ID: PMRREP31998| 290 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

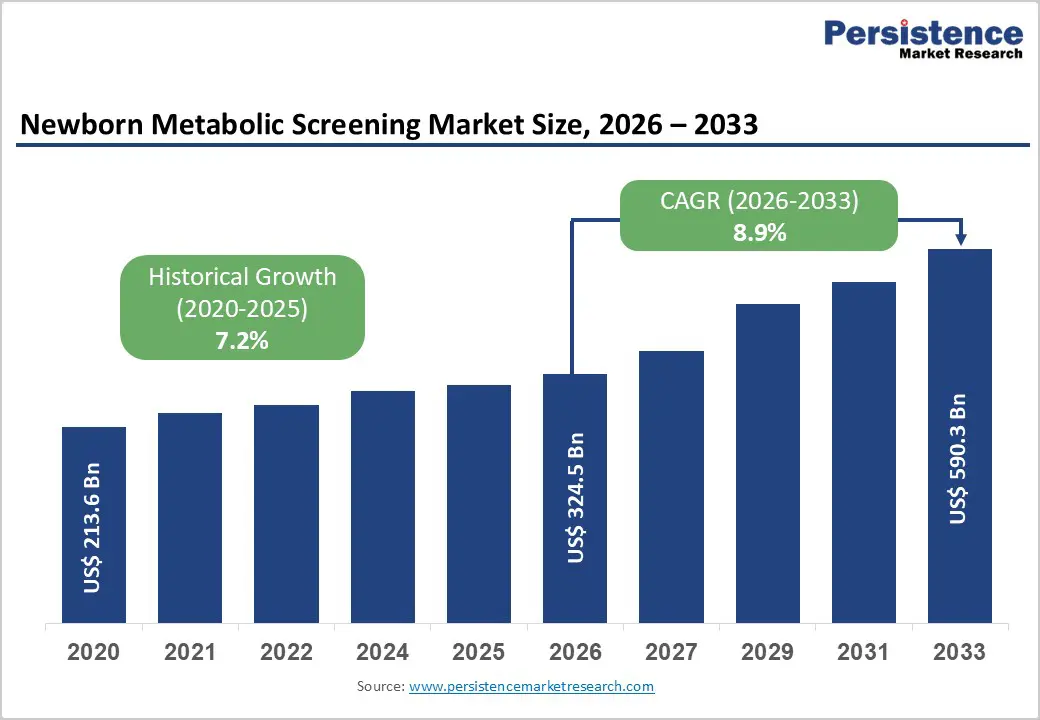

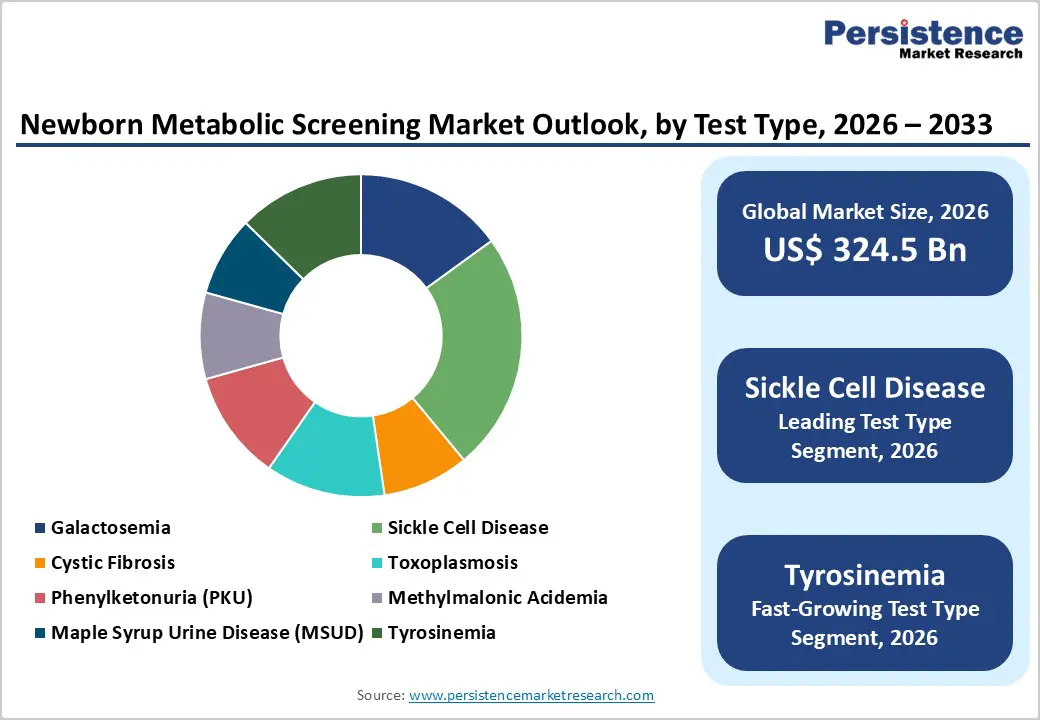

The global newborn metabolic screening market size is expected to be valued at US$ 324.5 billion in 2026 and projected to reach US$ 590.3 billion by 2033, growing at a CAGR of 8.9% between 2026 and 2033.

The market expansion is driven by the increasing prevalence of metabolic disorders in newborns and the critical role of early detection in preventing serious health complications. According to the World Health Organization (WHO) and recent global health estimates, approximately 40 million babies worldwide receive newborn screening annually, with early detection enabling effective treatment for nearly 40,000 babies each year. The rising adoption of advanced screening technologies, particularly tandem mass spectrometry (MS/MS), combined with government-mandated newborn screening programs in developed nations and the growing expansion of these initiatives in emerging economies, is substantially driving market growth. Furthermore, the increasing awareness among healthcare providers and parents regarding the long-term health benefits of metabolic screening has strengthened market demand across diagnostic laboratories, hospitals, and specialty clinics globally.

| Report Attribute | Details |

|---|---|

|

Newborn Metabolic Screening Market Size (2026E) |

US$ 324.5 billion |

|

Market Value Forecast (2033F) |

US$ 590.3 billion |

|

Projected Growth CAGR (2026-2033) |

8.9% |

|

Historical Market Growth (2020-2025) |

7.2% |

Technological Advancements in Screening Methodologies

Technological innovation has emerged as a primary growth catalyst for the newborn metabolic screening market. Advanced analytical techniques, particularly tandem mass spectrometry (MS/MS) and flow-injection analysis MS/MS (FIA-MS/MS), have revolutionized the detection of metabolic disorders by enabling simultaneous analysis of multiple biomarkers from a single dried blood spot sample. These innovations have substantially improved both the sensitivity and specificity of metabolic screening, reducing false positive rates and allowing the early identification of conditions including phenylketonuria (PKU), maple syrup urine disease (MSUD), and methylmalonic acidemia. The integration of next-generation sequencing (NGS) and DNA sequencing technologies further expands screening capabilities, enabling the detection of over 50 distinct metabolic and genetic disorders from a single screening panel. Hospitals and diagnostic laboratories are increasingly investing in these advanced technologies to improve operational efficiency and enhance screening accuracy, directly supporting market growth.

