ID: PMRREP34603| 200 Pages | 1 Feb 2026 | Format: PDF, Excel, PPT* | Packaging

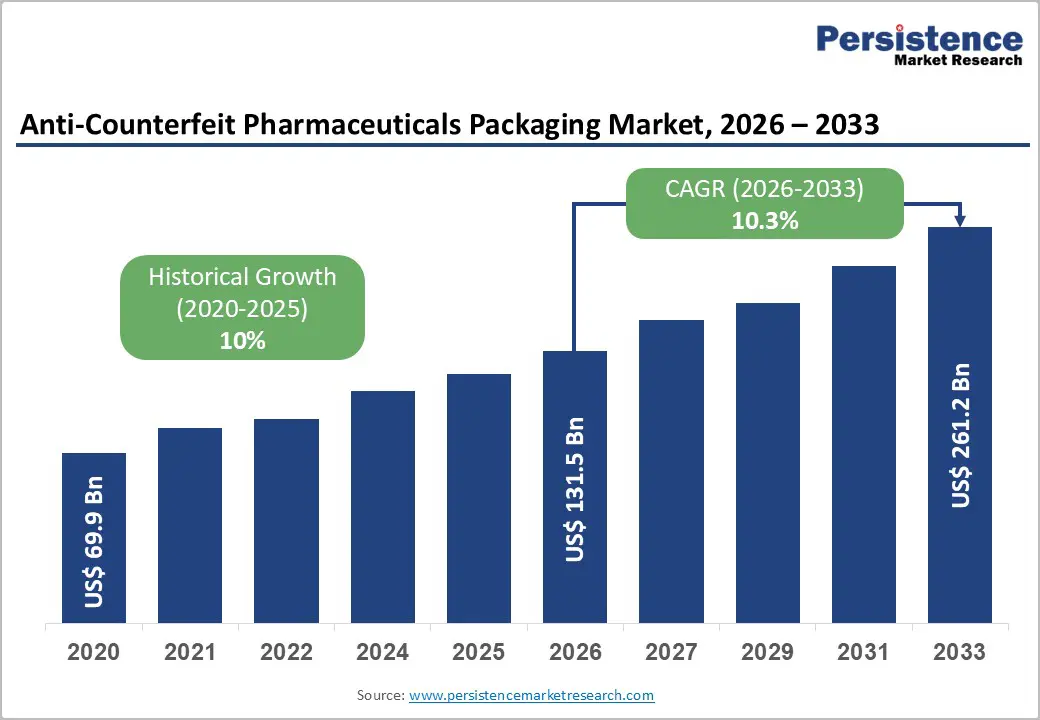

The global anti-counterfeit pharmaceuticals packaging market size is likely to be valued at US$ 131.5 billion in 2026, and is projected to reach US$ 261.2 billion by 2033, growing at a CAGR of 10.3% during the forecast period 2026-2033. Market expansion is primarily being driven by the rising prevalence of counterfeit medicines across both developed and emerging economies, which is increasing regulatory and commercial pressure on pharmaceutical manufacturers to strengthen product security. Governments and regulatory authorities continue to mandate serialization, track-and-trace, and tamper-evident packaging requirements across major markets, making anti-counterfeit packaging a non-discretionary investment rather than a cost-optimization decision.

Pharmaceutical companies are also increasingly integrating packaging security into broader risk-management and brand-protection strategies, reinforcing sustained demand. Growth momentum is further strengthening as biologics, vaccines, and temperature-sensitive therapies continue to gain market share in global drug pipelines, increasing the need for advanced packaging solutions that support traceability and authentication throughout complex supply chains. Expanding cross-border pharmaceutical trade and multi-tier distribution networks are increasing exposure to diversion and counterfeiting risks, thereby accelerating the adoption of end-to-end identification systems. Technological convergence between digital identification tools, such as serialization codes and data carriers, and physical security features embedded in packaging is enabling scalable and interoperable protection frameworks.

