ID: PMRREP19339| 250 Pages | 4 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

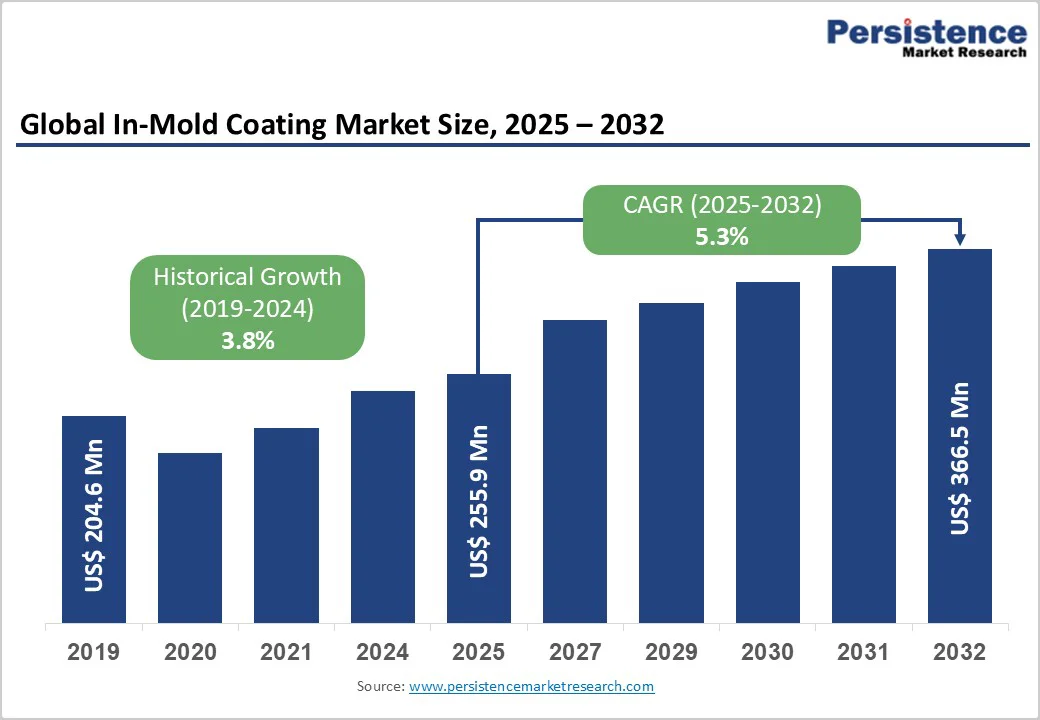

The global In-Mold Coating Market size is valued at US$255.9 Mn in 2025 and is projected to reach US$366.5 Mn by 2032, growing at a CAGR of 5.3% between 2025 and 2032. In-mold coating technology combines resin molding and surface coating into a single integrated process, achieving greater surface smoothness than conventional spray coating.

The automotive industry's transition toward electric vehicles and stringent environmental regulations mandating reduced VOC emissions are accelerating the shift from traditional painting processes to advanced in-mold coating systems.

| Key Insights | Details |

|---|---|

|

In-Mold Coating Market Size (2025E) |

US$ 10.2 Mn |

|

Market Value Forecast (2032F) |

US$ 47.4 Mn |

|

Projected Growth CAGR (2025-2032) |

5.3% |

|

Historical Market Growth (2019-2024) |

3.8% |

The automotive industry's push for lightweight, aesthetically superior components is a major driver for the In-Mold Coating Market, enabling integrated coating during molding to cut post-processing steps by up to 70% compared to spray methods, as per innovations from companies like Nippon Paint Automotive Coatings. This efficiency reduces energy consumption and aligns with the growing production of electric vehicles (EVs), where durable coatings protect intricate designs on interiors and exteriors.

