ID: PMRREP32698| 210 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

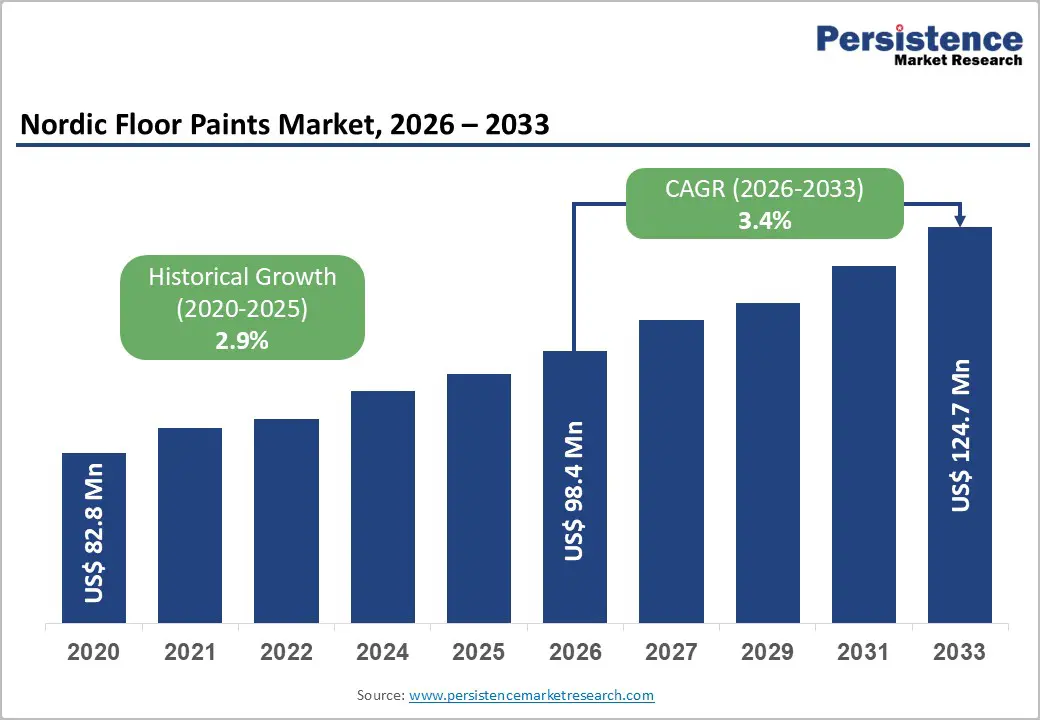

The nordic floor paints Market size is likely to be valued at US$ 98.4 million in 2026 and is projected to reach US$ 124.7 million by 2033, growing at a CAGR of 3.4% between 2026 and 2033.

