ID: PMRREP16510| 197 Pages | 2 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

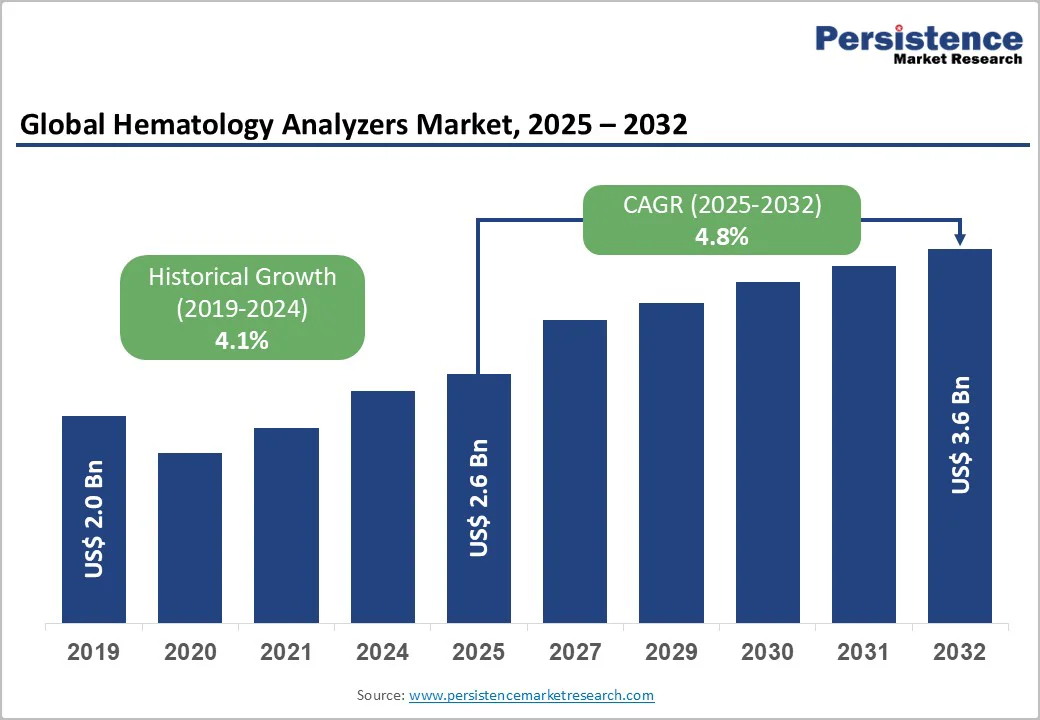

The global hematology analyzers market size is valued at US$ 2.6 billion in 2025 and projected to reach US$ 3.6 billion, growing at a CAGR of 4.8% during the forecast period from 2025 to 2032.

The global market is anticipated to grow rapidly throughout the forecast period due to the ongoing expansion of research and development efforts in areas such as stem cell research, gene therapies, targeted therapies, blood disorders, thalassemia, and omics. Owing to this trend, the market will continue to thrive over the forecast period.

| Key Insights | Details |

|---|---|

| Hematology Analyzers Market Size (2025E) | US$2.6 Bn |

| Market Value Forecast (2032F) | US$3.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.1% |

Over the past years, blood analysis has become increasingly popular for early diagnosis of several chronic diseases, which were previously only achievable through tissue biopsy. Improvements significantly influence the hematology analyzer market for blood indicators in disease diagnosis.

More than 1,125,000 men globally had an inherited bleeding problem, and over 418,000 of those had a severe form of the most undiagnosed disease, according to the World Federation of Hemophilia, July 2022. The safest way to protect a patient with blood disorders and maintain the quality of life is by early diagnosis and treatment.

Therefore, the market is projected to be driven by the rising burden of blood disorders. Furthermore, it is predicted that the market will also rise in the future due to the increasing adoption rate of automated hematology analyzers and the integration of AI-based hematology analyzers, along with growing preferences towards high-sensitivity hematology testing.

