- Executive Summary

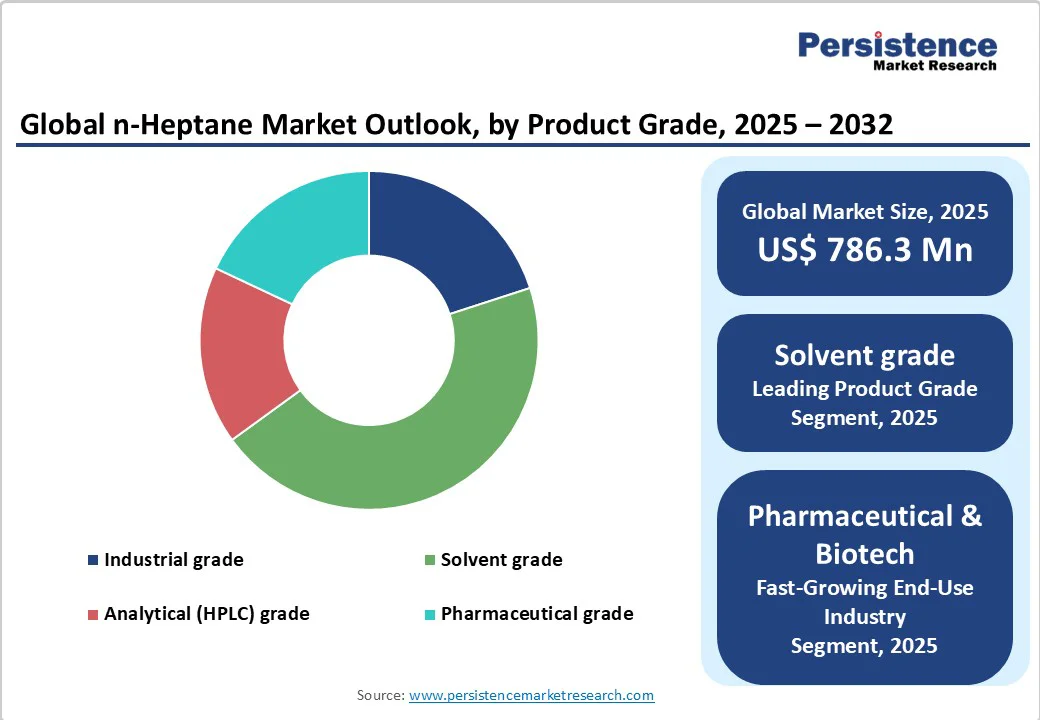

- Global n-Heptane Market Snapshot 2025 and 2032

- Market Opportunity Assessment, 2025-2032, US$ Mn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- Global GDP Outlook

- Global Pharmaceuticals Industry Overview

- Global Paints & Coatings Industry Overview

- Forecast Factors - Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter's Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2019 - 2032

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

- Global n-Heptane Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Global n-Heptane Market Outlook: Product Grade

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Product Grade , 2019-2024

- Current Market Size (US$ Mn) and Volume (Units) Forecast, by Product Grade , 2025-2032

- Industrial grade

- Solvent grade

- Analytical (HPLC) grade

- Pharmaceutical grade

- Market Attractiveness Analysis: Product Grade

- Global n-Heptane Market Outlook: Packaging

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Packaging, 2019-2024

- Current Market Size (US$ Mn) and Volume (Units) Forecast, by Packaging, 2025-2032

- Bulk

- Drums

- Intermediate containers (IBC)

- Small bottles

- Market Attractiveness Analysis: Packaging

- Global n-Heptane Market Outlook: Distribution Channel

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Distribution Channel, 2019-2024

- Current Market Size (US$ Mn) and Volume (Units) Forecast, by Distribution Channel, 2025-2032

- Direct contract sales

- Chemical distributors

- Laboratory suppliers

- Trading houses

- Market Attractiveness Analysis: Distribution Channel

- Global n-Heptane Market Outlook: Application

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Application , 2019-2024

- Current Market Size (US$ Mn) and Volume (Units) Forecast, by Application , 2025-2032

- Solvent for coatings, inks & adhesives

- Chemical synthesis

- blending and octane testing

- Laboratory solvent

- Extraction & degreasing

- Pharmaceutical manufacturing

- Agrochemical formulations

- Market Attractiveness Analysis: Application

- Global n-Heptane Market Outlook: End-Use Industry

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by End-Use Industry, 2019-2024