| Key Insights | Details |

|---|---|

|

Anti-Counterfeit Pharmaceuticals Packaging Market Size (2026E) |

US$ 131.5 Bn |

|

Market Value Forecast (2033F) |

US$ 261.2 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

10.3% |

|

Historical Market Growth (CAGR 2020 to 2025) |

10.0% |

Rising Counterfeit Risk, Regulatory Enforcement, and Expansion of High-Value Therapies

The pharmaceutical supply chain is facing an intensifying counterfeit medicines challenge that directly threatens patient safety and brand credibility. The World Health Organization (WHO) reports that 1 in 10 medical products in emerging markets is substandard or falsified, significantly eroding public trust in healthcare systems. Enforcement actions have also escalated, with Interpol’s Operation Pangea seizing more than US$ 12 billion worth of illicit medicines globally during 2024–2025, underscoring the scale and urgency of the problem. Counterfeit networks are becoming increasingly sophisticated, targeting both regulated and semi-regulated markets. As a result, pharmaceutical companies are under mounting pressure to strengthen product integrity beyond traditional packaging safeguards. This has elevated anti-counterfeit packaging from a defensive tool to a strategic necessity.

Governments have implemented legally binding serialization and track-and-trace frameworks, including the U.S. DSCSA, the European Union (EU) Falsified Medicines Directive (EU FMD), India’s DGFT barcode mandate for exports, and China’s MAH traceability rules. DSCSA enforcement mandated interoperable, unit-level traceability across the U.S. pharmaceutical supply chain. According to industry data and reports, the pharmaceutical sector is experiencing rapid growth in high-value therapies, with global biologics sales exceeding US$425 billion and rising, and vaccine manufacturing scaling sharply post-pandemic. These products carry higher per-unit value, cold-chain sensitivity, and elevated counterfeiting risk. Consequently, manufacturers are increasingly adopting multi-layered anti-counterfeit packaging solutions that integrate serialization, tamper-evident primary packaging, smart labels, and forensic markers.

High Cost Burden and Operational Complexity in Serialization Deployment

End-to-end anti-counterfeit packaging systems require substantial upfront investment in printing hardware, vision inspection systems, data management platforms, and production-line reconfiguration. For mid-sized pharmaceutical manufacturers, implementation costs typically range from US$ 2 to US$ 5 million per production line, creating a significant financial barrier. Several smaller contract manufacturing organizations, such as ABC Pharma in Thailand, delayed compliance initiatives due to rising capital and operating pressures. These cost constraints are particularly challenging for low-margin generic drug producers. As a result, adoption remains uneven across developing markets, slowing near-term market penetration despite rising regulatory pressure.

Serialization has also introduced complex data interoperability challenges across manufacturers, distributors, and regulatory systems. Serialization programs generate massive volumes of transaction and verification data that must be exchanged securely and accurately across supply-chain partners. DSCSA enforcement extensions included a reporting review that revealed systemic data exchange failures among U.S. trading partners, highlighting gaps in technical readiness and compliance processes. Technical fragmentation increases operational risk and complicates compliance for globally distributed pharmaceutical supply chains. These challenges discourage the rapid adoption of advanced technologies such as RFID in cost-sensitive markets.

Rising Demand from Emerging Manufacturing Hubs and Digital Packaging Innovations

The growth of the anti-counterfeit pharmaceutical packaging market is driven by the rapid expansion of emerging pharmaceutical manufacturing hubs in countries such as India, Vietnam, Indonesia, and Brazil, which collectively added more than 20% of new manufacturing capacity in recent years. Export-oriented manufacturers in these regions are increasingly required to comply with EU FMD and U.S. DSCSA traceability standards, creating a strong pull for advanced packaging solutions. Avery Dennison and SICPA are integrating multi-layered serialization systems and tamper-evident label platforms tailored for high-volume drug exports, while Antares Vision and SEA Vision are deploying AI-driven vision inspection systems and data management dashboards to improve compliance and line efficiency.

