ID: PMRREP35911| 210 Pages | 26 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

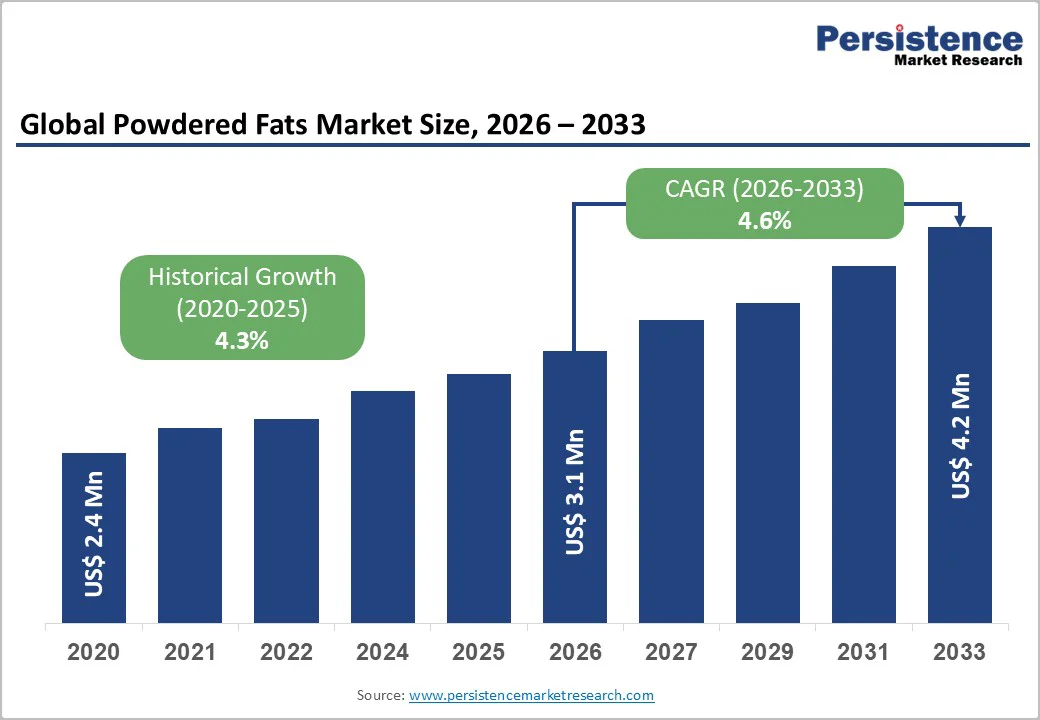

The global powdered fats market size is likely to reach US$3.1 billion in 2026 and US$4.2 billion by 2033, growing at a CAGR of 4.6% over the forecast period from 2026 to 2033, driven by their shelf stability, controlled functionality, and ease of formulation.

Key drivers include growth in convenience mixes, increased interest in functional fats such as MCTs and high-oleic oils, and technological improvements in spray-drying and encapsulation that enhance stability. Challenges include raw material price volatility and intensifying sustainability scrutiny around palm and animal-derived fats.

| Key Insights | Details |

|---|---|

| Powdered Fats Market Size (2026E) | US$3.1 Bn |

| Market Value Forecast (2033F) | US$4.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.3% |

Powdered fats deliver controlled fat content, predictable melting behavior, and extended shelf life, making them well-suited for dry mixes, confectionery fillings, and bakery shortenings. Bakery and confectionery applications form the largest user base, accounting for roughly 29% of total demand.

Industrial bakeries and premix manufacturers use powdered fats to simplify logistics and dosing while maintaining product consistency. These factors support the sector’s steady demand and contribute directly to the medium-term growth trajectory of the global market.

Manufacturers are incorporating functional fats such as MCT powders, omega-rich oils, and high-oleic plant oils to meet rising consumer interest in energy, ketogenic, and better-for-you products. Functional fat powders command higher margins and allow manufacturers to target premium nutrition, sports, and medical nutrition segments.

The shift toward value-added formulations improves revenue per tonne and encourages continuous product innovation, broadening the commercial footprint of powdered fats.

