ID: PMRREP33162| 189 Pages | 22 Jan 2025 | Format: PDF, Excel, PPT* | Healthcare

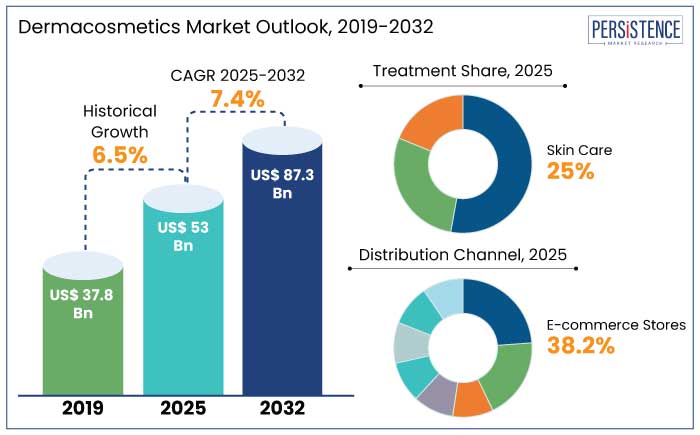

The global dermacosmetics market is estimated to reach a size of US$ 53 Bn in 2025. It is predicted to rise at a CAGR of 7.4% through the assessment period to attain a value of US$ 87.3 Bn by 2032.

Consumer awareness, rising incidence of skin diseases, and the need for efficient skincare products with active ingredients for UV-induced damage, eczema, and acne are driving demand for dermocosmetics in the healthcare sector. In October 2023, L’Oréal launched its La Roche-Posay Effaclar Serum, designed for acne-prone skin, emphasizing efficacy and safety. In November 2023, Beiersdorf launched Eucerin Anti-Pigment Dual Serum, which promotes even skin tone and targets hyperpigmentation.

Collaborations in research and development activities are set to improve the effectiveness of active ingredients and satisfy consumer needs. These are further projected to propel the dermocosmetics industry ahead with targeted releases that emphasize skin health and prevention.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Dermacosmetics Market Size (2025E) |

US$ 53 Bn |

|

Projected Market Value (2032F) |

US$ 87.3 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

7.4% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

6.5% |

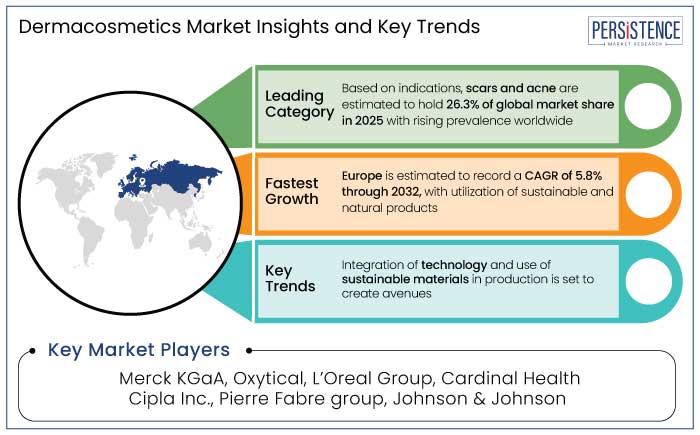

North America is anticipated to hold a share of 38.5% in the global dermocosmetics market in 2025, with a forecast CAGR of 5.8% from 2025 to 2032. High disposable income, a predilection for cutting-edge dermocosmetic products, and convenient access across retail and e-commerce platforms are contributing to growth of the skincare industry in North America. For instance,

The need for anti-aging products, growing awareness of skin health, and strict regulations are the main reasons why Europe is predicted to attain a market share of 37% in 2025. The region is estimated to report a CAGR of 5.2% from 2025 to 2032.

Consumers in Europe are embracing sustainable and natural products, following the worldwide trend toward greener options. For instance,

The skincare segment is set to hold a market share of 25% in 2025, driven by rising skin conditions like acne and eczema, and high popularity of aesthetic procedures like skin lightening and laser treatments. Growth is attributed to innovations in treatment options and consumer demand for effective solutions. For instance,

The skincare segment of the dermocosmetics industry is rising due to a shift toward less invasive treatments and easy access to solutions through dermatological clinics and online shopping.

