ID: PMRREP33929| 200 Pages | 9 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

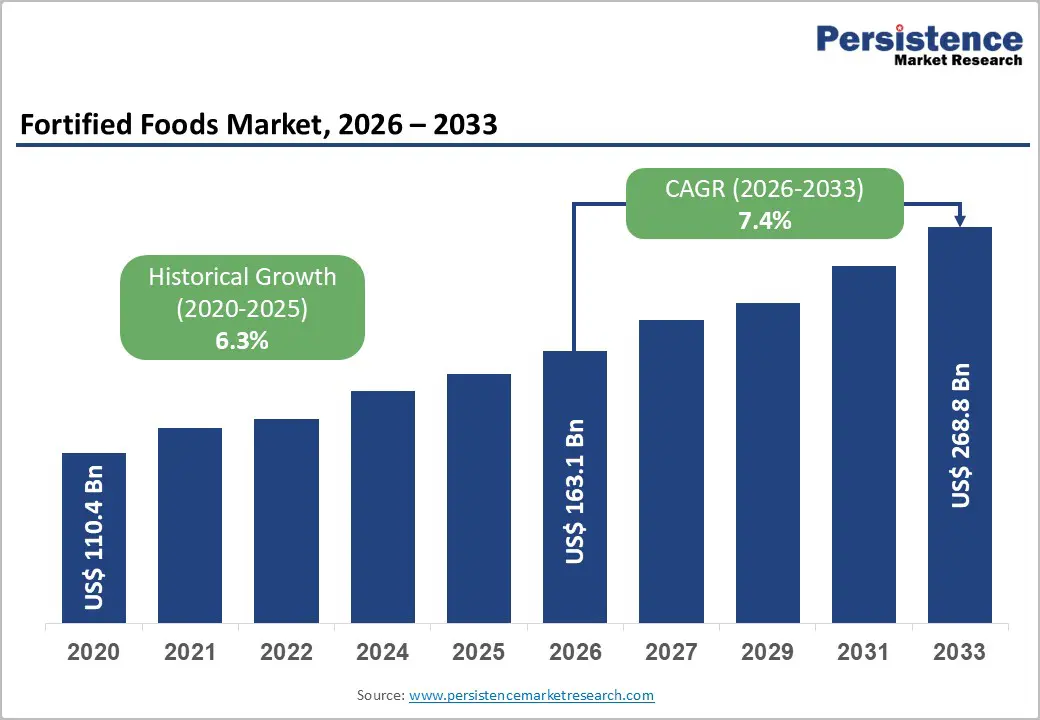

The global fortified foods market size is estimated to grow from US$ 163.1 billion in 2026 to US$ 268.8 billion by 2033, growing at a CAGR of 7.4% during the forecast period from 2026 to 2033.

Fortified foods are rapidly transitioning from niche health products to everyday dietary essentials, driven by preventive wellness thinking and population-wide nutrition goals. Innovation, regulation, and institutional demand are jointly shaping a resilient, purpose-led market landscape.

| Key Insights | Details |

|---|---|

| Fortified Foods Market Size (2026E) | US$ 163.1 Bn |

| Market Value Forecast (2033F) | US$ 268.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.3% |

Wellness has moved from an occasional choice to a daily priority, reshaping how consumers approach food purchases across age groups. Growing awareness around immunity, gut health, bone strength, and long-term disease prevention is pushing households to seek foods that deliver added nutritional value beyond basic calories. Fortified foods enriched with vitamins, minerals, probiotics, and functional ingredients are gaining traction as convenient solutions that fit into regular diets without requiring lifestyle overhauls. This shift is evident in staples such as cereals, dairy alternatives, beverages, and snacks that now double as preventive nutrition tools.

Preventive wellness spending is rising as consumers take greater responsibility for their health outcomes. Parents, aging populations, and fitness-oriented buyers increasingly view fortified foods as cost-effective investments in long-term well-being. Brands responding with science-backed formulations and clear benefit communication are accelerating adoption across both developed and emerging markets.

Sensory performance remains a critical hurdle in the fortified foods market, where added nutrients often disrupt taste, color, and overall product appeal. Minerals, vitamins, and functional compounds can introduce metallic notes, bitterness, or unexpected aftertastes that reduce repeat purchases. Color instability caused by nutrient interactions or oxidation further complicates formulation, especially in beverages, dairy alternatives, and baked goods, where visual consistency strongly influences consumer trust.

Stability challenges intensify across processing, storage, and distribution stages. Heat, light, and moisture can degrade sensitive nutrients, lowering efficacy before products reach consumers. Brands must invest in encapsulation, reformulation, and advanced packaging, increasing development time and cost. These technical barriers slow innovation cycles and limit the speed at which fortified products can scale globally.

Precision-led nutrition is reshaping how fortified foods are positioned, opening strong opportunities around targeted micronutrient packs designed for children, the elderly, and pregnant populations. Each group carries distinct nutritional requirements, pushing manufacturers to develop age- and life-stage-specific formulations that address immunity, bone health, cognitive development, and maternal wellness. Tailored packs allow brands to move beyond mass fortification toward clinically relevant nutrition solutions aligned with public health priorities.

Institutional buyers such as hospitals, schools, elder care facilities, and maternal health programs increasingly favor standardized, evidence-based nutrition formats. Startups can compete by offering modular, easy-to-dispense fortified foods with clear dosing and compliance advantages. For established players, this approach strengthens access to long-term supply contracts, stable volumes, and higher trust across regulated and healthcare-linked channels.

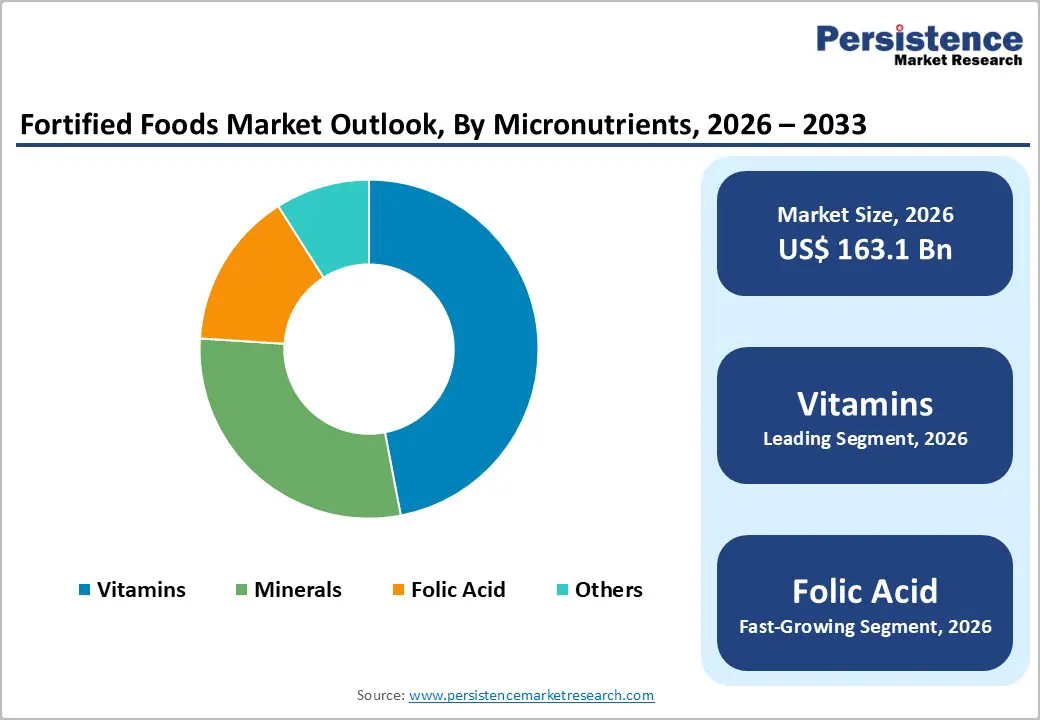

Vitamins are likely to account for nearly. 47% share as of 2025, underscoring their dominance in the global fortified foods market as everyday nutrition shifts from treatment to prevention. Their broad relevance across immunity, energy metabolism, bone health, and cognitive function makes vitamins the most widely accepted and easily integrated micronutrients across staples, beverages, snacks, and infant foods. Manufacturers favor vitamins due to their formulation flexibility, strong consumer familiarity, and ability to support multiple on-pack health claims. Regular dietary gaps and lifestyle-driven deficiencies further reinforce demand, positioning vitamins as the foundation of most fortification strategies worldwide.

Minerals are a critical component, supporting fortification aimed at bone health, hydration balance, and metabolic health, particularly in cereals and dairy alternatives. Folic acid remains a key component of maternal and prenatal nutrition, with consistent inclusion in flour and grain fortification programs focused on early-stage health outcomes.

Flours are projected to grow at a CAGR of 8.4% in the global fortified foods market during the forecast period, reflecting their central role in daily diets and large-scale nutrition programs. As a widely consumed staple, flour offers an efficient vehicle for delivering essential micronutrients such as iron, vitamins, and folic acid without altering eating habits. Governments, bakeries, and food manufacturers are increasingly aligning around fortified flour to address nutrient gaps at the population scale, especially in urbanizing regions where packaged staples dominate household consumption.

Demand is further supported by the rising production of fortified bakery goods, instant mixes, and ready-to-cook products. Advances in premix stability and milling technology are enabling consistent nutrient retention while maintaining taste and texture. With strong penetration across households, foodservice, and institutional feeding, fortified flours are positioned for sustained and scalable growth.

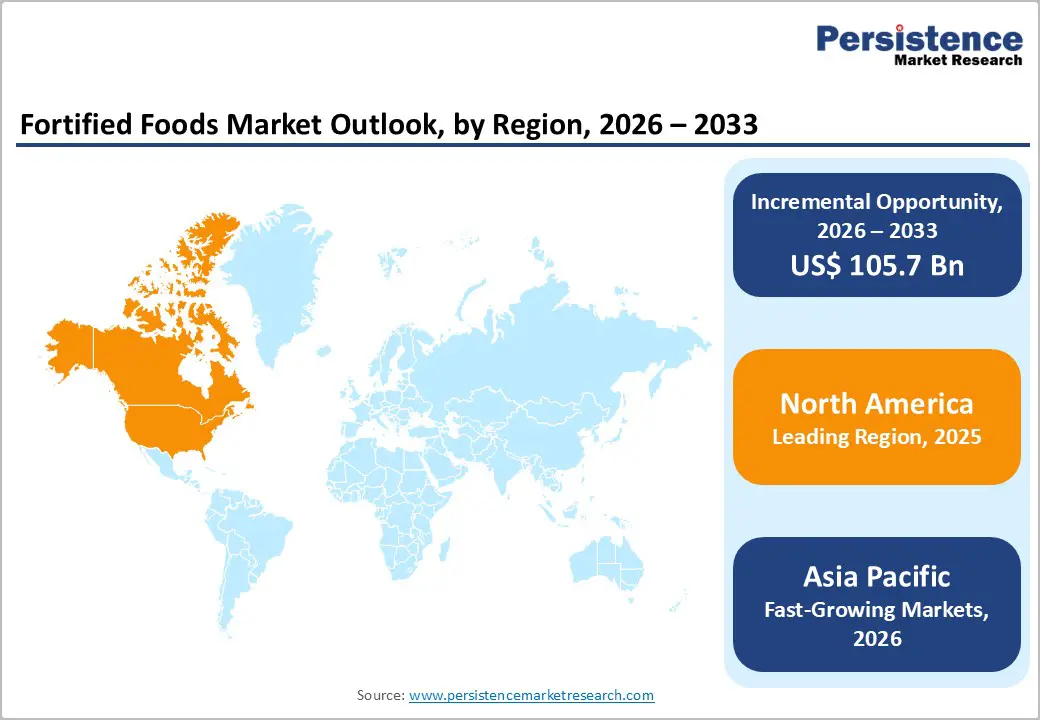

North America holds approximately 39% share in the global fortified foods market, reflecting a mature yet innovation-driven landscape shaped by preventive health priorities. In the United States, fortified cereals, dairy alternatives, and functional beverages are gaining momentum as consumers actively seek products supporting immunity, bone health, and metabolic wellness. Food brands are focusing on clean-label fortification, sugar reduction, and bioavailable vitamin formats to meet evolving nutritional expectations.

In Canada, demand for fortified staples such as flours, plant-based drinks, and snack foods is rising and aligned with national nutrition guidelines. Manufacturers are emphasizing transparency, responsible sourcing, and targeted fortification for aging populations and active lifestyles. Retailers and foodservice operators are expanding fortified offerings, reinforcing North America’s leadership in science-backed, everyday nutrition solutions.

Asia Pacific fortified foods market is expected to grow at a CAGR of 8.7%, driven by shifting dietary habits, urban lifestyles, and rising focus on micronutrient adequacy. In India, large-scale adoption of fortified flours, edible oils, and salt continues as consumers prioritize everyday nutrition linked to immunity and energy. China is accelerating demand for fortified dairy alternatives, beverages, and infant foods as middle-income households seek science-backed wellness products.

In Japan, precision nutrition is shaping fortified foods tailored to aging populations, with an emphasis on vitamins, minerals, and functional ingredients that support bone and cognitive health. South Korea is seeing strong traction for fortified snacks, cereals, and ready-to-drink beverages that align with busy, fitness-oriented lifestyles. Across the region, innovation in taste, format, and convenience is reshaping how fortified nutrition fits into daily consumption.

The global fortified foods market exhibits a moderately fragmented competitive landscape, with established food manufacturers and agile startups competing on formulation expertise, scale, and speed to market. Leading companies are strengthening portfolios by embedding vitamins, minerals, and functional ingredients into everyday staples while upgrading processing technologies to preserve taste and stability. Clean-label positioning has become central, with simplified ingredient lists and transparent sourcing gaining priority. Startups are entering with condition-specific products, innovative delivery formats, and digitally driven brand education. Collaborations, MoUs, and public-private partnerships are expanding access to institutional channels such as schools and healthcare programs. Rising consumer awareness around micronutrient deficiencies is amplifying demand, while government regulations on fortification standards, labeling, and safety are shaping product design, compliance strategies, and long-term competitive differentiation.

The global Fortified Foods market is projected to be valued at US$ 163.1 Bn in 2026.

Rising consumer health awareness and preventive wellness spending is driving the expansion of the global Fortified Foods market.

The global Fortified Foods market is poised to witness a CAGR of 7.4% between 2026 and 2033.

Formulating targeted micronutrient packs (children, elderly, pregnant) to win clinical and institutional contracts is a key opportunity for companies operating in the Fortified Foods industry.

Major players in the global Fortified Foods market include Nestlé S.A., BASF SE, General Mills, Tata Chemicals Limited, Unilever PLC, Cargill Incorporated, Danone, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Micronutrients

By Food Products

By Technology

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author