- Current Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Paints & Coatings

- Adhesives & Sealants

- Pharmaceuticals & Biotech

- Petrochemical testing labs

- Academic & Research Laboratories

- Electronics

- Agrochemicals

- Automotive & Aerospace

- Market Attractiveness Analysis: End-Use Industry

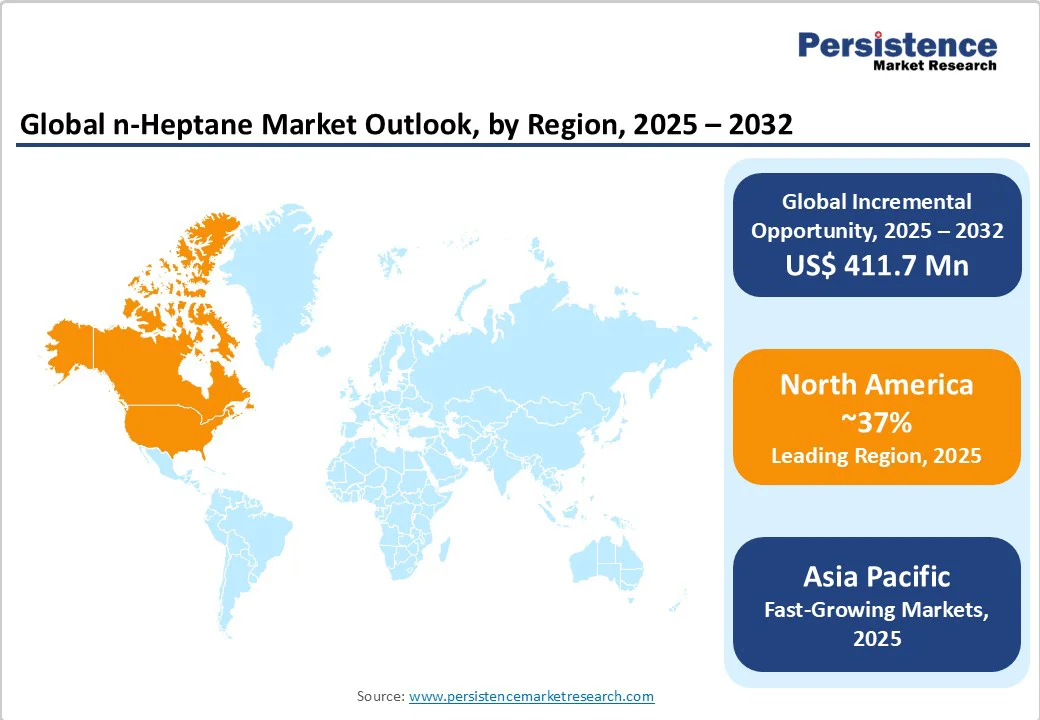

- Global n-Heptane Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Region, 2019-2024

- Current Market Size (US$ Mn) and Volume (Units) Forecast, by Region, 2025-2032

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America n-Heptane Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- North America Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- U.S.

- Canada

- North America Market Size (US$ Mn) and Volume (Units) Forecast, by Product Grade , 2025-2032

- Industrial grade

- Solvent grade

- Analytical (HPLC) grade

- Pharmaceutical grade

- North America Market Size (US$ Mn) and Volume (Units) Forecast, by Packaging, 2025-2032

- Bulk

- Drums

- Intermediate containers (IBC)

- Small bottles

- North America Market Size (US$ Mn) and Volume (Units) Forecast, by Distribution Channel, 2025-2032

- Direct contract sales

- Chemical distributors

- Laboratory suppliers

- Trading houses

- North America Market Size (US$ Mn) and Volume (Units) Forecast, by Application , 2025-2032

- Solvent for coatings, inks & adhesives

- Chemical synthesis

- blending and octane testing

- Laboratory solvent

- Extraction & degreasing

- Pharmaceutical manufacturing

- Agrochemical formulations

- North America Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Paints & Coatings

- Adhesives & Sealants

- Pharmaceuticals & Biotech

- Petrochemical testing labs

- Academic & Research Laboratories

- Electronics

- Agrochemicals

- Automotive & Aerospace

- Europe n-Heptane Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- Europe Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Mn) and Volume (Units) Forecast, by Product Grade , 2025-2032

- Industrial grade

- Solvent grade

- Analytical (HPLC) grade

- Pharmaceutical grade

- Europe Market Size (US$ Mn) and Volume (Units) Forecast, by Packaging, 2025-2032

- Bulk

- Drums

- Intermediate containers (IBC)

- Small bottles

- Europe Market Size (US$ Mn) and Volume (Units) Forecast, by Distribution Channel, 2025-2032

- Direct contract sales

- Chemical distributors

- Laboratory suppliers

- Trading houses

- Europe Market Size (US$ Mn) and Volume (Units) Forecast, by Application , 2025-2032