Growing Prevalence of Congenital Metabolic Disorders

The epidemiological burden of newborn metabolic disorders continues to drive market expansion globally. Research indicates that approximately 1 in 33 babies born in the United States is affected by congenital birth defects, with metabolic disorders constituting a significant proportion of these conditions. In India, approximately 200,000 babies are born with congenital conditions annually, while in the United Arab Emirates, newborn screening data documents an incidence of 1 in 1,873 for screened metabolic disorders. The prevalence of specific metabolic conditions remains substantial sickle cell disease affects approximately 1 in 500 births in African American populations in the United States, while phenylketonuria (PKU) occurs in approximately 1 in 10,000 to 15,000 births. The mounting prevalence of these treatable conditions has prompted healthcare authorities worldwide to expand mandatory newborn screening programs, thereby increasing demand for metabolic screening equipment, consumables, and related diagnostic services across the market.

High Initial Capital Investment and Infrastructure Challenges

The establishment and maintenance of a comprehensive newborn screening infrastructure requires substantial capital investment, which poses significant barriers to market growth, particularly in developing regions. Setting up newborn screening laboratories necessitates investment in expensive analytical instrumentation, including tandem mass spectrometry systems, trained laboratory personnel, and quality assurance protocols. The Asia Pacific region, despite accounting for approximately 50% of the world's births, faces considerable infrastructure development challenges. Many countries in this region continue to struggle with limited screening coverage and insufficient laboratory capacity. India, Bangladesh, Pakistan, and Indonesia collectively account for approximately 85% of births in the region yet lack comprehensive universal newborn screening programs. The high cost of screening instruments and the substantial operating expenses associated with laboratory maintenance and staff training present formidable barriers to implementation, particularly in low- and middle-income countries, thereby constraining overall market growth.

