ID: PMRREP4406| 199 Pages | 28 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

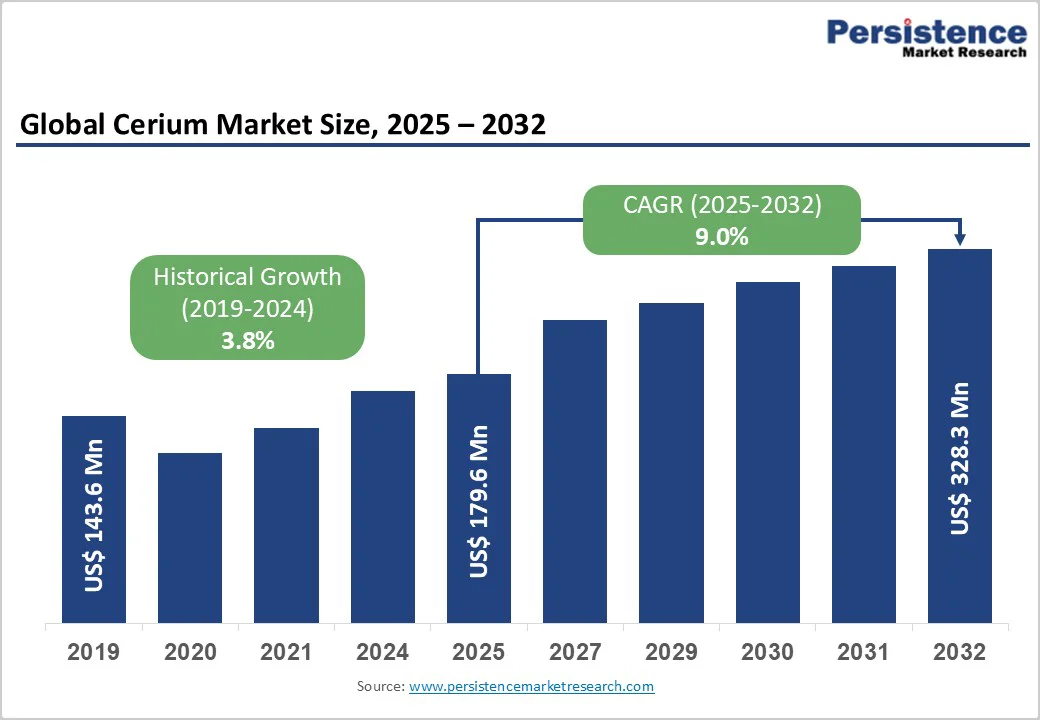

The global cerium market size is valued at US$179.6 million in 2025 and is projected to reach US$328.3 million, growing at a CAGR of 9.0% over 2025 - 2032.

The market growth is primarily driven by increasing demand for automotive catalytic converters in response to strict emission regulations, as well as surging applications in renewable energy technologies and the glass polishing industry.

As governments worldwide implement stringent environmental standards like the European Union's Euro 7 and the U.S. EPA's Tier 4 standards, manufacturers are actively investing in cerium-based emission control systems to reduce harmful pollutants such as nitrogen oxides and carbon monoxide from vehicle exhausts, thereby boosting market expansion across key manufacturing regions.

| Key Insights | Details |

|---|---|

| Cerium Market Size (2025E) | US$ 179.6 Mn |

| Market Value Forecast (2032F) | US$ 328.3 Mn |

| Projected Growth CAGR (2025 - 2032) | 9.0% |

| Historical Market Growth (2019 - 2024) | 3.8% |

The rapidly expanding electric vehicle (EV) market is creating substantial demand for cerium-based catalytic converters and emission control systems. According to IEA, EV car sales exceeded 17 million globally in 2024, reaching a sales share of more than 20%.

With governments globally implementing stricter environmental regulations to combat air pollution, automotive manufacturers are increasingly incorporating cerium oxide catalysts in both traditional and hybrid vehicles to meet regulatory compliance standards.

The U.S. EPA and European Commission have established increasingly stringent emission regulations, requiring reduced emissions of particulate matter, nitrogen oxides, and carbon monoxide from vehicle exhausts. Each passenger vehicle typically contains between 80 to 150 grams of cerium oxide in its catalytic converter system.

Cerium oxide is the preferred polishing material in precision glass manufacturing due to its ability to achieve ultra-smooth finishes without damaging glass surfaces. It is used in optical lenses, mirrors, flat-panel displays, and high-precision glass components for semiconductors and solar panels. The demand for cerium-based polishing powders has grown due to the expansion of 5G infrastructure, advanced display technologies, and semiconductor manufacturing.

The construction sector's growing preference for high-performance glass in modern buildings and the renewable energy sector's demand for solar panels coated with protective glass are amplifying cerium consumption. The glass polishing segment currently represents the dominant application market, with cerium oxide commanding approximately 48% market share within the Cerium Oxide Nanoparticles market, driven by its superior polishing efficiency compared to conventional materials such as iron oxide.

The global cerium market faces significant constraints related to price volatility and supply chain concentration, primarily driven by China's dominance in rare earth mining and processing. China currently controls approximately 60% of global rare earth mining production and over 85% of processing capacity, creating substantial vulnerability in global supply chains.

When China implemented export controls in 2023 and 2024, requiring special licenses for products containing more than 0.1% Chinese-sourced rare earth materials, prices for certain rare earth compounds experienced dramatic fluctuations.

Historical precedent exists for such disruptions, with cerium prices experiencing approximately 1,000% increases within months during the 2010 - 2011 trade dispute between China and Japan. Cerium oxide prices in 2025 currently hover around US$3,000 to US$4,000 per ton, reflecting both steady demand and increased extraction costs outside China. This geographic concentration creates significant planning challenges for manufacturers, as sudden export restrictions or policy changes can destabilize supply availability and increase operational costs substantially.

Rare earth mining, including cerium extraction, faces stricter environmental regulations that increase production costs and limit capacity outside China. The EU's Critical Raw Materials Act requires member states to assess supply chain risks, with mandates for 10% local extraction and 40% processing within the EU by set dates. Environmental standards for mining include advanced water treatment, air quality monitoring, land reclamation, and hazardous waste containment, all of which significantly raise capital expenditures.

The presence of radioactive elements like thorium and uranium in cerium-bearing deposits complicates extraction and adds regulatory requirements for radioactive waste management. The processing of monazite ore, a primary cerium source, generates significant environmental byproducts that must be contained and disposed of properly, presenting economic challenges for operations outside China that face stricter environmental standards compared to less-regulated Chinese operations.

The rapid adoption of clean energy, especially in hydrogen production and fuel cell technologies, offers significant growth opportunities for cerium-based catalysts. Thermochemical water splitting using cerium oxide to produce hydrogen from water with concentrated solar power or nuclear waste heat is an emerging area with strong potential. The U.S. Department of Energy and leading research institutions are developing viable thermochemical cycles with cerium oxide to achieve near-zero emissions in hydrogen production.

The advancements in solid oxide fuel cells (SOFCs) with cerium oxide membranes are expected to boost demand, aligning with government investments in hydrogen infrastructure. As China aims to install 443 GW of solar capacity by 2025 and global renewable energy investments exceed $500 billion annually, the demand for advanced catalyst materials in clean energy systems is set to rise, presenting significant opportunities for cerium producers and chemical manufacturers.

The emerging focus on circular economy principles and rare earth element recycling presents a critical growth opportunity to address supply chain vulnerabilities and reduce extraction pressures on primary mining operations. Advanced recycling technologies have demonstrated the ability to recover 90% or more of cerium oxide from end-of-life catalytic converters, electronic waste, and industrial residues, potentially contributing 15-20% of total cerium demand by 2030.

Government initiatives such as India's Production Linked Incentive (PLI) scheme for rare earth recycling and the European Union's Battery Regulation, emphasizing material recovery and circular design principles, are driving investments in recycling infrastructure development.

Magnetic-to-magnetic recycling processes and recovery technologies for cerium compounds from red mud byproducts in alumina refining operations are gaining commercial traction, with companies like Vedanta Aluminum piloting scandium and rare earth recovery from industrial residues.

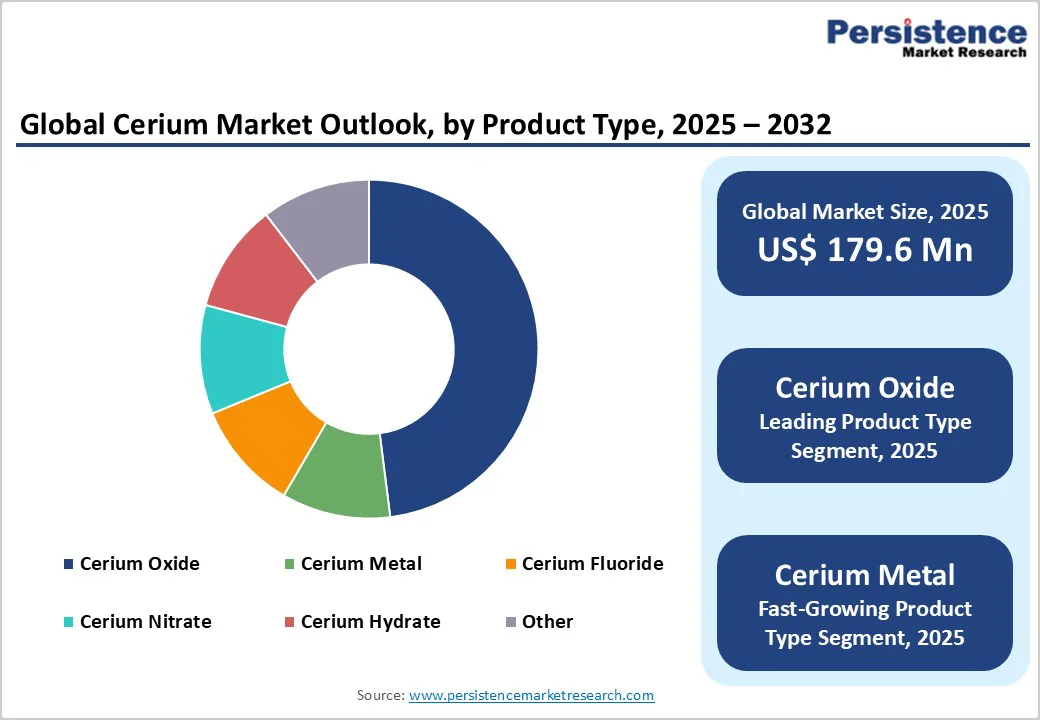

Cerium oxide (CeO2) dominates the global cerium market, representing about 48% of the total share in 2024. Its versatility in critical industries, especially in automotive catalytic converters for emission reduction and in precision glass polishing for superior finishes, drives this dominance.

Cerium oxide's high oxygen storage capacity (OSC) allows it to absorb oxygen in high-oxygen conditions and release it in low-oxygen conditions, making it effective for three-way catalytic converters (TWCs), diesel oxidation catalysts (DOCs), and selective catalytic reduction (SCR) systems.

The cerium oxide's application in semiconductor manufacturing for silicon wafer polishing, its use in glass colorization and UV absorption for optical applications, and its emerging role in fuel cell technologies and photocatalytic applications support its dominant market position.

The chemical and mechanical polishing capabilities of cerium oxide, combined with its thermal stability and resistance to sintering in high-temperature catalytic applications, continue to drive widespread adoption across the glass, electronics, and automotive manufacturing sectors globally.

The glass manufacturing segment remains the dominant application area for cerium compounds, accounting for approximately 38% of global market share in 2024, with particular emphasis on glass polishing and optical surface finishing.

Cerium oxide is crucial in the precision polishing of optical lenses, flat-panel displays, silicon wafers for semiconductor production, solar panel glass, and architectural glass components, where superior surface quality and minimal scratching are critical requirements.

The increasing demand for advanced display technologies, including liquid crystal display (LCD) panels and organic light-emitting diode (OLED) screens, drives significant consumption of cerium-based polishing powders in Asia Pacific manufacturing hubs, particularly in China, Japan, South Korea, and Taiwan.

The automotive industry's expansion of tempered and laminated glass applications in vehicles contributes substantially to cerium demand, while the renewable energy sector's growth in solar panel production creates additional demand for cerium oxide in glass surface treatment processes.

The North American cerium market demonstrates strong growth momentum driven by stringent emission regulations and substantial investments in clean energy technologies.

The U.S. maintains leadership within the region due to its robust automotive industry, well-established aerospace manufacturing sector, and significant institutional focus on reducing dependence on imported rare earth materials through domestic processing initiatives and strategic stockpiling programs.

The U.S. EPA has established stringent emission standards, such as the Tier 4 for engines, driving demand for cerium-based catalytic converters in combustion and hybrid systems. American manufacturers are investing in advanced production facilities and developing domestic rare earth processing to lessen dependence on Chinese imports.

The region's strong presence in fuel cell development and hydrogen infrastructure projects, supported by U.S. Department of Energy initiatives, contributes to emerging demand for advanced cerium catalysts in clean energy applications.

European market dynamics are shaped by ambitious environmental regulations and a strategic commitment to developing independent rare-earth supply chains to reduce Chinese dependency.

The European Commission's Critical Raw Materials Act (CRMA), adopted in March 2024, establishes mandatory consumption targets requiring 10% local extraction, 40% processing within the EU, and 25% from recycled materials by 2030, creating substantial incentives for cerium processing capacity development across member states.

The EU's Batteries Regulation, effective July 2023, focuses on sustainable battery lifecycle management and material traceability, boosting demand for cerium compounds in battery production and thermal management.

Strict emission control policies, especially the Euro 7 standards, are accelerating the use of advanced cerium oxide catalysts in automotive applications across Germany, France, the U.K., and Spain. The push for renewable energy enhances cerium demand for glass polishing and specialized applications.

Government investments in rare earth processing and cerium recycling research are making Europe a hub for cerium processing, although higher environmental compliance costs pose challenges compared to Chinese operations.

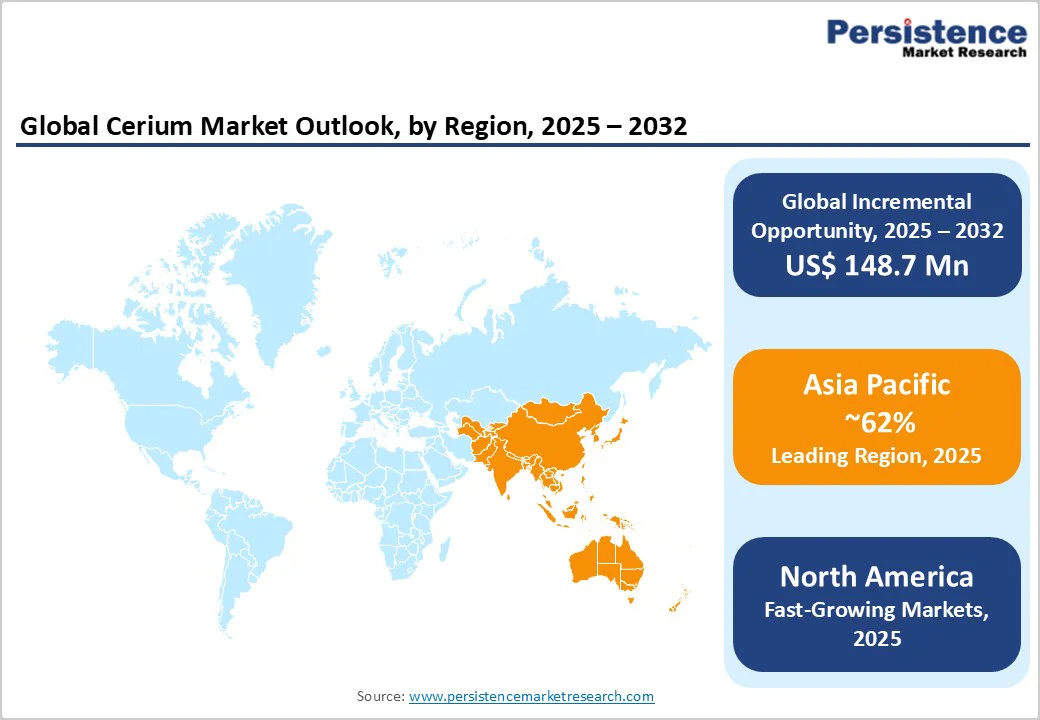

Asia Pacific dominates the global cerium market, accounting for approximately 62% of total global consumption in 2024, driven by China's overwhelming production capacity and Japan's advanced electronics manufacturing capabilities.

China remains the world's largest producer, controlling approximately 70% of global rare earth mining production and over 85% of processing capacity, with government policies providing substantial support for rare earth production and export optimization.

Japan and India are also among the key contributors to the Rare Earth Elements market in the Asia Pacific. India’s IREL Limited and Japan’s Toyota Tsusho Corporation, through their joint venture, operate a separation and refining facility in Andhra Pradesh, India. This partnership may open a plethora of opportunities in terms of technological investments and best practices.

The global cerium market is moderately consolidated, featuring a mix of dominant state-backed firms and emerging international players involved in raw material extraction, processing, and specialized applications. Chinese companies like China Northern Rare Earth hold significant market power due to government support, extensive resources, and integrated production capabilities.

Trends include the development of circular economy practices through recycling, collaborations between producers and research institutions to enhance clean energy applications, and strategies for geographic diversification to reduce reliance on Chinese processing while staying competitively priced.

The global cerium market is valued at US$179.6 Million in 2025 and is projected to reach US$328.3 Million by 2032, representing a compound annual growth rate of 9.0% during the forecast period.

The primary demand drivers include stringent automotive emission regulations (EPA Tier 4, European Union Euro 7 standards), surging electric vehicle adoption, requiring advanced catalytic converters.

Cerium Oxide represents the dominant product category with approximately 48% market share in 2024, due to its exceptional oxygen storage capacity for automotive catalytic converters.

Asia Pacific leads the global cerium market with approximately 62% market share in 2024, supported by China's dominant mining production capacity and extensive rare earth processing infrastructure.

Cerium recycling and circular economy development represent the most significant market opportunity, with advanced technologies demonstrating recovery rates exceeding 90% from catalytic converters and electronic waste.

Leading market participants include Lynas Rare Earth Ltd. (Australia), The Shepherd Chemical Company (United States), Mitsui Mining & Smelting Co., Ltd. (Japan), Sichuan Wonaixi New Material Technology Co., Ltd. (China), and China Northern Rare Earth Group, competing through integrated production capabilities, specialized applications development, and geographic supply chain optimization strategies.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn, Volume: Metric Tons as Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author