ID: PMRREP13876| 148 Pages | 28 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

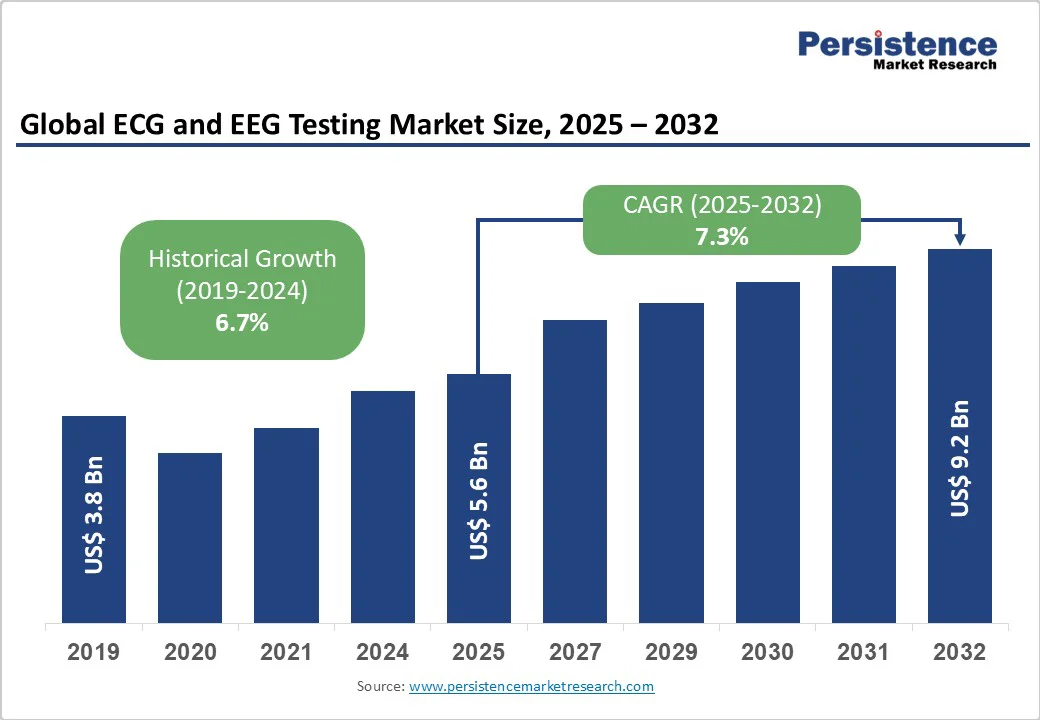

The global ECG and EEG testing market size is likely to be valued at US$5.6 Billion in 2025 and is estimated to reach US$9.2 Billion in 2032 , growing at a CAGR of 7.3% during the forecast period 2025-2032 , driven by the rising prevalence of cardiovascular and neurological disorders and the surging emphasis on preventive healthcare.

| Key Insights | Details |

|---|---|

|

ECG and EEG Testing Market Size (2025E) |

US$5.6 Bn |

|

Market Value Forecast (2032F) |

US$9.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.7% |

Growth Analysis - Rising Incidence of Heart and Brain Disorders

The surge in cardiovascular diseases and neurological conditions is a key driver for ECG and EEG testing. According to the Centers for Disease Control and Prevention (CDC), in 2023, 919,032 individuals died from cardiovascular disease in the US alone. Aging populations, sedentary lifestyles, and increasing stress levels are contributing to high occurrences of heart arrhythmias, strokes, epilepsy, and other brain disorders.

Hospitals and clinics are hence relying on unique ECG and EEG devices for timely diagnosis and continuous monitoring. For example, wearable ECG monitors such as the Zio XT Patch in the US are helping detect irregular heart rhythms early, while AI-assisted EEG tools are improving the accuracy of epilepsy and sleep disorder diagnoses. This rising demand for effective diagnostic solutions is fueling market expansion.

Increasing Focus on Early Detection and Preventive Care

Awareness about early diagnosis and preventive healthcare is pushing the adoption of ECG and EEG testing. Patients and healthcare providers are prioritizing proactive monitoring to prevent severe complications from heart or neurological diseases.

Initiatives such as NHS England's remote monitoring programs for cardiac patients and home-based EEG monitoring trials in Germany are encouraging the use of wearable and portable diagnostic devices. Integration with telehealth platforms enables continuous observation, reduces hospital visits, and empowers clinicians to make timely interventions, boosting the adoption of these technologies.