Regulatory Variability and Limited Awareness in Emerging Markets

Regulatory inconsistencies across jurisdictions and persistent low awareness of newborn metabolic screening significantly limit market expansion in developing economies. Screening panels vary substantially between countries. North American programs typically screen for approximately 29 to 31 conditions, while European programs range from 15 to 40 conditions, and many low-income countries screen for fewer than 10 conditions. The lack of government mandates and universal health insurance coverage for newborn screening in many developing nations restricts program implementation and scaling. Cultural, geographic, and economic barriers continue to impede the adoption of standardized screening protocols across the Asia Pacific region, with high rates of home births (approximately 65% in Pakistan) and limited parental awareness of screening benefits further constraining market potential. These regulatory and awareness gaps represent substantial obstacles to achieving comprehensive global market penetration.

Expansion of Newborn Screening Programs in Emerging Economies

Significant market opportunities exist through expanding newborn screening initiatives in high-growth emerging markets. The Asia Pacific region, which accounts for approximately 50% of global births, offers substantial growth potential as governments increasingly implement mandatory screening programs. Recent developments underscore this opportunity. China currently operates approximately 150 newborn screening laboratories, with over 100 facilities utilizing tandem mass spectrometry technology, while India and Southeast Asian nations are progressively establishing regional screening centers. The World Health Organization's recent resolutions and draft frameworks (2024-2025) emphasize integrating newborn screening into national health systems and universal health coverage initiatives, particularly in low- and middle-income countries. This policy shift creates compelling opportunities for market participants to partner with government health authorities and build screening infrastructure in these regions. The projected CAGR of 11-13% in the Asia Pacific region during the 2026-2033 forecast period reflects substantial growth momentum driven by expanding birth cohorts and increasing healthcare investments.

Implementation of Advanced Genetic Screening Technologies

The rapid adoption of advanced molecular and genetic screening technologies presents significant market opportunities for innovation and market expansion. Next-generation sequencing (NGS), whole-genome sequencing (WGS), and targeted genetic panels enable the simultaneous screening for multiple inherited metabolic disorders, genetic conditions, and rare genetic syndromes with unprecedented efficiency. Recent technological breakthroughs include the introduction of integrated DNA testing platforms capable of detecting over 50 distinct medical conditions from a single sample, as demonstrated by emerging diagnostic companies entering the market. The increasing prevalence of tyrosinemia, one of the fastest-growing segments with a projected CAGR exceeding industry averages, indicates growing demand for advanced diagnostic solutions capable of early detection and intervention. Healthcare providers in developed markets are actively investing in automation, artificial intelligence-driven analysis, and cloud-based data management systems to enhance screening efficiency and reduce turnaround times. These technological trends create substantial opportunities for diagnostic equipment manufacturers, software developers, and specialized laboratory service providers to capture market share and drive revenue growth.

Test Type Analysis

Sickle Cell Disease represents the dominant screening segment within the test type category, commanding approximately 24% of the metabolic screening market share in 2025. This leadership position reflects the significant disease burden associated with hemoglobinopathies globally and the critical importance of early detection for improving clinical outcomes. Sickle cell disease predominantly affects populations of African descent, with prevalence rates reaching 1 in 500 births in African Americans in the United States, while incidence rates in sub-Saharan African nations and the Middle East remain substantially higher. The American College of Medical Genetics and Genomics (ACMG) and the U.S. Health Resources and Services Administration (HRSA) include sickle cell disease screening as a primary condition in the Recommended Uniform Screening Panel (RUSP), mandating its inclusion in newborn screening programs across all 50 U.S. states. The prevalence of sickle cell disease combined with regulatory mandates, established diagnostic methodologies utilizing hemoglobin variant detection via HPLC and capillary electrophoresis, and documented clinical benefits of early diagnosis and treatment has established sickle cell screening as the market's cornerstone segment. This segment's dominance is reinforced by consistent demand for screening equipment and reagents supporting high-throughput analysis of hemoglobin variants from dried blood spot samples.

