ID: PMRREP35890| 199 Pages | 24 Nov 2025 | Format: PDF, Excel, PPT* | Packaging

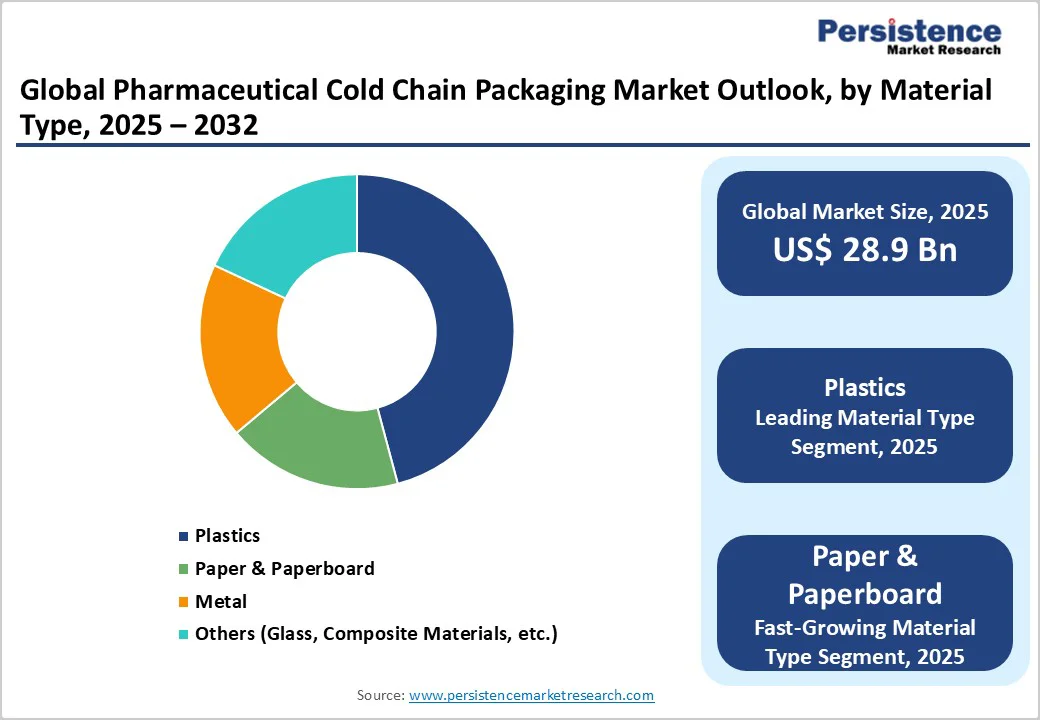

The global pharmaceutical cold chain packaging market size is valued at US$28.9 billion in 2025 and is projected to reach US$75.0 billion, growing at a CAGR of 14.6% during the forecast period 2025 - 2032. This robust expansion reflects accelerating demand for temperature-sensitive pharmaceutical products, including biologics, mRNA vaccines, and cell and gene therapies.

The market growth is underpinned by strengthened regulatory compliance requirements, expansion of biopharmaceutical manufacturing infrastructure in developed and emerging markets, and technological advancements in thermal packaging and IoT-enabled temperature monitoring.

As pharmaceutical companies increasingly prioritise product efficacy and supply chain integrity, cold chain packaging has transitioned from a logistics commodity to a strategic competitive advantage, particularly in high-value therapeutic categories where temperature excursions can render products ineffective or dangerous.

| Key Insights | Details |

|---|---|

| Pharmaceutical Cold Chain Packaging Market Size (2025E) | US$28.9 Bn |

| Market Value Forecast (2032F) | US$75.0 Bn |

| Projected Growth (CAGR 2025 to 2032) | 14.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 13.8% |

The pharmaceutical landscape has undergone a fundamental transformation with the proliferation of complex biopharmaceutical molecules. Biologics, including monoclonal antibodies, recombinant proteins, and cell therapies, inherently require stringent thermal environments to maintain potency.

