ID: PMRREP35877| 168 Pages | 20 Nov 2025 | Format: PDF, Excel, PPT* | Packaging

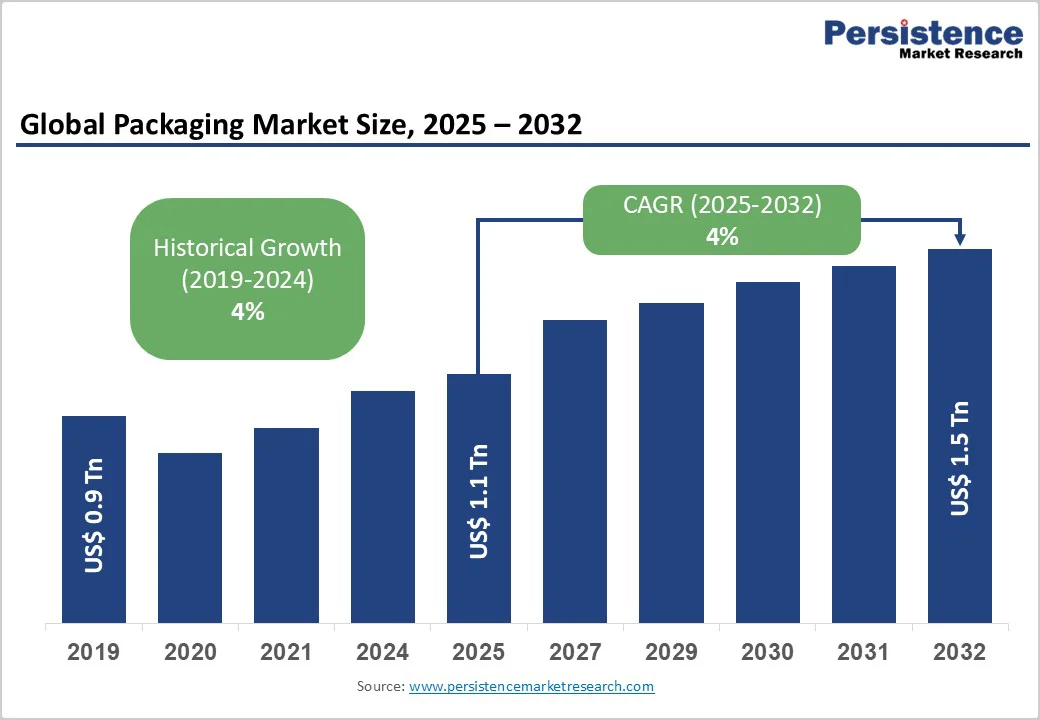

The global packaging market size is likely to be valued at US$1.1 trillion in 2025. It is estimated to reach US$1.5 trillion by 2032, growing at a CAGR of 4% during the forecast period from 2025 to 2032, driven by high rates of urbanization, rising middle-class consumption, especially in the Asia Pacific, and a strong shift toward sustainable packaging materials prompted by regulatory changes and consumer preferences.

The accelerated adoption of e-commerce and evolving retail distribution channels further catalyze demand for innovative packaging solutions that combine functionality, sustainability, and brand differentiation. Industry innovation in flexible and smart packaging is reshaping market dynamics through new product lifecycles and supply chain efficiencies.

| Key Insights | Details |

|---|---|

| Packaging Market Size (2025E) | US$1.1 Tn |

| Market Value Forecast (2032F) | US$1.5 Tn |

| Projected Growth (CAGR 2025 to 2032) | 4% |

| Historical Market Growth (CAGR 2019 to 2024) | 4% |

Governments worldwide, particularly in the Asia Pacific and Europe, are introducing stringent regulations targeting single-use plastics and non-recyclable packaging waste.

For instance, India’s Plastic Waste Management Rules and the European Union (EU)'s Circular Economy Action Plan impose stricter compliance requirements and incentivize the use of biodegradable, compostable, and recyclable materials. This regulatory push is accelerating investments in R&D for sustainable packaging solutions, fostering the growth of biodegradable plastics and fiber-based packaging segments.

Industry players are integrating recycled content and innovating lightweight materials to reduce carbon footprints while maintaining product integrity.

In November 2025, for instance, the Australian Competition and Consumer Commission (ACCC) approved an eight-year authorization for Soft Plastic Stewardship Australia and its partners to operate a national soft-plastics recycling scheme, aiming to expand recycling capacity, reduce waste, and promote circular-economy principles for soft-plastic packaging.

The sustainability mandate is driving both cost efficiency and brand loyalty, serving as a strategic lever for competitive differentiation and compliance risk mitigation.

The heavy reliance of the packaging industry on petroleum-based plastics and paper pulp exposes it to substantial volatility in raw material costs driven by geopolitical tensions, supply chain disruptions, and fluctuating energy prices.