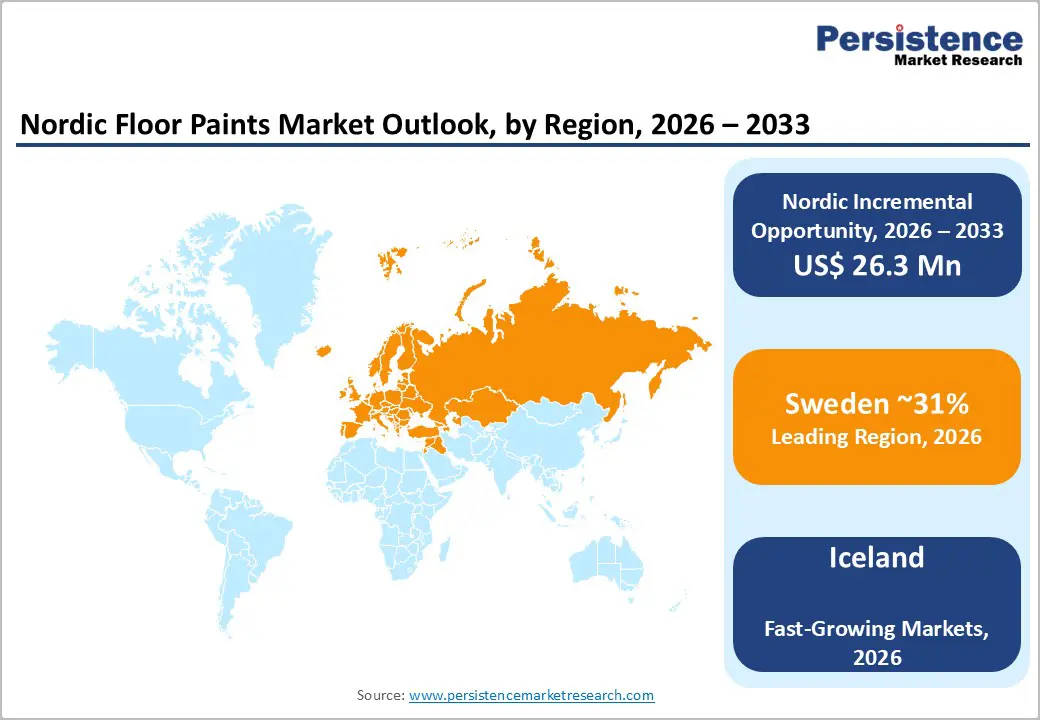

Market expansion is driven by systematic infrastructure modernization emphasizing sustainable flooring solutions, rising industrial facility demand for high-performance protective coatings supporting operational efficiency, and stringent environmental regulatory requirements including Nordic Swan Ecolabel criteria and EU Taxonomy compliance mandating low-VOC and eco-friendly product formulations. Sweden dominates with 31% regional market share anchored by Oslo-led manufacturing expertise and environmental consciousness, while Iceland demonstrates fastest growth at 4.0% CAGR supported by infrastructure development and tourism-related construction.

| Key Insights | Details |

|---|---|

|

Nordic Floor Paints Market Size (2026E) |

US$ 98.4 million |

|

Market Value Forecast (2033F) |

US$ 124.7 million |

|

Projected Growth CAGR (2026-2033) |

3.4% |

|

Historical Market Growth (2020-2025) |

2.9% |

Nordic region environmental consciousness and increasingly stringent regulatory frameworks are systematically transforming the floor paints market toward sustainable, low-VOC, and eco-certified formulations, with Nordic Swan Ecolabel Generation 7 criteria and EU Taxonomy compliance establishing baseline viability standards across regional markets.

Nordic Swan Ecolabel requirements mandate renewable material content, restricted CMR substances, PFAS elimination, and tightened VOC emission limits, with strict enforcement by national ecolabelling organizations across Denmark, Finland, Iceland, Norway, and Sweden. EU Taxonomy sustainability standards require documentation of energy-efficient production, renewable material sourcing, and circular economy principles supporting adoption of compliant product portfolios. International Concrete Repair Institute guidance emphasizing long-life coatings and lifecycle cost reduction drives preference for durable, high-performance solutions extending replacement intervals. Building certification programs including LEED reinforce specifier preference, while procurement and sustainability preferences support margins.

Industrial facility modernization and infrastructure expansion across Nordic regions are systematically driving demand for specialized floor paints addressing operational requirements, including chemical resistance, impact durability, and cleanroom compatibility, supporting manufacturing competitiveness. Swedish industrial flooring applications reached 2.5 million m² in 2011 representing 25% increase from 2004 baseline, demonstrating sustained infrastructure investment supporting protective coating deployment. Nordic e-commerce logistics expansion, pharmaceutical manufacturing facility development, and food processing industry growth create substantial demand for hygiene-compliant, seamless flooring systems meeting specialized operational requirements. Global concrete floor coatings market growing at 4.9% CAGR with industrial segment commanding 51% market share, demonstrating sustained demand for protective solutions supporting operational efficiency. Warehousing and distribution center expansion supporting e-commerce supply chain infrastructure creates demand for durable impact-resistant and chemical-resistant floor systems. Automotive and precision manufacturing facility development requiring cleanroom and anti-static flooring systems creates specialized coating demand. Facility modernization cycles addressing aging infrastructure replacement drive equipment procurement supporting market growth.

Floor paints market expansion is constrained by significant raw material price volatility affecting resin feedstocks, solvents, and specialty additives, with supply chain disruptions and manufacturing capacity constraints creating operational challenges limiting market penetration particularly among cost-sensitive customer segments. Polyol and isocyanate price volatility directly impacting polyurethane and polyaspartic coating costs affecting supplier profitability. Acrylic resin price fluctuations affecting waterborne coating economics and pricing strategies. Solvent and reactive monomer supply constraints creating cost pressures and manufacturing delays. Environmental compliance requirements necessitating reformulation away from restricted substances create R&D costs and manufacturing complexity. Supply chain complexity spanning raw material sourcing through specialty chemical blending and logistics creates vulnerability to disruption affecting product availability and delivery schedules.

