the US, Canadian, and European markets.

This collaboration merges Tohatsu’s industry heritage with Ilmor’s high-performance engineering, symbolizing a broader shift toward sustainable, emission-free boating. ePropulsion’s 2023 launch of the X40 electric outboard and ACEL Power’s 2024 debut of the IE 150 and IE 250 models, which cover power ratings from 50 HP to 250 HP, reflect the industry's push toward high-powered electric alternatives.

As government regulations and consumer preferences increasingly favor eco-friendly marine solutions, manufacturers investing early in R&D, strategic alliances, and scalable electric platforms stand to gain a first-mover advantage. Capitalizing on this electrification wave allows players to command premium pricing, reduce regulatory risks, and tap into a high-growth, high-margin segment that will likely dominate the market landscape over the next decade.

Leading outboard engine manufacturers are actively reshaping the market landscape through strategic investments in electrification and advanced propulsion technologies. Companies are no longer waiting for regulatory pressure; they are proactively engineering the future of marine mobility.

Brunswick Corporation, through its Mercury Marine division, launched its first electric outboard, the Avator 7.5e, at CES 2023, marking the beginning of a full electric outboard lineup and establishing a strong foothold in the clean boating segment. In 2024, Tohatsu entered the electric outboard space via a high-impact collaboration with Ilmor Marine, bringing to market a 6kW (≈8.2 HP) motor tailored for North America and Europe markets with rising demand for zero-emission marine solutions.

Honda Motor Co., Ltd., in January 2025, showcased the new BF300 outboard engine at boot Düsseldorf, blending enhanced performance with greater efficiency to meet evolving market expectations across Japan, Europe, and Asia. Meanwhile, Volvo Penta is leading the hybrid transition, working with Marell Boats and Hurtigruten Svalbard to launch a commercial hybrid-electric vessel, and partnering with Danfoss Editron to further scale marine electrification. These manufacturers are not just responding to change, they are setting the pace, unlocking new revenue streams, and positioning themselves at the forefront of a rapidly electrifying marine industry.

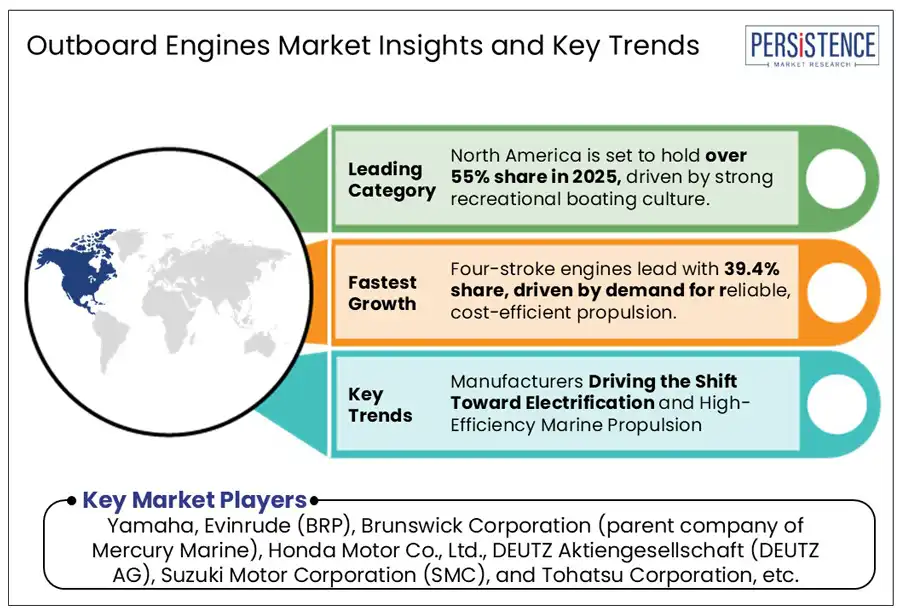

The demand for four-stroke outboard engines is steadily rising, particularly when evaluated on a value basis, as their higher upfront cost is justified by long-term performance, efficiency, and environmental benefits. The four strokes segment is expected to dominate in 2025, holding a substantial share of 39.4%, driven by increasing consumer preference for reliable and cost-efficient marine propulsion systems.

Four-stroke outboards are approximately 50% more fuel-efficient than most two-stroke engines and do not require two-stroke oil, reducing operational costs significantly. Their advanced design ensures every internal component is continuously lubricated and cooled, enhancing durability and extending engine life. Furthermore, four-stroke engines are about 90% cleaner and up to 50% quieter, making them more environmentally friendly and user-friendly compared to traditional two-stroke models.

Honda Marine, a leading player in this space, exemplifies this shift by incorporating automotive-grade technologies from its flagship vehicles into its marine outboards. As consumers increasingly prioritize longevity, cleaner emissions, and reduced maintenance, four-stroke engines are the preferred choice across both recreational and commercial boating sectors.