Barrier Analysis - Risks Associated with Stress-based ECG Tests

One limitation in the adoption of ECG testing is the potential danger posed by stress or exercise-based ECG procedures for certain patients. Individuals with severe heart conditions, unstable angina, or recent cardiac events may face complications if subjected to exertion during a stress test.

Although these tests are valuable for detecting hidden cardiac issues, the risk of adverse events such as arrhythmias or cardiac arrest can limit their widespread use in vulnerable populations. Healthcare providers often need to implement strict screening protocols and continuous monitoring to mitigate these risks. These tend to slow the adoption of novel ECG testing solutions despite technological developments.

Potential Complications from EEG Procedures

EEG testing carries a small but notable risk of inducing seizures in patients who already have seizure disorders. While this is uncommon, it requires that patients be closely monitored in clinical settings, and immediate intervention must be available to manage any triggered episodes.

This precautionary requirement can restrict the use of EEG, especially in outpatient or home-based settings. The risk also contributes to hesitancy among patients and healthcare providers, which can slow the broad adoption of EEG technology, even as wearable and AI-assisted devices are making diagnostics more accessible and accurate.

Opportunity Analysis - Developments in Signal Processing for ECG Analysis

Emerging techniques in signal processing are creating new growth opportunities for ECG testing. Methods such as wavelet decomposition and adaptive filtering allow for more precise extraction of key cardiac features while minimizing background noise. This improves the accuracy of arrhythmia detection, heart rate variability analysis, and other diagnostic measures.

For instance, the MIT-BIH Arrhythmia Database has been used alongside wavelet-based algorithms to improve automated ECG interpretation, enabling quick and reliable diagnosis. As these novel processing techniques are integrated into wearable and portable ECG devices, they expand the potential for continuous monitoring and early detection. It is evident in high-risk patients, pushing wide adoption in both clinical and home settings.

AI-based Insights for EEG Diagnostics

Artificial Intelligence (AI) is transforming EEG testing by enabling detailed analysis of complex brainwave patterns. AI algorithms can detect subtle abnormalities linked to neurological conditions such as Alzheimer's, Parkinson's, and stroke, and can even predict seizure onset before clinical symptoms appear.

Recent studies in the US and Europe have demonstrated that AI-assisted EEG tools improve diagnostic speed and accuracy, reducing clinician workload while improving patient outcomes. Integration with telehealth platforms and wearable EEG devices allows continuous monitoring outside hospital settings, delivering personalized treatment insights and extending the scope of neurological care, making AI a key growth opportunity.