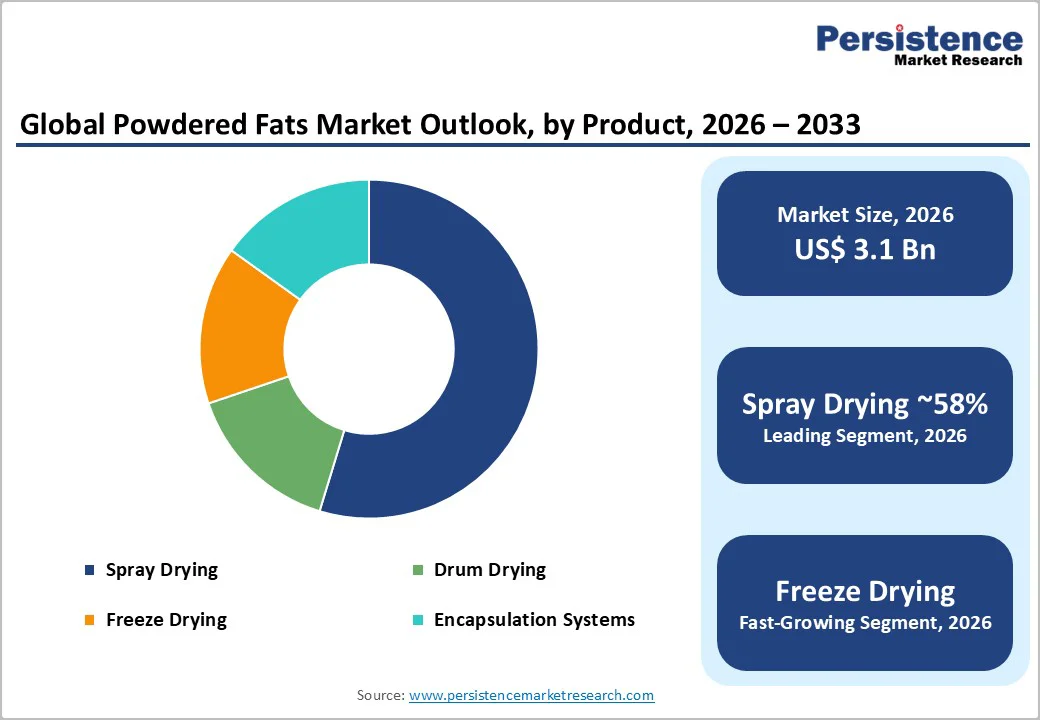

Spray drying remains the dominant processing route, representing over half of global production capacity. Its ability to create low free-oil, uniform particles with reliable dispersibility makes it the preferred method for industrial customers.

Continued investments in spray-dry towers, closed-loop systems, and encapsulation technologies lower production losses, enhance oxidative stability, and widen application possibilities. Scaled manufacturing improves cost efficiency and accelerates regional adoption.

Powdered fat prices directly depend on the cost of palm oil, coconut oil, dairy fat, and other vegetable oils. Historical volatility creates margin pressure, especially when manufacturers cannot fully pass on cost increases. Sustainability and regulatory expectations related to deforestation-linked palm oil and animal-derived fats increase compliance burdens.

Margin compression of several percentage points is common during high-volatility periods. Integrated sourcing or certified supply chains help mitigate these risks but require investment.

Producing high-quality powdered fats demands precise control over atomization, emulsion stability, carrier selection, and moisture removal. Spray-drying and encapsulation facilities require high capital investment and skilled operators, raising entry barriers.

Smaller processors face risks such as inconsistent particle quality, oxidation issues, and batch failures without robust process control. These factors concentrate technological leadership among established ingredient manufacturers.

