ID: PMRREP30731| 210 Pages | 12 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

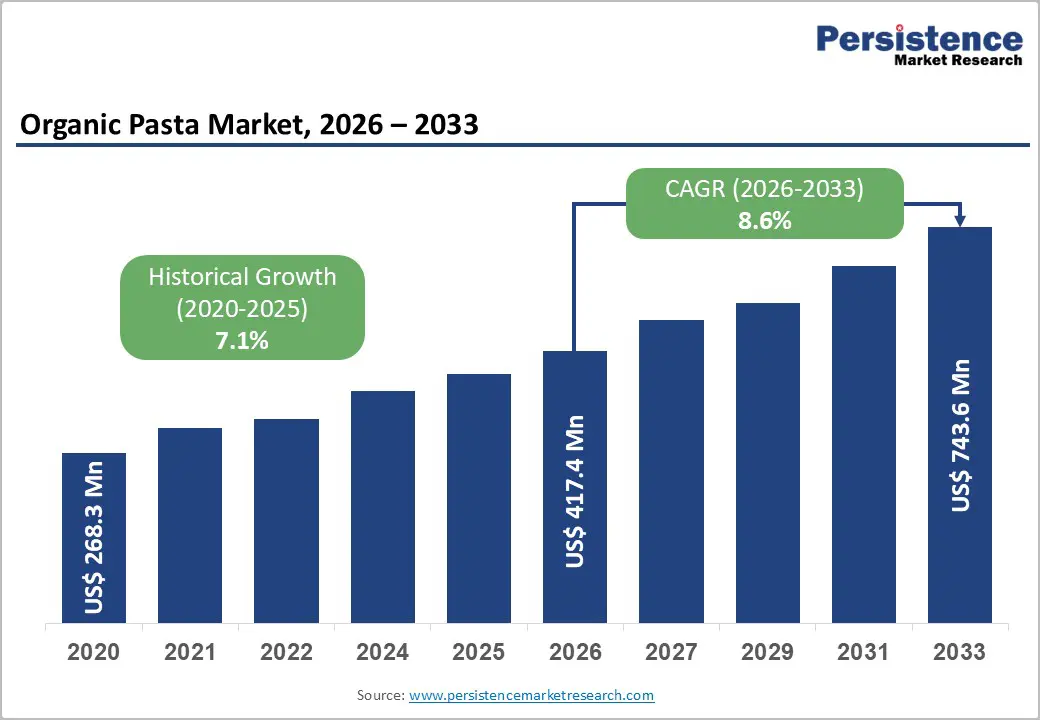

The global organic pasta market size is estimated to grow from US$ 417.4 million in 2026 to US$ 743.6 million by 2033. The market is projected to record a CAGR of 8.6% during the forecast period from 2026 to 2033.

The global market is evolving rapidly as health-conscious consumers increasingly prioritize clean-label, high-protein, and minimally processed staples. Rising awareness around functional foods, sustainable sourcing, and culinary innovation is transforming pasta from a basic pantry item into a versatile, wellness-focused choice for both home cooks and foodservice operators.

| Key Insights | Details |

|---|---|

| Global Organic Pasta Market Size (2026E) | US$ 417.4 Mn |

| Market Value Forecast (2033F) | US$ 743.6 Mn |

| Projected Growth (CAGR 2026 to 2033) | 8.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.1% |

Ingredient transparency has moved from niche preference to mainstream expectation, reshaping how consumers evaluate everyday staples like pasta. Clean-label organic pasta benefits directly from this shift, as buyers increasingly associate simple, recognizable ingredients with better digestion, lower chemical exposure, and long-term wellness. The absence of synthetic pesticides, artificial additives, and GMOs reinforces trust, especially among families, fitness-oriented consumers, and those managing dietary sensitivities.

Health perception further amplifies demand as organic pasta aligns with broader lifestyle choices around natural eating and preventive nutrition. Shoppers view organic grain sourcing and minimal processing as markers of superior quality and authenticity. This mindset is strengthening adoption across retail and foodservice channels, encouraging brands to expand organic pasta portfolios and position them as healthier comfort foods rather than indulgent carbohydrates.

Price tags speak loudly in the pasta aisle, and conventional private-label options continue to undercut organic offerings by a wide margin. Large retailers leverage scale, simplified sourcing, and aggressive cost control to keep private-label pasta affordable, making organic alternatives appear premium and less accessible to price-sensitive shoppers. During periods of inflation or economic uncertainty, consumers often prioritize value over certification, slowing organic pasta uptake.

Margin pressure intensifies as organic pasta producers face higher input costs tied to certified grains, traceability, and compliance. Matching private-label prices risks eroding profitability, while holding premium pricing limits volume growth. Retailers may allocate shelf space toward faster-moving conventional lines, further constraining visibility for organic pasta brands and reinforcing the competitive imbalance.

Crafted textures, regional grains, and storytelling around origin are reshaping organic pasta from a staple into a gourmet experience. Launching premium, artisan organic lines allows brands to target consumers who value culinary authenticity alongside health credentials. Slow-dried processes, heritage wheat varieties, bronze-cut finishes, and single-origin sourcing elevate perceived quality, supporting higher price points and stronger brand differentiation. These offerings resonate with food enthusiasts, specialty retailers, and upscale foodservice seeking products that combine flavor, nutrition, and transparency.

