ID: PMRREP35343| 185 Pages | 21 May 2025 | Format: PDF, Excel, PPT* | Healthcare

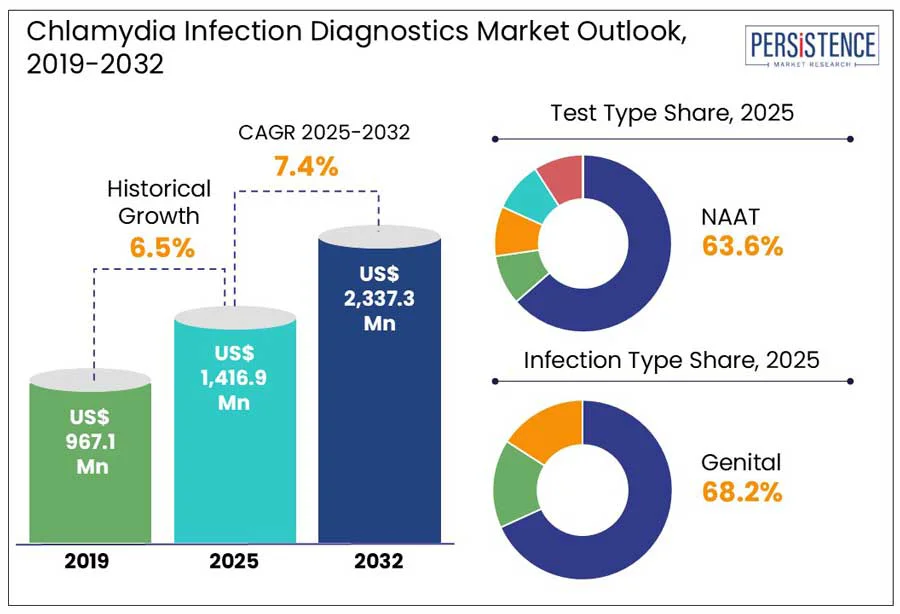

The global chlamydia infection diagnostics market size is predicted to reach US$ 2,337.3 Mn in 2032 from US$ 1,416.9 Mn in 2025. It will likely witness a CAGR of around 7.4% in the forecast period between 2025 and 2032.

Chlamydia infection diagnostics have become increasingly important due to rising public health concerns and surging incidence rates worldwide. As one of the most commonly reported Sexually Transmitted Infections (STIs) globally, Chlamydia trachomatis poses a silent threat, with more than 70% of infections in women and about 50% in men remaining asymptomatic, finds the National Institutes of Health (NIH). This diagnostic challenge has resulted in a wave of innovation in recent years. With changing transmission patterns, diagnostics are being reengineered to detect multiple infection sites and coinfections. These reflect the surging trend for highly sensitive, accessible, and quick diagnostic tools.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Chlamydia Infection Diagnostics Market Size (2025E) |

US$ 1,416.9 Mn |

|

Market Value Forecast (2032F) |

US$ 2,337.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

7.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.5% |

The surging prevalence of chlamydia infections is predicted to significantly propel demand for innovative diagnostic solutions, thereby accelerating the infection control market. As per the World Health Organization (WHO), in 2020, there were about 128.5 Mn new cases worldwide, with incidence rates rising rapidly among individuals aged 15 to 49. In the U.S. alone, the Centers for Disease Control and Prevention (CDC) reported a prevalence rate of 492.2 cases per 100,000 population marking chlamydia as one of the most reported conditions in the country. These numbers are anticipated to rise through 2032 with changes in sexual behavior, spurring demand for effective diagnostic tools to enhance early treatment and detection.

Government bodies and private health organizations in several countries are further promoting chlamydia diagnostics tools. The U.K.’s National Chlamydia Screening Program, for example, focuses on increasing testing among sexually active women under 25 years. It aims to boost treatment and testing in community settings. The U.S. Food and Drug Administration (FDA) has also approved at-home diagnostic tests such as LetsGetChecked's Simple 2 Test, thereby improving accessibility and encouraging more individuals to undergo testing.

False-negative results and misdiagnosis are speculated to hamper the chlamydia infection diagnostics market growth in the foreseeable future. A significant instance occurred in Finland in 2019, where more than 190 specimens tested equivocal or negative using the Aptima Combo 2 Assay (AC2). It usually targets the 23S rRNA gene, but was positive with the Aptima CT Assay (ACT), targeting the 16S rRNA gene. This discrepancy was due to a mutation in the 23S rRNA gene, resulting in an estimated 6 to 10% of chlamydia-positive cases being missed in laboratories using AC2.

The limitations of certain diagnostic tools further tend to exacerbate the issue. Antigen detection-based point-of-care tests (POCTs), while convenient, have exhibited variable sensitivity. A systematic review published by the National Library of Medicine reported a pooled sensitivity of 56% for antigen detection-based POCTs, compared to 94% for Nucleic Acid Amplification Test (NAAT)-based POCTs. This disparity highlights a significant under-detection of infections when relying on less sensitive methods.

Persistent chlamydia infections, often undetected and asymptomatic are being recognized as a key public health concern. These chronic infections tend to result in severe complications, including infertility and pelvic inflammatory disease. Their low bacterial load remains a challenge in diagnosing these infections, as it can lead to false negatives with standard testing tools. This diagnostic gap has bolstered the development of combination tests that are capable of simultaneously detecting multiple Sexually Transmitted Infections (STIs), further improving diagnostic efficiency and accuracy.

The integration of combination tests into home-based testing kits and Point-Of-Care (POC) settings is also expected to gain traction in the sexually transmitted disease testing market. These platforms offer rapid results and are specifically beneficial in resource-limited settings where laboratory infrastructure is poor. The accessibility and convenience of home-based tests and POC help encourage more individuals to undergo screening, facilitating the treatment of persistent infections.

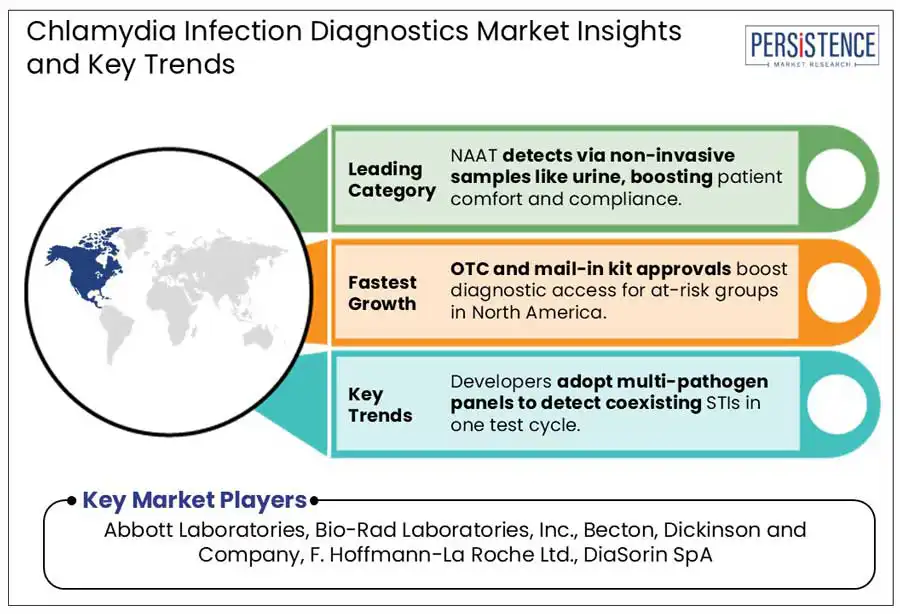

Based on test type, the market is divided into culture test, Nucleic Acid Amplification Test (NAAT), direct fluorescent antibody test, and serology test. Among these, the Nucleic Acid Amplification Test (NAAT) segment is projected to dominate with approximately 63.6% of the chlamydia infection diagnostics market share in 2025. This is attributed to their ability to detect as few as one organism per assay, unlike traditional nonculture methods that require 100 to 1,000 organisms for detection. This high sensitivity enables the identification of infections that can otherwise be missed by different methods. As per the CDC, NAATs detect 20 to 50% more chlamydial infections compared to culture or traditional nonculture tests. This positive result achieved by NAATs is predicted to create new avenues in point-of-care test market.

Serology tests, on the other hand, are gaining momentum worldwide due to their potential for cost-effective and rapid screening, mainly in resource-limited settings. In areas lacking innovative laboratory infrastructure, POC serology tests can offer instant results, influencing timely treatment decisions. This is evident in areas where access to comprehensive healthcare facilities is limited.

In terms of infection type, the market is trifurcated into genital, rectal, and ocular. Out of these, the genital segment will likely account for a share of nearly 68.2% in 2025. The bacterium Chlamydia trachomatis typically targets the mucosal epithelium of the genital tract, resulting in infections such as urethritis in men and cervicitis in women. This predilection for genital tissues makes sexual transmission the predominant route of infection.

As per a study published in BioMed Central, the high prevalence of asymptomatic cases, which is around 50% in men and more than 70% in women, facilitates unnoticed transmission during sexual activities. This further contributes to the widespread occurrence of genital chlamydia infections. The high burden of STIs in the genital area has also created concerns in the genital herpes treatment market, where similar dynamics of asymptomatic transmission are pushing developments in early diagnostic solutions.

Rectal infections are envisioned to exhibit considerable growth through 2032, backed by their high prevalence among men who have sex with men (MSM). In China’s Guangdong Province, for example, the prevalence of rectal chlamydia among MSM rose from 13.8% in 2018 to 26.4% in 2022. It showed an average annual percentage change of 19.2%. This surge is primarily due to factors, including co-infections with other STIs such as syphilis, having regular sexual partners, and seeking sexual partners through specific venues.

In 2025, North America is poised to generate about 41.5% of share, revealed Persistence Market Research. The U.S. chlamydia infection diagnostics market is speculated to remain at the forefront of growth through 2032, due to proactive public health initiatives and high infection rates. As per the CDC, around 55.8% of Chlamydia trachomatis infection cases in 2023 in the U.S. were among individuals aged 15 to 24, highlighting the significance of targeted screening in this demographic.

The CDC has hence been focusing on promoting early detection and regular screening of chlamydia. Recommendations include more frequent testing for those with multiple partners, as well as annual testing for sexually active women under 25 and men who have sex with men. Such initiatives aim to help reduce the prevalence of chlamydia and prevent complications related to untreated infections.

The Middle East and Africa point-of-care diagnostics market is seeing decent growth as the emphasis on integrating NAATs into diagnostic protocols rises. NAATs are highly preferred in this region as they are capable of detecting chlamydia infections accurately. Chlamydia is considered a significant public health concern in Sub-Saharan Africa. As per a 2020 study published in the National Library of Medicine, the predicted prevalence of chlamydia among 15 to 49-year-olds in the region was 4.2% in males and 6.9% in females in the same year. The region, however, faces specific challenges owing to limited access to innovative testing methods. It is further resulting in delayed treatment and underreporting.

A systematic review and meta-analysis published in BMC Infectious Diseases recently mentioned a pooled prevalence of Chlamydia trachomatis infection among reproductive-age women in Sub-Saharan Africa at 7.8%. It highlighted a significant burden of the disease in the region. The syndromic approach, which is primarily initiated in several countries in Sub-Saharan Africa, depends on the detection of symptoms to diagnose infections. This method, however, often fails to detect asymptomatic cases of chlamydia, leading to ongoing transmission and missed diagnoses. To address these challenges, government agencies are striving to implement NAATs in the region, thereby driving the market.

In Europe, the prevalence of chlamydia has been rapidly increasing, creating new growth prospects for diagnostic tool manufacturers. The European Center for Disease Prevention and Control (ECDC) reported 230,199 confirmed cases of chlamydia across 27 EU/EEA countries in 2023 alone, with a crude notification rate of 70.4 cases per 100,000 population. Transmission among MSM accounted for 20% of chlamydia cases in the same year, marking a 4% surge from 2022.

The 2025 guidelines in Europe on the management of chlamydia infections emphasize the utilization of validated NAATs for diagnosis, including the acceptance of self-collected specimens. In 2023, nearly 295,346 individuals were tested for chlamydia in Denmark, with 37,111 confirmed cases. The incidence rate dropped for both men and women across the country to a certain extent, except for men on Bornholm. The male-to-female incidence ratio surged to 0.75 nationwide, pointing to a narrowing gender gap in chlamydia incidence. There was also a slight decline in confirmed cases of rectal chlamydia among men, highlighting a growing trend of extragenital infections. Ongoing initiatives to improve diagnostic accuracy are likely to address the rising burden of chlamydia infections across Europe.

The global chlamydia infection diagnostics market houses several renowned diagnostic companies and emerging start-ups focusing on accessibility and accuracy. Leading players are generating high shares with their novel molecular diagnostic platforms, specifically NAATs, which are considered the gold standard for chlamydia detection due to their high specificity and sensitivity. These players are investing in the point-of-care adaptations, multiplexing capabilities, and automation to broaden their presence in decentralized healthcare settings. Emerging companies are launching portable and affordable diagnostic solutions across underserved areas to gain a competitive edge.

The market is projected to reach US$ 1,416.9 Mn in 2025.

The increasing prevalence of chlamydia and rising government initiatives to promote screening methods are the key market drivers.

The market is poised to witness a CAGR of 7.4% from 2025 to 2032.

Rapid development of multi-pathogen tests and surging focus on early detection are the key market opportunities.

Abbott Laboratories, Bio-Rad Laboratories, Inc., and Becton, Dickinson and Company are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Test Type

By Infection Type

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author