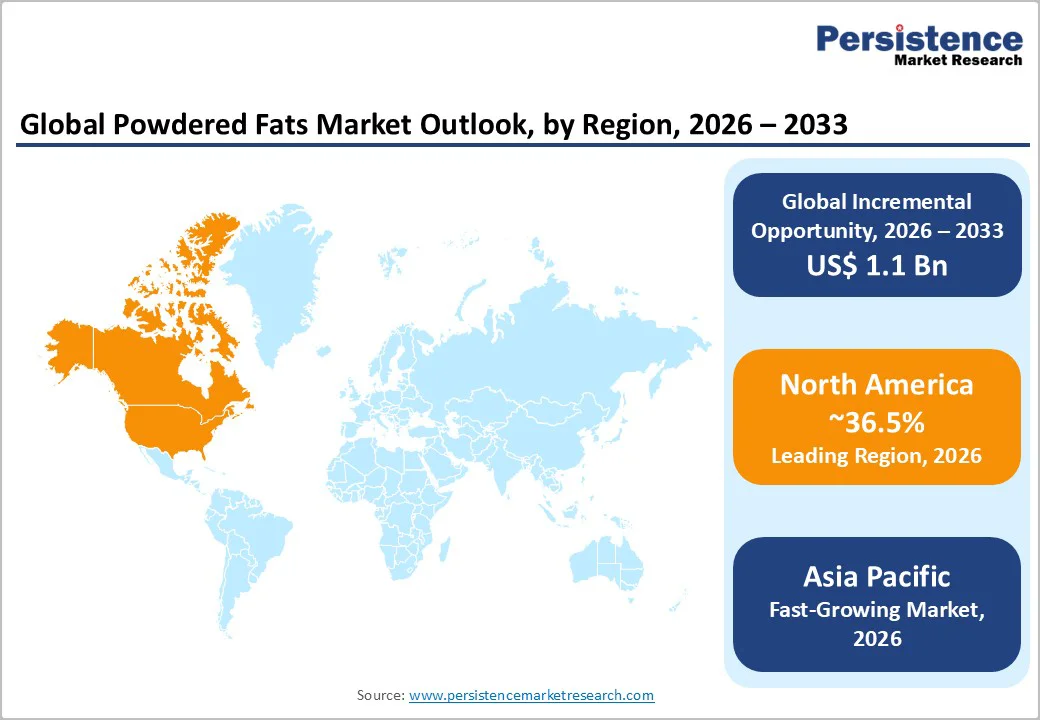

Asia Pacific’s cost advantages, access to palm and coconut feedstocks, and expanding industrial bakery sectors create opportunities to establish export-oriented manufacturing hubs. India, in particular, is emerging as a strong regional producer and consumer, with above-average growth potential. Contract manufacturing and white-label production for global nutrition brands offer high-margin opportunities for regional suppliers.

Spray drying accounts for around 58% of global powdered-fat production due to its high efficiency and compatibility with continuous manufacturing lines. The method produces stable, uniform particles with controlled moisture and low free-fat content, attributes essential for reliable performance in pancake mixes, powdered sauces, savory seasonings, and industrial bakery blends.

Its scalability allows processors to supply both bulk commodity powders and mid-range functional formulations. Spray-dried powders disperse quickly in both cold and warm liquids, which is why they are widely used in instant beverages, dry dairy mixes, and fortified food bases. The method’s operational reliability and relatively low cost per kilogram reinforce its position as the leading processing technology.

Although accounting for a smaller overall share, freeze drying is expanding at a rapid pace, particularly for high-value formulations. Its low-temperature process preserves bioactive components and minimizes oxidation, making it suitable for omega-3 oils, MCT concentrates, and customized nutrition blends that require maximum stability.

Freeze-dried powdered fats retain more of the original oil’s nutritional characteristics, which is why they appear increasingly in sports nutrition sachets, medical nutrition powders, and clinical dietary supplements. With improvements in throughput and energy efficiency, this technology is becoming more commercially accessible, encouraging wider adoption among producers targeting premium and specialized applications.

Bakery and confectionery represent the largest application segment, contributing approximately 29% of market demand. Powdered fats improve aeration, crumb softness, structure, and flavor release in cakes, muffins, cookies, pastries, and brownie mixes. In confectionery, they provide controlled melting profiles for chocolate coatings, pralines, dry fillings, and compound chocolates.

The ability of powdered fats to withstand ambient storage without refrigeration is a significant advantage for industrial bakeries, enabling simplified supply chains and consistent dosing into large-scale dry-blend operations. Their role in enhancing sensory attributes while maintaining extended shelf life ensures sustained dominance of this segment.

Nutritional supplements and specialty nutrition are expanding faster than all other applications, driven by rising adoption of functional fat systems. MCT powders are used in ketogenic drink mixes, instant coffees, protein shakes, weight-management products, and energy boosters.

Customized high-oleic or structured fat powders appear in sports performance blends, clinical nutrition formulas, and recovery beverages. These applications require validated stability, clean-label carriers, and controlled-release behavior, which powdered fats deliver effectively. Growing consumer interest in targeted nutrition, metabolic health, and convenient ready-to-mix formats continues to fuel the rapid growth of this segment.

North America holds 36.5% of the market share, supported by a highly developed industrial bakery sector, widespread use of dry mixes, and a strong nutrition, sports, and supplements industry. The U.S. dominates regional consumption, driven by high investment in microencapsulation R&D and advanced food-processing capabilities.

