ID: PMRREP35937| 198 Pages | 8 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

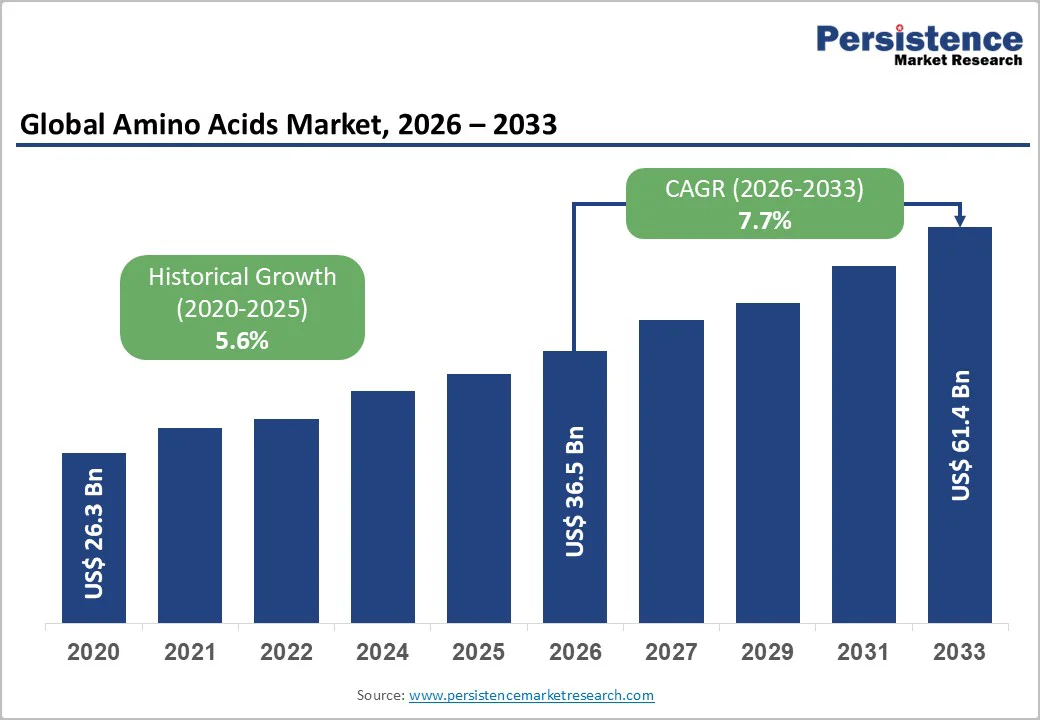

The global amino acids market size is likely to be valued at US$36.5 billion in 2026 and is expected to reach US$61.4 billion by 2033, growing at a CAGR of approximately 7.7% during the forecast period from 2026 to 2033, driven by the rising consumption of amino acids in animal feed, human nutrition, pharmaceuticals, and cell-culture applications.

Investments in fermentation technology, bioprocess optimization, and sustainable production pathways continue to reshape cost structures and competitive advantages across the industry. Companies with strong fermentation scale, specialty portfolios, and sustainable processing capabilities are positioned to outperform. Asia Pacific remains the most attractive region for near-term volume and revenue growth, particularly in feed nutrition and human nutraceutical applications.

| Key Insights | Details |

|---|---|

| Amino Acids Market Size (2026E) | US$36.5 Bn |

| Market Value Forecast (2033F) | US$61.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.7% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.6% |

Feed remains the largest volume application for amino acids such as lysine, methionine, and threonine, driven by expanding poultry and swine production. Asia Pacific accounts for nearly half of global consumption, reflecting intensive livestock systems that rely on crystalline amino acids to improve feed efficiency.

As per-capita meat consumption increases, producers depend on amino-acid supplementation to optimize feed conversion ratios and reduce nitrogen emissions. This structural demand anchors the bulk amino-acid segment and supports high utilization rates at large fermentation plants. Companies with robust feed-grade supply chains capture stable recurring revenues, while value-added blends and premixes enhance downstream margins.

Consumer focus on preventive health, sports nutrition, and functional foods is accelerating demand for high-purity amino acids such as glutamine, arginine, and branched-chain amino acids. Clinical nutrition applications linked to aging demographics and metabolic health further strengthen specialty-grade consumption.

The expansion of biologics and cell-culture media requirements boosts demand for ultrapure amino acids used as critical feedstocks. As a result, the market is bifurcating into low-margin bulk segments and high-margin specialty categories. Companies combining large fermentation capacity with advanced purification technologies capture superior profit potential in these high-value subsegments.