Sample Type Analysis

Dried blood spot (DBS) sampling represents the universal standard for newborn metabolic screening, establishing itself as the dominant sample collection methodology in the global market. Dried blood spots involve the collection of 3-5 microliters of capillary blood obtained through heel pricks in newborn infants, which is subsequently spotted onto specialized filter paper cards (commonly known as Guthrie cards) and air-dried for laboratory analysis. The DBS methodology offers exceptional advantages over alternative sampling techniques. The minimal blood volume requirement eliminates the need for venipuncture, reducing infant trauma and enabling easy self-collection by healthcare workers in resource-limited settings. Dried blood spot samples demonstrate remarkable stability, remaining viable for months to years when stored at ambient temperature, thereby facilitating specimen transportation from remote geographic locations to centralized screening laboratories. This sample type enables the simultaneous detection of multiple metabolic analytes, amino acids, and fatty acid oxidation products from a single punch, making it the ideal choice for tandem mass spectrometry (MS/MS) analysis. The established infrastructure supporting DBS collection, transport, and analysis across developed and emerging markets, combined with regulatory acceptance and standardized quality assurance protocols, has solidified the DBS category as the foundational sample type supporting the entire metabolic screening market.

End User Analysis

Diagnostic Laboratories emerge as the dominant end-user segment for newborn metabolic screening services, reflecting the centralization and standardization of screening programs globally. Specialized diagnostic laboratories equipped with advanced analytical instrumentation, including tandem mass spectrometry systems and high-performance liquid chromatography (HPLC) platforms, serve as the primary screening infrastructure in developed healthcare systems. These facilities handle the majority of newborn screening specimens in the United States, Europe, and developed Asia-Pacific nations, processing high sample volumes while maintaining rigorous quality assurance standards and regulatory compliance. Hospitals and specialty clinics operate as secondary end-users, particularly in regions where decentralized screening models prevail, often conducting preliminary screening before forwarding confirmatory testing to specialized diagnostic laboratories. The Centers for Disease Control and Prevention (CDC) and the Health Resources and Services Administration (HRSA) coordinate closely with diagnostic laboratories to maintain national screening standards and ensure program effectiveness. The dominance of diagnostic laboratories reflects the technical expertise, investment in advanced instrumentation, and economies of scale required for high-throughput, accurate metabolic screening operations supporting growing newborn populations.