For example, in early 2024, resin prices soared and then plunged, with all commodity resins - polyethylene (PE), polypropylene (PP), polystyrene (PS), PVC, and PET - experiencing a sharp drop. This volatility creates challenges for price stabilization and long-term supplier contracts, forcing companies to adopt cost-passing strategies that may deter price-sensitive customers.

Sourcing sustainable raw materials remains capital-intensive and regionally inconsistent, further complicating supply chain reliability. Market participants must navigate these uncertainties through diversified sourcing, increased vertical integration, and alternative material development, underscoring the critical role of risk management frameworks within packaging operations.

Smart packaging, incorporating sensors, QR codes, and RFID technologies to enhance supply chain transparency and consumer engagement. The growth of these technologies is attributable to the rising demand for next-generation solutions in healthcare for temperature-sensitive and tamper-evident packaging, and in the food industry for enhanced freshness monitoring and anti-counterfeit measures.

Regulatory frameworks that encourage traceability, such as pharma serialization mandates, further catalyze the deployment of smart packaging. These technologies reduce waste, improve inventory accuracy, and enhance consumer trust, delivering realistic return on investment (ROI). Market entrants prioritizing collaborative innovation with IoT and data analytics firms can capture significant value in this sector amidst increasing digital transformation trends in packaging.

Plastic will continue to dominate the packaging market in terms of revenue share in 2025 due to its versatility, durability, and cost-effectiveness. Its application spans most major end-user industries, including food & beverage, pharmaceuticals, and personal care.

Innovations in plastic formulations have enabled companies to align with tightening environmental regulations while preserving functionality through lightweighting and the incorporation of recycled content. However, the sector faces mounting pressure from the shift toward sustainability, as governments impose bans on single-use plastics and incentivize alternatives.

The paper & paperboard segment, including corrugated boxes and folding cartons, is the fastest-growing through 2032, driven largely by consumer preference for sustainable packaging and increased use in e-commerce logistics. The segment’s growth is underpinned by advancements in recycling technology and the development of bio-based packaging materials.

The adaptability of paperboard for printing and branding further enhances its appeal for premium and retail packaging, contributing to its rapid expansion. Investments in improving fiber sourcing and production efficiencies are expected to continue supporting double-digit demand growth in emerging markets.

Flexible packaging leads due to its lightweight, cost-efficient, and adaptable qualities for e-commerce logistics and retail. Products such as pouches, bags, and sachets are highly favored, especially within the food and pharmaceutical sectors, due to consumer demand for convenience and portion control. The reduction in transportation and material costs also adds to its appeal, alongside innovations that enable barrier improvements and increased shelf life.

Active and intelligent packaging, equipped with freshness indicators, temperature sensors, and anti-counterfeit technologies, is the fastest-growing segment for 2025 - 2032. The rising emphasis on food safety, product traceability, and enhanced supply chain management is driving increased adoption across the food, beverage, and healthcare sectors.

Regulatory changes requiring serialization and tamper-evident packaging in pharmaceuticals are significant growth enablers. Smart packaging digital integration creates new revenue streams, adding substantial value beyond traditional packaging.

The food & beverage industry is likely to account for nearly half of the packaging market share in 2025, reflecting the sector's overarching need for product protection, shelf-life extension, and brand differentiation.

Growth in on-the-go lifestyles, rising urban populations, and changing dietary habits fuel demand. The segment is witnessing a sharp increase in sustainable packaging demand, driven by consumer awareness and regulatory mandates targeting food waste reduction and recyclability.

The healthcare and pharmaceutical industry is poised to experience the fastest growth during the 2025 - 2032 forecast period, driven by rising healthcare expenditures, aging populations, and stricter drug-safety regulations worldwide.

Innovations such as child-resistant closures, serialization, and smart packaging are enhancing product security and compliance. Increased pharmaceutical production in emerging markets is driving expanding packaging demand, underscoring healthcare as a critical growth vector.

North America, with the predominance of the U.S., is anticipated to fuel the global market for packaging powered by its mature regulatory environment, spearheaded by the Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA), focusing on sustainability mandates and safety compliance.

This framework has pushed market players to innovate, particularly in bio-based materials and reuse models, driving growth in sustainable packaging segments. The presence of thousands of packaging manufacturers and converters fosters a robust innovation ecosystem enriched by collaborations with technology firms advancing smart packaging technologies.

Consumer demand for convenient, sustainable packaging in foodservice and healthcare sectors further boosts growth. Investment trends reveal strategic mergers, acquisitions, and digital transformation initiatives aimed at enhancing supply chain agility and reducing carbon footprints.

Europe is expected to make significant contributions to the packaging market growth on the back of Germany, the U.K., France, and Spain. The regional market is set to gain substantial momentum owing to a harmonized regulatory umbrella established by the EU Circular Economy Action Plan and associated directives mandating packaging recyclability and waste reduction.

German packaging firms lead in recyclable materials deployment, while France focuses heavily on eco-design innovations that align with consumer sustainability values. Spain has accelerated regulatory compliance initiatives promoting biodegradable packaging adoption.

Europe’s fragmented competitive landscape sees a mix of multinational packaging leaders and innovative regional players collectively emphasizing green portfolios and circular economy integration. Steady investment in recyclable fiberboard and bio-based polymers underscores the region’s commitment to sustainability and resource efficiency.

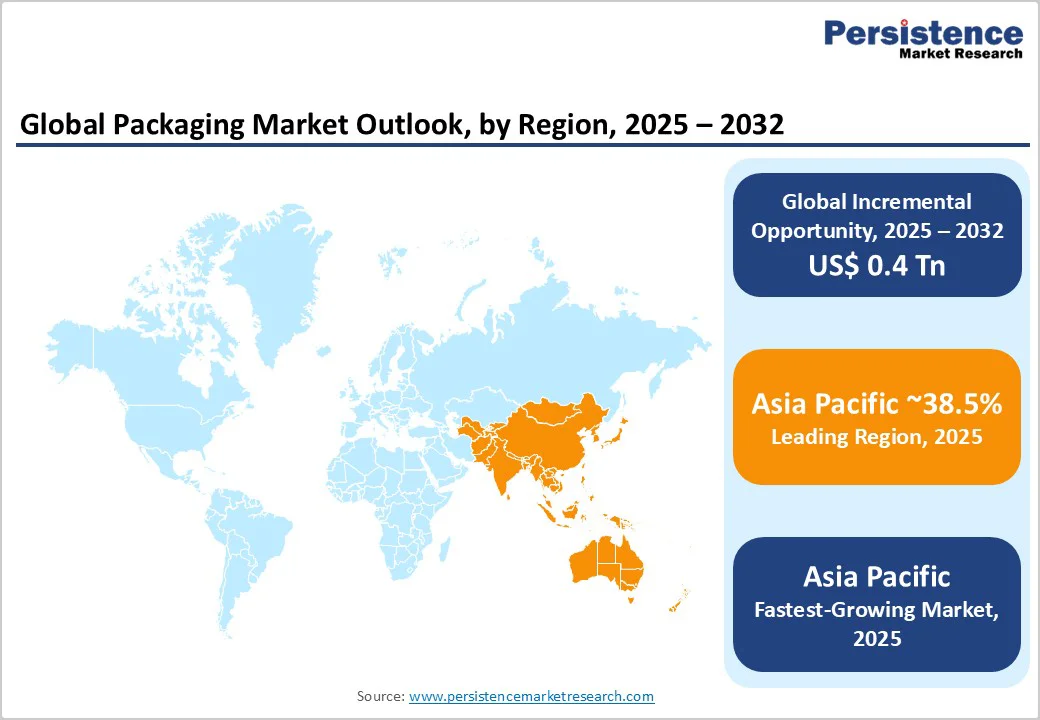

Asia Pacific dominates the packaging market share in 2025, and the regional market also shows the fastest growth trajectory through 2032. China and India emerge as pivotal drivers, supported by fast-growing middle classes, increasing disposable incomes, massive urbanization, and booming e-commerce sectors. The region benefits from a robust manufacturing infrastructure that supports large-scale production of both traditional and sustainable packaging.

Government initiatives, such as China’s ban on certain plastics and India’s Plastic Waste Management Rules, promote the adoption of sustainable packaging. Healthcare spending upticks and food safety concerns fuel demand for advanced packaging solutions. Competitive dynamics reveal intense activity from global packaging companies establishing manufacturing and R&D sites, combined with local innovators focusing on eco-friendly materials.

The global packaging market landscape reflects a moderately concentrated structure with top players accounting for nearly two-fifths of the share collectively. Amcor Limited, International Paper, Crown Holdings, and Tetra Pak lead with diversified product portfolios spanning multiple materials and industries, reflecting robust vertical integration strategies.

These leaders continually invest in R&D to develop lighter, more recyclable materials and integrate digital capabilities such as smart packaging solutions, underpinning competitive differentiation.

Market concentration varies by segment, with flexible packaging being more fragmented due to niche regional manufacturers, whereas the paperboard and rigid packaging sectors tend to be more consolidated. Strategic positioning is frequently predicated on technological innovation, sustainability leadership, and geographic footprint expansions.

The global packaging market is projected to reach US$1.1 Trillion in 2025.

High rates of urbanization, rising middle-class consumption, especially in Asia Pacific, and a strong shift toward sustainable packaging materials prompted by regulatory changes and consumer preferences are driving the market.

The packaging market is poised to witness a CAGR of 4% from 2025 to 2032.

The accelerated adoption of e-commerce, evolving retail distribution channels that are catalyzing demand for innovative packaging solutions, and industry innovation around flexible and smart packaging are key market opportunities.

Amcor Limited, International Paper Company, and Crown Holdings, Inc. are some of the top players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material

By Packaging Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author