ID: PMRREP13387| 202 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

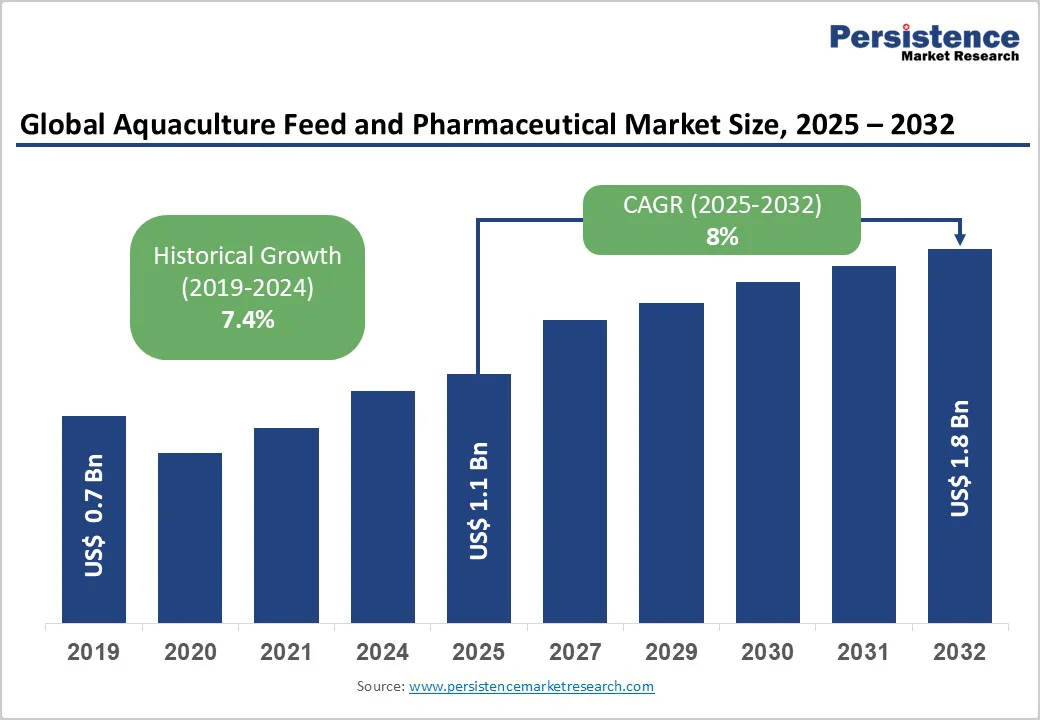

The global aquaculture feed and pharmaceutical market size is likely to be valued at US$1.1 Billion in 2025, and is estimated to reach US$1.8 Billion by 2032, growing at a CAGR of 8% during the forecast period 2025−2032, driven by an escalating demand for seafood worldwide, technological innovations in sustainable feed production, and advancing disease management solutions. Market growth is driven by rising aquaculture productivity and a shift toward organic, eco-friendly practices. Asia Pacific leads with major investments in feed and biologics, while North America and Europe focus on sustainable, high-value solutions such as vaccines, immunostimulants, and biotech or plant-based formulations.

| Key Insights | Details |

|---|---|

| Aquaculture Feed and Pharmaceutical Market Size (2025E) | US$1.1 Bn |

| Market Value Forecast (2032F) | US$1.8 Bn |

| Projected Growth (CAGR 2025 to 2032) | 8% |

| Historical Market Growth (CAGR 2019 to 2024) | 7.4% |

This driver reflects a niche yet pivotal evolutionary shift within the aquaculture industry, where functional feeds, enriched with probiotics, prebiotics, bioactive peptides, and immunostimulants, are disrupting traditional feed formulations. Driven by increasing disease outbreaks such as early mortality syndrome in shrimp and bacterial infections in finfish, these feeds promise substantial improvements in host immunity and overall farm productivity.

Government agencies, including the United States Department of Agriculture (USDA), European Food Safety Authority (EFSA), and the Chinese Ministry of Agriculture, are actively endorsing such innovations through research grants and policy incentives. This trend is particularly prominent in high-value species such as salmon, shrimp, and tilapia, where disease management costs can reach up to 15% of operational expenses. The growth trajectory of this market supports the broader shift towards sustainable, health-promoting aquaculture practices, reshaping supply chains as feed manufacturers collaborate with biotech firms, academic institutions, and regulatory bodies to develop ingredients that meet stringent safety standards.

