ID: PMRREP32304| 233 Pages | 29 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

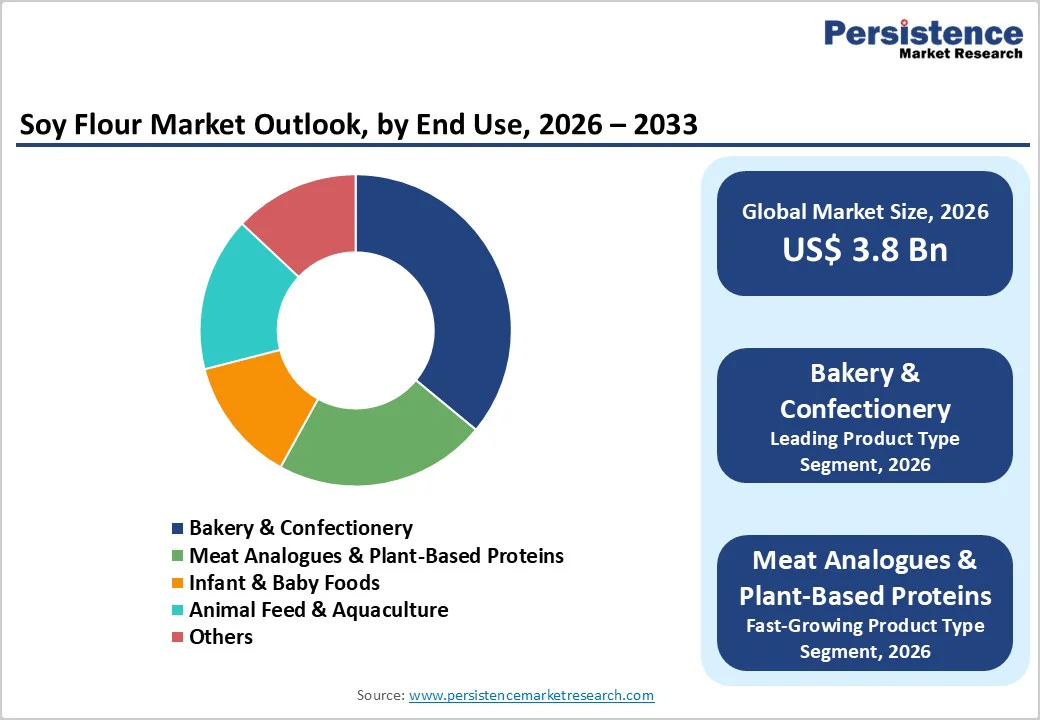

The global soy flour market size is expected to be valued at US$ 3.8 billion in 2026 and is projected to reach US$ 5.5 billion by 2033, growing at a CAGR of 5.5% between 2026 and 2033.

Strong momentum comes from rising adoption of soy ingredients in bakery, plant based proteins, and fortified foods, combined with expanding soybean cultivation and processing efficiencies worldwide. Demand is also supported by consumer interest in high protein, cholesterol-free foods and the ability of soy flour to enhance texture, moisture retention, and shelf life across multiple applications such as gluten-free bread and meat alternative products.

| Global Market Attributes | Key Insights |

|---|---|

| Global Soy Flour Market Size (2026E) | US$ 3.8 Bn |

| Market Value Forecast (2033F) | US$ 5.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.3% |

A key growth driver for the soy flour market is the rapid shift toward high-protein, fiber-enriched bakery and snack products, especially in urban markets where consumers seek convenient yet nutritious foods. Research on gluten-free bread formulations shows that substituting corn flour with 5–15% soy flour can raise protein content from 9.8% to 12.9%, while also increasing fat, fiber, and ash levels and improving crust texture scores from 3.3 to 4.1, demonstrating clear functional and nutritional advantages. These attributes allow bakers to position soy-based formulations as better-for-you alternatives without compromising sensory quality, thereby strengthening repeat-purchase intent and underpinning sustained use of soy flour in bread, cookies, cakes, and snack extrudates across both developed and emerging markets.

The second major driver is the robust global expansion of plant-based foods, particularly meat analogues that leverage soy for its complete amino-acid profile and excellent water- and fat-binding properties. In North America, soy remains the dominant plant protein source in meat and dairy alternatives, with plant-based food sales growing at double-digit rates as more than 9.5 million consumers regularly buy plant-based options. In parallel, volumes of soy flour used in meat substitute applications are projected to exceed 200,000 tonnes by 2031, reflecting its central role in formulating veggie burgers, sausages, and hybrid meat products that demand stable emulsions and a firm bite. As flexitarian diets expand and food manufacturers reformulate to improve sustainability and reduce carbon footprints, soy flour benefits from being a proven, scalable ingredient in the plant-based meat value chain.

Soy is among the major food allergens recognized by regulators such as the U.S. Food and Drug Administration (FDA) and European Food Safety Authority (EFSA), requiring mandatory allergen labeling that can deter certain consumer groups and limit soy flour penetration in sensitive categories such as baby foods. At the same time, a subset of consumers associates soy with genetic modification and hormone-related concerns, pushing brands to invest in non-GMO, organic, or identity-preserved supply chains, which raises sourcing and certification costs. These perception barriers create headwinds versus alternative plant proteins like pea or chickpea flours that are not subject to the same allergen warnings, particularly in premium “free-from” and clean-label product lines

An attractive opportunity lies in premium, non-GMO and organic soy flour offerings that address growing consumer scrutiny around sustainability, traceability, and health credentials. Certification bodies in Europe, North America, and Asia are expanding accreditation frameworks for organic and identity-preserved soy, allowing processors to command price premiums in bakery, infant nutrition, and specialty plant-based categories. As large food brands set corporate commitments for deforestation-free and responsibly sourced soy, suppliers that can demonstrate certified, segregated supply chains from farm to mill will be well-positioned to secure long-term contracts and participate in co-branding initiatives that highlight high-quality soy ingredients on front-of-pack. This aligns with broader trends in the soy-based food and plant-based protein markets, where traceable ingredient stories increasingly influence purchase decisions.

Within the product type, defatted soy flour is expected to be the leading segment, accounting for an estimated around 60% share of the market in 2025, owing to its high protein concentration and versatility across multiple food applications. Defatted variants, produced after oil extraction, typically contain over 50% protein, making them attractive for fortifying bakery, snacks, and meat systems while keeping fat levels low. They also provide consistent functionality in dough rheology and water absorption, which is essential for industrial bread and biscuit production lines that require tight process control. Given that a substantial portion of global soybeans is crushed for oil and meal, defatted flour benefits from existing infrastructure and raw material streams, reinforcing its dominant role in both B2B food ingredient and feed markets.

In end-use applications, bakery & confectionery is the leading segment, contributing approximately 56% of the soy flour market in 2025, according to the data provided. This dominance reflects the widespread incorporation of soy flour into breads, cookies, cakes, and pastry products to boost protein content, improve crumb structure, and extend shelf life by enhancing water binding. Scientific evaluations of gluten-free bread show that substituting up to 15% of base flour with soy flour significantly improves protein levels and sensory scores, validating its performance benefits at a commercial scale. With global consumers increasingly seeking healthier and higher-protein baked goods, particularly in convenience retail and quick-service channels, bakery manufacturers are likely to maintain high usage levels, reinforcing the central role of soy flour in this category.

In North America, the soy flour market benefits from abundant soybean production in the United States, which is consistently among the top global soybean producers, supporting reliable access to raw material for food-grade processing. The region’s advanced crushing and milling infrastructure, along with stringent safety standards defined by the FDA and USDA, helps manufacturers deliver consistent quality and traceable soy flour to the bakery, snack, and meat industries.

At the same time, North America’s fast-growing plant-based food sector, projected to expand at a robust double-digit rate through 2031, relies heavily on soy-based proteins for meat and dairy alternatives, thereby stimulating demand for functional soy ingredients, including flour. Innovation ecosystems in the U.S. and Canada, supported by food tech start-ups and corporate R&D, are exploring new soy-flour-based formulations in hybrid meat products, protein-fortified bakery items, and better-for-you snacks, which will likely keep the region at the forefront of high-value soy flour applications

Asia Pacific is the leading regional market, accounting for approximately 41% of the soy flour market share in 2025, driven by its dual role as both a major soybean producer and a high-growth consumer of soy-based foods. Countries such as China, India, Japan, and members of ASEAN have long culinary traditions with soy products such as tofu, tempeh, miso, and soy milk and are now extending these into modern packaged foods, bakery, and plant-based meat categories. Rapid urbanization, rising disposable incomes, and increased awareness of the health benefits of plant proteins are leading to higher demand for soy-enriched noodles, breads, snacks, and convenient meal solutions that use soy flour for protein fortification and functional performance.

Latin America is projected to be the fastest-growing regional segment for soy flour between 2025 and 2032, supported by the region’s strong soybean cultivation base in Brazil and Argentina and rising adoption of soy-based foods among younger, health-conscious consumers. In Middle East & Africa, demand is increasing gradually as soy flour is incorporated into bakery staples and affordable protein-fortified foods, with imports from major producing regions complementing nascent local processing capabilities

The global soy flour market is moderately fragmented, with a mix of multinational agribusinesses and regional specialists competing across commodity and value-added segments. Leading players focus on securing consistent soybean supplies, investing in de-fatting, micronization, and functionalization technologies, and expanding application support to bakery, plant-based meat, and nutrition manufacturers. Differentiation is increasingly based on non-GMO, organic, and identity-preserved offerings, along with sustainability credentials such as deforestation-free sourcing, carbon-footprint reporting, and regenerative agriculture partnerships with growers.

Key Developments:

The global soy flour market is expected to reach around US$ 3.8 billion in 2026, reflecting steady growth from 2020 supported by rising use in bakery, snacks, and plant‑based protein applications.

A primary demand driver is the surge in high‑protein bakery and plant‑based foods, where soy flour enhances protein content, texture, and shelf life, making it indispensable for gluten‑free bread, snacks, and meat alternatives.

Asia Pacific leads the soy flour market with about 41% share in 2025, fueled by strong soybean processing capacity, traditional soy food consumption, and rapid growth in processed and plant‑based foods.

One of the most significant opportunities is in non-GMO and organic soy flour with identity-preserved, deforestation-free supply chains, which allows suppliers to command price premiums and secure long‑term contracts with global food brands.

Key players include ADM, Cargill, Incorporated, Bunge Limited, Ingredion, SunOpta Inc., CHS Inc., The Hain Celestial Group, Inc., Sakthi Soyas Limited, White River Nutrition, Deesan Agro Tech, and several other regional and global agribusiness companies.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By End Use

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author