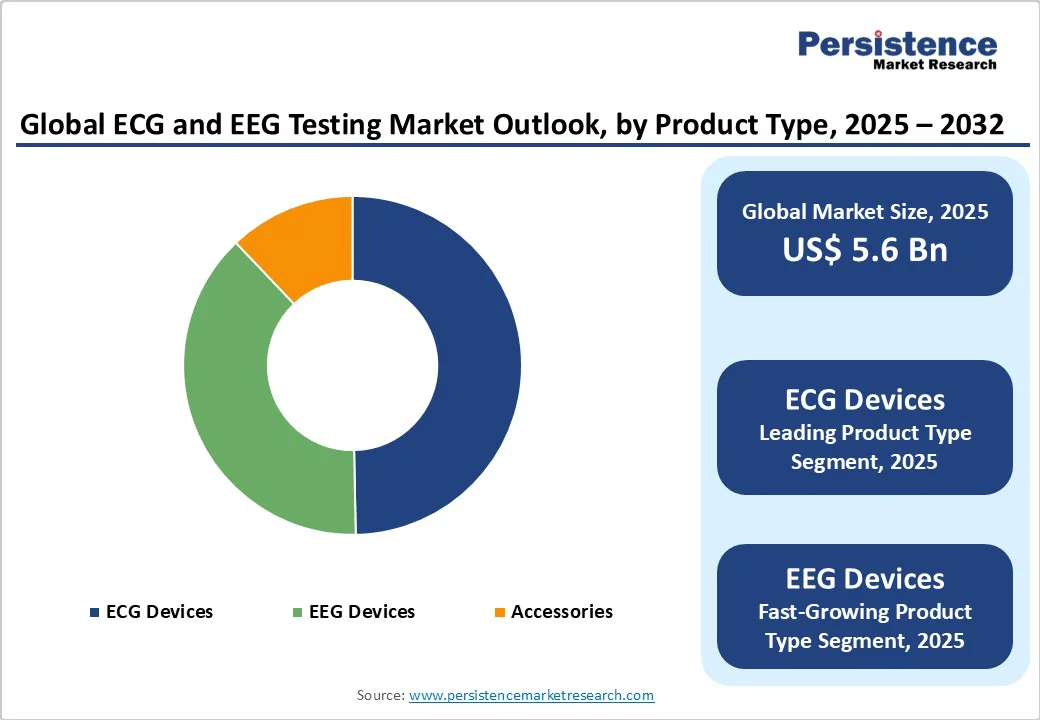

Product Type Insights

ECG devices are estimated to capture nearly 49.7% of the market share in 2025, owing to their ability to quickly and non-invasively detect a wide range of heart conditions, including arrhythmias, myocardial infarctions, and heart failure. Wearable and portable ECG monitors, including the Zio XT Patch in the US, allow continuous monitoring, improving early diagnosis and reducing hospital visits. Their simplicity, accuracy, and integration with EHR systems make them essential in both clinical and remote settings.

EEG devices are gaining traction as neurological disorders such as epilepsy, Alzheimer's, and sleep disorders rise globally. Developments in AI-assisted EEG interpretation are making detection faster and more accurate. For example, AI-based EEG tools in Europe are helping predict seizure onset, enabling timely interventions and extending their clinical relevance beyond traditional hospital use.

Application Insights

Hospitals are leading with a share of around 44.8% in 2025, as they manage complex cardiac and neurological cases requiring continuous monitoring and advanced diagnostics. High-end ECG and EEG systems with multi-channel capabilities are often installed in ICUs and neurology wards, providing real-time insights for critical patients.

Diagnostic centers play a key role in providing accessible and specialized testing for patients without hospital admission. Centers equipped with portable ECG and EEG devices provide convenient and quick diagnostic services, reducing patient load on hospitals and enabling early detection in community settings.

End-user Insights

Healthcare providers, including cardiologists, neurologists, and primary care physicians, dominate with a share of approximately 54.1% in 2025. Their ability to interpret results, prescribe timely interventions, and integrate testing into patient management makes them central to the use of ECG and EEG technologies, especially with the rise of wearable and AI-assisted devices.

Homecare is emerging as a key end-user segment due to the availability of wearable ECG and EEG monitors that allow continuous monitoring without hospital visits. Devices such as portable ECG patches and consumer-friendly EEG headsets enable early detection of heart or neurological issues, supporting preventive care and remote patient management, especially for elderly or chronically ill patients.