A critical challenge constraining the market growth stems from volatility in raw material prices, particularly fishmeal, soybean meal, and corn, which constitute core ingredients for aquaculture feeds. Fluctuations driven by geopolitical tensions, climate conditions, and fluctuating harvest yields impose unpredictable costs on feed manufacturers. For example, the price of fishmeal has seen frequent and considerable swings in recent years, influenced by supply disruptions in South America and changing fishing quotas. Such volatility creates margin compression, especially for regions heavily dependent on imported ingredients such as Latin America and Southeast Asia, where logistic delays during pandemics or geopolitical tensions amplify risks.

From an economic standpoint, supply chain uncertainties directly impact product pricing, market stability, and capacity planning. Farmers face increased costs, which diminish profit margins and slow the adoption of advanced formulations such as organic, medicated, or functional feeds. Regulatory hurdles further complicate pharmaceutical supply chains, as varying approval processes across regions add layers of compliance costs.

The burgeoning domain of biologics, including vaccines and immune-boosting feed additives, presents a lucrative opportunity, especially as global disease outbreaks in aquaculture gain prominence. Rising pathogen resistance and biosecurity concerns have prompted a paradigm shift from prophylactic antibiotics to targeted biologics, which offer precision disease control. Governments and international agencies, such as the Food and Agriculture Organization (FAO) and the World Organisation for Animal Health (OIE), are mandating stricter disease reporting and vaccination protocols, creating a regulatory landscape conducive to innovation.

Market leaders are collaborating with biotech firms to develop a pipeline of species-specific vaccines, particularly for shrimp and salmon, aimed at critical pathogens such as white spot syndrome virus (WSSV) and infectious pancreatic necrosis (IPN). Customizable vaccine platforms and feed-based immunostimulants are addressing unmet needs in emerging markets, where disease incidence remains high and farm margins are squeezed by production losses. This platform-based innovation can potentially reduce mortality rates, significantly boosting farm profitability and sustainability.

The finfish segment currently dominates the aquaculture feed and pharmaceutical market, commanding approximately 65% of the global revenue share in 2025. This dominance stems from the high-volume production of species such as carp, tilapia, and salmon, which benefit from well-established breeding programs, optimized feed formulations, and widespread market consumption. Finfish farming advances continue to drive demand for specifically tailored feed solutions that enhance growth rates and feed conversion efficiencies, as well as pharmaceutical interventions aimed at preventing bacterial and viral infections common to these species.

The crustacean segment is identified as the fastest-growing segment, fueled primarily by shrimp farming, which is increasingly adopting medicated feeds and novel vaccine technologies to overcome diseases such as WSSV and early mortality syndrome (EMS). The rising importance of crustacean health management is propelling pharmaceutical demand, including immunostimulants and probiotics, which enhance disease resilience. Mollusks, while a smaller segment, are growing steadily as niche markets for oysters and mussels adopt feed formulations to improve yield and nutritional quality.

Dry pellet feed remains the dominant product type, representing an estimated 70% of the aquaculture feed and pharmaceutical market revenue share in 2025 due to its convenience, storage stability, and balanced nutrient delivery. Pellets are variably formulated with floating or sinking properties tailored to species-specific feeding habits, supporting commercial aquaculture operations worldwide. Substantial innovation has occurred in pellet quality, incorporating enhanced vitamins and minerals to boost product value.

Extruded feed is the fastest-growing product type, driven by technological developments that improve pellet durability, water stability, and nutrient bioavailability, along with the incorporation of functional additives such as probiotics and immunostimulants. Medicated feeds, an essential sub-segment, are growing steadily as they integrate pharmaceutical compounds to prevent or treat infectious diseases, especially in shrimp and other high-value species. Vaccines, probiotics, and other pharmaceutical formulations targeting pathogen prevention are shaping therapeutic feed development.

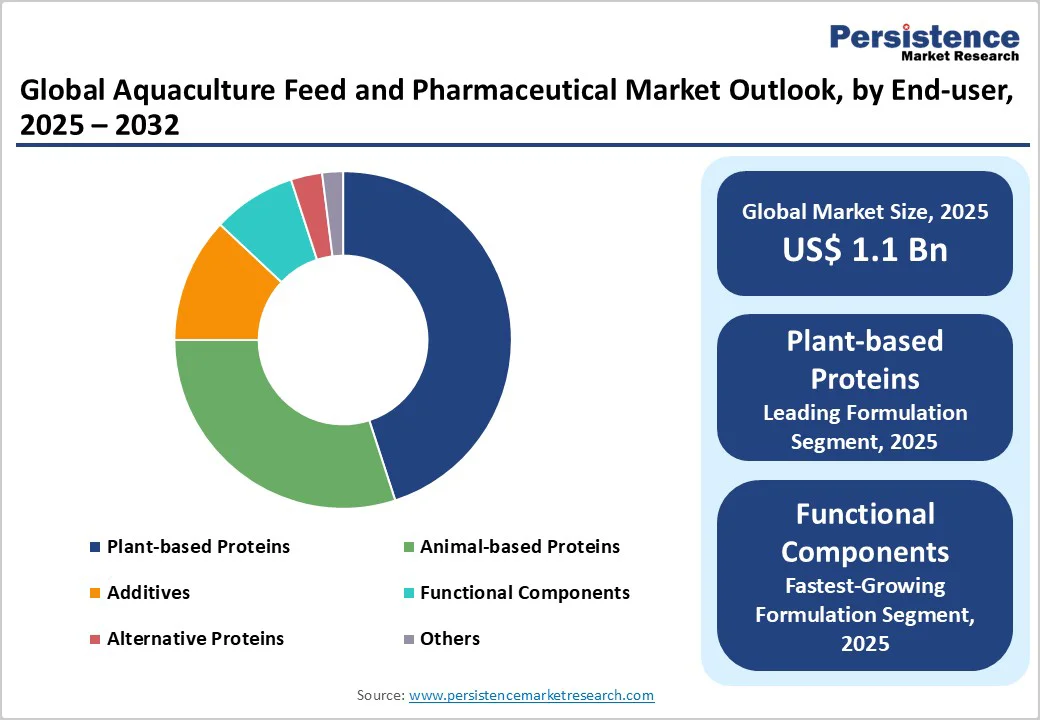

Soybean-based proteins, under the plant-based segment, currently represent the leading ingredient formulation segment, with a 2025 estimated share exceeding 45%. The wide availability, cost efficiency, and nutritional profile of soybeans make it a preferred protein source, especially as aquaculture transitions from marine fishmeal reliance to more sustainable plant-based alternatives. Technological enhancements in soybean processing have reduced anti-nutritional factors, increasing its inclusion rates.

Additives and functional components form the fastest-growing formulation category. This category includes immune-boosting ingredients such as amino acids, probiotics, pigments, and prebiotics that enhance fish health and growth performance. The increasing focus of the industry on reducing antibiotic dependency and meeting regulatory demands for residue-free products has escalated demand for natural feed additives. Emerging technologies such as microencapsulation improve additive efficacy by enabling controlled release, broadening their applications, and market penetration.

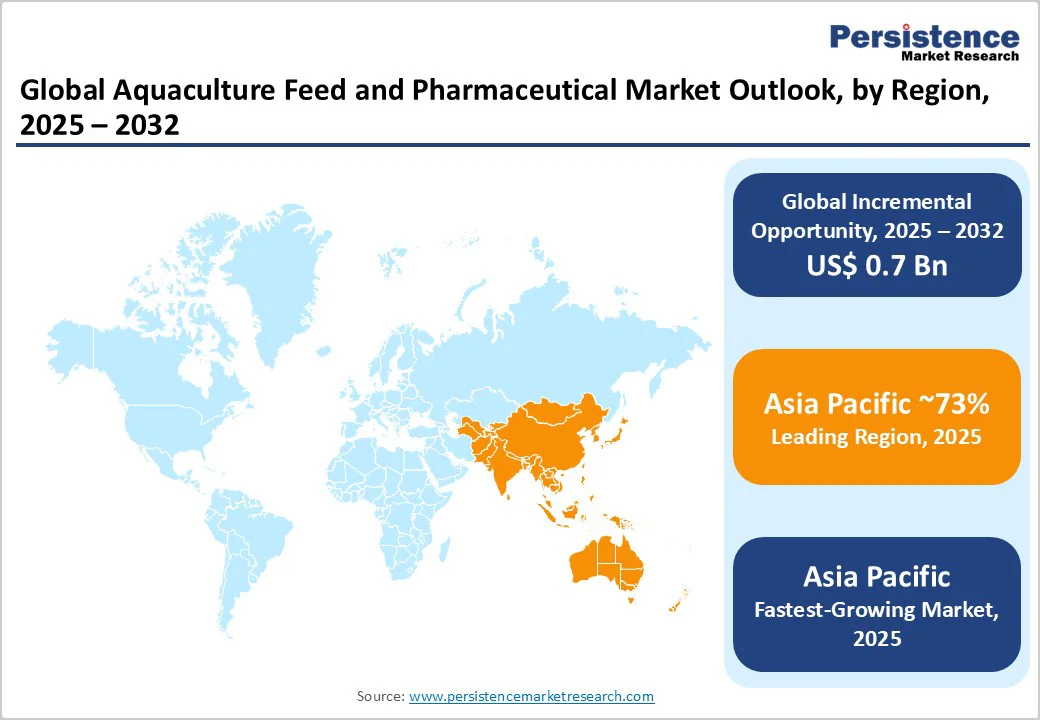

Asia Pacific is set to dominate with approximately 73% of the aquaculture feed and pharmaceutical market share in 2025. China, India, Japan, and ASEAN countries collectively drive this growth through expanding aquaculture production, low-cost feed manufacturing, and increasing government support. China’s vast aquafeed industry accounts for a major portion of global production, rapidly incorporating sustainable ingredients and pharmaceuticals aligned with evolving environmental regulations.

India's ongoing 'Blue Revolution' and related initiatives continue to propel growth in aquafeed demand. Regulatory advancements supporting quality control and residue standards reinforce market confidence. Biotechnological applications in disease prevention and feed formulation are gaining traction in the region. Manufacturing advantages in the form of cost-effective labor, abundant raw materials, and improved infrastructure will fortify Asia Pacific as the global epicenter for aquaculture feed and pharmaceutical innovation and production for the next several years.

Europe commands an estimated 14% market share in 2025, driven by countries including Germany, the U.K., France, Spain, Norway, and Scotland. European aquaculture emphasizes stringent regulatory harmonization and environmental sustainability, with the European Food Safety Authority (EFSA) enforcing product standards that encourage organic feed formulations and novel pharmaceutical approaches. European producers are actively investing in vaccine innovations and immunostimulants to mitigate disease outbreaks in economically important species such as Atlantic salmon, cod, and mussels. Public-private collaborations and substantial R&D funding are advancing feed additive technologies tailored to species and regional requirements.

North America is projected to hold approximately 9% of the market by 2025, driven primarily by the U.S. The regional market is expected to grow through 2032, supported by a mature regulatory environment and strong innovation networks. Regulatory agencies such as the Food and Drug Administration (FDA) and USDA facilitate streamlined approvals for biologics and novel feeds, encouraging accelerated adoption of vaccines and functional supplements.

Investment trends indicate expansion in domestic manufacturing of sustainable and medicated feeds, with companies such as Cargill and Alltech spearheading innovations in feed formulations that meet organic certification and biosecurity standards. The growth of the U.S. seafood market and consumer interest in ethically sourced products provide tailwinds for feed and pharmaceutical demand. Furthermore, partnerships between research institutions and private enterprises contribute to developing cutting-edge feed ingredients and health management products.

The global aquaculture feed and pharmaceutical market structure is moderately consolidated, with the top five players controlling nearly half of the market. Key corporates such as Cargill Incorporated, Nutreco N.V., Archer Daniels Midland Company, and Alltech Inc. dominate product innovation, supply chain optimization, and geographic reach. These players’ expansive product assortments across feed types, pharmaceutical formulations, and functional additives drive consumer preference and establish scale advantages.

The market continues to witness growing vertical integration, as firms secure raw material supply chains while investing in domestic manufacturing expansions. Simultaneously, fragmentation persists in emerging economies where smaller regional players specialize in local species and customized feed and pharmaceutical products. Competitive positioning largely revolves around innovation capacity, sustainable product development, and regulatory compliance agility.

Key Industry Developments

The global aquaculture feed and pharmaceutical market is projected to reach US$1.1 Billion in 2025.

An escalating demand for seafood worldwide, technological innovations in sustainable feed production, and advancing aquaculture disease management solutions are driving the market.

The aquaculture feed and pharmaceutical market is poised to witness a CAGR of 8% from 2025 to 2032.

The shift toward organic and eco-friendly practices, growing support for high-value segments such as vaccines, immunostimulants, and functional feeds, and rapid innovation in biotech-enabled pharmaceuticals and plant-based formulations are key market opportunities.

Cargill Incorporated, Nutreco N.V., and Archer Daniels Midland Company are some of the key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Species

By Product Type

By Formulation

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author