Precision fermentation, enzyme catalysis, and process intensification are lowering production costs and driving down carbon footprints associated with amino-acid manufacture. Leading players are investing in advanced bioprocess lines, digital optimization tools, and energy-efficient fermentation systems. Regional supply security initiatives and sustainability certifications are gaining importance among buyers in feed, food, and pharmaceutical supply chains. Producers showcasing reduced life-cycle emissions, renewable-energy integration, and non-animal sourcing gain preferential access to buyers prioritizing environmental performance and traceability.

Producers of feed-grade amino acids face significant margin variability due to fluctuations in sugar, molasses, corn, and energy prices. When input costs spike or when feed prices fall, manufacturers experience compressed EBIT margins and inventory write-downs.

Smaller players with older assets are disproportionately affected since their energy efficiency and scale advantages are limited. This cost volatility accelerates consolidation and favors producers with modern, energy-efficient fermentation infrastructure.

Producing amino acids for food, nutraceutical, and pharmaceutical applications requires strict compliance with GMP, hazard-control systems, and pharmacopeial standards.

Investments in high-grade purification, facility segregation, and documentation systems raise the barrier to entry. For smaller regional producers, the capital intensity of meeting these standards restricts movement into higher-value segments, limiting their portfolio diversification and long-term growth prospects.

Amino acids used in clinical nutrition, parenteral formulations, and cell-culture media represent one of the fastest-growing value pools. Specialty segments are experiencing stronger growth rates than bulk feed amino acids due to their premium pricing and rigorous purity requirements.

Firms investing in downstream purification, regulatory compliance, and customized formulation services can capture strong recurring revenues through long-term supply agreements with pharmaceutical, biotech, and contract manufacturing organizations.

Consumer-facing industries are increasing their preference for plant-based, fermentation-derived, and low-emission amino acids. Lower-carbon ingredients can command price premiums, particularly in food and nutraceutical applications where sustainability is a purchase criterion.

Producers leveraging renewable feedstocks, process electrification, and third-party carbon verification systems can differentiate their products and unlock new revenue avenues. Strategic alliances with renewable-energy providers and sustainability auditors will accelerate market adoption.

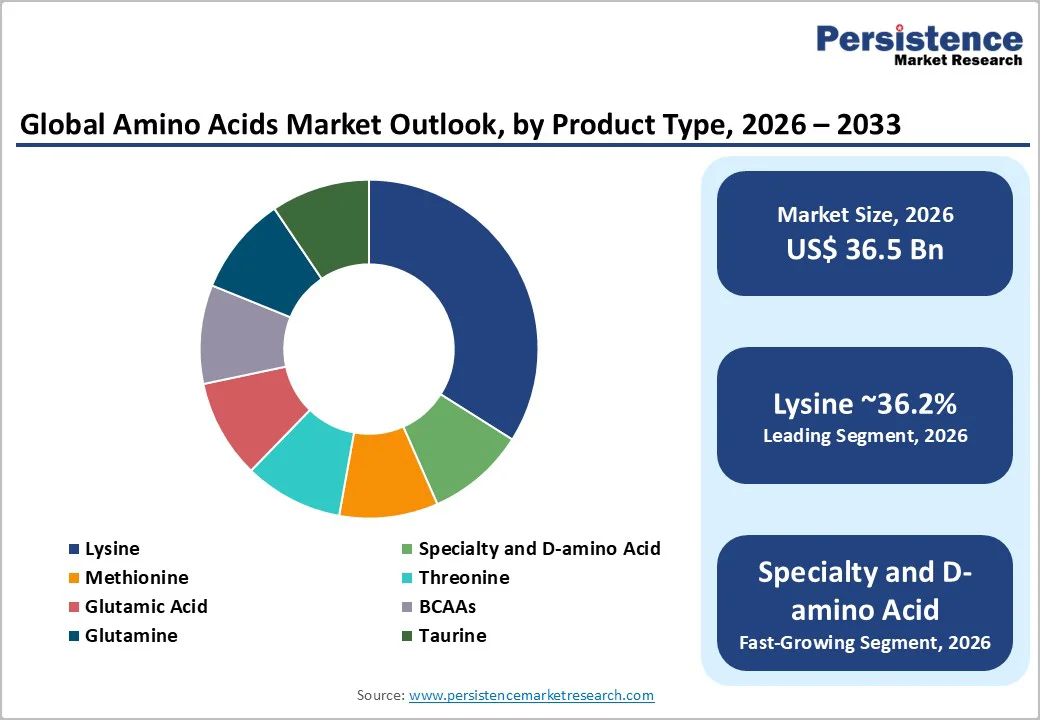

Lysine is anticipated to hold 36.2% of the market share in 2026, due to its indispensable monogastric feed formulations, particularly for poultry and swine diets, where lysine supplementation improves feed conversion ratios and reduces the overall protein costs. In commercial feed, lysine and methionine together represent more than half of total amino-acid usage.