In 2025, the acne and scars segment is anticipated to dominate the market with a 26.3% share due to rising consumer demand for effective treatments. The skincare and dermatology industry is anticipated to propel due to rising prevalence of acne among individuals aged 18 to 30, influenced by hormonal changes and lifestyle factors.

Companies like Johnson & Johnson and L'Oréal are investing heavily in innovative acne-fighting products under their Neutrogena and La Roche-Posay brands. The market is rising due to the surge of minimally invasive dermatological procedures like microneedling and laser therapies, as well as growing focus on post-acne scar treatment products.

Demand for dermatologist-backed skincare products is on the rise due to the aging population's preference for medical-grade solutions containing clinically proven ingredients. For example,

Market growth has also been aided by the post-pandemic spike in sales of dermatologist-recommended products on e-commerce sites like Amazon and Sephora. Male consumers are becoming more aware regarding skincare, and companies like Kiehl are providing customized skincare products for a range of skin issues utilizing AI-powered technologies.

The global dermacosmetics market recorded a CAGR of 6.5% in the historical period from 2019 to 2023. Post-pandemic, businesses are working together to speed up product distribution and approval. For instance,

Demand for dermacosmetics is estimated to record a considerable CAGR of 7.4% during the forecast period between 2025 and 2032.

Integration of Novel Technology for Product Enhancement to Boost Demand

The dermacosmetics industry is set to develop innovative products following new regulations and rules, with leading players using new technology to craft these products. For instance,

Integration of dermacosmetic items into clinical treatment programs has been shown to enhance patient outcomes by 45%, according to a February 2024 research study. As a result, large hospital systems have begun implementing authorized products into their dermatological protocols.

Focus on Natural and Clean Beauty Formulations to Push Product Development

Companies in the dermocosmetics sector are promoting sustainability, eco-friendly materials, and transparency in response to consumer desire for natural beauty formulas. For example,

In order to meet regulatory standards, build brand loyalty, and match consumer values, companies are adopting certifications such as COSMOS Organic and cruelty-free labels. This is propelling the dermocosmetics market's development and innovation.

Strict Regulatory Norms May Impede Skin Care Product Development

Strict healthcare regulations and a protracted research and approval process hinder the market penetration of skincare products based on dermatology. Small-scale producers and new brands have been impacted by the 30% rise in research and testing expenses brought on by the FDA's tight regulations for cosmetics with therapeutic potential. Severe rivalry in key areas, with over 200 new brand launches in Q1 2024, has resulted in price pressures and high marketing expenses, impacting profit margins throughout the industry.

Development of Personalized Skincare Solutions Provides Growth Avenues

The developments of customized skincare products that use cutting-edge technology like AI and genetic analysis to address certain skin types, issues, and environmental variables is revolutionizing the dermocosmetics sector. For example,

The platform's goals are to address specific skincare issues, foster customer loyalty, and extend the market in the highly customized skincare sector.

Boom of E-commerce Platforms to Offer Global Consumer Base

The convenience of e-commerce and rising awareness of skin diseases in emerging countries have led to the popularity of online platforms, which are known for their wide selection of products, easy-to-use information, and competitive prices. In 2025, e-commerce stores are estimated to account for 38.2% of the market share on the global scale.

According to a few research studies, the online shopping trend was highlighted by the 18% increase in worldwide e-commerce skincare sales in 2023. Big brands are taking advantage of the surge in online shopping. For example,

In the quickly developing dermocosmetics sector, these efforts seek to meet customer demands for ease and customized purchasing experiences, assuring online channels' continued expansion.

Key players in the dermacosmetics market are actively pursuing strategies such as mergers and acquisitions, forming strategic partnerships, and launching new products to enhance their presence in the industry. In recent years, there has been a notable increase in collaborative research and development efforts between leading pharmaceutical companies and specialized cosmetic manufacturers. Rising synergy has not only bolstered the market position of these leading players but has fostered innovation in derma care technology, benefiting the landscape of the healthcare and cosmetic industry.

Recent Industry Developments

The market size is set to reach US$ 87.3 Bn by 2032.

Safe cosmetics are non-toxic beauty and personal care products that are safe to consume, breathe, and absorb without harmful chemicals for human health or the environment.

In 2025, North America is set to attain a market share of 38.5%.

In 2025, the market is estimated to be valued at US$ 53 Bn.

Merck KGaA, Oxytical, L’Oreal Group, Cardinal Health, and Cipla Inc. are a few key players.

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Treatment

By Indication

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author