Floor paints market penetration is constrained by limited end-user awareness regarding advanced coating technology advantages and performance benefits, with consumer preference for lower-cost conventional alternatives limiting premium product adoption despite superior long-term value propositions. Polyaspartic coatings pricing premium relative to conventional epoxy despite superior curing speed, UV stability, and flexibility creates affordability barriers among cost-focused customers. End-user reliance on conventional epoxy and polyurethane products despite slower curing and performance limitations reflects established purchasing patterns and specification familiarity. DIY market price sensitivity limiting adoption of premium professional-grade systems restricting retail channel growth potential. Regional economic pressures affecting capital budget availability for facility upgrades delaying modernization cycles. Competitive pricing from low-cost imported products constraining regional manufacturer pricing power and margin sustainability.

Terrazzo and decorative overlay floor systems represent emerging growth opportunity driven by architectural trend toward polished concrete aesthetics, premium commercial interior design, and high-end residential renovation projects demanding specialized decorative coating systems and protective sealers. Polished concrete floor popularity in modern architecture and office design creating demand for specialized protective sealers, decorative overlays, and anti-slip additives supporting premium market segment. Architectural specification trends favoring exposed and polished concrete supporting natural aesthetics creating market demand for high-performance protective systems. Premium residential renovation market emphasizing aesthetic appeal and durability creating demand for specialized decorative coatings. Commercial real estate and hospitality sector demand for distinctive flooring aesthetics creating designer specification opportunities. DIY home improvement market growth supported by user-friendly epoxy kits and decorative floor paints generating retail channel opportunities.

Nordic and northern climate regions represent specialized market opportunity for advanced coating systems addressing temperature extremes, moisture challenges, and operational demands exceeding conventional technology capabilities supporting premium positioning and market differentiation. Polyaspartic technology enabling -5°C curing temperatures supporting cold-climate facility applications and year-round construction scheduling enabling expanded geographic market coverage. Cold storage facility flooring requiring low-temperature stability and moisture resistance creating specialized demand for advanced coating systems. Arctic and sub-arctic infrastructure development supporting mining, energy, and logistics operations creating specialized flooring requirements. Seasonal facility operation patterns enabling winter application windows previously unavailable with conventional epoxy technologies. Climate adaptation infrastructure supporting resilience objectives creating demand for durable protective systems.