The emergence of mRNA vaccine platforms, exemplified by COVID-19 vaccines requiring storage at -70°C to -80°C, has created unprecedented demand for specialised ultra-cold chain infrastructure. According to market research, mRNA therapeutics are expected to capture around 55.0% of the therapeutic product category by 2025, with these vaccines demanding logistics cost premiums of up to 25% compared to traditional biologics due to cryogenic requirements.

The Pharmaceutical Cold Chain Packaging Market directly benefits as manufacturers require differentiated packaging solutions capable of maintaining precise thermal profiles across multi-day shipments.

The global development pipeline for advanced therapeutics continues expanding, with gene therapies, CAR-T cell treatments, and antibody-drug conjugates representing the fastest-growing segments. This therapeutic innovation compels packaging providers to develop next-generation solutions featuring passive thermal systems, active temperature management, and real-time monitoring capabilities.

The complexity of maintaining ultra-cold conditions throughout manufacturing, distribution, and clinical administration channels creates sustained demand for sophisticated thermal packaging engineering and validation services.

Regulatory authorities, including the FDA, EMA, and international health organisations, have established increasingly rigorous cold chain management standards that directly mandate packaging performance specifications.

The FDA's Current Good Manufacturing Practice (cGMP) regulations require pharmaceutical companies to validate all cold chain processes, including packaging qualification and temperature-monitoring protocols, creating baseline compliance requirements that expand the addressable market.

European Union regulations under the Good Distribution Practice (GDP) guidelines, outlined in EudraLex Volume 4, establish mandatory temperature control and monitoring during transportation and storage, with non-compliance resulting in product recalls and regulatory sanctions.

These regulatory frameworks have transformed cold chain packaging from discretionary supply chain optimisation to mandatory infrastructure investment. Emerging markets are implementing similar standards; ASEAN member states are accelerating upgrades to cold-chain infrastructure to enforce compliance, creating investment incentives across the region.

Cold chain packaging solutions, particularly insulated shippers and temperature-controlled systems, require substantial upfront capital investment and ongoing operational expenses that constrain adoption, especially among smaller pharmaceutical companies and emerging market participants.

Reusable thermal shipper systems demand reverse logistics networks, cleaning validation protocols, and storage infrastructure, creating total-cost-of-ownership calculations that require multi-year payback horizons. Small and medium-sized pharmaceutical enterprises, clinical research organisations operating with constrained budgets, and regional distribution partners in emerging markets face financial barriers to implementing advanced cold chain technologies.

These cost constraints limit market penetration in price-sensitive regions and smaller therapeutic segments where volume economics do not justify premium packaging investments. Additionally, cryogenic packaging solutions for ultra-cold applications (-70°C to -80°C) command 40-50% cost premiums over standard refrigerated packaging, restricting adoption to high-value biopharmaceuticals and vaccines.

Real-time IoT monitoring systems represent a transformative opportunity for pharmaceutical cold chain packaging market participants as regulatory requirements increasingly mandate continuous environmental tracking throughout distribution networks. Current industry practice relies heavily on passive temperature data loggers that provide post-hoc visibility, failing to enable proactive intervention during temperature excursions.

Advanced IoT solutions utilising low-power networks such as cellular, LoRaWAN, or LTE-M transmit continuous environmental data to cloud platforms, triggering automated alerts when temperatures deviate from safe thresholds. This technological convergence enables logistics teams to implement rapid response protocols, preventing product spoilage before it becomes evident upon delivery.

Integration of IoT monitoring into thermal packaging systems creates competitive differentiation for market participants offering end-to-end solutions combining passive thermal performance with active digital visibility.

World Courier, a specialty pharma logistics provider, was recently recognised at the 2024 Supply Chain Excellence Awards for pioneering real-time location monitoring (RTLM) integration, demonstrating market momentum toward digitally-enabled cold chain solutions.

Healthcare facilities and biopharmaceutical companies increasingly evaluate packaging providers on data transparency and supply chain visibility rather than thermal performance alone, reflecting the maturation of customer procurement criteria. Smart packaging solutions incorporating temperature sensors, humidity monitors, and GPS tracking devices create a value proposition that extends beyond product protection to include supply chain optimization, demand forecasting, and integrated inventory management.

Immunisation programs, particularly vaccine distribution initiatives targeting emerging markets, represent a substantial growth opportunity for cold chain packaging providers as global health organisations and national governments expand vaccination infrastructure.

WHO-supported immunisation programs require packaged vaccine volumes to increase at double-digit annual rates in regions including Sub-Saharan Africa, Southeast Asia, and South Asia, creating demand for affordable, regionally appropriate cold chain packaging solutions.

Indian cold chain networks, spanning 4 Government Medical Supply Depots, 39 state vaccine stores, 123 divisional vaccine stores, 644 district stores, and 22,674 facility-level storage points, represent a massive distribution infrastructure that requires standardised packaging solutions for vaccine supply coordination across a 6-level organisational hierarchy.

This infrastructure scale creates sustained demand for thermal packaging designed for specific regional requirements, including extended ambient-temperature tolerances in tropical climates and optimised ice-pack configurations for extended transit durations in remote delivery scenarios.

Plastics, primarily polystyrene foam (EPS) and expanded polypropylene (EPP), dominate the pharmaceutical cold chain packaging market, accounting for approximately 74% of the material share, due to their superior thermal insulation, cost-effectiveness, and scalability.

EPS boxes with polypropylene linings and polyethylene closures maintain pharmaceutical products within the 2°C-8°C range for extended transit, with larger containers holding compliant temperatures for up to 23 hours using strategically placed coolant packs. Thermoplastic polymers enable rapid prototyping, custom sizing, and complex designs, supporting applications from small insulated shippers for individual vials to large pallet-sized containers for bulk distribution.

The dominance of plastics reflects established manufacturing infrastructure, high-volume cost advantages, regulatory approvals, and the ability to integrate temperature monitoring, moisture barriers, structural reinforcement, and active thermal management systems.

Established converters leverage high-speed thermoforming and injection moulding equipment, supporting emerging innovations such as phase change materials and thermochromic indicators embedded in plastic panels.

Paper and paperboard materials represent the fastest-growing segment within Pharmaceutical Cold Chain Packaging Market material composition, driven by sustainability regulatory requirements and corporate environmental commitments.

Sonoco's GREENCAN® fully recyclable packaging solutions, manufactured with 92-98% paperboard content and available barrier-layer integration, demonstrate market-ready technology enabling paper-based alternatives to plastic-dominated packaging configurations.

Small boxes and insulated shippers represent the market-leading product type, accounting for approximately 38% of the pharmaceutical cold chain packaging market, representing a standard solution for individual vials, small-batch, and clinical trial material transportation.

These compact containers, typically with a payload capacity of 1-50 kilograms, provide targeted thermal management for pharmaceutical products travelling across intermediate distribution distances (48-120 hour transit duration) under refrigerated conditions.

The manufacturing process involves thermoforming or foam injection processes, creating insulated cavity structures dimensionally optimized for specific pharmaceutical product categories, with standardised interior dimensions supporting pharmaceutical vial racks, clinical trial pack configurations, and speciality drug shipments.

Biopharmaceutical companies dominate the pharmaceutical cold chain packaging market, accounting for approximately 54% of end-user consumption. This leading segment includes manufacturers of biologics, monoclonal antibodies, recombinant proteins, gene therapies, cell therapies, and advanced therapeutics, all of which require temperature-controlled distribution across global supply chains.

These companies enforce stringent packaging specifications aligned with product stability profiles, regulatory compliance, and supply chain risk management protocols.

Hospitals and healthcare facilities represent the fastest-growing end-user segment, driven by the expansion of direct-to-facility pharmaceutical delivery, on-site biologic preparation, and clinical supply distribution, which previously relied on centralised pharmacy distribution centers.

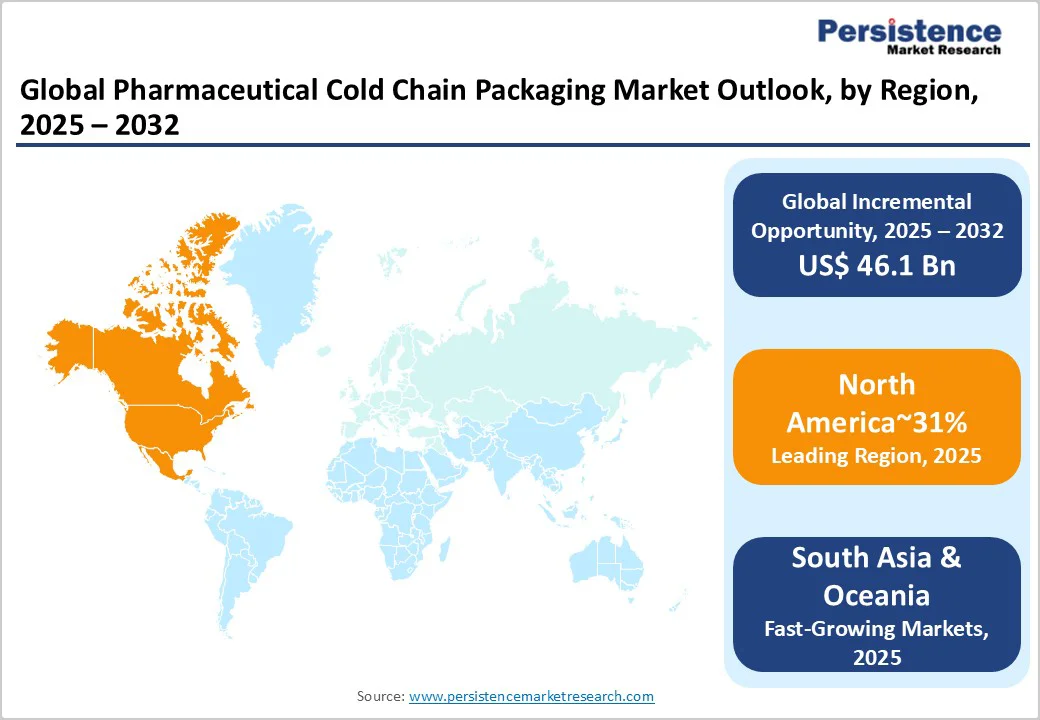

North America maintains the largest regional market share globally, accounting for approximately 31% of the Pharmaceutical Cold Chain Packaging Market, driven by a dominant biopharmaceutical manufacturing sector and sophisticated clinical trial infrastructure. The

The United States biopharmaceutical manufacturing industry expanded substantially during 2024 - 2025, with major pharmaceutical companies announcing combined capital investments exceeding US$ 90 billion in North American facilities.

Key projects include Novo Nordisk’s US$ 4.1 billion North Carolina expansion, Johnson & Johnson’s US$ 55 billion multi-site investment program, Merck’s US$ 1 billion Durham vaccine facility, alongside additional investments by Novartis, AbbVie, and Biogen, representing unprecedented infrastructure development supporting domestic growth and export manufacturing.

The United States flexible packaging industry generated US$ 41.5 billion in sales in 2022, representing the second-largest packaging segment with 21% share of the country's US$ 180.3 billion total packaging market. Pharmaceutical and medical packaging applications constitute 16% of the US flexible packaging industry shipments, demonstrating a substantial cold chain packaging segment within the broader packaging market.

The North American market benefits from advanced cold chain logistics infrastructure; specialised third-party logistics providers operate sophisticated temperature-controlled distribution networks spanning manufacturing, clinical trial, and commercial pharmacy distribution channels.

DHL Group's 2024 acquisition of CryoPDP, a US-based speciality courier managing over 600,000 annual shipments across clinical trials and biopharmaceutical products, represents a strategic investment expanding capabilities for temperature-sensitive logistics across North American markets.

The United States represents the leading market for innovative cold chain technologies; IoT-enabled monitoring systems, advanced phase change materials, and sustainable packaging solutions achieve the earliest market penetration in North America, supporting rapid adoption-to-maturity cycles.

East Asia represents a rapidly expanding regional market, accounting for approximately 19% of the Pharmaceutical Cold Chain Packaging Market, driven by biopharmaceutical manufacturing expansion, vaccine distribution infrastructure development, and rising pharmaceutical export volumes from regional manufacturing hubs.

China and South Korea emerged as leading biopharmaceutical manufacturing centers during 2020 - 2024, with investments exceeding US$ 8 billion in new biologics manufacturing facilities supporting domestic consumption and international export.

China's pharmaceutical market is projected to reach approximately US$ 185-190 billion by 2025, with biologics and speciality pharmaceuticals representing the fastest-growing segments, commanding premium cold chain logistics infrastructure.

Europe commands a significant regional market share of approximately 27% within the pharmaceutical cold chain Packaging Market, reflecting mature biopharmaceutical manufacturing infrastructure, stringent regulatory standards, and advanced healthcare distribution systems.

European pharmaceutical manufacturing represents approximately 23% of global production volume; Germany, Switzerland, Belgium, and the Netherlands maintain leading positions as biopharmaceutical production centres supporting both European consumption and international distribution.

European manufacturers maintain the highest regulatory compliance standards; EU Good Distribution Practice (GDP) requirements mandate temperature control documentation, validated packaging performance, and supply chain traceability exceeding regulatory requirements in most other regions.

This regulatory stringency creates demand for premium packaging solutions incorporating advanced temperature monitoring, real-time tracking, and comprehensive validation documentation.

The global pharmaceutical cold chain packaging market is moderately consolidated, characterised by a mix of established global players and emerging regional suppliers focusing on specialized thermal packaging solutions.

Leading companies such as Sonoco ThermoSafe, Cold Chain Technologies, Softbox Systems (a CSafe Global company), Pelican BioThermal, and Cryopak dominate through extensive product portfolios, R&D investment, and global distribution networks.

The market is driven by innovation in temperature-controlled packaging materials, phase change technologies, and reusable systems. Regional players are increasingly gaining traction with cost-effective, sustainable, and localised cold chain packaging solutions, intensifying competition. Strategic collaborations and acquisitions are common as companies expand manufacturing capacity and enhance global supply capabilities.

The global pharmaceutical cold chain packaging market is projected to be valued at US$ 28.9 Bn in 2025.

The Plastics segment is expected to hold around 74% market share by Material Type in 2025 in the Global Pharmaceutical Cold Chain Packaging Market, driven by superior thermal insulation, cost-effectiveness, and manufacturing scalability.

The market is expected to witness a CAGR of 14.6% from 2025 to 2032.

The Pharmaceutical Cold Chain Packaging market is driven by the surge in biologics, mRNA vaccines, advanced therapeutics, and stringent regulatory mandates requiring precise temperature-controlled distribution.

Key market opportunities in the pharmaceutical cold chain packaging market lie in integrating IoT-enabled real-time temperature monitoring systems and expanding cold chain distribution networks in emerging markets and underserved healthcare regions.

The leading global players in the pharmaceutical cold chain packaging market include Sonoco ThermoSafe, Peli BioThermal, CSafe Global, Cryoport Systems, va-Q-tec AG, and Envirotainer AB.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | USD Million for Value |

| Region Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Material Type

By Product Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author