For startups, artisan organic pasta creates a pathway to enter the market without competing on scale. Limited batches, chef collaborations, and seasonal releases build exclusivity and loyalty. Established players can use premium lines to enhance brand prestige, test innovation, and unlock higher-margin channels such as gourmet stores, online subscriptions, and experiential retail formats.

Organic spaghetti holds approx. 46% market share as of 2025, anchoring the category through familiarity and everyday usage across home kitchens and foodservice. Its long, uniform shape pairs easily with a wide range of sauces and vegetables, making it a default choice for health-conscious consumers adopting organic diets. Retailers prioritize spaghetti for shelf visibility and volume rotation, while manufacturers favor it for efficient extrusion, consistent drying, and lower breakage rates, reinforcing spaghetti as the backbone of organic pasta portfolios worldwide.

Linguine and fettuccine benefit from premium sauce pairings and restaurant appeal. Penne dominates baked and meal-prep formats. Shells suit family dishes, fusilli or rotini capture sauces well, while ravioli remains niche, driven by indulgence, fillings innovation, and higher production complexity and pricing sensitivity globally.

Organic Legumes Pasta are projected to grow at a CAGR of 10.7% during the forecast period in the global Organic Pasta market, driven by structural shifts in consumer nutrition priorities. Rising demand for high-protein, high-fiber staples positions chickpea, lentil, and pea-based pasta as credible alternatives to wheat. These products align with low-glycemic diets, gluten avoidance, and satiety-focused eating, strengthening repeat purchases.

From a supply-side lens, organic legume cultivation benefits from crop rotation advantages and nitrogen-fixing properties, improving farm economics and sustainability narratives. Foodservice operators increasingly adopt legume pasta for menu differentiation, while home cooks value shorter cooking times and distinct textures. As formulation and extrusion technologies mature, taste gaps narrow, removing a historical adoption barrier and accelerating mainstream acceptance, across global consumption contexts.

North America holds approximately 43% market share in the global Organic Pasta Market, reflecting an early shift toward ingredient transparency and premium staples. In the US, demand is accelerating for organic durum, legume-based, and whole-grain pasta positioned around protein density, low glycemic response, and clean labels, with private labels expanding shelf space. E-commerce subscriptions and direct-to-consumer bundles are reshaping trial and repeat purchase, while foodservice integrates organic pasta into menus.

In Canada, growth is supported by strong organic certification trust, rising flexitarian households, and expanding availability across mainstream grocery chains. Canadian consumers show higher interest in short ingredient lists and domestically milled grains, pushing suppliers toward local sourcing partnerships. Across the region, packaging innovation and sourcing signal a market focused on convenience regionally.

Asia Pacific Organic Pasta Market is expected to grow at a CAGR of 10.9%, fueled by rising health awareness, urbanization, and increasing adoption of Western dietary habits. In India, demand is expanding among affluent and health-conscious consumers seeking high-protein, gluten-free options, while e-commerce platforms are enabling wider reach beyond metro cities. China shows growing interest in organic legume and whole-grain pasta, driven by a younger demographic embracing functional foods and convenient meal solutions.

Japan and South Korea are witnessing a shift toward plant-based and clean-label pasta options, with supermarkets and specialty stores emphasizing locally sourced organic ingredients. Ready-to-cook organic pasta packs are gaining traction in these markets, while social media and influencer campaigns are accelerating consumer experimentation and acceptance across urban centers.

The global Organic Pasta Market exhibits a moderately consolidated nature, with a mix of established brands and agile startups competing for consumer attention. Leading companies are expanding portfolios through product innovation, including legume-based, whole-grain, and gluten-free variants, while emphasizing clean-label ingredients to align with rising health consciousness. Startups are gaining traction by targeting niche segments, offering premium, artisanal pasta and leveraging social media campaigns to educate consumers on nutritional benefits.

Globally, key players are focusing on market expansion through partnerships, e-commerce channels, and compliant labeling that adheres to regional organic certification standards. Digital marketing strategies, influencer collaborations, and transparent ingredient communication are enhancing brand visibility, reinforcing trust, and accelerating adoption among increasingly informed and health-aware consumers across North America, Europe, and Asia Pacific.

The global organic pasta market is projected to be valued at US$ 417.4 Mn in 2026.

Growing consumer preference for clean-label foods and the perceived health advantages of organic ingredients is a key driver fueling demand in the global organic pasta market.

The global Organic Pasta market is poised to witness a CAGR of 8.6% between 2026 and 2033.

Launch of premium, artisan organic lines to capture gourmet and health-driven buyers is key the opportunity.

Major players in the global Organic Pasta market include Barilla G. e R. Fratelli S.p.A, Ebro Foods S.A., TreeHouse Foods, Inc., Gallo, F.lli De Cecco di Filippo S.p.A, Rummo S.p.A., Pastificio Lucio Garofalo S.p.A., Newlat Food S.p.A, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Source

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author