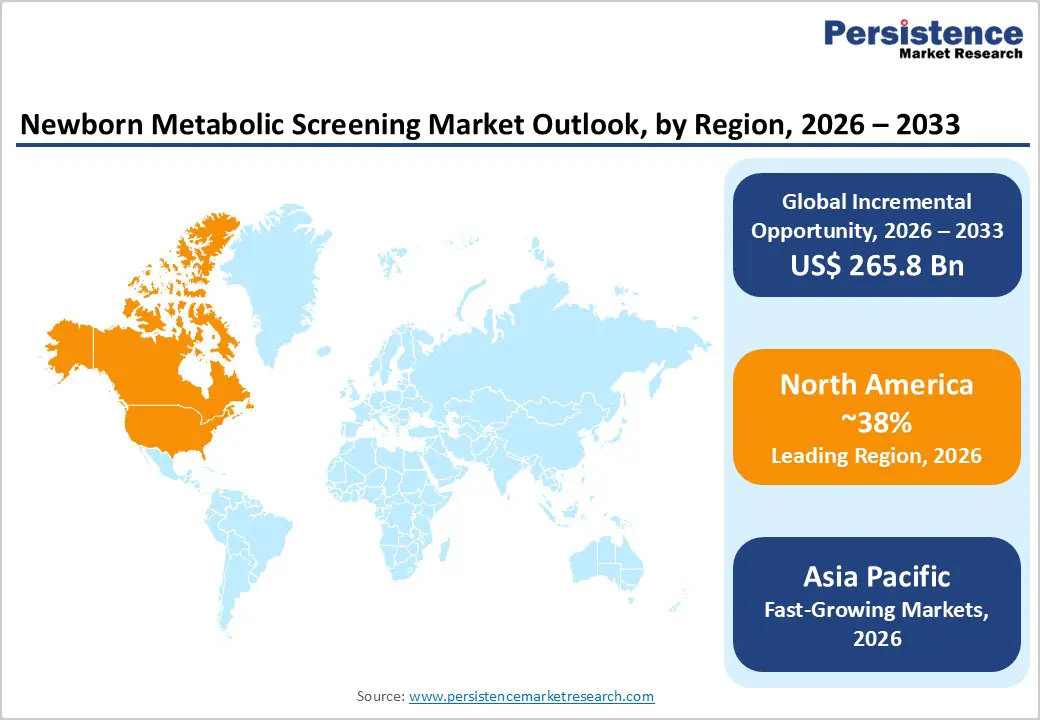

North America Newborn Metabolic Screening Market Trends and Insights

North America maintains the leading regional position in the global newborn metabolic screening market, commanding approximately 38% of total market share in 2025. The United States and Canada possess the most mature and comprehensive newborn screening infrastructure globally, with screening programs reaching approximately 99% of newborn populations. The U.S. Advisory Committee on Heritable Disorders in Newborns and Children (ACHDNC), established by the Children's Health Act of 2000, provides national leadership and recommendations that guide state-level screening implementations. The Recommended Uniform Screening Panel (RUSP), endorsed by the U.S. Secretary of Health and Human Services, includes 29 primary conditions and 25 secondary conditions, establishing the gold standard for metabolic and genetic disorder detection. All 50 U.S. states have incorporated sickle cell disease screening since the 1970s, while the inclusion of cystic fibrosis screening and advanced metabolic panels utilizing tandem mass spectrometry has been systematized across the nation.

Asia Pacific Newborn Metabolic Screening Market Trends and Insights

The Asia Pacific region represents the fastest-growing market for newborn metabolic screening, projected to expand at a CAGR exceeding 11-13% during 2026-2033. This exceptional growth is driven by the region's demographic significance. Asia Pacific accounts for approximately 68.5 million births annually, representing nearly 50% of global births. The five most populous countries (China, India, Indonesia, Bangladesh, Pakistan) collectively account for approximately 85% of regional births, yet historically have maintained limited newborn screening coverage. Recent developments signal transformative growth potential—China operates approximately 150 newborn screening laboratories, with over 100 facilities implementing tandem mass spectrometry technology. The country's large birth cohort of approximately 14 million annually, combined with government-driven healthcare modernization initiatives, creates substantial demand for metabolic screening services.

The competitive landscape of the newborn metabolic screening market is moderately consolidated and driven by continuous technological innovation and regulatory compliance. Market participants compete based on test accuracy, panel breadth, turnaround time, and cost efficiency. Strong emphasis is placed on expanding screening panels, improving mass spectrometry and genetic testing capabilities, and integrating automation to handle high sample volumes. Strategic collaborations with hospitals, diagnostic laboratories, and government newborn screening programs are critical to market positioning.

Key Market Developments

The global newborn metabolic screening market is expected to reach US$ 324.5 billion in 2026, reflecting strong growth from the 2025 baseline and representing the beginning of the forecast period characterized by accelerating market expansion driven by technological advancement and global program expansion through 2033.

The principal demand drivers include the rising prevalence of metabolic disorders that require early detection, the widespread adoption of advanced tandem mass spectrometry (MS/MS) and next-generation sequencing technologies, government-mandated screening programs in developed nations, and the critical health benefits of early diagnosis.

North America, primarily the United States, commands approximately 38% of the global newborn metabolic screening market share in 2025, supported by universal newborn screening programs across all 50 states, mature diagnostic laboratory infrastructure, comprehensive government mandates, and substantial investment in advanced screening technologies and services.

The Asia Pacific region represents the fastest-growing market, projected to expand at a CAGR of 11-13% during 2026-2033, driven by the region's massive birth cohort accounting for approximately 50% of global births, rapid implementation of government-mandated screening programs, increasing healthcare infrastructure investment, and the growing prevalence of metabolic disorder awareness in major population centers.

Major market opportunities include the expansion of newborn screening programs in high-growth emerging markets in the Asia Pacific region (particularly India, China, Indonesia), implementation of advanced genetic and molecular screening technologies including next-generation sequencing (NGS) and artificial intelligence-driven diagnostic systems, development of telemedicine-enabled screening solutions for rural and underserved populations, and strategic partnerships with government health authorities to establish screening infrastructure in low- and middle-income countries.

PerkinElmer, Bio-Rad Laboratories, Trivitron Healthcare Private Limited, BioMedomics, Inc., etc.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

Test Type

Sample Type

End User

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author