Large producers such as CJ CheilJedang, ADM, and Evonik operate integrated fermentation facilities in China, the U.S., and Southeast Asia, supported by global logistics hubs that ensure a stable supply to feed integrators.

These companies rely on long-term procurement alliances with premix manufacturers such as Cargill Animal Nutrition and Nutreco, enabling consistent volume offtake and competitive cost efficiencies. High-volume lysine production technologies such as glucose-based fermentation and strain-optimized Corynebacterium systems further reinforce its dominant position.

Specialty amino acids and certain D-amino acids are expected to represent the fastest-growing segment by value as demand accelerates in sports nutrition, clinical nutrition, and advanced bioprocessing.

Producers with high-purity capabilities, such as Ajinomoto, Kyowa Hakko Bio, and Fufeng Group, command premium pricing by supplying GMP-certified amino acids with ultra-low impurity thresholds. These suppliers invest in precision fermentation, membrane separation, and multi-step chromatography to scale pharmaceutical-grade output and meet the increasingly stringent expectations of CDMOs and biotech companies.

Feed is expected to hold the highest end-use share at over 49.3% in 2026, due to its critical function in enhancing protein utilization efficiency and reducing nitrogen excretion in poultry, swine, and aquaculture production systems. Asia Pacific, led by China, Thailand, and Vietnam, drives global demand, driven by the world’s highest livestock and aquafeed output.

Companies such as Charoen Pokphand Foods, Wen’s Group, and Japfa generate substantial recurring demand for feed-grade lysine, methionine, and threonine.

The stable, high-volume nature of this segment encourages producers such as Evonik, Novus International, and Meihua to expand fermentation complexes and establish regional blending stations that match local amino-acid inclusion needs. Market growth is further supported by sustainability-focused regulations encouraging low-protein diets supplemented with amino acids to cut ammonia emissions.

Pharmaceuticals and biotech are expected to lead value expansion as amino acids serve as essential components in biologics manufacturing, cell-culture media, parenteral nutrition, and advanced regenerative therapies. High-purity grades must comply with strict pharmacopeial standards (USP, EP, JP), driving premium pricing.

For instance, pharma-grade L-cysteine and L-tyrosine are integral to mRNA vaccine media and therapeutic protein production, while specialty blends are increasingly adopted in clinical nutrition by companies such as Baxter and Fresenius Kabi.

Producers such as Ajinomoto Bio-Pharma Services, Merck KGaA’s media division, and FujiFilm Irvine Scientific benefit from long-term supply agreements with CDMOs manufacturing monoclonal antibodies and gene-therapy vectors. Consistent documentation, end-to-end traceability, and collaborative formulation support remain critical to securing recurring contracts in this fast-growing vertical.