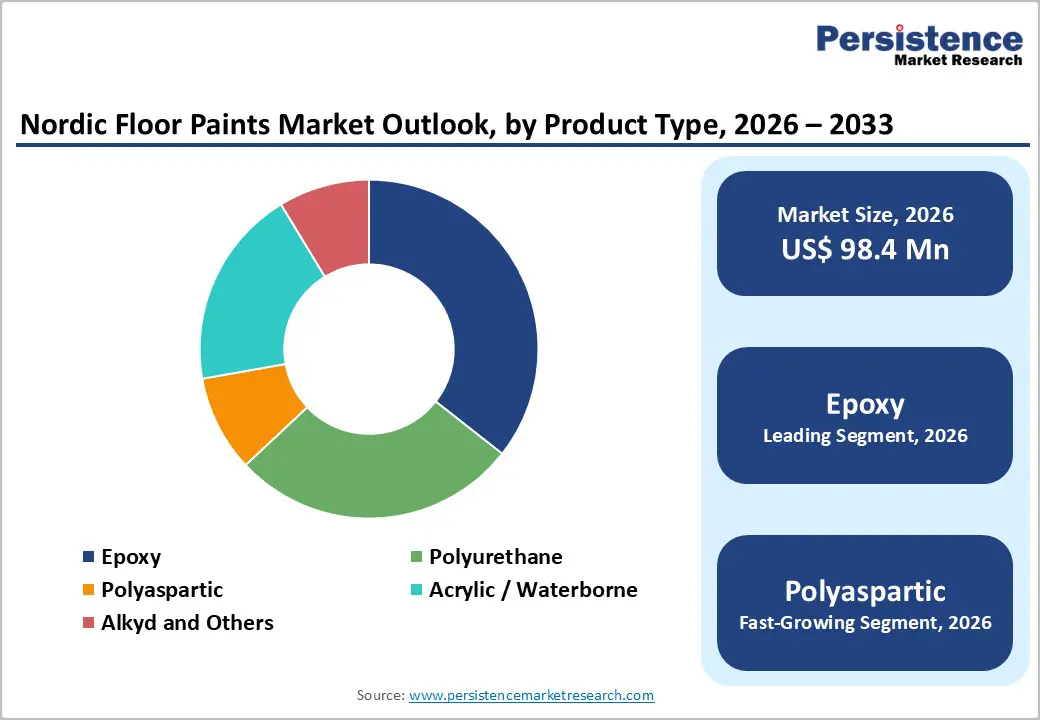

Epoxy-based floor paints command market leadership with approximately 36% share, driven by superior chemical resistance, durability, ease of application, and cost-effectiveness supporting widespread industrial, commercial, and institutional adoption. Epoxy coatings account for roughly 40–45% of the global concrete floor coatings market, reflecting strong performance credentials and long-standing market acceptance. These technologies provide excellent adhesion, minimal sagging, corrosion protection, and chemical resistance for high-traffic warehouses, factories, and institutions. Mature application infrastructure, contractor expertise, and supply chains enable competitive pricing. Waterborne low-VOC epoxy variants meet environmental regulations while preserving performance, sustaining relevance.

Polyaspartic coatings are the fastest-growing technology, recording a 5.5% CAGR, driven by ultra-fast curing, UV stability, flexibility, and moisture tolerance overcoming epoxy and polyurethane limitations. One-hour reoccupancy, -5°C application capability, non-yellowing aesthetics, 100% solids zero-VOC formulations, and humidity-insensitive installation deliver operational continuity, regulatory compliance, scheduling flexibility, and lifecycle cost efficiency.

Industrial applications represent approximately 45% of the market due to the essential need for durable, chemical-resistant, and impact-tolerant flooring systems. These systems protect significant investments in industrial facilities and support operational safety requirements. Industrial facilities including chemical processing, food and beverage production, pharmaceutical manufacturing, and electronics fabrication requiring seamless, hygienic, and cleanroom-compatible flooring systems. Automotive manufacturing facilities requiring anti-static, impact-resistant, and oil-resistant floor systems supporting safety and asset protection. Warehouse and logistics facilities requiring durable, impact-resistant, and chemical-resistant systems supporting heavy equipment operation and material handling. Mining and industrial processing operations utilizing specialized severe-service coatings for extreme-duty environments.

Residential floor paints represent the fastest-growing segment at 4.3% CAGR, driven by DIY adoption, aesthetic upgrades, and premium renovation activity. User-friendly epoxy kits and decorative coatings expand retail demand. Garage floors emerge as design focal points. Polished concrete and specialty finishes gain traction. Decorative overlays and protective sealers enhance durability, while health awareness accelerates preference for VOC-free, eco-certified formulations products.

Concrete represents dominant substrate type commanding approximately 63% of global coated floor area, driven by industrial, commercial, and institutional facility concrete floor prevalence and suitability for diverse coating system application. Concrete flooring ubiquity in industrial, commercial, and institutional facilities supporting baseline market demand. Concrete surface characteristics enabling epoxy, polyurethane, and polyaspartic coating system application supporting flexible technology deployment. Moisture challenges in concrete substrates driving demand for moisture-mitigation primer technology addressing technical barriers. Concrete slab construction industry representing substantial market segment with coatings addressing protection and aesthetic requirements.

Terrazzo and decorative overlay flooring is the fastest-growing substrate at 4.7% CAGR, driven by architectural aesthetics, premium commercial interiors, and polished concrete adoption. Design trends favor protective sealers and decorative overlays. Terrazzo’s resurgence in high-end projects boosts demand. Specialized substrate requirements necessitate tailored coating formulations, enabling technical differentiation, premium positioning, and strong designer-led specification influence.

Sweden dominates the Nordic floor paints market, commanding a 31% regional share, driven by advanced manufacturing infrastructure, environmental consciousness, sustainable procurement practices, and continuous industrial modernization supporting premium positioning. The Swedish architectural paints and coatings market grows at 4.2% CAGR, providing a strong foundation. Industrial flooring demand reaches approximately 2.5 million m² annually, reflecting sustained infrastructure investment. Environmental leadership drives eco-label adoption and low-VOC preference. Stockholm and Gothenburg industrial corridors concentrate manufacturing and logistics demand. A strong innovation ecosystem supports advanced coating development and commercialization. The market exhibits regulatory compliance excellence, premium product acceptance, and sustainability leadership. Established manufacturing capabilities and technical expertise reinforce competitiveness. High living standards support renovation spending. Government procurement policies favor certified products across Nordic markets.