Based on fuel type, the market is segmented into diesel, gasoline, and electric. Among these, Persistence Market Research report projects that gasoline will maintain a dominant position. This is attributed to its versatility and widespread availability, which significantly enhances the attractiveness of gasoline engines. Gasoline is expected to account for over 60% of the market share by 2025.

Gasoline outboard engines are valued for their high RPM output, which makes them particularly suitable for small to medium-sized boats that prioritize speed, agility, and dynamic performance. This makes them the go-to choice for most recreational users, including water sports enthusiasts and offshore anglers.

Versatility and widespread availability further boost the appeal of gasoline engines. Boaters benefit from the convenience of refueling at standard gas stations and appreciate the simplicity and ease of handling these engines. Additionally, gasoline engines deliver consistent power output across a wide RPM range, ensuring reliable performance even under heavy operational loads. This dependability is crucial for users who demand steady and responsive propulsion throughout various marine conditions.

Although diesel and electric engines are gaining traction in specific niches, diesel for long-range and commercial operations, and electric for eco-friendly, quiet cruising gasoline remains the dominant fuel choice due to its superior power-to-weight ratio, extensive fueling infrastructure, and unmatched suitability for high-speed recreational boating.

North America remains the leading region in the global market, accounting for a dominant more than 55% of the total revenue share in 2025, with the United States alone contributing approximately 87.4% of that value. This leadership is fueled by the region’s deeply embedded recreational boating culture, which spans fishing, cruising, and water sports.

The U.S., in particular, is home to a vast network of coastal zones, lakes, and inland waterways that support a thriving marine leisure economy. The demand for outboard engines is closely tied to the steady growth in boat ownership, new registrations, and consistent sales of both entry-level and high-performance vessels.

In 2024, U.S. consumer interest in boating remains strong, with buyers increasingly opting for technologically advanced and fuel-efficient propulsion systems, such as four-stroke outboards. Additionally, North America's appeal as a top destination for water-based tourism further boosts engine demand, especially in regions with heavy recreational boat traffic.

The presence of leading manufacturers, continuous innovation in marine technologies, and an expanding base of boating enthusiasts reinforce North America's position as the powerhouse of the outboard engines market, with the United States driving the majority of this momentum.

According to Persistence Market Research estimates, Asia Pacific ranks second and is anticipated to witness a 17.4% CAGR from 2025 to 2032. The demand for outboard engines in Asia Pacific is rising steadily, driven by a combination of economic growth, expanding coastal and inland waterway activities, and increasing recreational boating.

Countries such as China, Japan, Australia, Indonesia, and Thailand are witnessing a surge in marine tourism, fishing, and water sports, all of which require reliable and efficient propulsion systems. Additionally, governments across the region are investing in the development of marine infrastructure, including ports and boating facilities, which supports the broader maritime economy.

The large coastline and abundant water bodies in Asia Pacific make outboard engines especially suitable for small to medium-sized boats used in both commercial and personal applications. Furthermore, there is growing adoption of cleaner and more fuel-efficient four-stroke and electric outboard engines, particularly in environmentally sensitive areas. The rise in disposable incomes, especially in Southeast Asia, is also enabling more consumers to invest in leisure boats powered by outboard motors.

Together, these factors are creating a favorable environment for manufacturers and suppliers to expand their presence and meet the rising demand for technologically advanced, cost-effective outboard engines across the Asia Pacific.

The global outboard engines market is increasingly competitive, driven by rapid technological advancements and a strong push toward electrification and performance optimization. Manufacturers are focused on differentiating through innovation, developing high-powered, fuel-efficient engines and next-generation electric outboards.

Leading companies are investing in R&D and entering the electric propulsion segment to meet environmental standards and evolving consumer preferences. Strategic collaborations allow traditional engine makers to leverage engineering expertise and accelerate market entry. Companies are expanding across North America, Europe, and Asia, aligning products with the rising demand for recreational boating and marine tourism. The landscape is defined by legacy brands enhancing existing models and new entrants introducing innovative electric solutions, creating a market marked by fast-paced innovation, diversification, and intense competition.

The Outboard Engines market is estimated to be valued at US$ 5,469.1 Mn in 2025.

The rising popularity of recreational boating and water-based leisure activities are the key demand driver for the Outboard Engines market.

In 2025, North America region dominates the market with more than 55% share in the global Outboard Engines market.

Among fuel type, preference for Electric Fuel segment is expected to grow rapidly at 7.4% CAGR from 2025 to 2032.

The key players in the Outboard Engines market are Yamaha, Evinrude (BRP), Brunswick Corporation (parent company of Mercury Marine), Honda Motor Co., Ltd., DEUTZ Aktiengesellschaft (DEUTZ AG), Suzuki Motor Corporation (SMC), and Tohatsu Corporation.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn , Volume : Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Horsepower

By Engine Type

By Start Type

By Boat Type

By Fuel Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author