Regulatory incentives for fuel efficiency, such as those under the Corporate Average Fuel Economy (CAFE) standards, further amplify this, with global vehicle output expected to rise by 5% annually through 2030, directly boosting coating demand. The automotive industry's commitment to sustainability has driven collaborations, such as the partnership between Nippon Paint and Covestro, to develop bio-based coating solutions that reduce CO2 emissions by over 50% while meeting performance requirements beyond those of conventional coatings.

Technological progress in low-VOC and water-based formulations is propelling market expansion. In June 2025, Uchihamakasei Corp., in partnership with Nippon Paint Automotive Coatings Co., Ltd., developed a groundbreaking UV-curable in-mold coating (IMC) technology for large-scale thermoplastic automotive exterior applications, significantly boosting efficiency and environmental performance. The new process achieves drying times of under one minute and cuts VOC emissions by over 99% compared to conventional coating systems.

Such initiatives support global sustainability goals, including the European Union's Green Deal, which mandates reductions in emissions in manufacturing, thereby fostering adoption in high-volume sectors such as electronics. Regulatory bodies such as the South Coast Air Quality Management District (SCAQMD) in California and the European Commission have established increasingly restrictive VOC limits for automotive coatings, with the SCAQMD Rule 1151 proposing further reductions effective January 1, 2030. These developments not only ensure compliance but also improve product durability, significantly influencing positive market trajectories.

Elevated costs of raw materials and specialized equipment pose a significant barrier, with in-mold coating formulations requiring premium resins that can increase production costs by 20-30% compared with traditional methods, according to analyses in chemical industry journals. Advanced coating formulations, particularly those incorporating UV-curable systems and nanotechnology-based additives, command premium prices compared to conventional solvent-based coatings. The development of specialized equipment and mold modifications required to facilitate the in-mold coating process necessitates substantial capital investments from manufacturers, creating barriers to market entry for smaller players.

Small-scale manufacturers struggle with these investments, particularly in developing regions where petrochemical price volatility, up 15% in 2024 due to supply chain disruptions, exacerbates profitability issues. This restraint limits market penetration for emerging players, slowing overall adoption despite efficiency gains.

In-mold coating systems exhibit compatibility constraints that restrict their application across the full spectrum of thermoplastic and thermosetting substrates. Strong adhesion requires precise interface chemistry. Materials like Makrolon® IMC2477 optimize bonding with polycarbonate, while surface energy, temperature, and expansion must stay within tight limits to prevent defects such as cracking or delamination.

Complex geometries, such as undercuts and deep-draw sections, limit the in-mold coating compared to spray methods. The technology's reliance on mold transcription for surface texture and design elements requires costly tooling modifications for design changes, reducing flexibility in applications where frequent aesthetic updates or product customization drive market competitiveness, particularly in consumer electronics and appliances segments.

The rapid growth in electric vehicle (EV) production offers a significant opportunity for in-mold coatings. These coatings enable the creation of lightweight EV battery housings and interior trims, improving design flexibility while reducing component weight by 10–15%. This advancement aligns with global sustainability targets, including the International Energy Agency’s projection of 60 million EVs produced annually by 2030.

Developments in nanotechnology-infused coatings offer self-healing properties for high-wear parts, as seen in Covestro's Makrolon IMC2477, which integrates seamlessly with thermoplastic substrates for premium finishes. This segment's rapid growth, driven by policies like the US Inflation Reduction Act subsidies, could generate substantial demand, allowing companies to capture a share of the expanding Automotive Coatings Market through innovative, durable solutions.