Iceland demonstrates fastest growth at 4.0% CAGR, driven by tourism infrastructure development, cold-climate facility modernization, and emerging construction activity supporting specialized flooring requirements and advanced coating technology adoption. Iceland's tourism-related hospitality and commercial facility expansion creating demand for quality flooring systems supporting international visitor experience standards. Cold-climate characteristics supporting demand for temperature-resilient coating systems including polyaspartic technology enabling extreme-temperature application. Infrastructure development and construction activity supporting facility modernization and new construction projects. Small but growing market demonstrating high growth rates reflecting low base effect and emerging opportunity expansion. Iceland's emerging market characteristics supporting growth momentum despite small absolute market size. Tourism infrastructure development creating quality specification requirements. Cold-climate facility requirements supporting specialized technology adoption. Government infrastructure investment supporting project pipeline development.

Norway maintains a prominent market position with approximately 24% share, driven by industrial facility concentration, cold-climate operating requirements, and a sophisticated manufacturing base supporting premium coating adoption. The Norwegian architectural paints and coatings market grows at about 4.5% CAGR, providing a solid regional foundation. Petroleum refining, chemical processing, marine, and advanced manufacturing facilities require high-performance, chemical-resistant flooring systems. Jotun’s headquarters and manufacturing operations in Norway create technology leadership, supply reliability, and innovation advantages. Cold-climate conditions favor polyaspartic, moisture-tolerant, and rapid-curing coatings enabling year-round application. Oslo and Bergen industrial corridors represent key demand centers. Strong environmental policies, green procurement, and sustainability mandates accelerate adoption of eco-certified products, reinforcing Norway’s industrial orientation, technical sophistication, and competitive positioning within Nordic coatings market landscape.

The nordic floor paints market shows a consolidated structure, led by multinationals including Jotun, AkzoNobel, Beckers Group, Tikkurila, and Teknos Group, supported by strong distribution, regional manufacturing, and technical expertise. Jotun’s Nordic footprint strengthens leadership, while AkzoNobel’s European platform enables innovation. Ongoing consolidation, including Hempel’s acquisition by CIN, highlights restructuring. Regional specialists address niche and decorative segments, supported by retail and DIY partnerships.

CIN acquired Hempel A/S, Dutch-based industrial coatings manufacturer, expanding European industrial coatings portfolio and strengthening Nordic market presence through product portfolio integration and distribution network consolidation. Transaction combines complementary product portfolios and geographic coverage. Manufacturing and distribution rationalization supporting operational efficiency improvements.

AkzoNobel announced closure of production facilities in Wapenveld (Netherlands) and Machelen (Belgium) with production consolidation into major regional hubs supporting operational efficiency and cost reduction while maintaining product availability. Strategic facility rationalization supporting long-term cost competitiveness. Production concentration into larger-scale facilities improving manufacturing efficiency.

AkzoNobel, Beckers, and Jotun launched low-VOC and Nordic Swan Ecolabel compliant floor paint formulations addressing environmental regulatory requirements and customer sustainability preferences. Product innovation addressing regulatory framework requirements. Environmental product certification supporting procurement decision-making.

The nordic floor paints market is likely to be valued at US$ 98.4 million in 2026 and is projected to reach US$ 124.7 million by 2033.

Market growth is driven by stringent sustainability regulations, industrial and logistics facility modernization, and advanced coating technologies, including low-VOC formulations, Nordic Swan Ecolabel compliance, and polyaspartic systems enabling rapid curing and cold-climate application.

The market is expected to grow at a 3.4% CAGR from 2026 to 2033.

Key opportunities include premium terrazzo and decorative overlays, cold-climate flooring solutions enabled by polyaspartic technologies, and circular-economy innovations using bio-based and recyclable materials aligned with Nordic sustainability mandates.

Leading players include Jotun, AkzoNobel, Beckers Group, Tikkurila, and Teknos, supported by Hempel (CIN Group), Flügger, PPG, and RPM International, with ongoing consolidation, production optimization, and environmental compliance driving competitive dynamics.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By End-Uuser

By Substrate Type

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author