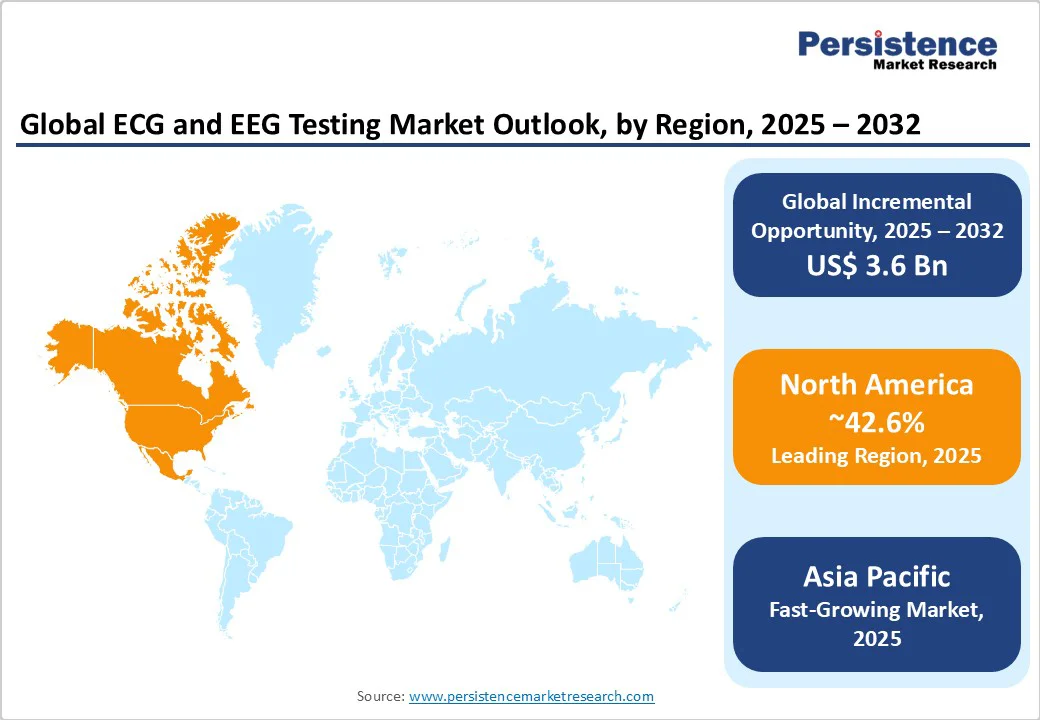

North America ECG and EEG Testing Market Trends

North America will likely account for approximately 42.6% of the share in 2025, owing to constant technological developments and widespread adoption of novel technologies. The region leads globally in terms of the use of wearable ECG devices. This dominance is attributed to the high prevalence of cardiovascular diseases and the increasing demand for remote monitoring solutions. Notably, the integration of wearable ECG devices into Electronic Health Records (EHRs) has improved workflows and real-time arrhythmia detection.

North America holds a substantial share of the EEG devices market, pushed by the rising incidence of neurological disorders and the adoption of unique diagnostic tools. The US market for smart wearable ECG monitors is expected to see continued growth due to a tech-savvy population and strong regulatory support. Also, the integration of EEG devices into telehealth platforms has facilitated remote patient monitoring, improving accessibility and patient engagement.

Asia Pacific ECG and EEG Testing Market Trends

In the Asia Pacific region, the adoption of ECG and EEG testing is experiencing steady growth, bolstered by technological developments, increasing healthcare infrastructure, and a rising prevalence of cardiovascular and neurological disorders. China, India, and Japan are at the forefront of this expansion, with substantial investments in healthcare modernization and a rising demand for diagnostic tools. The wearable medical devices market in Asia Pacific is seeing considerable growth due to favorable government initiatives supporting the adoption of unique medical devices.

The integration of AI and machine learning into ECG and EEG testing is further gaining momentum in Asia Pacific. These technologies are being utilized to improve diagnostic accuracy, predict disease progression, and personalize treatment plans. Collaborations between healthcare providers and tech companies are boosting development in this segment, leading to the emergence of more sophisticated and user-friendly diagnostic tools.

Europe ECG and EEG Testing Market Trends

In Europe, the field of ECG and EEG testing is characterized by ongoing developments in technology, widespread adoption of wearable devices, and a surging emphasis on preventive healthcare. The integration of AI into diagnostic tools is improving the accuracy and efficiency of both ECG and EEG tests. For instance, AI algorithms are being utilized to calculate the heart's biological age through ECG data, predicting increased risk of mortality and cardiovascular events.

Wearable ECG and EEG devices are gaining popularity in Europe, augmented by the demand for continuous monitoring and early detection of health issues. These devices are specifically beneficial for patients with chronic conditions and those requiring regular monitoring. The adoption of such devices is supported by favorable regulatory frameworks and increasing healthcare investments across key countries.

Competitive Landscape

The global ECG and EEG testing market is influenced by strategic initiatives focusing on technological developments, market expansion, and partnerships. Medtronic has recently announced a strategic partnership with Philips to expand access to patient monitoring technology. This collaboration aims to improve the reach and capabilities of both companies in providing unique monitoring solutions. Nihon Kohden has a superior presence in the EEG market, holding a 90% share in Japan. The company continues to utilize its core strengths, including the capacity to develop technologies rooted in medical practice.

Key Industry Developments

The ECG and EEG testing market is projected to reach US$5.6 Billion in 2025.

The rising prevalence of heart diseases and increasing focus on preventive care are the key market drivers.

The ECG and EEG testing market is poised to witness a CAGR of 7.3% from 2025 to 2032.

The adoption of wearable monitoring devices and the emergence of telehealth-enabled diagnostics are the key market opportunities.

Philips Healthcare, GE Healthcare, and Nihon Kohden Corporation are a few key market players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author