The convergence of smart packaging and digital authentication technologies is opening new revenue and innovation avenues. Smartphone-scannable QR codes, NFC tags, and blockchain-enabled verification systems have gained significant momentum, particularly for over-the-counter (OTC) and direct-to-consumer pharmaceutical brands. Zebra Technologies and Avery Dennison are advancing IoT-enabled sensor labels and cloud-linked traceability networks, while Antares Vision is piloting cryptographically secure QR codes coupled with blockchain for real-time product verification. Adoption of tamper-evident and traceable packaging in government-led vaccine and public health programs further drives innovation, with SICPA’s secure ink solutions and Zebra’s smart label ecosystems supporting safer distribution across high-volume networks in the Asia Pacific and Africa.

Technology Insights

Serialization is expected to be the leading technology, accounting for 42% of the anti-counterfeit pharmaceutical packaging market revenue in 2026. Regulatory mandates such as the DSCSA and EU FMD require unit-level traceability, thereby enabling faster batch tracking, recall management, and supply-chain integrity. Pfizer scaled up 2D data matrix serialization across global vial and carton lines, while GlaxoSmithKline upgraded multiple European packaging lines to GS1-compliant barcodes. These solutions reduce counterfeiting risk and improve operational efficiency. Serialization is particularly effective across both primary and secondary packaging levels. Manufacturers adopting early gain a competitive edge in global markets. It also supports digital verification systems for distributors and pharmacies.

RFID is anticipated to be the fastest-growing technology segment, projected to grow at a roughly 12% CAGR from 2026 to 2033. Schreiner MediPharm introduced RFID-embedded “Cap-Lock” labels for prefilled syringes, while Impinj partnered with SML Group to implement item-level RFID tagging and cloud verification solutions. These technologies enable real-time inventory visibility, diversion prevention, and laboratory-level authentication. High-value oncology drugs and temperature-sensitive biologics increasingly use these systems. Adoption is accelerating across hospitals and distributors. RFID integration also supports predictive analytics and compliance reporting. The segment is poised for strong growth due to regulatory and operational demand.

Format Insights

Secondary packaging, such as cartons & boxes, is expected to be the leading format, accounting for approximately 46% of revenue in 2026, as most serialized codes and tamper-evident measures are applied at this level. Gilead Sciences integrated variable QR codes and tamper-evident holographic seals on EPCLUSA® and TRODELVY® cartons, enabling authentication via smartphone scanning. Pfizer and GlaxoSmithKline also standardized GS1-compliant 2D barcodes on secondary packs across multiple markets. This format allows batch-level verification, reduces manual scanning errors, and supports automated inspection systems. High-volume pharmaceuticals rely heavily on it, and it simplifies downstream verification at wholesalers and pharmacies. Adoption continues to rise as global regulatory compliance expands.

Primary packaging, such as vials, ampoules, and blister packs, is projected to be the fastest-growing packaging format, with a 2026-2033 CAGR of approximately 11%. Growth is driven by biologics, injectables, and vaccines requiring unit-level authentication. Schreiner MediPharm and Avery Dennison introduced QR-verified tamper labels and laser-etched codes directly on vials and blisters, enabling point-of-care verification. These innovations also support the integration of smart labels and cold-chain monitoring for sensitive therapies. Adoption is increasing in regulated and export markets. Primary packaging complements secondary packaging and ensures robust anti-counterfeit protection.

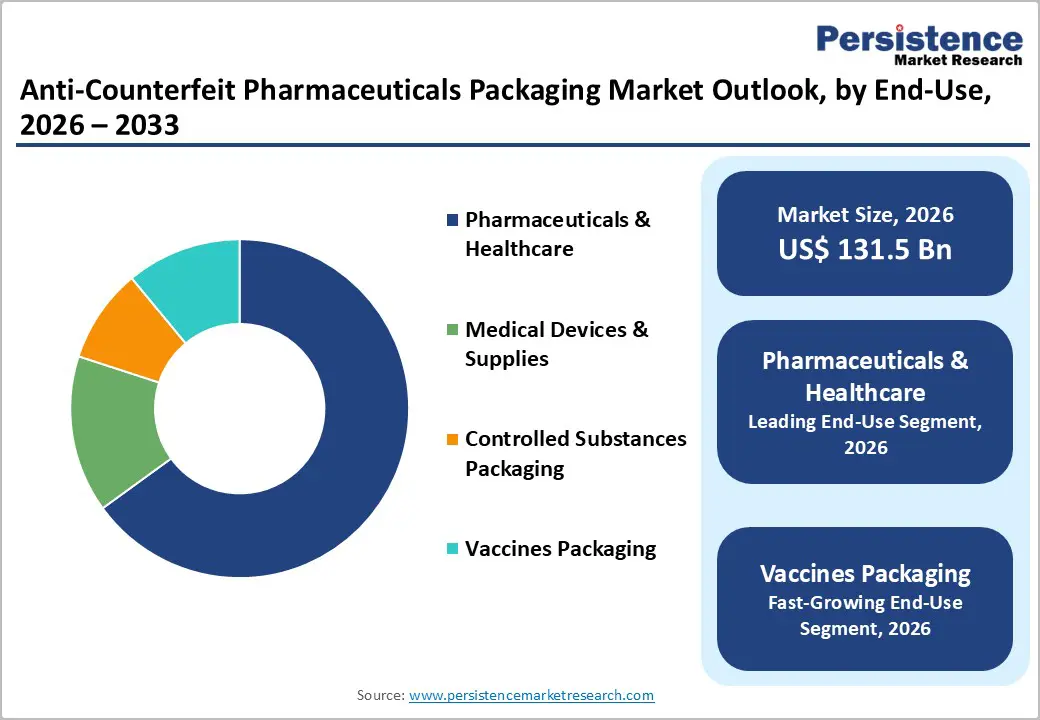

End-Use Insights

Pharmaceuticals & healthcare are projected to account for nearly 65% of total anti-counterfeit pharmaceutical packaging demand in 2026, owing to high-volume prescription drugs and chronic therapies. Companies such as Roche and Novartis have fully implemented unit-level serialization across their prescription portfolios, thereby improving traceability and recall capabilities. This ensures compliance with DSCSA and EU FMD mandates. Serialization reduces counterfeiting risk and enhances supply-chain visibility. Both branded and generic drugs increasingly adopt tamper-evident packaging. Hospitals and pharmacies rely on these measures for authentication. Regulatory compliance drives continuous upgrades in this segment.

Vaccine packaging is projected to be the fastest-growing segment, with a projected 12% CAGR from 2026 to 2033. QuVa Pharma expanded its RFID-enabled label platforms for temperature-sensitive vaccines, integrating GS1-compliant tracking to enhance cold-chain visibility. Government immunization programs prioritize tamper-evident, trackable packaging. Controlled substances packaging is also growing due to stricter opioid diversion regulations. Smart labels, QR codes, and tamper indicators are being increasingly deployed. These measures enhance safety and supply chain monitoring. Vaccine and high-risk drug segments are driving rapid technology adoption.

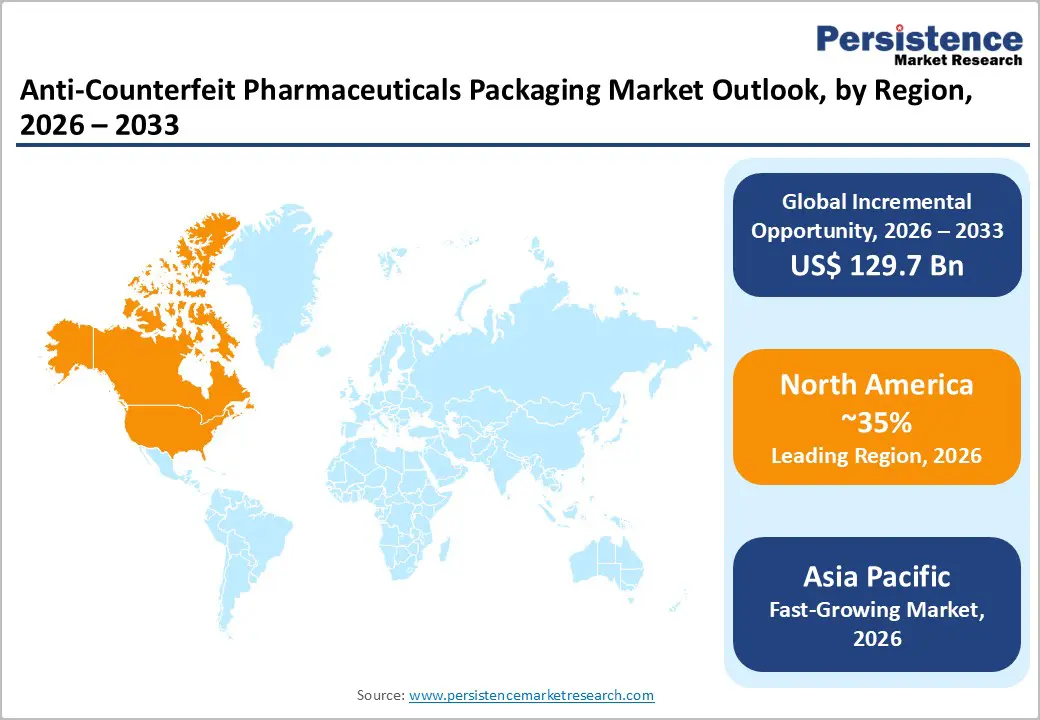

North America Anti-Counterfeit Pharmaceuticals Packaging Market Trends

North America is expected to lead the anti-counterfeit pharmaceutical packaging market in 2026, with approximately 35% market share, driven by stringent regulatory frameworks and advanced supply chain infrastructure. The U.S. Food and Drug Administration (FDA) approved updates to tamper-evident packaging standards that require enhanced serialization and anti-counterfeit features for prescription drugs, accelerating the adoption of secure packaging. U.S. pharmaceutical contract packagers are integrating serialization and electronic track-and-trace systems into high-volume secondary packaging to ensure compliance with DSCSA. Does this regulatory emphasis drive broader adoption of cloud-based traceability platforms and real-time verification tools throughout the supply chain? Does Canada’s emerging serialization infrastructure support growing domestic generic drug output and complement U.S. enforcement efforts? Market demand is bolstered by biologics and specialty medications that require multi-layered packaging security solutions. Compliance investments remain high as manufacturers seek operational and regulatory resilience.

The market in North America is highly innovation-driven, with major packaging firms partnering with technology providers to deploy AI-assisted serialization platforms and RFID pilots for controlled substances. Biologic drug manufacturers are testing tamper-evident smart labels embedded with digital verification features at manufacturing sites across the U.S., supporting unit-level authentication. Cold-chain sensitive products benefit from enhanced sensor-integrated packaging systems that monitor temperature and supply-chain integrity. The region’s robust IT infrastructure and advanced logistics networks facilitate rapid scaling of anti-counterfeit technologies. North American demand also reflects heightened litigation risk and patient safety priorities, prompting large pharmaceutical players to elevate packaging security standards. Early adoption of digital authentication places the region at the forefront of global compliance efforts.

Europe Anti-Counterfeit Pharmaceuticals Packaging Market Trends

Europe is projected to hold an estimated 29% market share in 2026, driven by harmonized regulatory compliance across major markets. EU FMD mandates unit-level serialization and tamper-evident features for prescription pharmaceuticals throughout member states. The European Commission approved a blockchain-based drug traceability pilot project, enabling secure cross-border verification of serialization data across supply chains and expansion of digital authentication capabilities. Germany remains a strong center for advanced printing and the deployment of security ink on secondary packaging, enhancing traceability. France and the U.K. continue to emphasize tamper-evident primary formats for biologics, aligning packaging security with regional healthcare mandates. Regulatory consistency across the EU lowers compliance risk and facilitates cross-country pharmaceutical distribution while maintaining high traceability standards. Are European manufacturers increasingly integrating secure barcodes and anti-tamper seals into high-value therapeutic packaging.

Europe’s anti-counterfeit packaging ecosystem is supported by collaborative initiatives that enhance automated serialization operations and advanced inspection systems. Several European drug makers began using enhanced digital verification codes linked to centralized EU databases for unit authentication, increasing real-time monitoring capability. Sustainability-oriented anti-counterfeit materials gained market attention under EU environmental targets, combining secure packaging with recyclable substrates. Multinational companies integrating advanced digital features into packaging formats benefit from coordinated regulatory frameworks across member states. Secondary packaging remains a focus for high-volume export compliance, while smart labeling techniques support faster authentication at points of dispense. European regional integration continues to encourage technological innovation and secure supply chain practices.

Asia Pacific Anti-Counterfeit Pharmaceuticals Packaging Market Trends

Asia Pacific is projected to be the fastest-growing regional market for anti-counterfeit pharmaceutical packaging market at an estimated 11% CAGR through 2033 due to rapid pharmaceutical manufacturing expansion and stringent export compliance. China and India dominate manufacturing volumes and are accelerating the adoption of serialized packaging to meet both domestic safety rules and export requirements. Several firms showcased next-generation anti-counterfeit security solutions that blend physical and digital features for pharmaceuticals and consumer goods across the region. ASEAN markets are strengthening anti-counterfeit regulations and packaging traceability infrastructure to support cross-border trade. Japan continues to innovate with high-security printing and smart labeling systems for complex drug formats. Enhanced authentication technologies are increasingly integrated into both secondary and primary pharmaceutical packaging.

The speedily widening adoption of advanced authentication and traceability by pharmaceutical and medical device companies in Asia Pacific also reflects broader supply-chain digitization. Holostik demonstrated “phygital” anti-counterfeit solutions at the Traceability and Authentication Forum, highlighting hybrid physical/digital security for supply-chain and consumer verification. Local market players are integrating digital verification, blockchain-linked authentication, and secure tamper-evident holography to address rising counterfeit risks and e-commerce-driven demand. China’s large pharmaceutical output is increasingly incorporating serialized primary and secondary packaging formats. India’s compliance upgrades reflect enhanced tracking of export-oriented drug consignments. These developments support ongoing regional demand growth and position Asia-Pacific as a high-velocity adopter of anti-counterfeit packaging innovations.

The global anti-counterfeit pharmaceuticals packaging market structure is moderately consolidated, with Avery Dennison, CCL Industries, WestRock, Amcor, and SML Group collectively accounting for a substantial share of industry revenue. These companies are leveraging long-standing pharmaceutical client relationships, deep regulatory expertise, and integrated capabilities that combine materials, hardware, and digital platforms. Continuous investment is strengthening portfolios across serialization, smart labeling, RFID, and tamper-evident technologies, which are supporting compliance with global regulatory mandates and enhancing brand protection. Research and development activity is increasingly integrating physical security features with digital traceability systems, enabling end-to-end visibility across pharmaceutical supply chains. This integrated positioning enables large players to scale solutions efficiently across highly regulated markets while maintaining consistent quality and compliance.

Specialized providers such as Schreiner MediPharm, Holostik, AlpVision, and Systech focus on niche capabilities, including forensic markers, holographic authentication, and software-driven track-and-trace platforms. Entry barriers remain high due to the need for regulatory validation, production-line integration, and qualification within pharmaceutical quality systems, which is limiting large-scale new market entry. However, the growing adoption of cloud-based authentication and software-centric traceability platforms is enabling technology-focused firms to participate through partnerships and modular deployments. At the macro level, market consolidation is gradually increasing, as acquisitions and strategic integrations continue to reshape competitive dynamics and strengthen end-to-end solution offerings.

Key Industry Developments

The global anti-counterfeit pharmaceuticals packaging market is projected to reach US$ 131.5 billion in 2026.

Rising counterfeit drug risks, strict global track-and-trace regulations, and growth in biologics and vaccines are driving market expansion.

The market is poised to witness a CAGR of 10.3% from 2026 to 2033.

Smart packaging, RFID adoption, forensic authentication, and expansion in emerging pharmaceutical manufacturing hubs are creating major opportunities.

Some of the key players include Avery Dennison, CCL Industries, Amcor, WestRock, Schreiner MediPharm, and SML Group.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Technology

By Format

By End-Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author