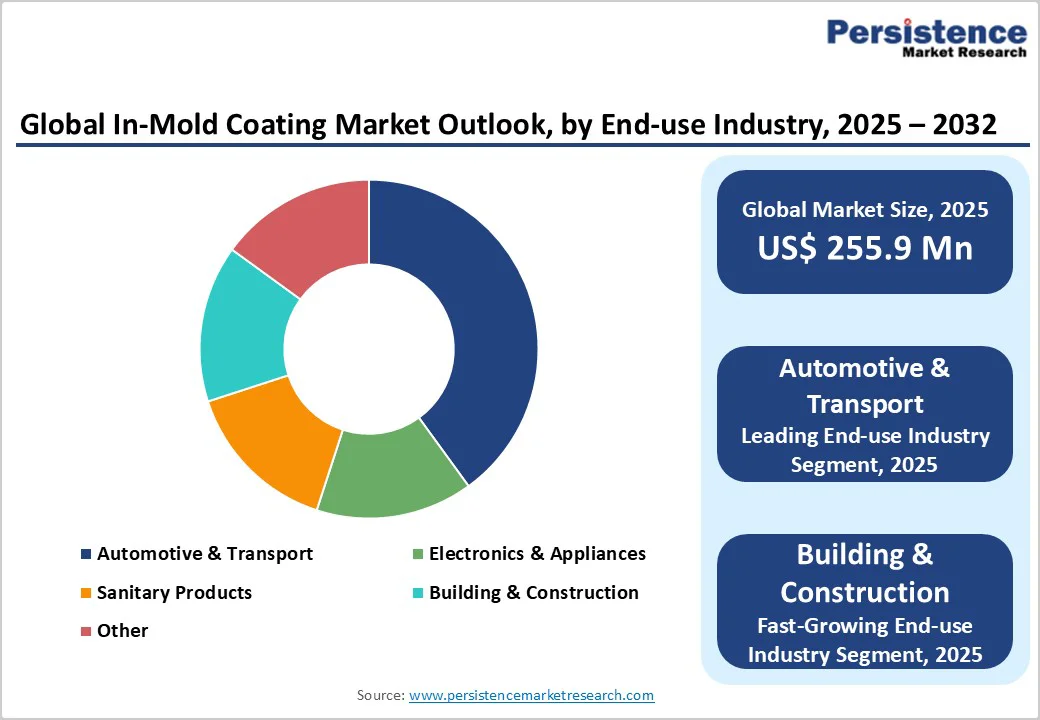

The rising demand for low-VOC formulation coatings due to the shift towards sustainability-driven products in the building and construction industry offers a significant opportunity for the in-mold coating market. BASF SE, Akzo Nobel N.V., and Arkema established a value chain partnership reducing architectural powder coating carbon footprints by up to 40% through bio-attributed raw material integration, demonstrating industry commitment to decarbonization objectives. The Specialty Paints and Coatings market is moving toward integrated manufacturing, making in-mold coating a key technology for sustainable construction aligned with global carbon reduction goals.

In-mold coating applications in sanitary products, including faucets, washbasins, and plumbing fixtures, leverage the technology's near-zero waste characteristics and elimination of spray booth infrastructure to achieve green building certification requirements. Physical Vapor Deposition (PVD) coatings currently dominate premium sanitary ware applications, but in-mold coating technology offers cost advantages and broader substrate compatibility for mainstream market segments.

Water-based coatings lead the product type segment with approximately 45% market share. The dominance of water-based formulations is driven by regulatory mandates restricting VOC emissions across developed economies and the demonstrated performance advantages of water-based systems in achieving compliance with stringent environmental standards. Water-based in-mold coatings deliver 99% lower VOC emissions compared to solvent-based alternatives while maintaining gloss retention, chemical resistance, and weatherability standards essential for automotive and appliance applications.

The development of advanced acrylic and polyurethane water-based formulations by leading manufacturers is enhancing performance characteristics, including chemical resistance, adhesion strength, and curing speed, thereby expanding the addressable market for these products. Their ease of application in molding processes further solidifies leadership, enhancing efficiency without compromising aesthetics.

Thermoplastic substrates command about 50% share in the substrate category, favored for their versatility in high-speed injection molding used in electronics and automotive parts, offering recyclability and reduced cycle times by 20% compared to thermosets. Thermoplastic materials, including polycarbonate, ABS, and polyester-based composites, dominate automotive interior components, electronic housings, and appliance panels requiring Class-A surface finishes with integrated color and protection.