Strong regulatory expectations for ingredient safety, purity, and labeling accuracy require suppliers to demonstrate oxidative stability and carrier compliance through validated documentation. The competitive environment includes diversified ingredient manufacturers, contract spray-drying specialists, and emerging innovators offering tailored fat systems for keto, performance, and clinical nutrition products.

Investments in the region continue to expand spray-dry capacity, enhance flavor-masking techniques, and develop clean-label carrier systems such as gum acacia and non-GMO starches.

Recent developments include the commissioning of new high-capacity spray-drying lines in the Midwest in early 2024 to support the growing demand for powdered creamers and MCT blends, the launch of low-saturated powdered fat products for bakery mixes in 2025, and a strategic collaboration between a U.S. nutrition brand and a microencapsulation technology company in late 2023 to enhance the dispersibility of plant-based fat systems.

Europe represents an innovation-led, regulation-intensive market characterized by stringent ingredient requirements, sustainability expectations, and demand for premium formulations. Western European countries, particularly Germany, France, the U.K., and Spain, contribute the largest value share due to the scale of industrial bakery networks, confectionery manufacturers, and premium processed-food producers.

European buyers prioritize clean-label positioning, traceability, reduced-saturated-fat formulations, and alignment with broader sustainability goals, which directly influence product development choices. Suppliers invest in sustainable sourcing certifications, advanced EU-compliant encapsulation processes, and small-batch specialty production targeted at premium bakery mixes, plant-based creamers, and infant-food applications.

R&D efforts often focus on achieving tighter control over free-fat content, odor neutrality, and improved cold-water solubility.

Recent developments include the installation of energy-efficient encapsulation systems in Germany in 2024 aimed at producing lower-carbon-footprint powdered fats, the launch of sustainably sourced high-oleic sunflower oil powders in the U.K. during 2025, and Spain’s expansion of specialty dairy-fat powder production in late 2023 to cater to artisanal confectionery and premium bakery brands.

These initiatives reflect Europe’s commitment to technological leadership and responsible sourcing.

Asia Pacific is the fastest-growing regional market, supported by strong raw material availability, lower manufacturing costs, and expanding demand for processed foods, bakery products, and nutritional supplements. China leads production due to large-scale snack, dairy-alternative, and meal-replacement industries, supported by advanced spray-drying hubs.

India is evolving into a high-growth player as industrial bakeries, premix manufacturers, and supplement brands expand capacity to meet rapidly increasing domestic demand. Southeast Asian markets benefit from vertically integrated supply chains connecting palm and coconut production to powdered-fat conversion, strengthening the region’s export competitiveness.

Manufacturers continue to invest in high-throughput spray-dry systems, customized encapsulation for heat-sensitive oils, and export-driven production lines aligned with global food safety and halal standards.

Recent developments include the commissioning of new coconut-based MCT powder plants in the Philippines in 2024, a Chinese facility upgrade in 2025 to support freeze-dried omega-3 powders for nutrition brands, and India’s establishment of dedicated contract spray-drying partnerships in 2023 to meet the rising demand for bakery premixes and instant beverage blends.

These expansions underscore Asia Pacific’s growing importance in both volume-driven and specialty powdered-fat segments.

The global powdered fats market is moderately consolidated. Large global ingredient houses dominate commodity palm- and dairy-based powders due to their supply-chain integration and scale. Specialty powders, such as functional, nutrition-specific, and encapsulated fats, are supplied by a more fragmented base of innovators and regional processors. Technical expertise, carrier system design, and certification capabilities differentiate market leaders.

Prevailing strategies emphasize functional differentiation, sustainability certification, vertical sourcing integration, and capacity expansion in cost-efficient regions. Companies pursue plant-based innovations, clean-label carrier systems, and partnerships with nutrition brands.

The global powdered fats market size in 2026 is estimated at US$3.1 Billion.

By 2033, the powdered fats market is expected to reach US$4.2 Billion, reflecting stable adoption across processed foods and functional nutrition segments.

Key trends include the rising use of clean-label carrier systems, rapid growth of MCT and high-oleic fat powders, expanding applications in sports nutrition and medical foods, advancements in spray-drying and encapsulation technologies, and increased demand for plant-based and reduced-saturated-fat formulations.

By application, the bakery and confectionery segment remains the dominant category.

The powdered fats market is projected to grow at a CAGR of 4.6% between 2026 and 2033.

Major companies with a strong product portfolio include Kerry Group, Cargill, FrieslandCampina Ingredients, AarhusKarlshamn (AAK), and MEGGLE Group.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Source

By Processing Technology

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author