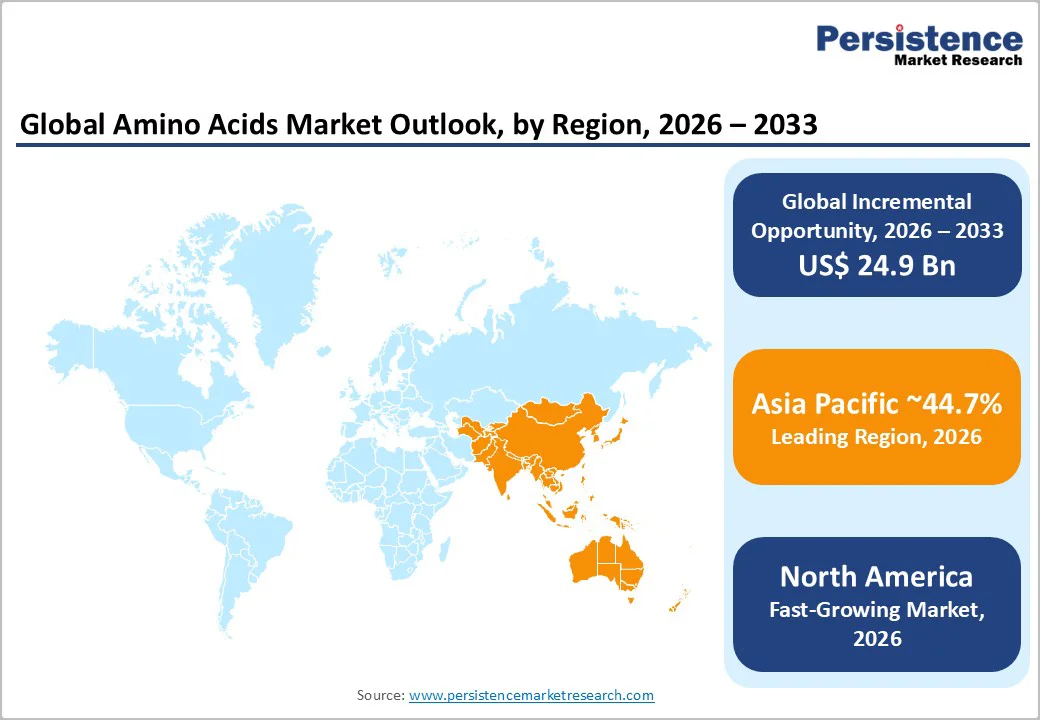

North America is anticipated to be the fastest-growing market in 2026, driven by specialty amino acids used in nutraceuticals, pharmaceuticals, and cell-culture media. The U.S. leads regional demand due to its strong pharmaceutical manufacturing base, advanced biotech clusters, and widespread consumer adoption of dietary supplements and sports nutrition products.

Canada contributes niche demand through functional foods and specialty ingredient applications. The region’s regulatory environment emphasizes strict compliance with GMP standards, pharmacopeial specifications, and traceability requirements. This regulatory clarity encourages investments in high-purity manufacturing, quality-assurance technologies, and documentation platforms.

The competitive landscape includes global incumbents and specialized regional producers. Strategy trends include expanding purification capacity, integrating digital quality systems, and forming partnerships with biotech firms for long-term supply of cell-culture media inputs. North America continues to receive investments in purification, fermentation modernization, and formulation services aligned with the expansion of biologics manufacturing across the region.

Europe maintains a strong demand for specialty, pharmaceutical, and high-purity amino acids. Germany serves as a key hub for biotech research and industrial amino-acid production, supported by sophisticated R&D infrastructure. The U.K., France, and Spain contribute distinct demand profiles ranging from pharmaceuticals and clinical research to feed optimization.

European regulations impose stringent requirements across chemical safety, food labeling, and environmental compliance. While these regulations increase operational costs, they also serve as protective barriers against lower-quality imports. Specialty producers in the region often differentiate through high-purity portfolios, tailored formulations, and sustainable production processes aligned with corporate environmental targets.

Investment trends in Europe include modernization of purification assets, development of traceability systems, and exploratory joint ventures focused on specialty chemicals. Companies are evaluating portfolio restructuring to concentrate resources on high-value amino-acid categories that align with European demand patterns and sustainability initiatives.

Asia Pacific is projected to be the largest regional market, accounting for over 44.7% in 2026. China dominates both manufacturing and feed consumption, supported by extensive fermentation parks and large-scale livestock production. Japan and South Korea specialize in high-purity and specialty amino acids, driven by strong R&D ecosystems, while India and ASEAN countries are emerging growth markets with increasing feed and nutraceutical needs.

Regional growth is fueled by rising meat consumption, expanding health-supplement markets, and large capital investments in fermentation capacity. Regulatory frameworks vary considerably: China continues to enforce stricter environmental and safety regulations, leading to industry consolidation and upgrades in manufacturing practices, while Japan emphasizes quality and export-oriented production.

Asia Pacific’s competitive environment blends high-volume, cost-competitive producers with advanced specialty manufacturers. Investments focus on new fermentation plants, joint ventures, export-oriented logistics infrastructure, and local premix/blending facilities that align with the region’s status as the global production center for amino acids.

The global amino acids market is moderately consolidated. Commodity feed-grade amino acids are produced at scale by large fermentation companies primarily concentrated in Asia, while specialty and pharmaceutical amino acids are supplied by a smaller number of global leaders with advanced purification technologies.

Consolidation is increasing as firms pursue joint ventures, divest non-core assets, modernize plants, and expand fermentation and purification capacities. The strategic shift toward specialty portfolios is particularly visible among companies diversifying away from low-margin bulk segments.

Key strategic themes include scaling fermentation capacity, expanding downstream purification for high-value grades, forming regional joint ventures, and prioritizing sustainability through lower-carbon processes. Long-term offtake agreements, regulatory compliance capabilities, and formulation support services remain essential differentiators.

The global amino acids market size is estimated to reach US$36.5 billion in 2026.

By 2033, the market value is projected to reach US$61.4 billion.

Key trends include the rising use of feed-grade amino acids to enhance livestock productivity, fast-growing demand for pharmaceutical- and biotech-grade amino acids, expansion of precision fermentation technologies, increased adoption of sports and clinical nutrition, and stronger investment in high-purity specialty amino acids.

Lysine remains the leading product segment, accounting for the largest share due to its essential role in monogastric feed formulations.

The amino acids market is projected to grow at a CAGR of 7.7% between 2026 and 2033.

Major players include Ajinomoto Co., Evonik Industries, CJ CheilJedang, ADM, and Meihua Holdings.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By End-user

By Form

By Production Method

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author