Covestro's Makrolon® and Bayblend® product lines, specifically engineered for in-mold coating applications, demonstrate the chemical industry's investment in adhesion-optimized substrate formulations supporting technology adoption. The materials' ability to undergo multiple heating and forming cycles enables complex part geometries and overmolding operations that integrate structural and aesthetic functions in single components.

The Automotive & Transport sector holds a leading 40% share among end-use industries of the In-Mold Coating market. In-mold coating applications span exterior body panels, interior trim components, functional electrical housings, and underbody protection systems, where conventional multi-step finishing represents significant capital and operational expenditure. Toyoda Gosei's breakthrough in applying in-mold coating to large automotive parts eliminates a key technical barrier previously limiting technology adoption for exterior body panels, where surface quality and durability requirements are most stringent.

The report from the International Organization of Motor Vehicle Manufacturers (OICA) shows that global vehicle production has surpassed 92 million in 2024. Global automotive production dynamics, with China producing 31.28 million units and India growing output by 3% to over 6 million units in 2024, create substantial addressable markets for coating technologies offering cost and sustainability advantages.

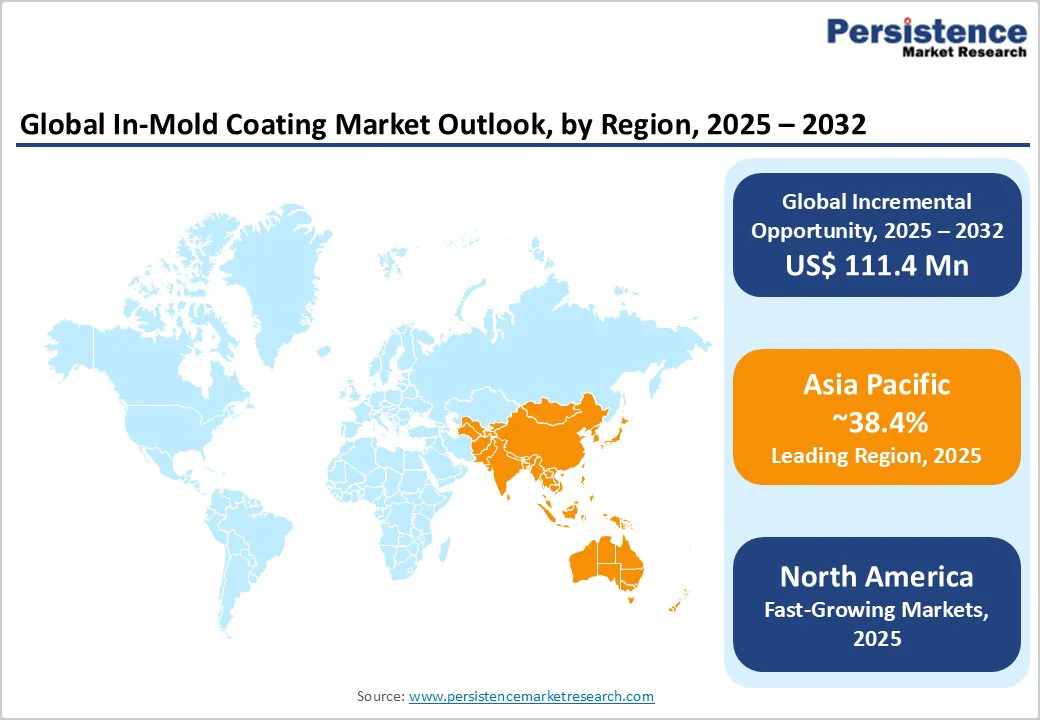

North America, led by the U.S., exhibits robust market dynamics through its innovation ecosystem, where advanced R&D in UV-curable coatings supports the automotive and electronics sectors. The EPA's implementation of VOC content limits below 250 g/L for automotive refinish coatings, reducing emissions by 31,900 tons per year, establishes regulatory drivers compelling manufacturers toward low-emission alternatives, including in-mold coating systems. The region's focus on sustainable manufacturing is evident in developments like Covestro's film insert molding technologies for premium designs, enhancing efficiency in EV production.

North American automotive production, totaling 19.2 million units in 2024, with 55% concentrated in the U.S., exceeding 10 million units, provides a substantial market foundation for coating technology deployment. Major chemical companies, including PPG Industries, The Sherwin-Williams Company, and BASF SE, maintain significant research and manufacturing infrastructure across the region. This leadership is reinforced by strong supply chains and collaborations, positioning North America as a hub for high-performance in-mold applications.

European markets demonstrate leadership in sustainable coating technology development, supported by regulatory harmonization across EU member states and aggressive carbon reduction commitments. Germany leads regional BEV production with 1.2 million units manufactured in 2024, followed by France at 330,000 units, establishing a substantial automotive manufacturing base for advanced coating applications.

BASF SE, Akzo Nobel N.V., and Arkema's collaborative development of bio-attributed architectural powder coatings, achieving 40% carbon footprint reductions, exemplifies the region's commitment to value chain decarbonization. Regulatory frameworks, including Qualicoat Class 2 and GSB Florida 3 superdurability standards for architectural applications, drive technical requirements influencing coating formulation development.

Asia Pacific's In-Mold Coating market growth is fueled by manufacturing advantages in China and Japan, where rapid industrialization drives 38.4% global share. China's Made in China 2025 initiative is boosting automotive coatings demand through efficient in-mold processes. India and Southeast Asian nations are emerging as rapid-growth markets, supported by robust infrastructure development, expanding automotive manufacturing capacity, and increasing consumer spending on premium consumer goods.

Japan's technological prowess in powder-based formulations supports electronics, with production hubs reducing costs by 15% via scale. Toyoda Gosei's recent breakthrough in developing Japan's first in-mold coating technology applicable to large automotive exterior parts represents a pivotal advancement in regional technological capabilities.

The In-Mold Coating Market features a moderately consolidated structure, with top players like Akzo Nobel N.V., PPG Industries, and BASF SE holding over 50% share through extensive R&D and global supply chains, while fragmented smaller firms focus on niche innovations. Expansion strategies emphasize mergers and sustainable tech investments, with leaders differentiating via low-VOC portfolios and digital integration for customized solutions. Emerging models include partnerships for EV coatings, enhancing competitiveness in a market projected for rapid growth.

Akzo Nobel N.V. (headquartered in Amsterdam, Netherlands) leads with a diverse portfolio of water-based coatings, generating significant revenue from automotive applications through innovative low-VOC solutions that comply with international regulations, establishing strong market influence via global expansions.

PPG Industries (headquartered in Pittsburgh, USA) excels in thermoset-compatible formulations, leveraging R&D maturity to capture 20% share in electronics, with portfolio strength in durable finishes driving sustained growth and partnerships.

BASF SE (headquartered in Ludwigshafen, Germany) dominates via advanced digital printing integrations, boasting high revenue from sustainable innovations like anti-microbial coatings, influencing the market through extensive chemical expertise and regional dominance.

The market is valued at US$255.9 Mn in 2025 and expected to reach US$366.5 Mn by 2032, growing at a 5.3% CAGR driven by automotive and sustainability trends.

Key drivers include automotive sector needs for efficient coatings and advancements in low-VOC technologies, reducing emissions by 99% and aligning with global regulations like EPA standards.

Water-based coatings lead with 45% share, favored for environmental compliance and adhesion in molding processes across automotive applications.

Asia Pacific represents the dominant regional market, commanding approximately 38.4% of global market value as of 2024 and experiencing the most rapid growth trajectory.

Expansion in EV components offers potential via nanotechnology for self-healing coatings, tapping into the growing Automotive Coatings Market with policy incentives.

Leading players include Akzo Nobel N.V., PPG Industries, and BASF SE, influencing through R&D in low-VOC solutions and global automotive partnerships.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Substrate

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author