Automation has created new opportunities in the market by encouraging the development of new instruments, such as automated erythrocyte sedimentation rate (ESR) systems, integrated slide-makers, HbA1c systems, tube sorters, and electronic morphology systems connected to middleware. This continuous product innovation and its commercialization will create high demand for haematology analyzers throughout the forecast period.

Modern products available on the market are not accepted or preferred in underdeveloped countries. Another significant factor is product recalls and concerns about the product's efficacy and safety, which are expected to limit market growth. A lack of preference, which slows this device's adoption in developing nations, is a factor restricting market growth.

Market growth is expected to be constrained over the forecast period by competition among current players and the high cost of haematology analyzers. Additionally, market challenges, such as stringent regulatory standards, are expected to remain strong during the projected period.

For example, portable hematology analyzers from Wuhan Darppon Medical Technology Co, Ltd. cost between US$3500 and US$5500. Due to their exorbitant prices, these items have limited adoption rates and are unable to compete and are lowly preferred by the people in underserved regions and emerging markets.

The hematology analyzers market is uniquely positioned to benefit from the ongoing shift towards decentralized healthcare models. Increasingly, healthcare systems are adopting point-of-care testing (POCT) solutions, which enable rapid diagnosis and timely treatment decisions outside traditional laboratory settings.

This trend significantly drives demand for compact, easy-to-use hematology analyzers that provide accurate results directly at patient locations such as clinics, emergency rooms, and remote care centers. The adoption of advanced technologies, including AI integration and automation, enhances the throughput and reliability of these devices, further cementing their role in decentralized healthcare.

Additionally, the growing burden of blood disorders such as anemia, leukemia, and coagulation disorders globally accentuates the need for fast and precise hematological diagnostics, accelerating market expansion. Healthcare providers increasingly seek tools that reduce turnaround times while ensuring diagnostic accuracy to improve clinical outcomes and patient management.

The combined effects of technological innovation and evolving healthcare delivery models present significant growth opportunities for manufacturers and service providers in this space. This opportunity aligns well with rising trends towards personalized medicine and the need for scalable diagnostics in expanding healthcare infrastructures worldwide, especially in emerging markets.

This shift is evidenced by increased investment in developing portable hematology analyzers and the growing incorporation of these devices in ambulatory and home care settings, which contribute to the decentralization and democratization of access to high-quality blood analysis.

Thus, the hematology analyzers market stands to gain substantially from these dynamics, driven by the convergence of decentralized healthcare delivery, rapid diagnostic needs, and technological advancements that support efficient and accurate blood testing at the point of care.