- Solvent for coatings, inks & adhesives

- Chemical synthesis

- blending and octane testing

- Laboratory solvent

- Extraction & degreasing

- Pharmaceutical manufacturing

- Agrochemical formulations

- Europe Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Paints & Coatings

- Adhesives & Sealants

- Pharmaceuticals & Biotech

- Petrochemical testing labs

- Academic & Research Laboratories

- Electronics

- Agrochemicals

- Automotive & Aerospace

- East Asia n-Heptane Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- East Asia Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- China

- Japan

- South Korea

- East Asia Market Size (US$ Mn) and Volume (Units) Forecast, by Product Grade , 2025-2032

- Industrial grade

- Solvent grade

- Analytical (HPLC) grade

- Pharmaceutical grade

- East Asia Market Size (US$ Mn) and Volume (Units) Forecast, by Packaging, 2025-2032

- Bulk

- Drums

- Intermediate containers (IBC)

- Small bottles

- East Asia Market Size (US$ Mn) and Volume (Units) Forecast, by Distribution Channel, 2025-2032

- Direct contract sales

- Chemical distributors

- Laboratory suppliers

- Trading houses

- East Asia Market Size (US$ Mn) and Volume (Units) Forecast, by Application , 2025-2032

- Solvent for coatings, inks & adhesives

- Chemical synthesis

- blending and octane testing

- Laboratory solvent

- Extraction & degreasing

- Pharmaceutical manufacturing

- Agrochemical formulations

- East Asia Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Paints & Coatings

- Adhesives & Sealants

- Pharmaceuticals & Biotech

- Petrochemical testing labs

- Academic & Research Laboratories

- Electronics

- Agrochemicals

- Automotive & Aerospace

- South Asia & Oceania n-Heptane Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Forecast, by Product Grade , 2025-2032

- Industrial grade

- Solvent grade

- Analytical (HPLC) grade

- Pharmaceutical grade

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Forecast, by Packaging, 2025-2032

- Bulk

- Drums

- Intermediate containers (IBC)

- Small bottles

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Forecast, by Distribution Channel, 2025-2032

- Direct contract sales

- Chemical distributors

- Laboratory suppliers

- Trading houses

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Forecast, by Application , 2025-2032

- Solvent for coatings, inks & adhesives

- Chemical synthesis

- blending and octane testing

- Laboratory solvent

- Extraction & degreasing

- Pharmaceutical manufacturing

- Agrochemical formulations

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Paints & Coatings

- Adhesives & Sealants

- Pharmaceuticals & Biotech

- Petrochemical testing labs

- Academic & Research Laboratories

- Electronics

- Agrochemicals

- Automotive & Aerospace

- Latin America n-Heptane Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by Product Grade , 2025-2032

- Industrial grade

- Solvent grade

- Analytical (HPLC) grade

- Pharmaceutical grade

- Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by Packaging, 2025-2032

- Bulk

- Drums

- Intermediate containers (IBC)

- Small bottles

- Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by Distribution Channel, 2025-2032

- Direct contract sales

- Chemical distributors

- Laboratory suppliers

- Trading houses

- Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by Application , 2025-2032

- Solvent for coatings, inks & adhesives

- Chemical synthesis

- blending and octane testing

- Laboratory solvent

- Extraction & degreasing

- Pharmaceutical manufacturing

- Agrochemical formulations

- Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Paints & Coatings

- Adhesives & Sealants

- Pharmaceuticals & Biotech

- Petrochemical testing labs

- Academic & Research Laboratories

- Electronics

- Agrochemicals

- Automotive & Aerospace

- Middle East & Africa n-Heptane Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by Product Grade , 2025-2032

- Industrial grade

- Solvent grade

- Analytical (HPLC) grade

- Pharmaceutical grade

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by Packaging, 2025-2032

- Bulk

- Drums

- Intermediate containers (IBC)

- Small bottles

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by Distribution Channel, 2025-2032

- Direct contract sales

- Chemical distributors

- Laboratory suppliers

- Trading houses

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by Application , 2025-2032

- Solvent for coatings, inks & adhesives

- Chemical synthesis

- blending and octane testing

- Laboratory solvent

- Extraction & degreasing

- Pharmaceutical manufacturing

- Agrochemical formulations

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Paints & Coatings

- Adhesives & Sealants

- Pharmaceuticals & Biotech

- Petrochemical testing labs

- Academic & Research Laboratories

- Electronics

- Agrochemicals

- Automotive & Aerospace

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- ExxonMobil Chemical

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- Shell Chemicals

- SABIC

- Chevron Phillips Chemical Company

- Honeywell International

- LG Chem

- Total Petrochemicals

- Reliance Industries

- Maruzen Petrochemical

- Zhejiang Materials Industry Group

- Chuzhou Runda Solvents

- DHC Solvent Chemie

- Gadiv Petrochemical Industries

- Haltermann Carless Deutschland

- Shenyang Huifeng Petrochemical

- ExxonMobil Chemical

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment