ID: PMRREP31738| 200 Pages | 23 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

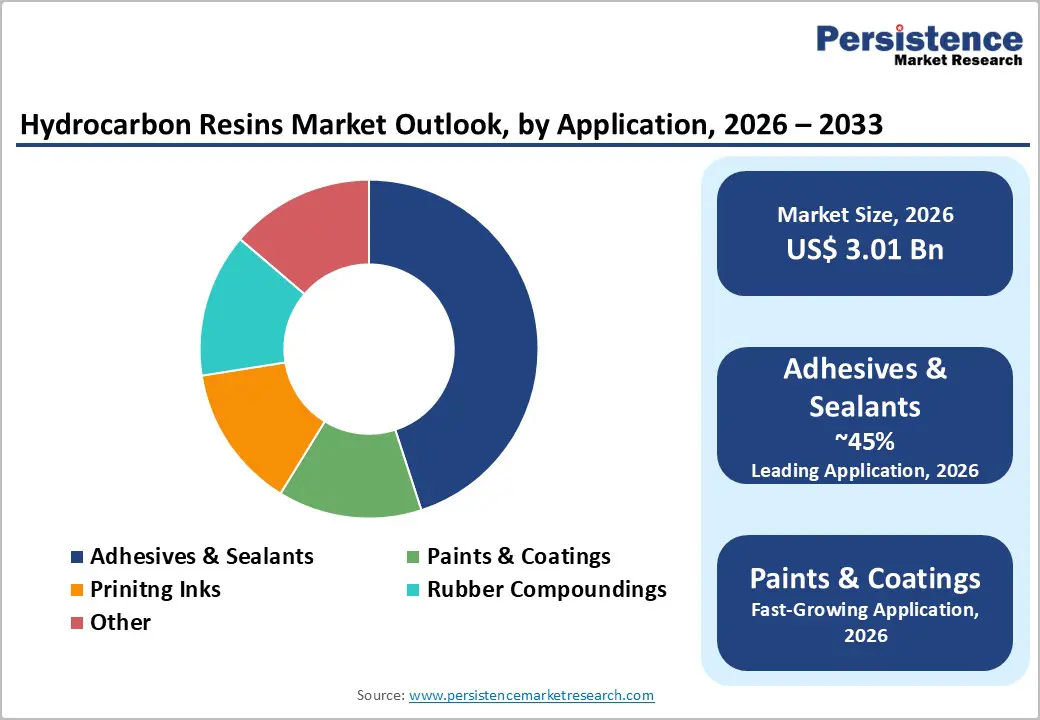

The global hydrocarbon resins market size is likely to be valued at US$ 3.01 billion in 2026 and is projected to reach US$ 4.53 billion by 2033, growing at a CAGR of 6.0% between 2026 and 2033.

The market is fundamentally driven by the escalating demand for high-performance adhesives and sealants across automotive, construction, and packaging applications, where manufacturers increasingly prioritize lightweight solutions to improve fuel efficiency and reduce emissions. The proliferation of hot-melt adhesives (HMA) in industrial and consumer applications, combined with the exponential growth of e-commerce packaging that requires fast-setting, durable bonding solutions, is driving substantial demand acceleration. Furthermore, stringent regulatory frameworks in North America and Europe mandating reduced volatile organic compound (VOC) emissions are propelling manufacturers to adopt hydrocarbon resins as preferred raw materials in compliant formulations.

| Key Insights | Details |

|---|---|

| Hydrocarbon Resins Market Size (2026E) | US$ 3.01 Bn |

| Market Value Forecast (2033F) | US$ 4.53 Bn |

| Projected Growth CAGR (2026 - 2033) | 6.0% |

| Historical Market Growth (2020 - 2025) | 4.8% |

Rising Demand for Lightweight Materials in Automotive Manufacturing

The automotive industry is one of the most significant growth catalysts for the hydrocarbon resins market, with global automotive adhesives and sealants expected to expand at a high CAGR through 2034. Automotive manufacturers are increasingly replacing traditional welding and mechanical fastening methods with advanced adhesive solutions to reduce vehicle weight, thereby improving fuel efficiency and lowering emissions. Hydrocarbon resins serve as critical tackifiers in these high-performance bonding formulations, enabling rapid curing times essential for high-speed production lines while delivering superior structural integrity and durability.

The transition toward electric vehicle (EV) production further amplifies demand, as approximately 14 million electric vehicles were registered globally in 2023, with projections surpassing 40 million units on the road today, each requiring specialized adhesives to bond lightweight composite materials without adding excessive weight that would compromise battery efficiency.

Expansion of E-Commerce and Packaging Industry Demand

The explosive growth of global e-commerce logistics has fundamentally transformed packaging requirements, driving unprecedented demand for hot-melt adhesives with hydrocarbon-resin tackifiers. The packaging adhesives segment is experiencing accelerated growth, driven by the need for fast-setting, reliable bonding solutions that can operate in automated, high-speed production environments.

Hydrocarbon resins, particularly C5 and C9 variants, provide the tackifying properties essential for bonding diverse substrates, including cardboard, plastics, and laminates within milliseconds, supporting packaging manufacturers' pursuit of operational efficiency and sustainability objectives. The shift toward eco-friendly, low-VOC packaging adhesives increasingly favors hydrocarbon resin-based formulations over solvent-based alternatives, as they emit minimal volatile compounds while maintaining superior adhesive performance across multiple packaging applications from flexible pouches to rigid corrugated structures.

Volatility in Crude Oil and Raw Material Pricing

The hydrocarbon resins manufacturing industry faces substantial headwinds from persistent volatility in petroleum and crude oil prices, which directly impact the cost structure of raw material procurement and influence overall production economics. Since hydrocarbon resins are derived from the C5 and C9 fractions of naphtha obtained during crude oil refining, any fluctuations in global petroleum prices cascade through the entire supply chain, creating unpredictability in manufacturing costs and compressing profit margins.

This pricing volatility forces manufacturers to maintain strategic inventories and negotiate long-term supply contracts with uncertain cost implications, while end-use customers remain hesitant to commit to large orders amid uncertain trajectories of input costs. Manufacturers operating with thin margins face operational challenges in absorbing price shocks, particularly in competitive markets where pricing transparency prevents full cost pass-through to customers.

Stringent Environmental Regulations and VOC Emission Compliance Requirements

The hydrocarbon resins industry encounters increasingly rigorous environmental compliance obligations globally, particularly concerning volatile organic compound (VOC) emissions regulated under frameworks such as the EU REACH Regulation, EPA Clean Air Act standards, and regional State Implementation Plans (SIPs). Regulatory bodies, including the European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA), mandate comprehensive testing, documentation, and disclosure of chemical properties before production authorization, imposing substantial compliance costs on manufacturers.

The transition toward low-VOC and bio-based formulations requires significant research and development investments to reformulate products meeting evolving regulatory thresholds, while outdated production facilities necessitate expensive retrofitting or replacement to achieve compliance targets. These regulatory pressures create competitive advantages for well-capitalized multinational corporations while raising barriers to entry for smaller manufacturers lacking resources for compliance infrastructure.

Development of Bio-Based and Sustainable Hydrocarbon Resin Solutions

The global marketplace demonstrates accelerating consumer and regulatory demand for sustainable, environmentally responsible materials, creating substantial opportunities for manufacturers developing bio-based and partially renewable hydrocarbon resin alternatives. TotalEnergies' Cray Valley affiliate has partnered with renewable chemical developers to commercialize sustainable feedstock options, recognizing that environmental consciousness among consumer goods manufacturers increasingly translates into preference for suppliers demonstrating tangible sustainability commitments.

Industry projections indicate that bio-based adhesives and resins are among the fastest-growing segments of the broader adhesives market, driven by corporate sustainability targets, supply chain certification requirements, and consumer demand for products with reduced carbon footprints. Manufacturers investing in bio-hybrid resin technology, circular economy production methods, and third-party sustainability certifications position themselves to capture premium market segments willing to absorb higher input costs in exchange for demonstrated environmental stewardship and regulatory compliance assurance.

Accelerating Growth in Asia-Pacific Manufacturing and Infrastructure Development

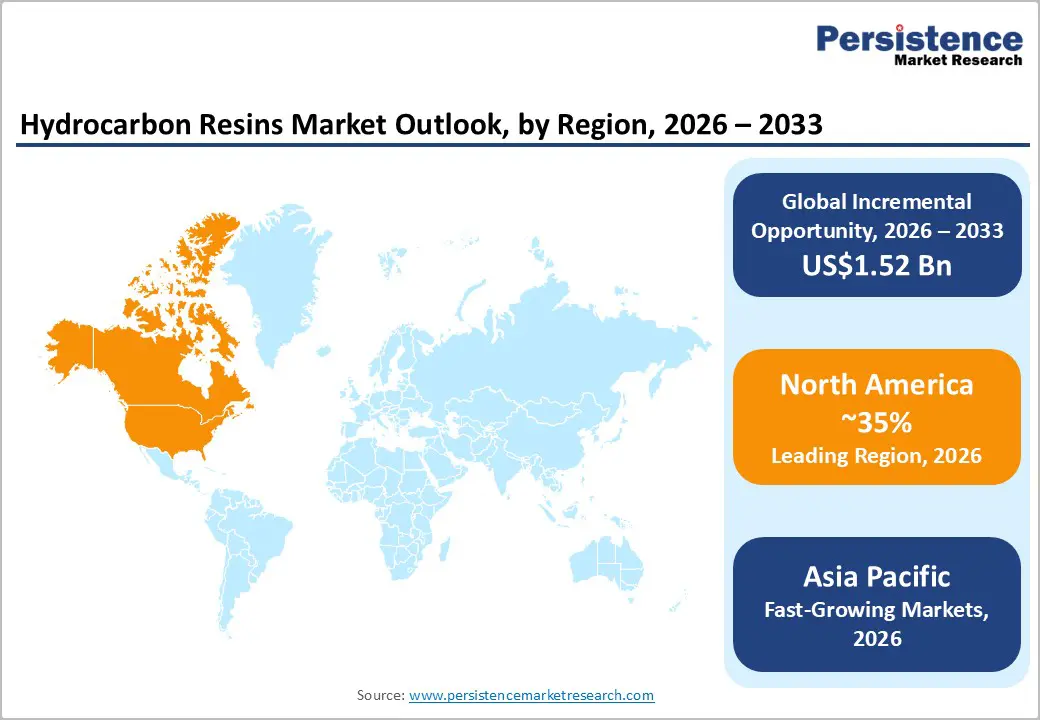

The Asia-Pacific region represents the fastest-growing geographic market for hydrocarbon resins, driven by unprecedented infrastructure investment, industrial expansion, and manufacturing concentration in countries including China, India, Japan, and South Korea. China's petroleum hydrocarbon resin market alone is reflecting the region's dominant manufacturing position and rising domestic consumption. The Belt and Road Initiative, with USD 66.2 billion in construction contracts and USD 57.1 billion in investments recorded in the first half of 2025, substantially accelerates infrastructure development requiring adhesives, coatings, and sealants incorporating hydrocarbon resins.

Manufacturers establishing production capacity and distribution networks within Asia-Pacific benefit from cost-competitive manufacturing advantages, proximity to rapidly expanding end-use industries, favorable government industrial policies supporting chemical manufacturing, and direct access to growing domestic consumer markets increasingly consuming packaged goods, automotive products, and construction materials.

The C5 Resins segment holds a dominant position in the hydrocarbon resins market, accounting for roughly 40% of total market share and exhibiting the fastest growth across application areas. These C5 aliphatic hydrocarbon resins are valued for their outstanding tackifying properties, low odor, and excellent compatibility with various polymer systems such as SIS (Styrene-Isoprene-Styrene), SBS (Styrene-Butadiene-Styrene), and EVA (Ethylene-Vinyl Acetate). They are widely used in hot-melt adhesives, pressure-sensitive tapes, road marking paints, and asphalt modification.

The segment’s leadership is driven by the technical advantages of C5 resins, including rapid curing, superior color stability, and low toxicity, critical for food-contact adhesives and consumer packaging. Zeon Corporation’s Quintone® product line exemplifies this preference, offering multiple grades tailored for specific applications. Manufacturers continue to invest in advanced polymerization technologies to enhance performance and broaden the scope of applications.

The Adhesives & Sealants segment is the largest application category, accounting for approximately 45% of the global market and showing consistent growth across regions and end-use industries. Hydrocarbon resins play a vital role as tackifiers in formulations that require rapid bonding, extended open times, and compatibility with diverse substrates. These properties make them essential for applications in automotive assembly, electronics manufacturing, packaging automation, and construction.

Within this segment, hot-melt adhesives (HMA) incorporating hydrocarbon resin tackifiers represent the fastest-growing subcategory. The global HMA market is driven by automation in packaging lines, sustainability trends favoring solvent-free formulations, and expanding use in hygiene products, footwear bonding, and textiles. Pressure-sensitive adhesives (PSA) also demonstrate strong resilience, capturing about 30% of adhesive applications in 2024, supported by steady demand for packaging labels, protective films, and specialty tapes.

North America, comprising the U.S., Canada, and Mexico, continues to lead the global hydrocarbon resins market, accounting for nearly 35% of the total share through 2035. The region demonstrates steady growth across adhesives, automotive, and industrial applications. North American manufacturers benefit from robust regulatory frameworks, strong R&D capabilities, established distribution networks, and premium pricing acceptance from customers prioritizing product quality, compliance, and technical support.

The region’s regulatory environment, featuring EPA VOC emission standards and stricter state-level requirements such as CARB (California Air Resources Board), encourages the development of low-emission formulations, creating competitive advantages for suppliers offering compliant, high-performance alternatives. Additionally, the accelerating shift toward electric vehicles and lightweight structures continues to fuel demand for advanced adhesive technologies, with 14 million EVs registered globally in 2023, signaling exponential growth in specialty adhesive applications.

Europe ranks as the second-largest regional market for hydrocarbon resins, supported by its strong industrial base, stringent environmental regulations, and premium positioning in automotive and adhesive applications. The region’s adhesives and sealants sector is expanding rapidly, driven by demand for high-performance bonding solutions in luxury vehicle production, electric vehicle assembly, and lightweight composite integration.

Regulatory frameworks such as the EU REACH Regulation and Directive 2010/75/EU impose rigorous compliance requirements, favoring well-capitalized multinational manufacturers. Key players include TotalEnergies’ Cray Valley affiliate, offering Ricon®, Krasol®, and Cleartack® resins; KOLON Industries, supplying C5 and C9 resins under HIKOREZ® and HIKOTACK®; and Arakawa Chemical Industries, providing ARKON® hydrogenated resins. Emphasis on sustainability and third-party certifications creates differentiation opportunities for environmentally responsible suppliers.

The Asia-Pacific region is projected to be the fastest-growing market for hydrocarbon resins, expected to capture approximately 24% of the global share by 2035. Growth is driven by rapid industrialization, infrastructure development, and manufacturing concentration in China, Japan, India, and South Korea.

China’s hydrocarbon resin market is supported by capacity expansion and rising demand from adhesives, coatings, and printing applications. The Belt and Road Initiative, with USD 66.2 billion in construction contracts in early 2025, further accelerates demand for resin-based adhesives and coatings. Regional leaders such as ZEON Corporation, Mitsui Chemicals, and KOLON Industries leverage advanced technologies and localized production to serve diverse industrial applications.

The global hydrocarbon resins market demonstrates moderate consolidation, with ExxonMobil Corporation and Eastman Chemical Company jointly accounting for over 25% of market share through extensive production capacity, diversified portfolios, and global distribution networks. Beyond these leaders, the landscape remains fragmented, with regional and specialty manufacturers such as KOLON Industries, ZEON Corporation, TotalEnergies (Cray Valley), Arakawa Chemical Industries, and Neville Chemical Company competing through technical differentiation and specialized offerings. Limited consolidation reflects product specialization, supply chain optimization, and the complexity of establishing compliant production facilities. Leading players prioritize R&D in bio-based resin development, hydrogenation technologies for enhanced color stability and VOC reduction, and functional grade innovation to capture premium segments.

The global Hydrocarbon Resins market is projected to reach US$ 3.0 billion in 2026, growing from US$ 2.3 billion in 2020, with sustained expansion anticipated through 2033 when the market is forecast to reach US$ 4.5 billion, reflecting 6.0% CAGR growth driven by rising adhesives demand and automotive applications expansion.

The market's primary growth drivers include escalating demand for lightweight automotive bonding solutions, reducing vehicle emissions, explosive e-commerce packaging sector expansion requiring fast-setting adhesives, stringent VOC emission regulations favoring low-emission hydrocarbon resin formulations, and accelerating electric vehicle production necessitating specialized adhesive technologies for advanced composite material integration.

C5 Resins, categorized as aliphatic hydrocarbon resins, command the dominant market position with 40% market share, driven by exceptional tackifying properties, superior compatibility with diverse polymer matrices, low odor profiles, and widespread utilization in hot-melt adhesives, pressure-sensitive tapes, and road marking paint applications across automotive and industrial sectors.

North America maintains commanding market leadership, capturing approximately 35% of global market share through 2035, supported by an established automotive manufacturing base, sophisticated adhesives industry infrastructure, stringent EPA VOC regulations incentivizing low-emission product adoption, and premium market positioning for high-performance bonding solutions serving automotive, industrial, and consumer goods applications.

Bio-based and sustainable hydrocarbon resin development constitutes the most substantial market growth opportunity, driven by escalating corporate environmental commitments, regulatory mandates favoring renewable feedstocks, and customer preferences for low-carbon materials, positioning manufacturers investing in bio-hybrid technologies and circular economy production methods to capture premium market segments and align with evolving sustainability frameworks.

ExxonMobil Chemical and Eastman Chemical Company collectively command approximately 25%+ of global market share, while significant regional and specialty manufacturers including KOLON Industries, ZEON Corporation, TotalEnergies (Cray Valley), Arakawa Chemical Industries, and Neville Chemical Company maintain strong competitive positions through product specialization, technical differentiation, and strategic geographic market penetration serving diverse adhesive, coating, and rubber compounding applications.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author