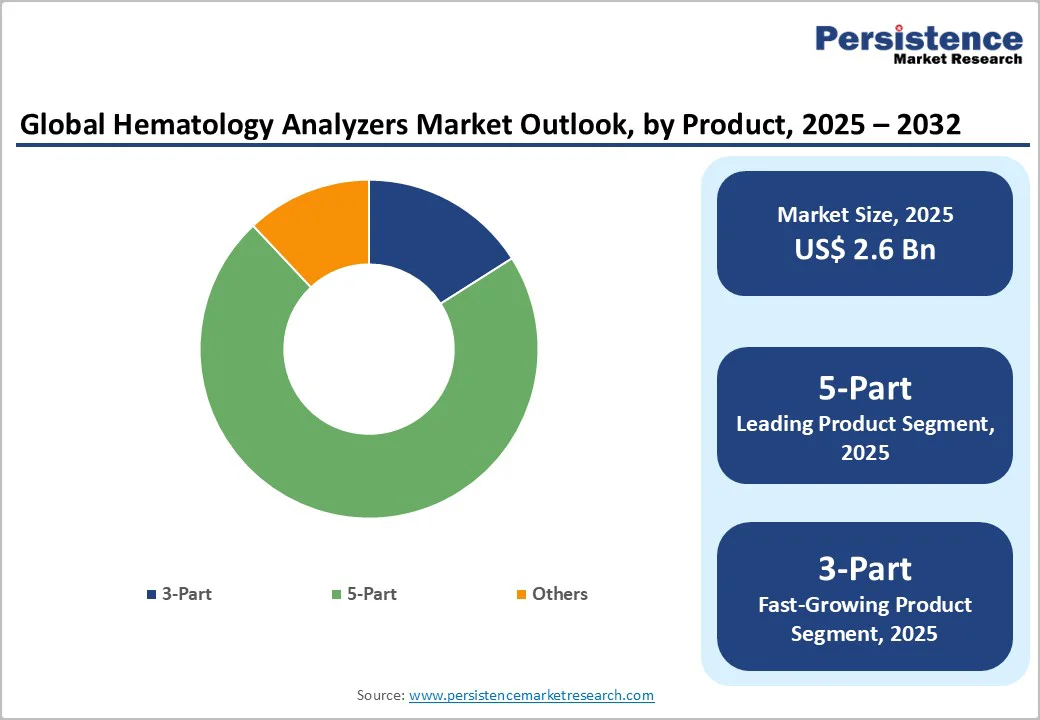

5-part hematology analyzers hold a dominant position in the market, capturing an estimated 73% share in 2025. These analyzers are highly preferred in hospitals and advanced diagnostic laboratories due to their ability to provide comprehensive differential counts, including detailed insights into white blood cell subtypes.

This capability allows clinicians to detect subtle abnormalities, support accurate diagnosis, and monitor complex conditions effectively. The high accuracy, reliability, and extensive clinical information offered by 5-part analyzers make them a standard choice for sophisticated medical facilities and high-throughput laboratories.

Despite the dominance of 5-part analyzers, the 3-part hematology analyzer segment is currently the fastest-growing. Its growth is driven by affordability, compact design, and suitability for smaller clinics and laboratories with limited budgets or simpler diagnostic needs.

Emerging healthcare facilities in developing regions are increasingly adopting 3-part analyzers to meet basic hematology requirements without compromising operational efficiency. As a result, while 5-part analyzers lead the market in share, 3-part systems are gaining traction rapidly, indicating a balanced evolution of the hematology analyzer market globally.

In 2025, standalone hematology analyzers hold a leading position in the market, commanding over 54% share. Their widespread adoption in hospitals and diagnostic laboratories is driven by their ability to perform comprehensive blood tests with high accuracy and reliability.

These systems are designed for high-throughput environments, enabling laboratories to process large numbers of samples efficiently, which is critical for patient management and timely reporting. The robust performance and advanced functionalities of standalone analyzers make them the preferred choice for routine and complex diagnostic workflows.

While point-of-care (POC) hematology systems offer convenience and rapid testing, their adoption remains limited to specialized decentralized settings, such as emergency departments or remote clinics. POC systems are typically used when immediate results are essential, but they cannot match the extensive capabilities and sample-handling efficiency of standalone analyzers.

As a result, standalone systems continue to dominate the global hematology analyzer market, combining reliability, accuracy, and operational efficiency for clinical laboratories and hospitals worldwide.

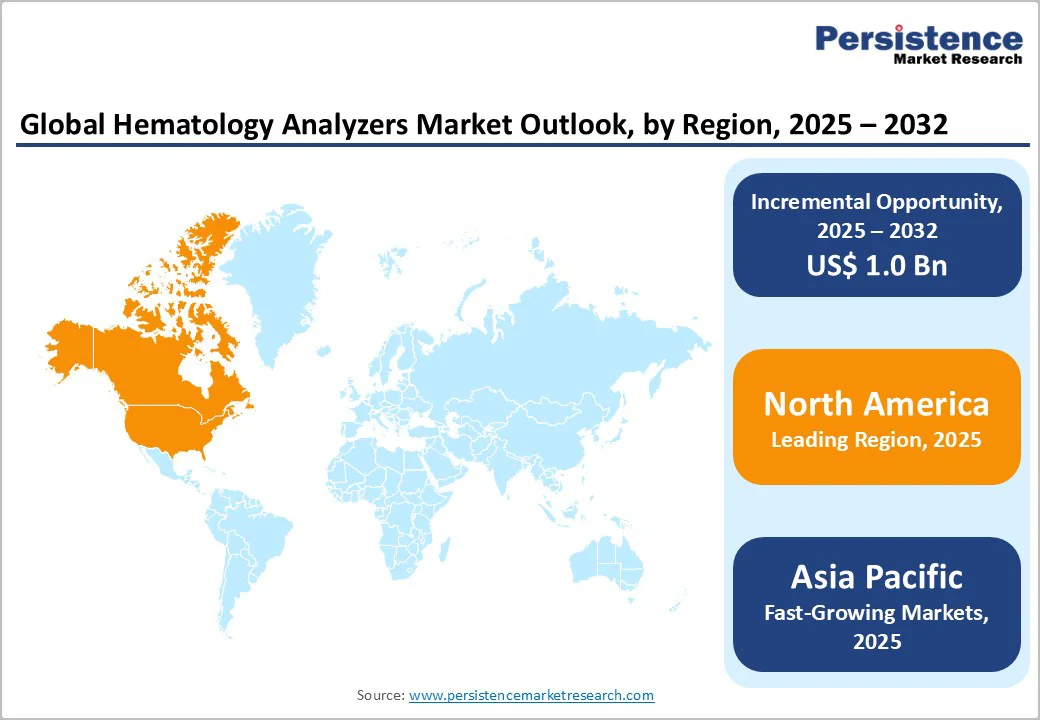

The North America hematology analyzers market is predominantly driven by the U.S., which accounted for approximately 90% of the regional market share in 2025. The high prevalence of blood disorders, particularly anemia, is a major factor supporting market growth.

According to the World Health Organization, over three million Americans, mainly young women, are affected by anemia. This rising disease burden is creating sustained demand for advanced diagnostic tools, including hematology analyzers, across hospitals and clinical laboratories.

Furthermore, the increasing adoption of automated hematology systems by diagnostic centers, coupled with continuous technological innovations in laboratory instruments, is expected to bolster market expansion. North America’s strong healthcare infrastructure, skilled workforce, and emphasis on early disease detection are additional factors driving the preference for high-precision hematology analyzers.

The region is projected to maintain its leading position in revenue, with new product launches, digital technology integration, and high-throughput testing solutions contributing to steady market growth in the coming years.

In the Asia-Pacific region, China dominated the East Asia market. The growth of hematology analyzers in this region is primarily driven by the rising prevalence of blood disorders, such as thalassemia, and the increasing adoption of automated hematology instruments.

A study published in Hematology, Volume 27, 2022, reported that 26.76% of individuals of reproductive age in southwestern China had thalassemia, highlighting the significant healthcare burden. The increasing awareness of early diagnosis, coupled with rising demand for high-sensitivity point-of-care (POC) hematology testing, is driving investments in advanced analyzers.

Moreover, expanding healthcare infrastructure, modernization of diagnostic laboratories, and government initiatives to improve healthcare access are further supporting market growth. The need for precise, rapid, and efficient blood analysis is anticipated to boost sales of hematology analyzers across the region.

Overall, the combination of rising blood disorder cases and technological adoption is expected to create lucrative opportunities for market expansion in the coming years.

The majority of players are highly committed to developing new products. In the last ten years, 6-part and 4-part hematology analyzers have been introduced, providing end-users with more options to meet their needs.

Along with this, a lot of attention is being paid to creating new features and automating tools such as 3D scatter maps and suspect mapping. Another important area of focus for market players in hematology analyzers is partnerships with distributors, which will improve product penetration globally.

The global hematology analyzers market is valued at US$ 2.6 Bn in 2025.

Key drivers include the rising prevalence of blood disorders, automation and AI integration, and infrastructure expansion.

The global market is poised to witness a CAGR of 4.8% between 2025 and 2032.

Opportunities abound in AI-driven analyzers, miniaturized point-of-care devices, and cloud-enabled data solutions for broader clinical access.

Leading companies include SYSMAX CORPORATION, Abbott Laboratories, Beckman Coulter Inc, Siemens AG, and Others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Modality

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author